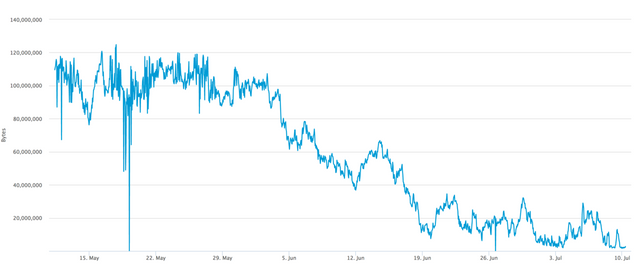

Bitcoin Mempool Size down 98% in the past 6 weeks

The Bitcoin Mempool is basically the backlog of pending bitcoin transactions. Over the past 6 weeks, the Mempool size has dropped precipitously.

Mempool was as high as 120 million bytes and is now less than 3 million

Recent bitcoin transactions have lower fees and are processed much quicker than when the scaling debate was at its climax.

However, the story is not the reduced mempool size, but who or what was causing it to be higher previously.

My theory: Ask yourself who benefits?

In my mind there are two possible explanations for the previously bloated mempool size:

- Spam transfers by miners who had incentive to keep the network bloated

- Someone spent millions in transaction fees to push an agenda of raising block size

The two most obvious scapegoats are the most outspoken people for unlimited blocksize: Bitmain and Roger Ver.

Let’s start with Bitmain

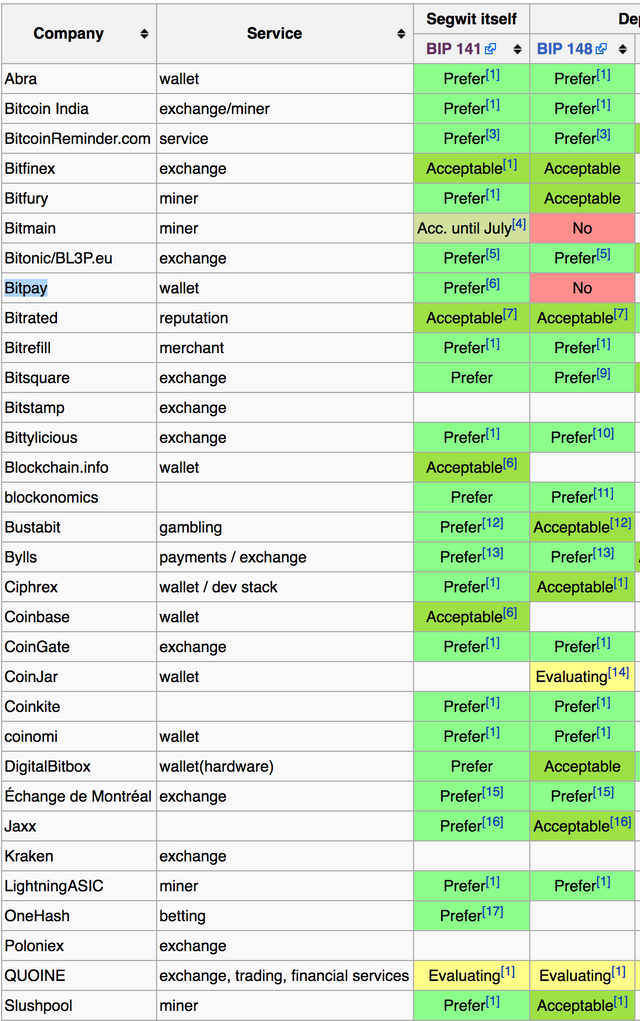

Bitmain is a Chinese company that makes bitcoin mining hardware and is one of the largest mining operations in the space. Bitmain is in favor of larger blocks (up to 16MB) because it will reduce the number of people who can run full nodes which further centralizes mining operations and enriches them. They were one of the only groups that didn’t accept Bitcoin Improvement Proposals 141 and 148:

Bitmain also threatened to hard fork as a contingency against BIP 148, which as seen above, mostly everyone thinks is satisfactory.

Bitmain could easily clog the network with spam transfers back and forth. Not only would they receive some of the transaction fees back through mining, but it helped raise overall mining fees and they made more money because of it.

Roger Ver

Roger Ver is an early bitcoin adopter and the owner of Bitcoin.com, who is rumored to own upwards of 300k bitcoins. He is a longtime proponent of larger blocksizes, and even attempted to increase support for larger blocksizes by bribing people to switch to Bitcoin Unlimited. Roger has a large amount of bitcoins so he has the funds to withstand losses in transaction fees, has been very pro blocksize increase, and his willingness to pay to get what he wants shows that it is possible he would be behind the backlog as well.

It’s likely that one or both of these groups was behind the increased mempool size in an attempt to push their agendas for larger blocksizes. But since it is looking increasingly more likely that there will be a smooth transition to segwit, there was little reason to continue backlogging the mempool.

What’s your theory?

My name is Ryan Daut and I'd love to have you as a follower. Click here to go to my page, then click  in the upper right corner if you would like to see my blogs and articles regularly.

in the upper right corner if you would like to see my blogs and articles regularly.

I am a professional gambler, and my interests include poker, fantasy sports, football, basketball, MMA, health and fitness, rock climbing, mathematics, astrophysics, cryptocurrency, and computer gaming.

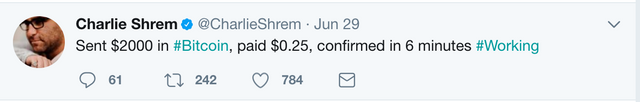

Shrem:

Was that supposed to be a joke? Poor @charlieshrem.

Perhaps its the massive run of Ethereum ICO's the last couple of months that has helped clear up the backlog of Bitcoin's transactions. But you are right, it sure feels like manipulation at a grand scale when you see the graph...

I thought about that, but some of the biggest ICOs were after June 20th: EOS, Tezos, and tenx. And a bunch of others were after June 5th when it was already starting to drop.

Jeez that is one big mempool.

What has led to the lower fees and faster transaction times?

I thought that was going to occur after the hardfork

BTC has sown to be vulnerable to this kind of attacks and being based on old technology nothing much will change

One thing is for sure, I can't wait for August 2nd. These past couple years have been exhausting.