$BTC.X - The Percentage Of Buy Orders Is INSANE

I charted this after seeing it two days ago. I assumed someone would've mentioned it here and it would be important enough to 'trend' or be 'hot', but I went through both of those pages and found nothing.

But the importance of this moment is pretty critical in-terms of the crypto market as a whole.

As I expressed in an earlier post, it would seem that the mainstream media's narrative has suddenly shifted. For a while towards its' all-time highs last year their stories were consistent.

They all professed stories of BitCoin being this crazy and dangerous thing that is primarily used to buy drugs, utilize the services of hitmen and to launder money

[ Side Note: It's not a fiat currency; how is that even laundering? ]

But, then their narrative changed after BitCoin dropped from that kiss of 20,000 down to 8. After their reporting had caused a mass exodus of amateur traders....they started to slowly shift the narrative. We got news that major banks were starting to trade the currency. We heard of government crackdowns; most of which the government ended up negliging on.

To be quite frank, I'm a conspiracy sort of guy most people I believe in the power of Hegelian Dialectic....which summarized means to take any strong belief, contrast it with the polar opposite, then what meets in the middle is more than times than not the truth.

His work would later turn into what most of us were taught as Venn Diagrams.

So if we take the two extreme sides of the narrative, we end up with essentially that ok BitCoin is extremely volatile. Yes that's true. It is.

But that's also the fundamental principle between some of the greatest trades ever (be they in equities, futures, bonds, crypto or any investment vehicle)... they were fairly high with regards to risk/return (R) ratios. Most conservative fund managers don't trade above an R Ratio of 2-4. The sweetspot in the middle (an R ratio of 3) Which is to say, they are willing to risk 3 dollars to make 1 dollar (risk/reward...so 3/1=3).

BitCoin's R ratios are next to impossible to calculate and execute unless you set firm take profit points or firm stops to get out of a short-term trade.

One constant that, in my trading career (which is now presently based primarily on trading options on stocks on the NYSE (New York Stock Exchange), regardless of the asset, is that heavy buying pressure that comes in to slowly build something back up whose price has crashed dramatically.

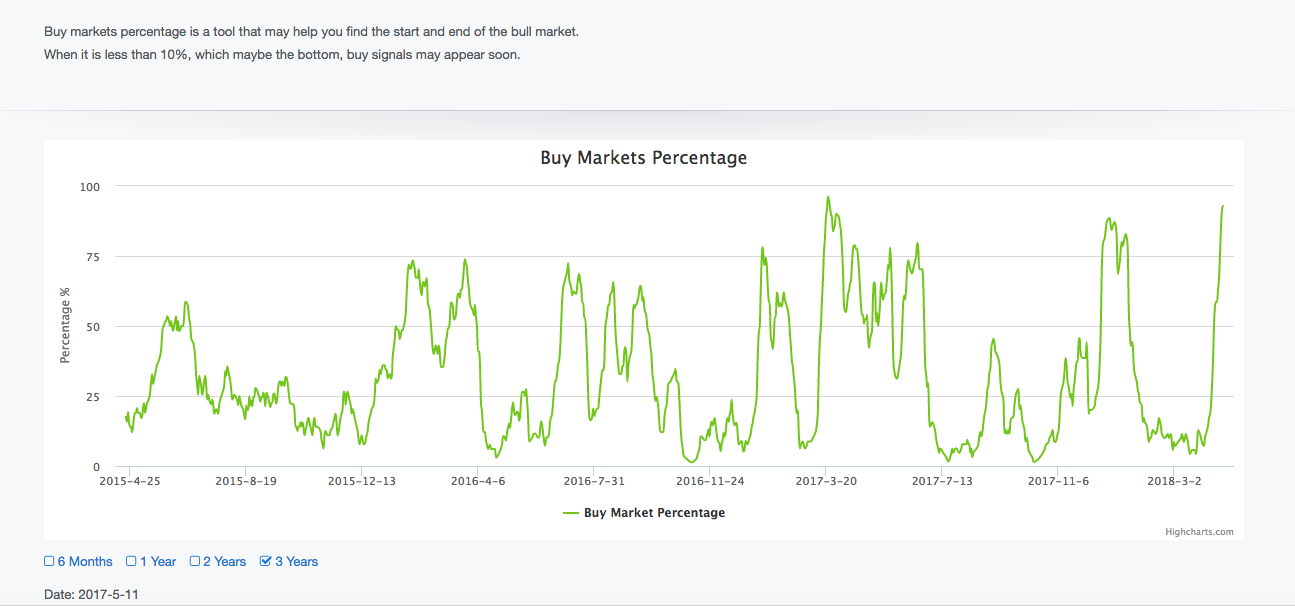

And according to TurtleBC we are just about to test the highest point of BitCoin [and other cryptos] trades that were/are buy orders...

The last time we were close to this % of orders being buys was in March of last year. You can see what happened there.....

</ center>

So I remain bullish. Read more of the idea here.... https://www.tradingview.com/chart/BTCUSD/Rgz8iKSb-BTC-X-ETH-X-LTC-X-90-of-Open-Crypto-Orders-Are-Buys/

Good luck out there. Feel free to ask any questions you may have.

Cheers!

androsForm

http:///www.androstrades.com

https://www.stocktwits.com/androsform

You got a 3.09% upvote from @postpromoter courtesy of @androsform!

Want to promote your posts too? Check out the Steem Bot Tracker website for more info. If you would like to support the development of @postpromoter and the bot tracker please vote for @yabapmatt for witness!

This post has received a 5.55 % upvote from @boomerang.