Bitcoin Technical Analysis Update 8/15/2018

TECHNICAL ANALYSIS:

- Bitcoin BTC/USDT - See LINK for previous analysis

- No change to original hypothesis

- The trend is still down, and I expect a move down to the $5000 level potentially as low as $4800

- Bitcoin is currently correcting its move from $8400 down to $5800 with a move up (corrective waves can go in either direction - because there was a market reaction and impulsive sell off that occurred, this corrective move is going up)

- Bitcoin is putting in a B WAVE which I can see topping off somewhere between $6900-$7000 as stated in my analysis on 8/9/2018

- In the chart above, I present a more detailed analysis of Bitcoin's potential price action over the course of the next few days

- A move down to the $6150 range (THE GOLDEN RATIO between the .618 fib and .65 fib retracement level)

- Followed by a move up to the $6900-$7000 level to complete the correction

- And then the resumption of the overall downtrend towards the $5000 level

- The chart below shows my analysis on 8/9/2018 where I presented a potential pathway for Bitcoin on the daily chart

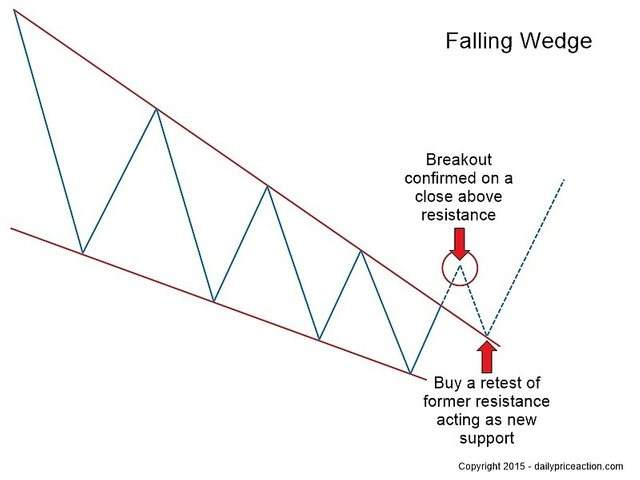

- Unless Bitcoin breaks above $8000 with volume, and out of this downward wedge can this theory be negated

INVESTOR NOTES:

To be clear, these notes are from the perspective of a day/swing trader. The notes above are not applicable to long term investors. Corrective price action and intermediate spikes in this market are of little or no consequence to anyone holding for long term for larger percentage gains.

- If you are an investor for the long term, all of these prices are great buy zones

- Buying at $6000, $8000, or even $9000 is of little or no consequence when you believe the price of Bitcoin will one day be $50,000 and beyond

- Good investors will accumulate over time, constantly cost averaging their positions, with confidence that current market prices do not represent the true value of the asset in the long term (anywhere from 6months - 4 years)

- Bitcoin and Cryptocurrencies are still in its infancy as an asset, with only a few hundred billion in its total market cap - as compared to the trillions in the majority of all other asset classes

- Patience is key

- I am a long term BULL

If you have found this helpful, please UPVOTE, FOLLOW, and RESTEEM :0)

Any and all donations are much appreciated and will allow me to continue producing free analysis! Let me know what charts and analysis you are interested in and I will be happy to work on them!

- LITECOIN: MNwqCX6HoU6MeU9SRwNakT3iHEkfrig2YB

- BITCOIN: 3MwvZ6Q7R7dtSR8P1o5bb3oz4hegwtSuiR

- BINANCE: 0xcaf1e0cd3de21a7d27497a95f8196f74a073ad76

- ETHEREUM: 0x4c8d59799E6EF1faE64Bc40D1668B77DD8d5e9Ed

START INVESTING TODAY!

CLICK HERE TO SET UP AN ACCOUNT ON COINBASE

LEGAL DISCLAIMER:

I am not a financial advisor, nor is this post intended to be financial advise. I encourage you to do your own research before investing, or trading, any coin, token, stock, or security. This blog is intended for me to document my own personal analysis, charts, thoughts, opinions, trading decisions, and experiences. If you would like to learn more about trading, cryptocurrencies, and the resources I utilize to trade and invest, see my previous post - LINK.