Bitcoin futures: Everything you need to know

.jpg)

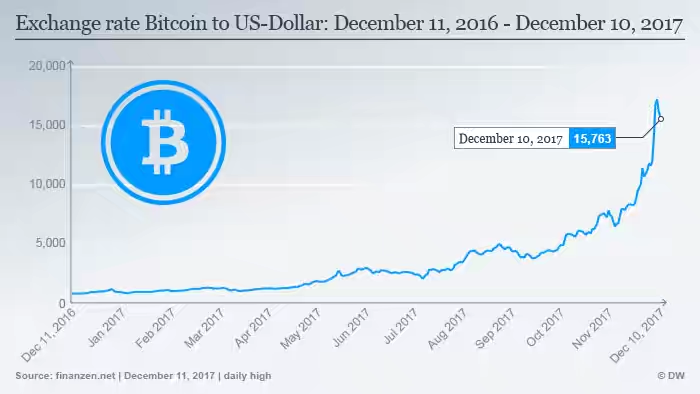

While some still hold the belief that Bitcoin and other virtual currencies emerged in the aftermath of financial crises and while it's legitimacy is questioned and it's considered as a fool's gold, a bubble or viable means of payment or store of value. Nevertheless, the coins continues to reach new high. It is no doubt that a new legitimate era for Bitcoin dealing gets more real as trading in futures contracts of the virtual currency has started on Chicago's CBOE exchange. The subsequent buying frenzy prompted skeptics to again warn of a bubble.

When Bitcoin was first created in 2009 it was only worth a few cents. Since the beginning of the year though, Bitcoin has seen an amazing 15-fold gain. In another step toward legitimacy, futures trading — actually bets on Bitcoin's price in the future — made its debut on a major global exchange on Sunday after gaining US regulatory approval. That is a milestone for a controversial digital currency that has no central bank backing and no legal exchange rate.

Bitcoin futures surged more than 20 percent on Monday, forcing the Chicago Board Options Echange (CBOE) to halt trading twice. While CBOE said "heavy traffic" caused spotty service on its website following the launch, tight risk limits imposed by banks and brokers prevented all but a handful of investors using the untested futures market.

By late afternoon in London, January 2018-expiry Bitcoin futures were at $17,888 (€15,159) per Bitcoin, off their highs but up from an opening price of $15,000, with more than 3,000 contracts traded. That compared with a price of about $16,350 for buying Bitcoin immediately on cryptocurrency exchanges.

"The prospective launch of bitcoin futures contracts by established exchanges in particular has the potential to add legitimacy and thus increase the appeal of the cryptocurrency market to both retail and institutional investors," Nikolaos Panigirtzoglou, a global markets strategist at JPMorgan, said in a Friday report.

"In all, the prospective introduction of bitcoin futures has the potential to elevate cryptocurrencies to an emerging asset class," Panigirtzoglou said. "The value of this new asset class is a function of the breadth of its acceptance as a store of wealth and as a means of payment and simply judging by other stores of wealth such as gold, cryptocurrencies have the potential to grow further from here."

To read more, check https://www.cnbc.com/2017/12/01/jpmorgan-strategist-bitcoin-futures-can-add-legitimacy.html

https://finance.yahoo.com/news/bitcoin-futures-everything-need-know-163848978.html

The upcoming CME future probably will be bigger than the CBOE one. The future will offer a chance for miner to hedge their coins, which is a good thing.