An in-depth review of Libra, Facebook's new coin from the perspective of a cryptocurrency user

It seems like most cryptocurrency news sites, forums and subreddits are making fun of "Facebook's new centralized coin" without providing any details that can help the average cryptocurrency user understand the implications that the introduction of such new coin will have on other cryptocurrency projects. You may decide to not like this new centralized coin, but at least you should know enough about it to dislike it for the right reasons.

I'm someone who value decentralization over convenience, so it's obvious that Libra is not for me, however, I understand that I'm not the average user. So even though you too don't plan on using Libra, you should try to understand what Libra is because the success or failure of Libra may affect other cryptocurrencies indirectly.

I want to make clear it that this post will include both facts and my subjective opinion about different aspects of the Libra project, so I will make it clear what's my opinion and what's a fact.

I - Libra FACTS

After reading the news that Facebook has finally unveiled its new "cryptocurrency", I was very interested in learning more about it. Fortunately, the Libra project already has a website Libra.org that is well designed, and even though there are still many unanswered questions that I couldn't find answers for, they have done a great job at explaining what their goal is and how they are planning to achieve it.

Even if you believe that Facebook is the designer and kick-starter of this new Libra project, Facebook is definitely not trying to claim sole ownership of Libra, as you will understand throughout this post, Facebook is not a bank or a central bank and they are not trying to become one, they are in the data business and that's what they are interested in. Facebook is presenting Libra as a collaboration between multiple independent parties coming together to create a new "cryptocurrency" designed for the whole world to use, a currency that is secure, stable and "decentralized".

So this is clearly not a Facebook Coin or a Zuckerberg Coin, this a new currency that Facebook wants to influence its design but not take all the regulatory responsibility by itself and to ease any backlash against it so that the public doesn't perceive it as a Facebook coin.

1 - What is Libra?

Libra is the native currency of the Libra blockchain, a blockchain designed and governed by the Libra Association, an organization that consists of 28 independent members. Libra is created to be stable, it is pegged to a basket of relatively stable and low-risk assets, these assets are put into what is called the Libra Reserve, this reserve will be managed by geographically distributed entities.

Libra is not is a stable coin. Unlike Tether, one Libra will not always have the same value against one currency like USD because unlike Tether, Libra is pegged to a basket of assets not just to USD.

Libra wants to empower people around the world to access financial services. They believe that 1.7 billion adults don't have access to traditional banking system, from this 1.7 billion, there are 1 billion who already have a mobile phone and nearly half of these mobile phone owners already have access to the Internet. Libra believe that today's financial system is outdated and uses mostly old technology that is costly and inefficient, these inefficiencies are reflected in the huge fees that users around the world are paying for simple transactions.

With these listed problems that face traditional banking services, Libra doesn't think the current projects in the crypto space offer solutions to these problems, they think although some decentralized blockchains solve some of these problems they introduce their own problems like price volatility and transaction scalability. They also think these cryptocurrency are not compliant with current regulations which Libra think is the only way for such currency to reach mainstream and that is to start by being more compliant with regulations of each country they will operate in.

Libra will be using the blockchain technology to issue the Libra currency that is backed by a baskets of other valuable assets which will derive its value from. The Libra network will be governed by the an independent organization called Libra Association, an organization based in Geneva, Switzerland. The members of this association will also be the validator nodes in the Libra Blockchain. The founding members of this association will be the one who will design the Libra Blockchain, but in the future, new members will be able to join the association as validator nodes to secure the Libra network and make the Libra network more distributed across multiple geographic locations and different institutions and companies across the world. Currently there are 28 members in the Libra Association but by the launch time of first half of 2020 they want to have around 100 members in the Libra Association. Here are the names of the Libra Association founding members: Mastercard, Paypal, PayU, Stripe, Visa, Booking Holdings, Ebay, Calibra (Facebook's subsidiary), Farfetch, Lyft, Mercado Pago, Spotify, Uber, Iliad, Vodafone, Anchorage, BisonTrails, Coinbase, Xapo, Andreessen Horowitz, Breakthrough Initiatives, Ribbit Capital, Thrive Capital, USV, Creative Destruction Lab, Kiva, Mercy Corps, Women's World Banking.

As for Facebook, they will not be involved in Libra directly. They will work on Libra through a subsidiary called Calibra this is because they want their social network business and finance business to be separate and not share data between each other. Calibra will be representing Facebook's interests in Libra, however, it will have no special power over the other 27 Libra Association members. So even though Facebook has the most influence when it comes to the Libra development, this is because of the company's size and expertise in the technology industry and not because they have special membership in the Libra Association. One example of this influence is that the proposal for the Libra Protocol present in Libra official website Libra.org is written by 53 authors all of which are employed by Calibra, the Facebook subsidiary.

Libra Association is the organization that will govern anything related to Libra. Libra Association is the one that is designing the Libra blockchain software and its specifications. The Libra currency that everyone is talking about in the press is just the native currency of the Libra blockchain. The Libra blockchain will also have the capability of running smart-contracts using the newly in-house developed Move language.

Even though Libra wants to be as distributed as possible, they are limited by the technology they use, so their goal is a balance between distribution, security and transaction speed because as the number of validator nodes increase, the transaction latency increases and the transaction throughput decrease. They think that with 100 validator node they can achieve around one thousand transaction per second.

Unlike blockchains like EOS where most of block producers don't have to store the whole blockchain but rather rely on another third party to get the full blockchain and there are only 4 entities currently who have the full history of EOS blockchain, Libra validators will all be required to host the full Libra blockchain to participate in voting in the Libra network. Not every Libra Association member have to be a validator.

Similar to EOS, validator nodes will take turn to act as the leader that will arrange and propose transactions. The leader will propagate the transactions to other validators who will execute them and then compare the new state of the blockchain between each other. Even though Libra is a permissioned blockchain, anyone can replicate the entire Libra blockchain if they wish to do without being a validator node.

Libra transactions will be pseudo-anonymous, meaning you can know the address of the sender and the receiver but without doing deep analysis to the history of transactions of these addresses you won't be able to know the identity of the sender nor the receiver, however, third-parties with enough resources will easily be able to uncover the identity of any address especially law enforcement agencies which Libra Association, exchanges and wallet providers will have to comply with.

Libra technical recommendation for its members to run a full validating node is to have half a rack of server space, I'm not sure what does a half a rack of a server mean, what kind of server, processor, storage? It's not clear what is the server's requirements. For Internet speed it have a recommendation of 100Mbps. With that said, Libra Association will help any member that wants to rely on a cloud service like Amazon Web Services to run their Validator Node.

Libra consensus protocol is called LibraBFT. This is their Byzantine Fault Tolerant consensus. It is a variant of the HotStuff Protocol which they claim can sustain 33.3% attack where one-third of the validator nodes are compromised. They specifically choose this consensus over Proof-of-Work because it supports higher transaction throughput, low latency and because it consumes way less energy than Proof-of-Word consensuses.

The Libra software will be open source. However, each members are free to create their own Libra wallet. The only wallet that is confirmed to be in development is Calibra wallet. This wallet will be created by Facebook's subsidiary Calibra. Any user who want to use Calibra will have to verify their identity. However, Users of Libra Blockchain will be able to create multiple addresses that are not linked to their real-world identity. It is not yet clear how the interaction between verified and unverified addresses will work in the real world.

As for the smart-contract aspect of Libra. The Libra blockchain will allow developers to write their smart-contracts using the Move programming language. This is a new programming language created by Facebook designed specifically for writing smart-contracts. Libra claims that Move is designed to be simple for developers to make their code's intention clear to avoid any catastrophic incident where the code is different from the developer's intention, incidents like the famous DAO smart-contract in the Ethereum blockchain.

Even though Libra's public ledger is advertised as a blockchain, the data structure of this "blockchain" is different from other traditional cryptocurrency blockchains. The Libra blockchain is not a collection of blocks that are put together to form a blockchain, the Libra blockchain is a single data structure that record transactions and states over time.

As I mentioned before, Libra will derive it value from the basket of assets that it is backed by. This basket of assets will constitute multiple fiat currencies in the form of bank deposits and other securities. The money in the Libra Reserve will come from two sources. The first source is from the founding members who will have to invest at least $10M each to join the Libra Association. This source of money for the Libra Reserve is for kick-starting the Libra currency. The second source of money for the Libra Reserve, which is the long term source, is purchases of Libra currency directly from the Libra Association using fiat money through authorized resellers. These authorized resellers can be banking institutions or regulated cryptocurrency exchanges.

The circulating supply of Libra coins will vary depending on the Libra Reserve. When new money enters the Libra Reserve, the Libra Association will create newly minted Libra. When someone wants to redeem their Libra coin, the Libra Reserve will be used for the payment and the Libra coins that the Libra Association receives will be destroyed so that the peg between Libra and the assets is always maintained whether the Libra supply increase or decrease.

The Libra Reserve money will be stored with independent entities that are distributed geographically. These assets will be invested in low-risk assets. The profit generated from these investments of the reserve money will be used to cover the cost of running the Libra blockchain and to minimize the transaction fees. What is left will be used to pay dividends to the investors who hold a special token called the Libra Investment Token. This token is different from the Libra currency that normal users will be holding. The Libra Investment Token will be distributed to the Libra Association members relative to their investment.

The Libra Association, the body responsible for governing anything related to the Libra project will have around 100 members when it launches in the first half of 2020. Each member of the Libra Association will appoint one representative that will represent them in the Libra Association. For any proposal to be accepted, it will require two-thirds of the Libra Association members to agree for it to pass.

Concerning Libra development state, they already have a testnet ready for developers to start using.

At the time of Libra launch and during the first five years of its operation, Libra will be a permissioned blockchain which means that only a selected pre-approved member can be validator nodes, unlike permissionless blockchains like Bitcoin or Ethereum where any person or company can join the network to be a miner and start verifying blocks and can leave anytime they want without impacting the security of the network. In permissioned blockchains like Libra, this is not case.

Libra is clear about its goals, they believe that the permissionless model is a better model but they choose the permissioned model just as a way to kick-start the network with the ultimate goal to transition into a permissionless blockchain. They state that it is currently not possible to have a scalable and secure permissionless blockchain that is needed to support transactions between billions of people as the reason behind their decision. They plan to start working on this transition to a permissionless blockchain within the next five years from its launch.

At the time Libra blockchain launches, the ones who control this blockchain are the ones who own the Libra Investment Token not the owners of the Libra currency as it is the case in most cryptocurrencies. However, Libra Association stated that their goal is to transition from that model to a model where the Libra currency owners are the one who control the Libra blockchain in the future. Once the transition to permissionless model happen, users who hold Libra that don't want to be a full validator nodes, can delegate their power to someone who will vote on their behalf. No one knowns when will that happen as the Libra Association believes that it doesn't have yet the technology to create a scalable, secure and permissionless blockchain.

II - My opinion about Libra

In my opinion, Libra is the next iteration of fiat money. A digital fiat that is trying to catch up to the blockchain revolution. Libra is not a cryptocurrency, it not decentralized, it is not permissionless. The only thing that separates it from traditional fiat money is that Libra will live in a public blockchain and will allow you to interact with it using smart contracts.

I still remember the Bitcoin memes about Fedcoin, maybe this is the Fedcoin we have all been anticipating. As I quote from Libra's Protocol Proposal paper. "Libra which will be fully backed with a basket of bank deposits and treasuries from high-quality central banks". From this statement you can see that Libra is not trying to compete with Bitcoin.

Please note that I'm reviewing the current format of Libra not what they are planning for Libra to be in the future. They can promise that the current design of Libra is temporary and that in the future it will be totally decentralized but these are just promises, they are easy to make but hard to fulfill.

1- Libra vs Bitcoin

When it comes to cryptocurrencies, which Libra is being advertised as such, there are multiple aspects we need to look at to evaluate such projects.

The first thing about Libra is that everything comes from "official" channels, unlike Bitcoin where there is no official website, official wallet, official organization. Libra have an official website Libra.org, official wallets like Calibra, official organization like the Libra Association. So as you can see it doesn't look good from the start, but maybe we can overlook these as a lot of altcoins also share some of these negative aspects.

When it comes to the security of the blockchain, where Bitcoin uses a permissionless blockchain that anyone can join to be a miner to secure the network and leave anytime they want without affecting its security. This means if the current miners are compromised, new miners can join to secure the network. In the case of Libra, it is a premissioned blockchain by design, this means only the members of the Libra Association are allowed to be validator nodes, these are hard coded nodes, if one-third of these nodes got compromised, the Libra network will not able to recover.

In a permissioned blockchain, the parties involved are not in competition, so they are more likely to collaborate then compete. This means transaction censorship will be rampant. This is way less likely to happen in Bitcoin because permissionless blockchain's miners compete with each other and one proof of this competition is the continuous raise in the mining difficulty.

In Bitcoin there are multiple checks and balances. Miners are not all-powerful, the only power they have is to roll back the blockchain a few blocks back that will cost them a huge amount of money or to censor some transactions if they conspire together, they can not steal your coins, and if they break any consensus rule, there are thousands of businesses such as exchanges and individual users that run the full Bitcoin node that will not accept any blocks that violate the consensus rules from these miners. This is unlike Libra Blockchain which, although it is public, there is only one network and that network is the network of the approved validators, so they can decide to change the consensus rules any time without the user being able to do anything about it.

Unlike Bitcoin where users will benefit directly from the success of the Bitcoin project, so if Bitcoin became more mainstream, the users of this currency will also benefit from this by seeing their holding in bitcoin increase in value. Whereas in the case of the Libra project, the success of the Libra currency will not benefit the holders of the Libra currency it will only benefit the holders of the Libra Investment Token.

Bitcoin intrinsic value is digital, it doesn't get its value from somewhere else, everything about bitcoin is already digital, it doesn't need digitalization. Whether you see non-physical assets to have value or not, that's up to you, however, what matter is that a lot of people already recognize this value from the fact that bitcoin is a hard asset. That's unlike Libra that derive its value from something, so it is not really a digital-first value, it derives its value from an asset that is not a digital-first asset, which means this peg between these two assets will never be trust-less. It's similar to how banks transfer between each other, they are not transferring value, they are just transferring IOU, where as in Bitcoin when you transfer your bitcoins, you are actually transferring the actual value because the intrinsic value of Bitcoin is already digital, whereas the intrinsic value of Libra is physical and you'll need to trust these Libra Association to maintain that intrinsic value.

Bitcoin is made to be decentralized so that no user need trust a single party to abide by the consensus rules and at the same time prevent any organization or government for interfering to shut-down the network. Facebook or other members in the Libra Association surely can not go against the wishes of world's governments, it will be extremely regulated after all. So creating the illusion of decentralization by having multiple "independent" validator nodes, distributing the Libra Reserve across multiple distributed locations is either for increasing the security of the system against malicious users or for gaining the trust of the users who don't necessary trust a single company like Facebook with their money. I think it is more the former than the latter. My trust in Libra wouldn't change whether it was controller solely by Facebook or by 28 "independent" members, I see them as relatively the same because in cases where it will actually matter to be decentralized, all of these members will act as a single entity. So the use of distribution and the blockchain technology is for security reasons alone.

2 - Who actually controls Libra

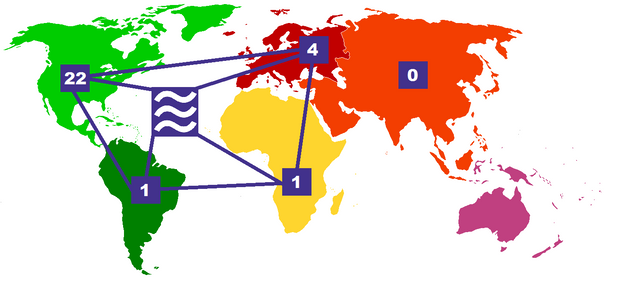

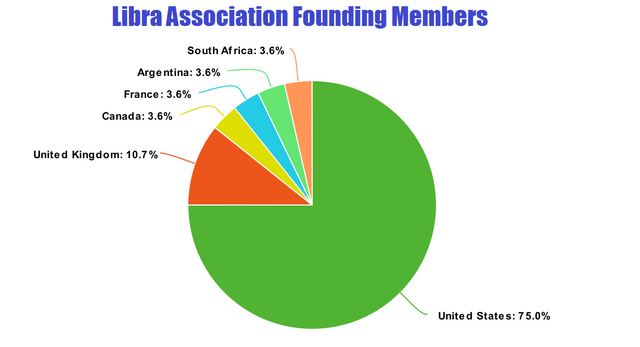

Lets dig deeper on who are the 28 founding members of the Libra Association, who will effectively be governing everything about Libra. For example, here is the country of origin of each member of the Libra Association (Note that if one member is a subsidiary of another parent company, then the country of origin is that of the parent company not the subsidiary):

United States (21|75%): Mastercard, Paypal, Stripe, Visa, Booking Holdings, Ebay, Calibra (Facebook), Lyft, Spotify, Uber, Anchorage, BisonTrails, Coinbase, Andreessen Horowitz, Breakthrough Initiatives, Ribbit Capital, Thrive Capital, USV, Kiva, Mercy Corps, Women's World Banking.

United Kingdom (3|10.7): Farfetch, Vodafone, Xapo.

Canada (1|3.6%): Creative Destruction Lab.

France (1|3.6%): Iliad.

Argentina (1|3.6%): Mercado Pago.

South Africa (1|3.6%): PayU.

Even though Asia account for 60% of the world population and 37% of world GDP, none of the founding members is from Asia. As I will discuss later, maybe Libra is not interested in the unbanked after all.

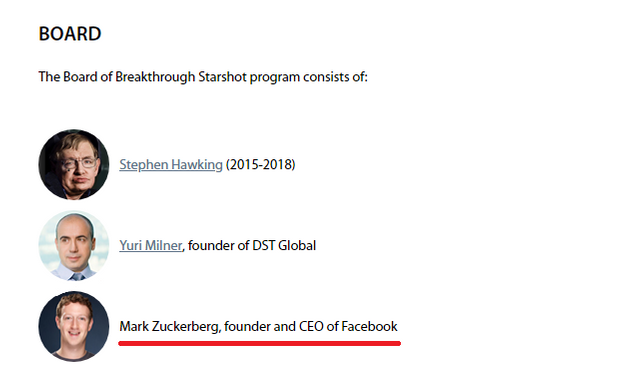

The above chart clearly shows that U.S. corporations have the most influence in Libra. Another thing that I noticed while trying to find the country of origin of each of these companies is that some of these companies have deep relations between each other. What I mean by that is, take for example Breakthrough Initiatives which has a project called Breakthrough Startshot that want to develop a spacecraft capable of traveling to a 4.37 light years far star system searching for extraterrestrial life, The Breakthrough Startshot has 3 board members and one of these members is Mark Zuckerberg.

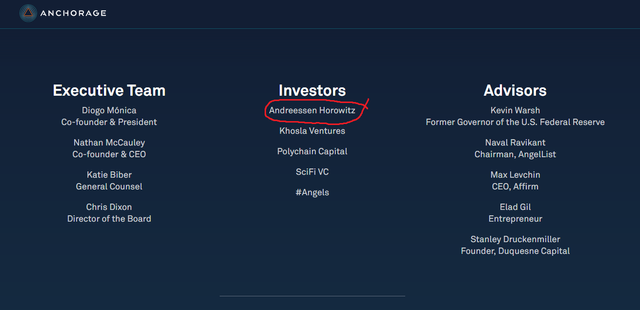

Anchorage is also one of the founding members of Libra Association. If we go to their website, we can see that one of their investors is Andreessen Horowitz which itself is a founding member of the Libra Association.

I don't have time to check all other members for any connections they have with each other, but I'm sure that the Libra Association members are less independent than they seem at first glance.

3 - Libra is anything but a cryptocurrency

I don't want to assume that people behind Libra don't understand what Bitcoin and other cryptocurrencies are trying to achieve, but they still call Libra a cryptocurrency. Where Libra is still relying on traditional institution and audits to prove the Libra Reserve, innovations like DAI by MakerDAO is already able to create a stable coin where its easy to prove the reserve that is backing that stable coin simply because the reserve value is already a digital value and it is public in the blockchain. Unlike Bitcoin where an exchange can prove their solvency by proving that they own the addresses that they use hold their cold wallet in easily, in the case of Libra, since it is backed by a basket of fiat, you will always need to trust a third-party to verify and audit the Libra Reserve.

What makes Bitcoin special is that it is decentralized, the blockchain is just one of the technologies that it uses to achieve that. The blockchain is just a tool that you can use it to create decentralization applications or fiat that uses the blockchain just for advertisement.

Libra is not the "Internet of money" because it is native to the Internet. Libra derives its value from an asset that is not Internet based. Whereas bitcoin is a digital value that is not backed by anything, the advantage that it has over Libra is that its value doesn't depend on no other asset outside of its control.Although Libra was created with value stability in mind, there is no guarantee against volatility, after all, it is backed by a basket of assets that fluctuate in price. In that case Libra Association will be able to change the composition of the reserve basket to accommodate this change in value. They claim that this change will only happen in exceptional circumstances, but still, just the fact that they have the power to do such a thing is enough to not trust it.

Currently, an attacker needs more than one-third of Libra Investment Tokens to attack the Libra Network, but if they achieve their goal of transition from a Libra Investment Token to Libra currency for governance, they think that this will create a problem where a malicious user can accumulate enough Libra coins to attack the Network, so they think they will have some safeguards to prevent this from happening. It seems like the language they are using is uncertain and can have a lot of meaning. What's the point of having a distributed network when you also have safeguards that may alter the decision of the Network?

4 - How will Libra affect other cryptocurrencies

Libra will definitely have an impact on other cryptocurrencies and blockchain platforms. However, since Libra is basically a centralized corporate coin, it will not compete with decentralized blockchains like Bitcoin or Ethereum, it may even increase adoption of cryptocurrencies as it becomes easier to purchase cryptocurrencies with Libra.

Many people when talking about Libra, only mention Libra the currency and forget that Libra will be a blockchain platform not just for transferring value, but also a platform for smart-contracts. With that said, Libra will compete and win against blockchains who sacrificed decentralization for scalability which is the case for most blockchains that are advertising that they have solved the scalability issue, but in reality, all they actually did is sacrifice decentralization or security to increase their transaction throughput. Even Libra has said that they are going with the permissioned model because currently there is no technology that allow them to have decentralization, security and scalability at the same time. Libra ditched decentralization for better scalability, which means it will be directly competing against blockchains that did the same thing. But, since Libra will be backed by bigger corporations and will be accepted in more places, I don't think these unnamed blockchains will stand a chance against it.

In the past year, a lot of countries have started to regulate Initial Coin Offering. New ICOs require identity verification for anyone who want to participate. You can't expect users to verify their identity with every ICO they want to participate in, this is why some ICOs are turning into Initial Exchange Offering IEO where the new projects are letting exchange's already verified accounts to participate in the offerings. Libra will be different in that the account verification will happen on the blockchain account level not on the exchange's level, this means less friction and more opportunities for developers.

Another aspect of the introduction of Libra is that it may affect users of cryptocurrencies indirectly in a bad way. Today you can use bitcoin to pay for services online and these services will not ask you to verify your identity because they know that most people don't trust their private information to share it with unknown websites. Most website expect that they will lose the majority of customers if they start forcing users to verify their identity. Note that when I say users don't trust unknown website, I don't mean the same way that they don't trust websites like Facebook or Google which may violate their privacy, but rather they don't trust unknown website to use their private information to do criminal stuff.

However, with the introduction of Libra, users who will be using the Facebook wallet Calibra will have to verify their identity, most people have no problem with that because they know Facebook will not steal their identity and that's enough for them to trust it even though Facebook won't respect their privacy, just look at the number of Facebook 1.7 billion users and you will see they don't care about their privacy. Now, the previous websites that couldn't force users to verify their identity, can now verify the user's identity without a worry from the customers and the ones who don't have a Libra verified account won't be able to use these services.

5 - The Facebook Element

Facebook could have single handedly created Libra, but they chose not to do so, instead they chose to bring multiple entities to participate in the Libra Association for the simple reason that they are not interested in exploiting the currency itself for profits.

Facebook doesn't want to benefit directly from Libra, I would be surprised if they introduced any transaction fees beside the anti-spam fees because they don't want to profit this way, as they themselves said, they wouldn't have created Libra if they found something similar that is already working and meet they requirement for a currently to be integrated in their platform to facilitate trade.

Facebook may benefit from Libra using its subsidiary Calibra. As they mentioned in their Libra Proposal paper, anyone who wish to use the Calibra wallet will have to verify their identity. Although Facebook said Calibra won't share info with Facebook social network division, I think they can come up with a wording that can cover them if they decide to do so in the future. So maybe Calibra won't share user's financial data with Facebook social network division, but will share with them user identity. In the future this will mean that each Facebook account is the account of a unique person something that was not possible before. If that happens this will mean that your Facebook account will be equivalent to your identity, you could use your Facebook account to verify your identity with other websites/exchanges without the need to share private data with these websites.

Facebook wants to create digital identities, meaning one Facebook account is equivalent to one real world identity. This is a first that was not possible before, it will make the creation of a lot of new applications that weren't possible before possible. If right now a polling company wants to use Facebook to conduct a poll, they can't be sure about their results because they can't be sure about whether every vote corresponds with one user. Now, imagine if every Facebook account corresponds with a single real world identity, then in this case the results are extremely accurate, this will mean running polls on Facebook will be extremely accurate, thus more money in Facebook's pocket.

Although officially, all Libra Association members have the same power, in reality this may look different. Take for example some members of the Libra Association that have no technology experience, these members will not be arguing with Facebook when it comes to technical problems.

6 - Libra, the new world currency

Libra wants the currency to be accepted in many places, and by the way they choose their words in the Libra Proposal paper, it seems to me like they not only want products to be priced in Libra but also for people to start thinking about the value of things in Libra. So unlike when a website says they accept bitcoin but the prices change to reflect bitcoin's price, for Libra, they want its price to be stable so that people start to think in terms of its value instead of using their local currencies. This is different from other stable currencies like Tether which is pegged to USD. Libra is different in that its value is different from USD, it could be more or less, it doesn't matter as long as it's not pegged to single currency but rather multiple assets. This means that for people to use this currency they will have to eventually accept it as a real currency that they can see themselves evaluating their wealth in. I'm not sure how will governments across the world react to this, as I'm sure a lot of governments will not let a private company control the currency that their citizens use.

However, if Libra is not created for the unbanked but rather for developed countries, the fiat used to back Libra will be similar to the local currencies of these countries. In that case, If big countries that will have their currency used as back up for the Libra Reserve, regulate Libra enough, so that for example to not run on fractional reserve and constantly auditing it, then I don't think these governments will have any problem with Libra. In this case, demand for Libra will also result in an increase demand for the underlying assets that are backing Libra.

Another possibility is that Libra may replace local currencies where it is accepted. Libra will start as a currency backed by other fiats, but as more people start using it and start thinking in terms of Libra rather than their local currency, it will be possible to abandon the peg and Libra will still hold value similar to how the US Dollar derives its value from user's trust. Libra draw a parallel between this approach of introducing a new currency backed by a reserve and currencies in the past like the U.S. Dollar that was backed by gold to instill trust in it to gain widespread adoption. If that happens, the Libra Reserve will be the equivalent of the Federal Reserve on the world scale, after all you can't deny that they share a similar name.

7 - Libra may never launch

Even though big companies like Facebook, Visa, Mastercard etc are behind Libra, there is still a chance that Libra will never be a reality. Libra is supposed to bank the unbanked, and a lot of these unbanked are located in countries where either Facebook is not allowed or there are strict capital control regulation where Libra will have a hard time operating. Even in Europe, countries such as France who is still controlling the minting of CFA franc, a national currency of 14 of France's former colonies in Africa. France has already created a G7 cryptocurrency task force to look into Libra and the threat of other cryptocurrencies.

Conclusion

No matter how you look at it, Libra is just a fiat backed by a basket of fiat, it has nothing to do with cryptocurrencies. Libra is a wake up call for all blockchains who abandoned decentralization for convenience.

Now that I've explained what is Libra, I only have one hashtag to say, #deletefacebook.

All that I care about with this Facebook Libra business is that it will bring so much more awareness to crypto mainly Bitcoin. So when people get tired of being jerked around by the untrustworthy Facebook they'll always have Bitcoin. aaaaye!

Congratulations @arnoldwish! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!