If Bitcoin Is a Bubble, So Is Everything Else!

"There’s nothing that’s cheap today. " — Howard Marks (August 2017)

This article is available in video. The video is scripted and is a concise version of the article below with many pictures of headlines from the hyperlinks in this article to give a better understanding of what is happening. If you enjoy this content, please consider subscribing. Hope you all enjoy!

Is Bitcoin a bubble? My last article on the subject provoked a ton of discussion from both sides of the aisle. It certainly exhibits some characteristics of one. Yet if we look at Bitcoin in the context of other investment assets, it becomes harder to argue that Bitcoin’s price movement is unique. Equities, bonds, and real estate (especially in some regions) are all expensive. We are in the middle of a strong bull market across not only asset classes, but also both domestically and internationally. Even if we look at private equity and alternative investments, we still see some strong uptrends. In this context, it’s hard to say definitively that Bitcoin is in a bubble despite the cryptocurrency space providing evidence of “irrational exuberance.”

Stocks

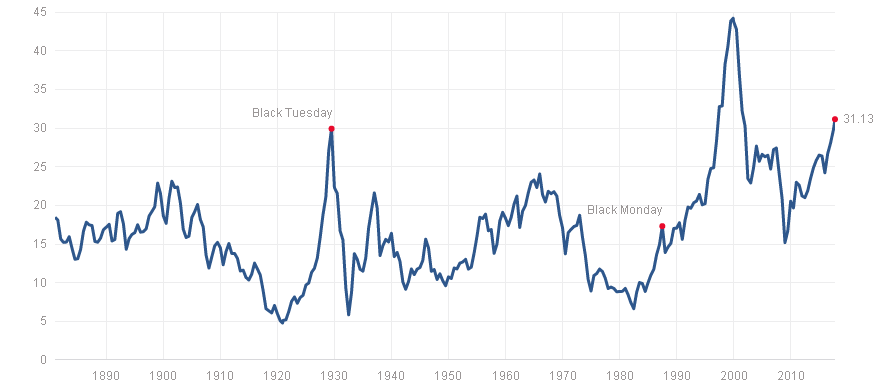

Let’s begin with stock valuations. The Shiller PE (CAPE) for the S&P 500 is the most commonly cited reason that equity valuations are extended, given it is at levels we’ve only seen twice in history before: Once in the roaring 20s, and once in the dot-com bubble. We all know how those worked out.

Source: multpl.com

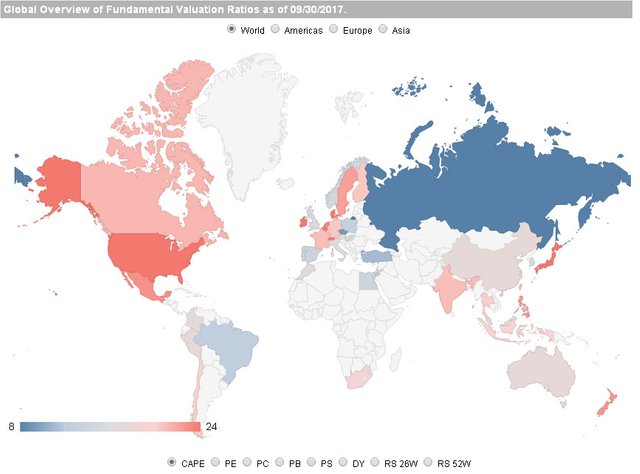

It’s not just in the United States where we are seeing equity valuations become rich, although it is certainly the extreme case. This map here is a great way to get a bird’s eye view of equity valuations worldwide based off a variety of fundamental indicators:

Source: Star Capital — feel free to play around with this tool yourself.

Is it any wonder we are seeing money managers increasingly recommend moving into emerging markets (they had a great quarter too)? Or to increase your portfolio allocation to internationally developed equities? Or that the forecasts for future returns are so abysmal? Large, medium, and small caps all performed well over the past decade since the Great Recession:

Source: Investing.com

And don’t worry, we have plenty of examples of stocks that have gone through the roof as well:

Source: Investing.com. Depicted: FANG stocks and Nvidia over past 3 years.

Technology stocks are among the primary culprits for the increase in P/E ratios. We are seeing more and more companies valued based almost entirely off their future potential (not discounted much either due to falling required returns) rather than their balance sheet and current earnings (e.g: Tesla). There is no shortage of people calling equities a bubble. Yet you don’t see anyone calling them tulips because they have intrinsic value. Earnings are improving: We just had a phenomenal Q3. The outlook for Q4 is positive as well.

These fundamental drivers continue to push equities higher, and the cheap capital availability has allowed many companies to expand inexpensively. The Brookfield “family” (BAM) (BBU) (BIP) (BEP) (BPY), as I call it, is a perfect example of this. The subsidiaries have access to cheap capital from Brookfield Asset Management for a variety of hard asset driven projects (infrastructure, renewable energy, etc). The result has been strong performance across the board for each subsidiary.

As such, despite seeing pitiful forecasted annual returns relative to history, many wealth managers still believe the market will continue to remain strong. This is especially true domestically (United States) if we receive tax reform before the second half of 2018. So despite the rich equity valuations, we see many arguments from both institutional investors and retailers alike that the equity markets, although rich, are still worth investing in now.

Dot-com Bubble vs. Cryptocurrency “Bubble”

Many of these same wealth managers, driven by comparisons to the dot-com bubble, point out how Bitcoin and other cryptocurrencies are nothing more than a bubble. Another subcategory of wealth managers claim Bitcoin will go to zero. While it is fine to argue Bitcoin is overpriced, you should not dismiss the cryptocurrency as a result of this (just as you shouldn’t have dismissed the internet despite absurd valuations). There is certainly a ton of speculative behavior in the market right now, including people leveraging their houses. The booming ICO market, where unsophisticated investors are blindly throwing money at any idea that sounds remotely good, doesn’t help Bitcoin’s image either.

However, there are several differences between Bitcoin and the dot-com bubble:

- Traditional investors haven’t even begun to touch Bitcoin. The best “traditional” way to invest in Bitcoin is the Bitcoin Investment Trust (GBTC), and even that isn’t ideal. Bitcoin ETFs will lead to a huge flow of new capital into the market, and ETF approval odds will improve as the Bitcoin derivative markets grow in 2018.

- Dot-com companies had massive expenses that were far outweighing their revenues, and hence had unsustainable business models. In the long-term, they were doomed to fail unless they fixed their margins problem. Bitcoin is NOT a business. While it does provide a service, the overhead and costs associated with Bitcoin are not incurred by any single entity. You know how Wikipedia has a fundraiser each year? They mention in each said fundraiser that if every single person donated $1–3, it would be done in a single day. That’s essentially what Bitcoin is. It is funded by millions of contributions on a global scale. Bitcoin is sustainable, unlike most dot-com companies which used new metrics to ignore profit and avoided the issue of weak balance sheets by issuing more and more stock. Bitcoin’s development is a “labor of love,” if you will, and its marketing is all grassroots. Take that, Pets.com (still love your sock puppet though)!

- The overall market size is still peanuts compared to the size of the NASDAQ back in 2000. The NASDAQ reached approximately $4T in 2000 as opposed to the $170b that cryptocurrencies sit at right now. Note the size difference is largely the result of the fact that dot-com companies were still “just stocks,” while cryptocurrencies are a nascent asset class that hardly anyone understands how to even invest in. If you’re reading this on Seeking Alpha, how many of you know what a hardware wallet is? Or the difference between hot and cold storage? Or what the most reliable exchanges are? How to even use said exchanges if they don’t accept fiat directly? Many wealth managers still do the majority of their trades by phone!

- We have never had an asset class like cryptocurrencies before, which means understanding how it should be valued is a rather difficult task. While it behaves like a currency in that it is a unit of account and store of value, it struggles to be a medium of exchange due to volatility. It also isn’t backed by any government. While price is determined by supply and demand like a commodity, it also offers a service similar to how a company would. Yet unlike stocks, it generates no cash flows. So what is it? It’s a cryptoasset (read his book, seriously — that’s not even a referral link)! We’re still in the beginning stages of valuing such assets.

- Aside from the cryptocurrency enthusiasts, there is no one talking about a “new economy” like they were in the late 1990s. Unlike the 90s, which were dominated by strong GDP growth and low inflation, we currently have low everything. Inflation, interest rates, GDP growth, unemployment… Almost everything except debt!

Point is, there is nearly no “new economy” discussion around cryptocurrencies in the sense of how they are going to change the relationships between GDP, interest rates, unemployment, inflation, and credit cycles. No, all of that discussion is centered on the long-term impacts of loose monetary policy such as quantitative easing and zero interest rate policies. This is exactly what cryptocurrency investors are trying to avoid! And yes, while many people believe that cryptocurrencies will replace fiat currencies in the long-term, I would say this is not a view most people would be willing to bet on if it came down to that. Unless you just don’t care like Roger Ver.

In summary here, while we do have irrational exuberance with cryptocurrencies similar to what we saw in the late 1990s, realize that historical economic events don’t literally repeat themselves down to the last detail. There are some huge differences here between cryptocurrencies and the dot-com bubble and I’d recommend you think over them carefully before dismissing cryptocurrencies on that premise. Let’s have a look at the performance of some of the other major asset classes because it gives a bigger picture of where we stand currently and why Bitcoin might be making some of its gains.

Bonds

You don’t even need to be involved in finance to know bond prices must be high due to the inverse relationship between interest rates and prices. With zero interest rate policies occurring around the world, many asset managers predict the next 30 years will also be dominated by low interest rates. Bond prices have soared in the past decade, but it’s more than just the long-term interest rates.

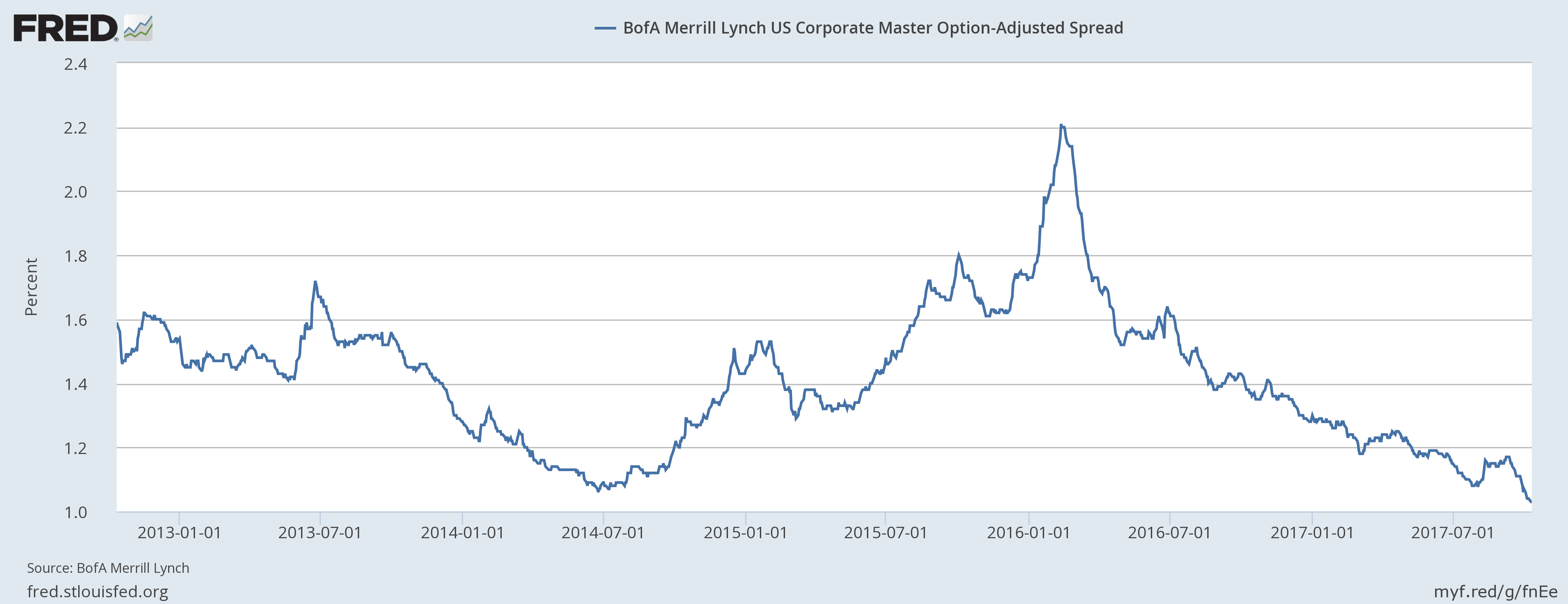

Corporate Investment Grade Spreads

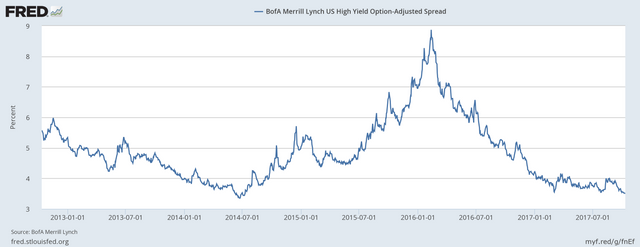

Junk Bond Spreads

The spread between treasuries and both investment grade and junk bonds has thinned. Investors are hungry for yield and they are bidding up prices for higher yielding issues, closing the spreads. Distressed and private debt has become a lucrative market, as evident by Oaktree’s (OAK) excellent year. It is worth noting there are some exceptions, such as the selloff in Puerto Rico’s general obligation 2035 bonds. These are selling roughly between 35–39 cents on the dollar following comments from Trump. But in a few months, I would not be surprised to see investors bid those prices up as well in the hunt for yield. Shorting treasuries (TLT) is a popular trade, but it has been a dangerous gambit in this interest rate environment. As with equities, loose monetary policy has led to odd market conditions and a bubbly bond market. You’ll note that this is a common thread across all asset classes.

Real Estate

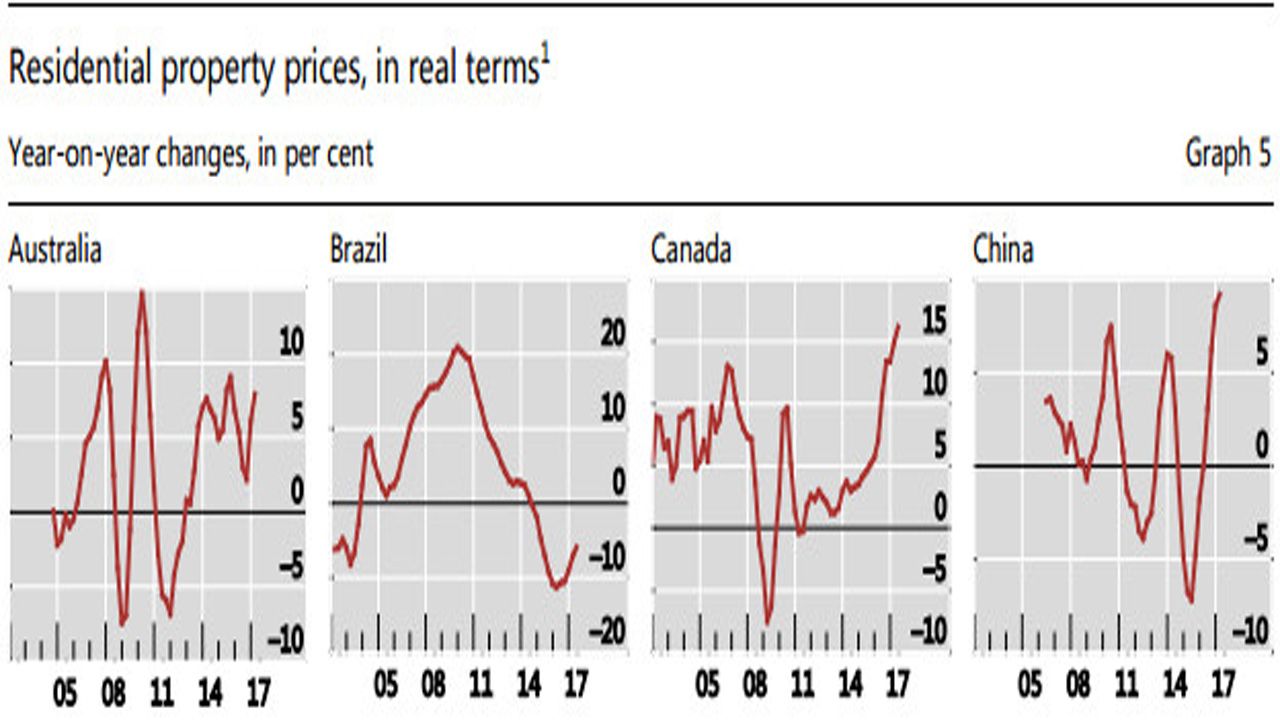

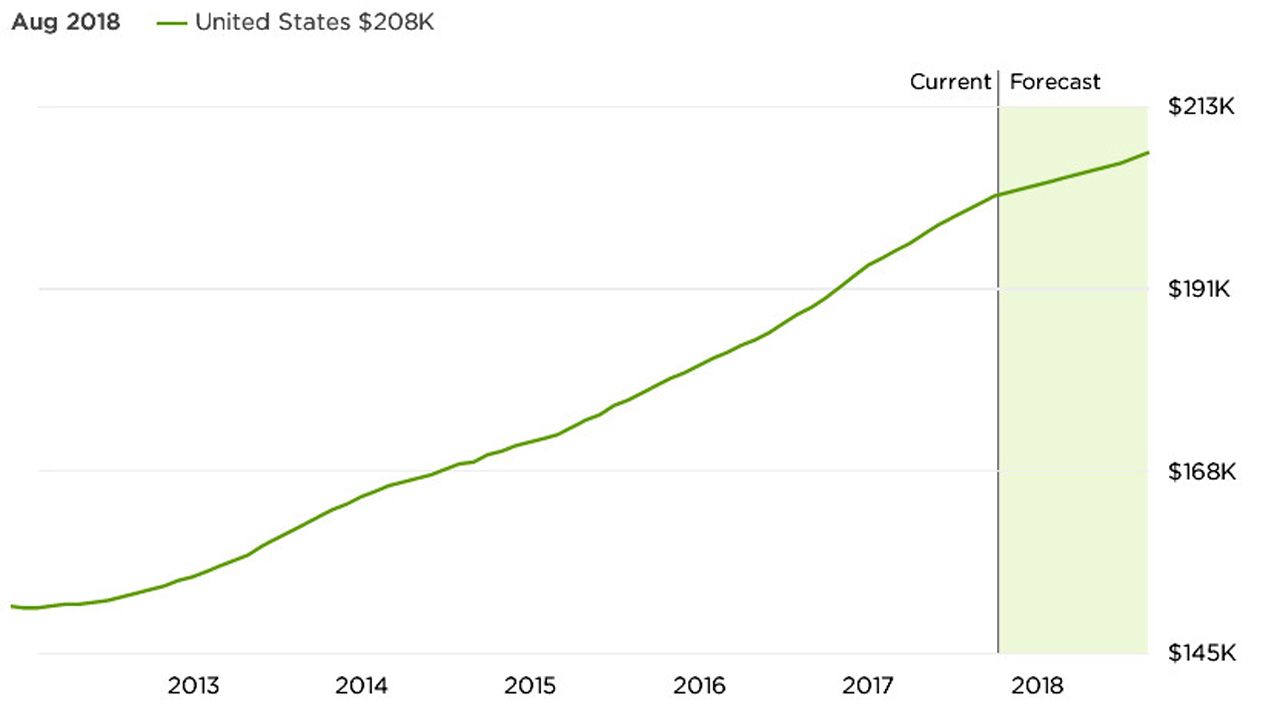

According to Zillow, the median home value is up to $201,900 in the US. We are back to where we were before 2008 in nominal terms across most geographic regions. However, the increase in home values isn’t exclusive to the United States as can be seen below:

Source: Bank for International Settlements (bis.org)

Developed nations are seeing houses appreciate in real terms steadily over the past five years. This report goes to Q1’17 and real home values were only 2% below what they were prior to the crisis. Given the continued housing strength, real home values are now close to what they were prior to the housing bubble. In some countries, we are seeing explosive growth in property values:

Source: bis.org

Ignore poor old Brazil there, which was plagued with high inflation in the past few years, resulting in negative real growth. Housing is booming in Canada and is seeing strong growth in Australia and China as well. I can tell you from anecdotal experience that when real estate prices keep going up, it is one of the first asset classes that unsophisticated investors are drawn to. Those stock things are for wealthy people. But real estate? I know a friend who has a friend who flips houses for a living. My sister’s husband owns a house that he rents out and he also makes money from the increase in the home value! How tough can it be? It’s like the gateway drug for investing, which is ironic given that the lower liquidity and challenges associated with managing property make it one of the least friendly asset classes to invest in directly!

Oh and, in case you missed it, mortgages are becoming easier to secure again. Creditors are starting to play with the terms to make it easier for home buyers again. It’s all about attracting new borrowers. Yet again, loose monetary policies affect another asset class as low interest rates encourage consumers to purchase their houses now while rates are still low.

Alternative Investments

Alternative investments are booming as well (I view alternative investments as outside the financial world). The floor prices of liquid domain names (e.g: google.com is a domain name) have steadily increased in the past year. The total liquid domain estimated market cap has increased from roughly $7.8 billion in Q3’16 to $8.135b in Q2’17, or roughly a 4.3% increase (didn’t do year over year because reports only began in Q3’16). Note this doesn’t include sales of non-liquid domain names (e.g: Freedom.com sold this year for $2 million and wouldn’t be considered a liquid domain), which are also doing well year-to-date.

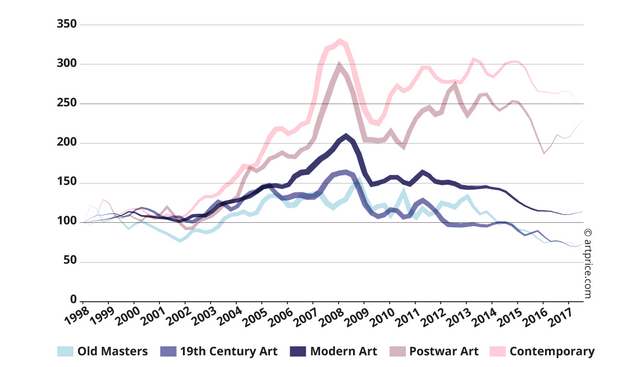

If you’ve read or watched the news lately, you’ve likely heard about the last Da Vinci held in private hands going to auction at Christie’s for at least $100 million. Notably, fine art is one of the few investments where prices are slowing down across most subcategories:

Source: Artprice’s H1’17 report. Graph is their proprietary index with base level 100 in 1998.

Perhaps we should all be investing in art! If only I understood it. Even with art, we’re seeing an increase in transaction volumes which suggests more players are entering the market. If we dig even further into niche alternative investments, such as collectibles and trading cards, we’ve seen a spike in interest there as well in the last few years. I don’t have any fancy charts to show you, so take what I have to say with a grain of salt (you should be anyway). I have a friend who owns an antiques store who claims he is seeing higher turnover and more “investing” types lately than traditional hobbyists. I suspect we will see a trend toward nontraditional asset classes moving forward as well given the expected returns in traditional asset classes. Guess which one Bitcoin belongs to?

Bitcoin & Cryptocurrencies

In the end, no one can say for certain whether or not Bitcoin is a bubble. We can infer that loose monetary policy has led to rich asset valuations across all classes (refer to my Howard Marks quote at the top of this article). We also know investors have been hungrier for higher returns and yields, pushing more capital into tech companies and riskier bonds despite the fact that confidence in the markets is relatively low. It’s like we’re in a bull market because Mr. Market is being held at gunpoint by central bankers (comic strip idea). The gun is monetary policy, in case that wasn’t abundantly clear yet.

Bitcoin is an asset that has not only offered returns, but is also the first “killer app” of a brand new, powerful technology known as the public blockchain. We are only beginning to explore the implications of this technology, but we know that Bitcoin’s sheer size makes it very difficult for any other cryptocurrency to displace it in its niche case of peer-to-peer transactions.

Due to its decentralized nature, Bitcoin has begun to act as a “safe haven” asset for countries whose currencies face hyperinflation such as Venezuela. We’ve seen it move in the same direction as gold during the last two North Korean threats, although these were short-lived movements for gold.

Even disregarding its hedges against geopolitical instability, Bitcoin has a notably low correlation against other asset classes. Several studies (Chris Burniske’s book “Cryptoassets” also shows similar results) have shown Bitcoin’s correlations with the stock market, bonds, and commodities such as gold to be close to 0. The primary reason is its volatility, which in turn is the result of its pitiful size in comparison to the other asset classes we are comparing it to. Financial advisors are beginning to look at the place of cryptocurrencies such as Bitcoin in a modern portfolio as low correlations are beneficial for risk reduction.

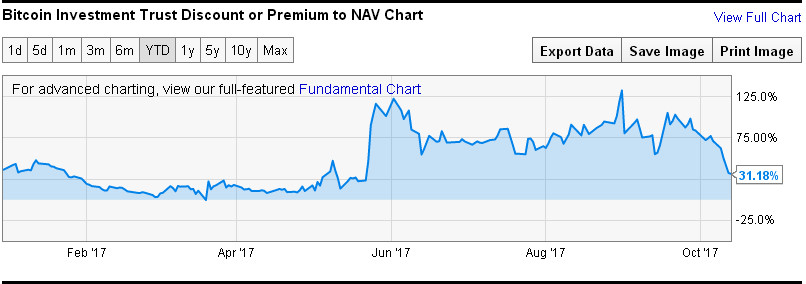

The largest catalyst on the horizon is the approval of a Bitcoin ETF (COIN), which will allow traditional investors to enter the market more easily. Note that the only traditional vehicle right now, GBTC, trades at a sizable premium because of investor demand:

Source: YCharts

Some of this demand comes from the fact that it is the only vehicle by which traditional investors can have Bitcoin exposure in an IRA. However, there are other options such as the company literally called Bitcoin IRA. The premium behind GBTC can only be explained as the byproduct of traditional investors who honestly have no idea how to invest in the underlying asset. The lack of supply due to the share creation process and an increase in demand over the past 6 months has led to a much higher premium lately. The volatility in said premium is the result of rapidly fluctuating Bitcoin prices, investor demand, and folks such as me who like to trade the premium.

Final Thoughts

The point of this is that there are investors waiting on the side lines with Bitcoin. The last “crash” was eaten up quickly at $3000 which would have been considered remarkable just 3 months ago. While I can’t tell you if Bitcoin is a bubble definitively, I can say there is no shortage of investors in the market for riskier assets based on current asset valuations (despite how cautionary many guests are on CNBC). I can also tell you that it’s a baby right now relative to the other asset classes we are comparing it to, which invalidates some of the comparisons made.

As institutional investors begin to support it, more businesses will as well. The name Bitcoin has made its rounds across Wall Street, but it still has a long way to go until it is in the households of ma and pa (just like e-mail back in the 90s). Many investors today are betting that we will reach that point.

There are other factors in play as well such as the fact that the largest demographic of cryptocurrency investors are millennials, who, thanks to the Great Recession, generally do not trust the banks or the government. To them, the value of Bitcoin goes beyond transaction speed and ease.

Loose monetary policy has inflated the values of all asset classes. In this environment, it becomes more difficult to analyze whether or not Bitcoin is a bubble, or if all risky markets are being impacted by chasing return and yield. Alternative investments have surged in popularity and while Bitcoin leads that pack right now by returns, it is certainly not alone. As with all markets, it comes down to a matter of opinion. All I hope is that everyone can give it a fair thought, rather than echo chambering what they hear off the media which is usually heavily biased either for or against Bitcoin. Happy investing everyone!

If you found this analysis useful, I hope you'll consider following. Also, consider subscribing to my YouTube channel where I post frequent content on investing in cryptocurrencies. This will help you stay notified when I publish new analysis and it goes a long way in helping me know you like my work. Lastly, I have started posting updates to Twitter for those interested. I look forward to your thoughts in the comments. Thank you for reading!

Cryptos and precious metals are looking good at the moment. Real estate prices and the dow just keep going up without coming back down...could get ugly fast.

Absolutely outstanding article. Follow and upvoted. Really quick, what's your pen name on seekingalpha? (I got the impression you're writing over there as well.) I'd like to add you.

In the meantime, check out my piece on this theme here if you're interested. I'd love to hear your feedback.

Outside of that, I think, in the current environment, we're facing a point with Bitcoin where it's considered a risk-on asset but doesn't behave like one. The demographics of the BTC and alts holders are very different from the traditional investors and as a result those "true believers" don't give a damn what Wall Street thinks. If BTC holds value when we finally get volatility coming back to the market, the true believers would be vindicated. If it doesn't then the naysayers win saying it was just a fad. Ironically, all the planning and jawboning in the world will not protect BTC from what the overall economy will do to it, leaving its marks - warts and all.

In any event, again thanks for the article! Take care!

I write under the pseudonym "Truth Investor" on Seeking Alpha. The demographics and more liberal beliefs supporting Bitcoin are both a reason to believe it can grow further and also why you could believe it is overly priced (as people investing for the reason of politics tend to avoid fundamentals). It is fairly interesting how that might play out. Long-term what I find interesting is what will happen as millennials start growing in influence as the group ages.

I just skimmed your piece and bookmarked it. I'm almost braindead right now because I've been working on this article + video for the last 14 hours straight, so going to save fully reading it when I am a bit rejuvenated. But I'm happy to see someone else covering these topics. Thanks for your comment!

I appreciate ya. I'm about brain dead too but I'd like to keep this conversation going. Looking forward to it.

I think the real lesson here is to invest in fine art.

hopefully @cryptomaker can give you credit for this post https://steemit.com/bitcoin/@cryptomaker/if-bitcoin-is-a-bubble-so-is-everything-else which makes reference to your video on this post.

Very good video and analysis , thanks.

Thanks for informing me felipe.

you're welcome @cryptovestor , yeah I can tell that your article and video took a lot of time to create and also they provide great info so it's only the minimum to show who originally created the content. Cheers.

the truth is that everything is a buble.... natural disasters,wars, events of history....etcetc.... never warn before coming ,yet these events are so much orchestrated that they hardly leave any traces behind.... however this is a separate topic... the hotcake these days is BITCOIN and thats it.... till a new option, i think we just need to concentrate on this fact only.....

Very informative and on point.

Thanks for the kind comment superfly.

Congratulations @cryptovestor! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPIt would be a safe and profitable bubble.