Unconfirmed Transactions Queue and Bitcoin Fees Drop Considerably

For about a week and a half, the Bitcoin network’s transaction congestion and rising fee market has subsided. People are now reporting on how they are sending transactions for smaller fees, and some of them are having difficulty with wallets that are recommending fees that are much higher than needed.

Bitcoin’s Network Congestion Has Subsided For Now

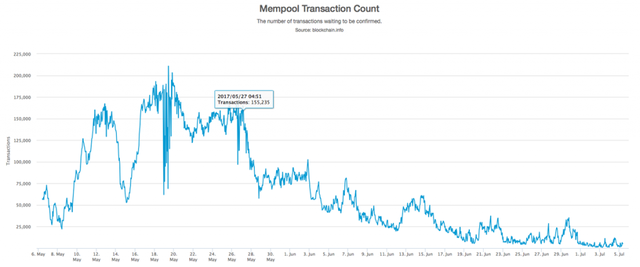

The amount of unconfirmed transactions has been significantly lower than usual with the mempool (transaction queue) averaging roughly 7,000 to 15,000 unconfirmed transactions per day. This is a stark contrast to the 200,000+ transactions held up in the mempool just a few weeks prior. The transaction stress started diminishing around the first week of June and has continued to decline to the levels we are at today.

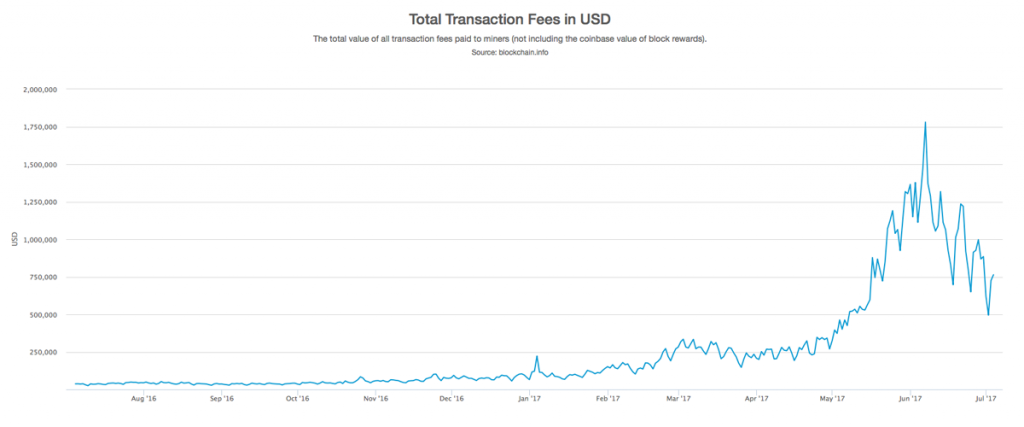

Since the number of unconfirmed transactions has dropped and there has been more room for bitcoin transactions — fees have also dropped. Less than two years ago anyone could send some bitcoin for a fee of roughly $0.02 worth of BTC, but this past May fees reached an average median of $5 per transaction. However, fees now have abated to levels under a dollar and some as low as $0.25 according to a few bitcoin proponents.

Difficult to Verify Theories

Of course, there are multiple theories detailing how the number of unconfirmed transactions has waned and why the fee market is significantly lower than a few weeks prior. Some believe the issue stemmed from a “spam attack” where an individual or group sends a large amount of low fee transactions relentlessly. However, people believe the cost to keep this attack going is considerable and some proponents believe this theory is merely a conspiracy.

Another reason people believe transactions and fees are lower is due to less bitcoin activity. For instance, the price of bitcoin has dropped a few times after reaching all-time highs, and people are not transacting as much. Alongside this, trade volume has weakened as well to less than $1 billion compared to $2 billion USD worth of BTC trades per day. Some have also attributed the prior congestion and higher fees towards the use of darknet mixers. Another theory is that companies like Genesis mining, and other bitcoin businesses are moving/batching more transactions “off-chain” instead of settling as often as previously done. Many of these theories are difficult to verify.

Congratulations @anton1009! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP