A Silly Mistake Most Crypto Traders Make

“You are given a gun, one of the six chambers is loaded with a bullet. The game is to point the weapon at yourself and pull the trigger. If you come out alive, you will be rewarded with $1 Million. Would you take a chance?”

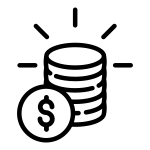

There is one in six chances of losing your life. Now, Imagine the case where there are thousand chambers and five of them are loaded. You are still at risk, storing your crypto assets on exchanges has similar risks. Here is a list of popular attacks.

In most centralised exchanges you don’t get a real wallet, but an illusion of a wallet is created. Because it’s inefficient to have separate wallets for a huge user base. They store the map of “who owns what assets” in a database, crypto assets are collectively stored(irrespective of ownership) in a few real wallets. When users trade with each other, trades are updated in the database and account balances are updated, real crypto transfers don’t happen.

If an exchange store all the Bitcoins in a single wallet and if it gets compromised, everything is lost. This has occurred several times in the past.

Though many exchanges claim to store it on cold/physical wallets, this process is not easy. A cold wallet is usually a paper wallet or a USB thumb drive where wallet credentials (private/public key) is stored.

Paper wallets are prone to fire/water damages. If one loses his thumb drive, there are no means of recovery.

Poor Guy Lost His Cold Wallet

The other problem is because of exchanges are not regulated, chances of fraud are higher. It’s easy for exchanges to disappear with people’s money. There is also a possibility of governments forcing exchanges to hand over their wallets.

Storing crypto assets on centeralised exchanges doesn’t make sense because the key concept of cryptocurrencies is decentralisation. But, since it stored in centralised exchanges, they can increase their trade/withdrawal fee as they wish. Users have no option, but to bear it.Storing your crypto assets in exchanges is a bad idea. This is not practical for people who trade in high volumes because storing on their own wallets is time-consuming and costly.

It’s better to identify one’s trade volumes and keep only what is required in exchanges. Only store assets on exchanges you can afford to lose, storing everything should be avoided. Blockchain projects have started warning people about holding their tokens in exchanges, it applies to all type of crypto assets, not just Bitcoin or Ethereum.

I hope this problem won’t last long, exchanges should adopt a mechanism to enable trade without holding their user’s assets.

What do you think? Do you have an alternative opinion? Comment here, let’s discuss.

I have all on exchanges..