Bitcoin jumps nearly 70% for August to record high, offshoot 'bitcoin cash' falls to more than one-week low

Precisely a month since bitcoin split into bitcoin and bitcoin money, the first computerized cash hit a record high Tuesday while the branch tumbled to its most minimal in over seven days.

Bitcoin climbed more than 6.5 percent, to a record high of $4,703.42, up almost 70 percent for the month, as per CoinDesk. Bitcoin edged off that high in evening exchange, floating around $4,603, still more than fourfold in esteem for the year and up around 60 percent for August.

Bitcoin money hit a low of $559.61, its least since Aug. 18, preceding recouping to around $575, as per CoinMarketCap. The option rendition of bitcoin, upheld by a minority of engineers, is still up around 170 percent from a low of $210 hit on Aug. 1, the day of the split.

blob:https://www.cnbc.com/62e1b5d4-3b29-4307-b5b6-66e92aa0336c

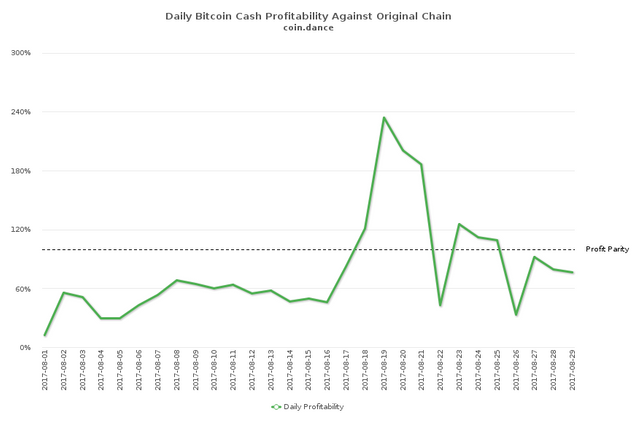

While computerized money "diggers" incidentally discovered bitcoin money more gainful than the first form to mine, by Tuesday it was 32 percent more productive to mine bitcoin, as indicated by information from the Coin Dance site.

"With Bitcoin back to being more gainful, Bitcoin money lost some steam," Nolan Bauerle, executive of research at CoinDesk, said in an email to CNBC.

Relative benefit to "mine" bitcoin money versus bitcoin

In the interim, institutional enthusiasm for bitcoin is rising. A Tuesday report from money related research firm Autonomous Next recognized 55 crypto-related assets.

"I believe it's quite recently new cash coming in," said Brian Kelly, a CNBC giver and head of BKCM, which runs a computerized resources methodology for customers. He noticed the main part of the increases in bitcoin came just around the season of the U.S. securities exchange open Tuesday morning.

Another computerized money, ethereum, climbed almost 5 percent Tuesday, to around $364, as per CoinMarketCap. Ethereum is up more than 4,400 percent this year and has picked up almost 79 percent this month.

A few examiners likewise ascribed bitcoin's increases to financial specialists searching for a wellbeing exchange after North Korea let go a ballistic rocket over Japan.

"With both bitcoin and ether, we're seeing a flight to wellbeing because of the issues in North Korea, like when financial specialists beforehand rushed to gold out of values amid past wars," said Andrew Keys, head of worldwide business advancement at blockchain programming engineer ConsenSys.

Interest for bitcoin and ethereum from Japanese and South Korean financial specialists stayed solid, as indicated by CryptoCompare. The site demonstrated exchange the Japanese yen and South Korean won represented almost 50% of all bitcoin exchange volume, while won-designated ethereum exchange represented around 22 percent.

Asian stocks shut for the most part lower, European markets fell more than 1 percent and U.S. stocks opened lower after North Korea late Monday Eastern Time let go a ballistic rocket over Japan. Neighborhood telecaster NHK said Japan made no move to shoot down the rocket, which later broke into three pieces and fell into the ocean.

U.S. stocks recouped the majority of their misfortunes to exchange barely blended early afternoon Tuesday.

Gold prospects for December conveyance stretched out Monday's bounce to climb the greater part a percent Tuesday to $1,331.90 an ounce, their most noteworthy since Nov. 9.

Numerous computerized money lovers anticipate that bitcoin will turn into the "advanced gold" of cryptographic forms of money since its supply is restricted to 21 million yet request stays solid the same number of speculators utilize bitcoin as their way into the computerized cash world.

All things considered, bitcoin is a long way from achieving an indistinguishable status from the valuable metal. About $7.5 trillion of gold is available for use, while the estimation of every single computerized cash just came to $160 billion Tuesday, as indicated by CoinMarketCap. Bitcoin had the biggest offer at about $75 billion, while ethereum was second with a market estimation of $34.7 billion, the site appeared.

oh my god

every device are greats

Bitcoin rose at a higher rate than gold and silver. This suggests that cryptocurrency is being treated as a safer investment than precious metals. This flight to safe haven assets makes Bitcoin the premier risk aversion asset.