Bitcoin Value Examination: Bearish Continuation Likely as BTC Tests Solid Help

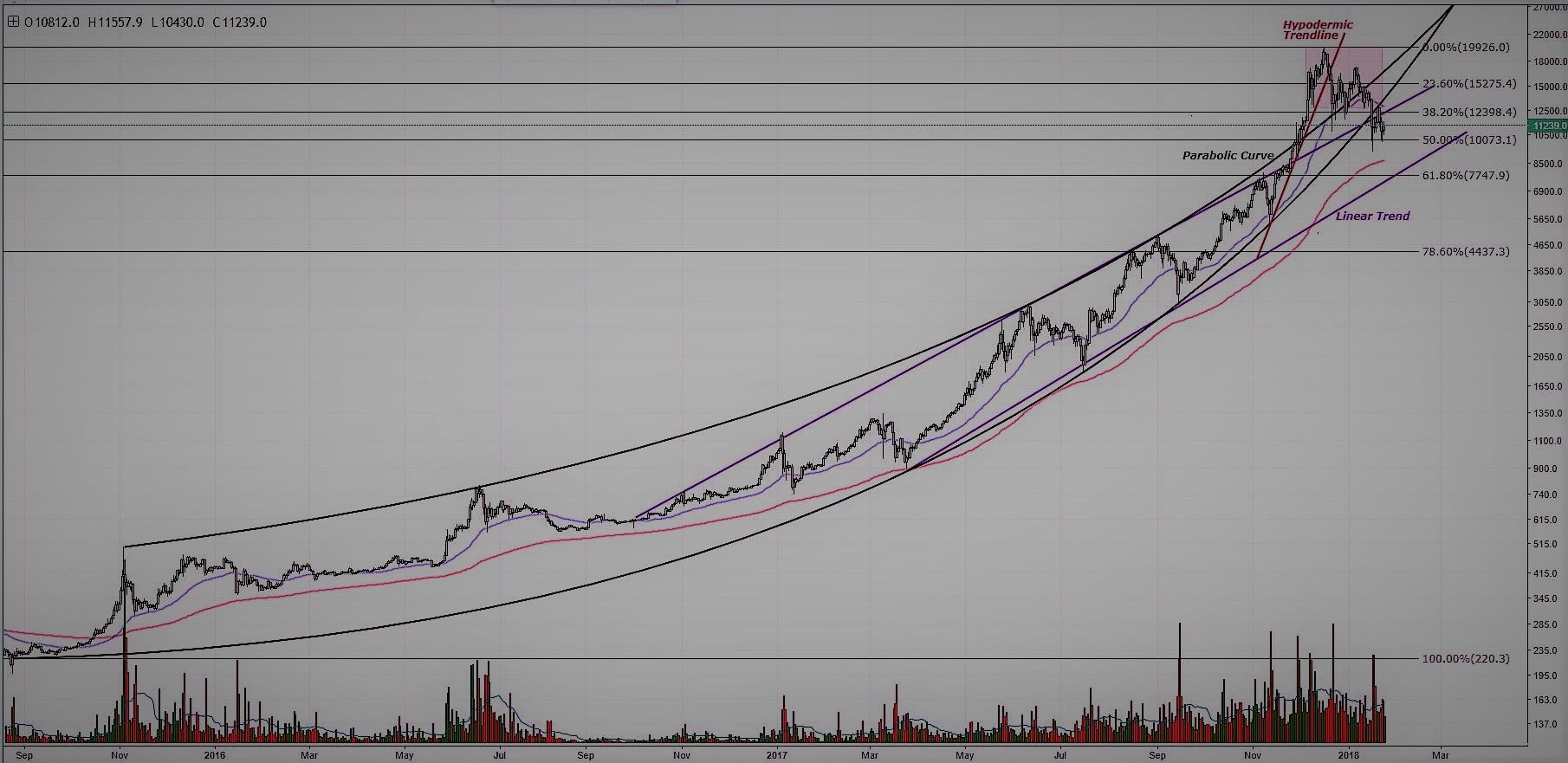

Lower highs and lower lows have been the tale of bitcoin throughout the previous couple of weeks — showcase conduct that has left even the most bullish financial specialists scratching their heads. Since bitcoin's sensational ascent to $20,000, there has been a progression of brutal drops briefly smothered by weak revitalizes. At the season of this article, BTC-USD has figured out how to get through three noteworthy levels of help of both the upper and lower explanatory patterns, and a long haul direct pattern

For now, BTC-USD has figured out how to discover bolster on the full scale half retracement esteems twice. The half retracement has turned out to be a solid level of help, however in the event that you investigate the market, there isn't a mess of help beneath those qualities the distance down to the $7,000 esteems.

Taking a gander at the way the 50 and 200 EMA are following up on the 6-hour diagram, we see that the general large scale drift is moving descending and is really discovering protection on the 200 EMA — values that for a drawn out stretch of time have appeared to be firm levels of help. On the 6-hour candles, the 50 and the 200 EMAs have shaped an example called a "demise cross." A passing cross is the point at which the 50 EMA crosses descending and starts inclining beneath the 200 EMA. This is regularly an indication of a more large scale, bearish market standpoint.

On the off chance that the half esteems neglect to offer help on the following test, a sharp drop could be in store — a sharp drop like the one from $14.5K to $9K. Taking a gander at the picture above, it ends up plainly evident that the illustrative ascent to $20K was so sharp and forceful, there was brief period to set up firm levels of help in transit up.

Indeed, now that we are moving down in value, the forceful development accompanies forceful results. For our situation, the forceful outcome is the absence of help between the $10,000 and $7,000 esteems. On the off chance that we do see a dip under the half Fibonacci line, it is profoundly liable to discover bolster along the 61% esteems where the blue bar is appeared previously.

Another level of help is probably going to be found on the day by day 200 EMA, simply over the blue district

The 200 EMA on the every day diagram has ended up being a firm level of help in past remedial periods. It is exceedingly far-fetched that this level of help would break without a few trial of the 200 EMA. By and large, there is a solid conversion of help between the low $7,000s and high $8,000s. Given the present pattern of lower highs and lower lows, I believe it's feasible we will see a trial of these help levels.

Rundown:

Bitcoin has figured out how to set up a pattern of three lower highs and four lower lows to truly concrete the current bearish pattern.

Bitcoin figured out how to discover protection on the allegorical bend and is presently during the time spent testing the help of the half Fibonacci retracement esteems.

On the off chance that the present levels of help don't hold, support will be found between the $8,000s and $7,000s as there is a solid conversion of help in those value esteems.

Exchanging and putting resources into advanced resources like bitcoin and ether is exceedingly theoretical and accompanies numerous dangers. This investigation is for enlightening purposes and ought not be thought about speculation guidance. Proclamations and budgetary data on Bitcoin Magazine and BTC Media related destinations don't really mirror the assessment of BTC Media and ought not be translated as a support or proposal to purchase, offer or hold. Past execution isn't really demonstrative of future outcomes.