Bitcoin is not a bubble !!!

The Internet is filled with people who talk about the Bitcoin as a bubble. They believe that the high price of Bitcoin predicted an imminent catastrophe by launching criticisms that go beyond mere skepticism. It seems that these people hate crypto money.

Yet many of these "experts" do not seem to grasp the potential of Bitcoin.

For the uninitiated, a speculative bubble corresponds to a disproportionate and arbitrary increase in the price of a security, an index, or even an entire sector, occurring in a few months or years and which ends , often bursting, brutally, occasionally, for example, a stock market crash.

Would the bitcoin be misunderstood?

Many people like Peter Schiff regularly repeat that the Bitcoin is a bubble, and that it may collapse at any time. All these commentators do not seem to understand how the Bitcoin works.

Internet is brimming with titles in the type of:

"Bitcoin a false truth"

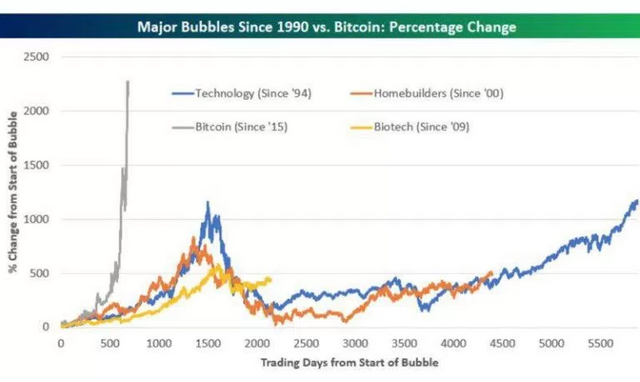

"The rise of Bitcoin in 2017 seems very similar to the rise of the Internet bubble"

There is even a dedicated website to collect all these FUD statements: 99bitcoins.com

In a recent Chicago Tribune article titled "Why investors should be wary of Bitcoin," writer Gail Marks Jarvis also compared the boom bitcoin to various bubbles in history:

"Do you remember the housing crisis of 2008, when honest citizens who bought homes thinking they would make a fortune with rising real estate prices ended up losing 30% on their investments? Do you remember the internet bubble in early 2000? Until the bursting of this bubble, people were euphoric about the pioneers of the nascent Internet in the 1990s and thought that the gains in technological actions would never end. "

She added that it was a "volatile bubble" that could break out at any time and leave investors on the straw.

All these comparisons are wrong, because the Bitcoin is not comparable to any of the above-mentioned history lessons.

Bitcoin has something special

Bitcoin is special. It can not be controlled by a company, a bank, or even a government.

Its value is not increasing sharply due to the lies of the "classic" market.

Its value increases because it is a financial invention that will change our lives. It is increasing because of its adoption. The network effect is put in place.

It is true that more and more investors are delighted to get on board and this excitement causes the Bitcoin price explosion, but do not take this for an artificially inflated bubble based on a "false truth."

Depending on the network effect, the more people getting involved in the Bitcoin the higher the price will be.

The law of supply and demand

The price of Bitcoin also increases because of "the law of supply and demand". The number of Bitcoin is limited to 21 million units and this makes it rare. When things are scarce and many people want to own them, their value increases.

So when the economy and the network effect mingle, you have all the ingredients for explosive growth. Bitcoin is not a new version of the 17th century tulip crash. It is a revolutionary innovation in many fields.

Bubbles related to technological failures

All this does not mean that Bitcoin will inevitably succeed. If something serious happens to the protocol, its price would be affected. If this type of event happens people would definitely lose confidence in Bitcoin and its price would collapse.

Bubble or not bubble?

If people continue to say that the Bitcoin is a bubble, it would be interesting for them to explain why exactly instead of comparing it imprecisely to past bubbles that do not share any characteristic with Bitcoin except a sharp rise price. If the bitcoin were a bubble, it would be the greatest that mankind has ever known (not counting the gold bubble of 6000 years ago, of course). All this is unlikely. It is more likely that bitcoin is an incredible invention. Its value and potential in the finetech are enormous and the Blockchain communities are beginning to multiply.

A very interesting perspective sir!

Upvoted and resteemed!

This is what makes Bitcoin so much more better: no government control. Experts might be fearing Bitcoin due to past experiences with other such phenomena, but Bitcoin is more than a bubble, it's a phenomenon, a paradigm shift.

If anything, along with other cryptocurrencies like Dogecoin, Litecoin, Dash, Ethereum, Ripple (XRP), etc, it could well be on its way to replace the banking system and possibly international currencies.

Ten years from now, who knows, we won't even need to go to banks any longer. This could save a lot of government revenue which can be used for other purposes. However this is just an estimation. Only time will tell!

Thanks!

Bitcoin is the begining , ethereum is the proof and the next generation will be a fully distributed peer to peer coin that avoidsmany of the pitfalls of todays digital currecies .

Only time will tell and the longer we support Steemit the better Bitcoin will do in the long run.