How to Implement a Crypto Index

My last post showed how to create a crypto index and this one will show how it can be actually implemented. One of the most important aspects of crypto-currency and blockchain is to own your own money and not rely on a third party to store it such as a bank. At the moment the best way to do this is on a hardware wallet such as a Ledger Nano S or Trezor.

https://www.ledger.com/

https://trezor.io/

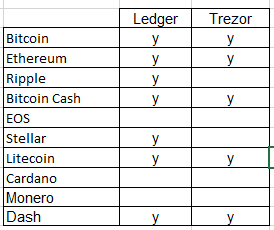

These devices store the private keys offline ensuring hackers can't get to them and eliminating third party risk. Also each device is only compatible with certain coins although both continue to add more. I own both the Ledger and Trezor since I want as many of my coins private keys in my possession as possible. For coins which are not yet compatible I just keep on the trading exchange.

At the time of writing for the top 10 coins the compatibility looks like:

Example steps using Coinbase and Binance to implement an index:

1, Decide how much you want to invest/speculate in crypto.

2, Buy bitcoin on Coinbase using the full amount you decided to invest.

3, Calculate how many of each coin you need to assemble the market cap weighted index.

4, Send the appropriate amount of Bitcoin for the index to your hardware wallet.

5, Send all the rest of the Bitcoin to Binance.

6, On Binance exchange the Bitcoin for the coins you need to complete the index.

7, Send coins which are supported by the hardware wallets to the hardware wallets.

8, Coins which aren't currently supported (EOS, Cardano & Monero) leave on Binance.

Other tips:

When sending do an initial trail of a small amount to check you are doing it correctly.

Don't mix Bitcoin (BTC) and Bitcoin Cash (BCH)

Enable 2FA for Coinbase and Binance and store the 2FA keys.

Keep the wallet backup phrase safe.