Bitcoin VS Litecoin in the Massive Price Rally

If you haven’t heard of it, you will soon! Bitcoin has taken the world by storm.

Simply put, it’s decentralized money, rather than a central bank controlling the currency price/flow, it is the everyday people who are their own banks, in other words, peer to peer.

For the early birds who got in while Bitcoin was pennies, it has made people multi-millionaires, Bitcoin as this is being written is now $1000!

Others are now starting to flock to it. Governments are scrambling to make their own versions of this but with technological advancements brings more innovation and more affordable alternatives to the mighty Bitcoin… Enter Litecoin (LTC)

How Does Litecoin Compare To Bitcoin & What Are The Differences?

Bitcoins maximum supply of ‘coins’ is 21 million compared to Litecoins 84 million maximum supply.

Litecoin is more advanced tech! It has faster transaction times – payments are processed faster.

To digitally mine (create) these currencies, large amounts of electricity are exhausted, Bitcoin is well known for this, Litecoin is much more energy efficient in the mining process.

Both Bitcoin & Litecoin are quite similar in their price movement patterns (more on this later).

Huge difference in price but both have become more stable as time has gone by.

Litecoin boasts much more efficiency and more supply for the market while still being inflation proof due to the limited number of coins that can be in circulation.

With potentially 84 million coins rather than 21 million, Litecoin may have the upper hand for general day to day buying and selling as a larger amount in supply.

On the flip side, Bitcoin can be broken down into smaller amounts (like pence to a pound, cent to a dollar) satoshis e.g. 0.5 or 0.005 or even 0.00001 for smaller transactions, Litecoin also can do this.

Bitcoin maybe slower (although it is still much faster than any bank transfer), less economically efficient than Litecoin, it still totally undermines the fiat banking system in terms of speed of transactions, price of transactions, and freedom of holding your own wealth also it holds so much dominance in the crypto scene and has such a high market capital that it simply is the go between if you want to start purchasing other digital currencies by a long stretch.

Bitcoin by far, is the currency people cash into from alternative crypto currencies and the currency people buy them with. It’s also mainly used to cash out into local fiat money!

Although there are many Bitcoin copy cats out there, Litecoin has been dubbed the silver to Bitcoin’s gold, a worthy title and well-earned because of the similarities between the two.

To understand the dynamics behind these two digital currencies relationship we have to look at Bitcoin & Litecoin more like siblings than rivals!

Bitcoin & Litecoin Behave Similar In Market Behaviour (Most Of The Time)

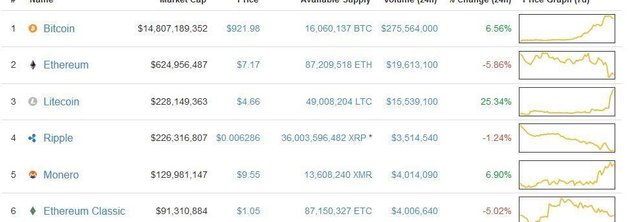

Almost every time Bitcoin has a surge, its little brother Litecoin follows, as these images I got from coinmarketcap demonstrate below

From left to right is the currency, market capital, price, available supply, change in price (24hrs) , seven days chart.

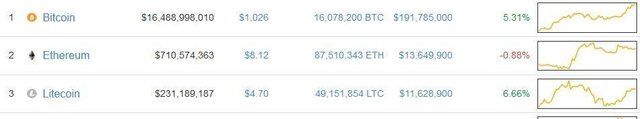

In this more recent example below the surge isn’t as intense, but it still demonstrates a similar pattern to Bitcoin.

A lot of the other digital currencies usually struggle when Bitcoin flexes its muscles, but Litecoin always maintains its price or increases it and volume.

Bitcoin has the highest volume of course as it is the base currency for the digital crypto currencies, but a sign of a good long term currency is its usage. If people don’t use it to buy/sell with, then it’s obsolete. Litecoin has shown a very high volume consistently throughout the last year and has held its ground against other newer currencies that have been ‘pumped’ and hyped up.

With good volume, the currencies do well, people trade them at high amounts and use them to buy/sell online. The more usage increases the higher the price goes because demand goes up! Supply and demand are what these currencies are based on.

As a store of value, Bitcoin and Litecoin can be good alternative options (Bitcoin is less volatile than the pound sterling) One advantage Litecoin has over Bitcoin is the cheapness of it, one Litecoin is around $3 – $4.00 while Bitcoin is around the $1000 range, you can certainly get more with your money with Litecoin. But always remember you can buy any amount of Bitcoin or Litecoin, you don’t have to buy one, you can buy it in smaller decimals like 0.1 or 0.2 of the respective currency!

You can purchase $10.00 or $100 worth of Bitcoin no matter how much the price of one Bitcoin is!

Bitcoin And Litecoin Long term, Competitors Or Allies? Conclusion

Bitcoin has many long term predictions and nothing is set in stone, but with the current banking system becoming more and more obsolete, the declining fiat money value combined with so much uncertainty Bitcoin is proving to be a very good yet savvy alternative.

Litecoin and its community are fighters. Litecoin has been in circulation since 2011 and has proven itself as a strong long term currency with its high volume and strength during Bitcoin surges, 2017 will be an interesting year for both these currencies as new updates happen, such as segregated witness which allows Bitcoin & Litecoin to scale larger.

For new people to embrace this new form of wealth/money, we will need a silver to Bitcoins gold. I do not see Litecoin surpassing Bitcoin anytime soon, but a correction on Litecoin’s part in an upward trend is its ratio to Bitcoin is possible if Bitcoin continues its progress.

Bitcoin does not need Litecoin as much as Litecoin needs Bitcoin. When investors/traders & consumers use alternative coins (altcoins) Bitcoin is the gatekeeper to go through. You have to go through Bitcoin to get it and go through Bitcoin to cash out to local fiat based money!

In the foreseeable future, things look very bright! This innovative technology behind this is still very young and being researched by some of the world’s top centralized banks! China is coming on in leaps and bounds with this and more and more mainstream adoption is happening daily. That being said, it is good to do your own research based on logic, understand the good and bad aspects and come to your own conclusion. Use history to your advantage and look at the long term potential this could bring to many nations where their currencies are being devalued and inflated (India, China, Venezuela, Zimbabwe).

Old article you posted?

People been saying this for years. Maybe the recent surge points to it, I'm not sure, but Ethereum has always been a bold competitor.

Good points in this blog. I fully understand what you're talking about. Many people say the prices of cryptos are high but we also thought that about Amazon, Apple and Facebok last year. Besides coinmarketcap.com there is: https://www.coincheckup.com I'm really happy with this site that gives complete coin analysis for every single crypto. Check: https://www.coincheckup.com/coins/Litecoin#analysis For a complete Litecoin Indepth analysis.