Embrace The Pain! BTC/USD 10th March 2018 23.15 UTC Chart Analysis

After an excruciating (for bears at least) ten day detour up to test the long term overhead trend line again, Bitcoin price action bounced off the immovable object that it seems to be and made another hasty retreat down into the low nines. It has deliberated there for a few days, pulling back to test $9500, where it failed, after an initial panic had driven prices down to $8342. It is currently deliberating just below the psychological $9000 support level, teasing the bears and giving hope to the bulls (fig.1):

Unfortunately (as always seems to be the case recently), that hope is probably misplaced. As it is currently developing, the price action is forming an 'M' or 'double top' reversal pattern. As the name implies, this marks a change in the recent uptrend and could see prices visiting the $8000 mark, with the worst scenarios being another $6000 breakdown. The key features of the pattern are a decrease in volume between the two peaks, a break below the lowest point of the trough ($9280 - broken earlier today) and a sudden decline thereafter, with a few reaction rallies to test the new resistance level (already happened and failed to break through). At this point, the pattern looks pretty well confirmed (fig.2):

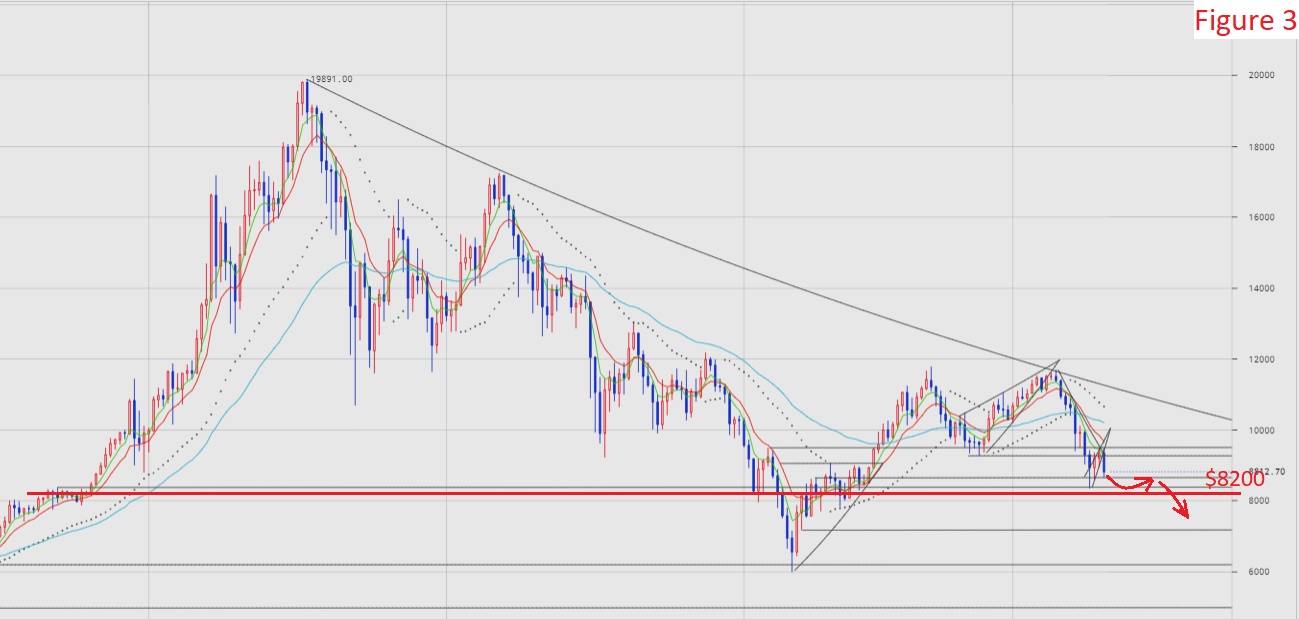

While most traders are expecting a drop down to anywhere between $6000 and $8000, a single short down to that level might not be the best strategy, since reaction rallies are expected at major confluence and support points. Indeed very few things fall straight down. The next support level is around $8200 although it is not as clean a support level as bears and bounce traders would probably like. Given the overall downward momentum I doubt it will hold for longer than a few days if at all, but my own strategy is to take profits when available, wait for a pull back and short again when the reaction rally fails. The very best traders will also squeeze a small dip buy in-between the two shorts (fig.3):

Summary

The short lived attempt to prevent a true breakdown to February's lows, by supporting the price action in the low $9000 region and forcing a test of the $11,700 trend line failed. Declining buying volume has allowed buying pressure to cease to the point where multiple stop loss levels and liquidations of long positions have come into play, driving the market further down. The price action has conformed to a double top or 'M' pattern and lows are likely to revisit the $7000 mark, but a reaction rally at the support level between $8000 and $8400 ($8200) may be manipulated into effect.

Potential Plays

Buy now

Avoid, this would likely be a loss; multiple support levels have been broken, buying volume is decreasing and sentiment remains negative.

Short now

Motivation: falling price having broken $9280 support level

Likelihood: already proven

Current likely outcome: gain to $8300

Action: seek

Position size: medium/large

Entry: anywhere below $9280, but high enough above exit to have profitable downside

Exit: around $8300 or a little higher, watch the level 2 to see if large buy orders are eaten away (avoid $8200 bounce).

Risk/Alert levels: $9000, $9280

Buy later

Potential small dip buy on a bounce from $8200. This would need to be carefully watched and monitored, since bounces or pull backs on generally low buying volume have unpredictable highs. Invalidation of the current downtrend would happen with a close of a daily candle around $10,500, in which case the current scenario would be aborted and a short term breakout could be considered. However, at present this looks very unlikely.

Short later

A potential excellent panic short below $8000 or even $6000 in the coming days. Keep in mind and watch the volumes. Shorting at any multi month low needs a convincing break below that level with a failed pullback and increasing selling volume.

Cryptonym.

NB.

Values in USD are representative of prices traded on the Bitfinex exchange.

Times are UTC standard.

This does not constitute official investment or trading advice. Your losses are your own.

If you appreciate this work and would like to support Cryptonym, please consider donating:

Steem - via Steemit

Fiat - https://www.patreon.com/CryptonymFund

Bitcoin - 3EYtdz4J7aCsW3wnz64rMvqzmkyBKPahee

Bitcoin Cash - 17VXEM8gRYrms1jtoadoLob5DvBFwWkVug

Litecoin - MQhdRXjojwCwzFLQxtExMKaaYyFZ9ftdB7

Ethereum - 0x46Aa8d31f5d1a7e72b38A13e5E7F9bD5FBC7d8ea

Coins mentioned in post:

You posted the same on my last post before the prices crashed down to low 8s. A marginal correction is entirely possible, as I wrote in my original post above. As I also mentioned, unless we have a candle close above 10.2 or 10.5, the trend is still very bearish. 200 day emas and ichimoku cloud calculations have also dipped down for the first time in over a year. Very bearish signals.

Congratulations @cryptonym! You received a personal award!

Click here to view your Board of Honor

Congratulations @cryptonym! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!