CoinDesk Releases Q1 2018 State of Blockchain Report

After reaching historic highs in 2017, cryptocurrencies languished throughout a number of basic metrics on this 12 months's first quarter.

Unease permeated the business, principally from regulatory uncertainty and pull-back after a 12 months of parabolic development.

To make clear a tumultuous Q1, CoinDesk's newest State of Blockchain report offers a 90-plus slide evaluation of a few of the most vital knowledge factors.

Launched Monday, the report covers public blockchains, distributed ledger know-how (DLT), consortium chains, preliminary coin choices (ICOs), buying and selling and investments, and regulation. It additionally options the outcomes of our 50-plus query sentiment survey, which offers perception from over 420 CoinDesk readers.

Listed here are six of crucial tendencies that outlined Q1 2018:

</noscript>

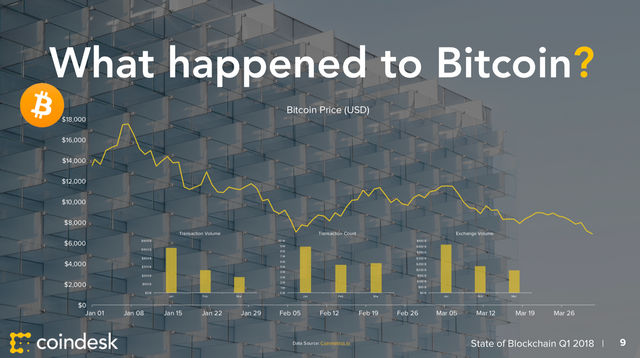

1. Bear marketplace for crypto

Following an all-time excessive of almost $20,000 within the earlier quarter, bitcoin suffered a 51% decline in Q1. Different basic metrics, similar to transaction quantity, transaction rely, and alternate quantity, noticed related drops.

Most altcoins mirrored this habits and adopted bitcoin down, with correlation coefficients of returns starting from 0.7 to 0.9. Your entire cryptocurrency market capitalization misplaced about $348 billion.

The numbers might look grim, however that did not present up in total sentiment: 79 p.c of the respondents to our CoinDesk Sentiment Survey thought this bear market can be short-lived.

Eighty-six p.c stated this was a correction after the rampant over-speculation of the prior quarter whereas 62 p.c stated that regulation was a miserable issue.

</noscript>

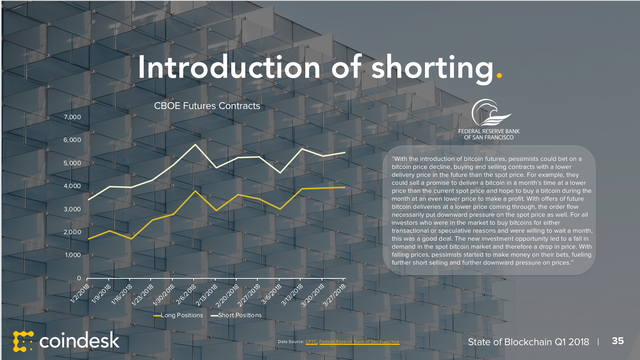

2. Market matures

After the introduction of bitcoin futures markets on the finish of This fall, we have seen regular development on this exercise by way of Q1. Each lengthy and quick positions grew - however strikingly, the shorts outnumbered the longs.

Quick positions ended the quarter at about 5,000 and lengthy positions ended at about 3,000. It seems that it is principally pessimistic buyers profiting from these contracts.

And this, in flip, seems to have contributed to the slump within the underlying asset.

In accordance with researchers on the Federal Reserve Financial institution of San Francisco, "the new investment opportunity led to a fall in demand in the spot bitcoin market and therefore a drop in price."

</noscript>

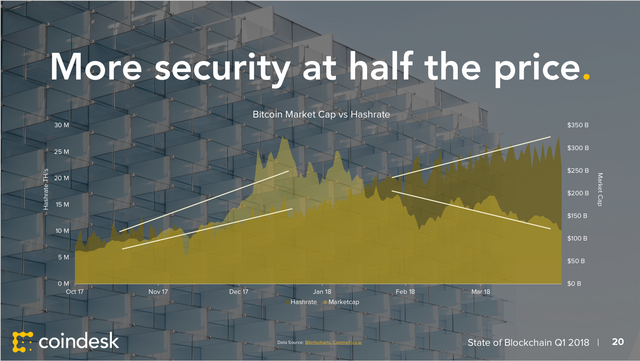

3. Miners keep lengthy

Bitcoin miners did not seem phased by the dips, nonetheless.

Over Q1 we noticed the slope of hash charge - the quantity of processing energy dedicated to securing the bitcoin community - diverge from market cap, as an alternative of every transferring in the identical path, as in This fall 2017. The hash charge grew 47% over the quarter with little deviation.

Bitcoin's hash charge held robust in opposition to the competitors; bitcoin money, the cryptocurrency with the second-strongest hash charge, averaged solely 12 p.c of bitcoin's hash charge over the quarter.

It is also essential to notice that miners are inclined to take a long-term view and provide a counterpoint to short-term pessimists. Seven p.c of our respondents stated they discovered extra about miner dynamics throughout Q1.

</noscript>

4. Taxes loom giant

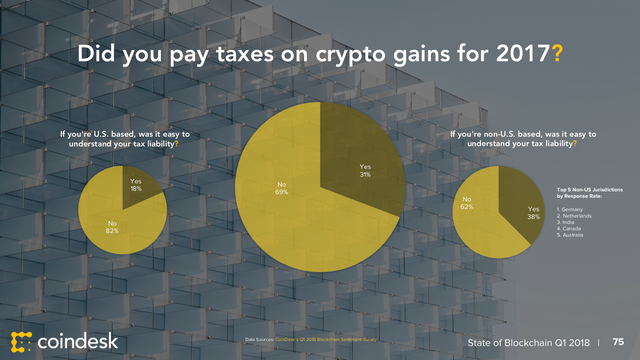

Taxes have been top-of-mind for a lot of buyers, with cryptocurrencies producing an estimated $70 billion in international tax income for 2017, based mostly on the whole beneficial properties out there and the common of assorted governments' tax charges.

The tax parameters surrounding cryptocurrencies stay in flux. Thirty-one p.c of survey respondents stated they paid taxes on beneficial properties; nonetheless, the variety of these obligated to pay taxes is perhaps increased than those who report taxable beneficial properties.

Of U.S.-based respondents, 82 p.c indicated that it wasn't simple to know their tax legal responsibility whereas 62 p.c of non-U.S. based mostly respondents stated the identical. These observations lend assist to the speculation that folks (regulators included) are genuinely confused concerning the authorized and tax standing of all the asset class.

The 20 proportion level distinction in tax understanding between the U.S. and non-U.S. respondents may point out the U.S. is failing to embrace the subsequent technology of monetary know-how as competing nations think about friendlier methods.

</noscript>

5. ICO development continues

ICO exercise remained brisk, with $6.Three billion raised in Q1. Month-to-month breakdowns of ICO raises present every particular person month of Q1 was increased than the report quantity set in December.

Telegram's $1.7 billion ICO was a big outlier that accounted for over 25% of the funding in Q1. The subsequent-largest ICO on this interval was Dragon's $320 million providing. With out Telegram, the tally for March would have been beneath December's.

But bigger ICO raises seem like a rising pattern. The typical elevate quantity virtually doubled from This fall to Q1, from $16 million to $31 million. The distribution of ICOs shifted in the direction of bigger elevate quantities and fewer complete offers.

The variety of ICOs declined every month from December's excessive of 78, aside from a slight uptick in March. Whereas the discount within the variety of ICOs would possibly seem to be a bearish sign, 40% of survey respondents participated in an ICO, up from 30% final quarter.

</noscript>

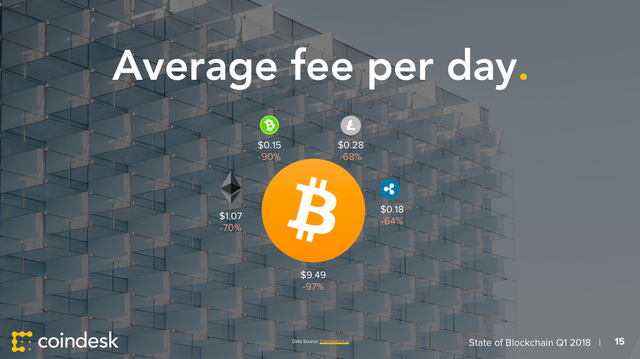

6. Charges fall

Transaction charges on the bitcoin community dropped from drastic highs set by the feverish demand of This fall 2017, when on some days charges averaged $40. Over Q1, charges settled on a median of $9.49 per transaction.

Most different cryptocurrencies noticed 60 to 90 p.c declines in charges as nicely, however in absolute numbers, they have been by no means so excessive previous to Q1.

Excessive charges might need discouraged customers from transacting, but it surely's uncommon to see charges come down and nonetheless see declines in transaction counts. Payment ranges are additionally a barometer of demand. As extra individuals purchased into cryptocurrencies in This fall, we noticed will increase in charges. So a discount in charges may suggest that demand is shrinking.

There are answers to assist mitigate charges additional, most notably the lightning community, which made important strides within the first quarter and reveals promise as a steady, second-layer resolution for frequent and smaller transactions.

Seventy-eight p.c of our respondents thought-about lightning a constructive improvement and look ahead to utilizing it. And whereas 21 p.c counsel lightning will centralize bitcoin extra, the opposite 79 p.c assume there will likely be no change or much less centralization due to it.

The chief in blockchain information, CoinDesk is a media outlet that strives for the best journalistic requirements and abides by a strict set of editorial policies. CoinDesk is an unbiased working subsidiary of Digital Foreign money Group, which invests in cryptocurrencies and blockchain startups.

fbq('init', '472218139648482');

fbq('track', "PageView");</script>

Hi, thank you for contributing to Steemit!

I upvoted and followed you; follow back and we can help each other succeed :)

P.S.: My Recent Post