HOW THE ASTAKE PROTOCOL HELP INVESTORS MAXIMIZE PROFIT

Making profits in trading crypto currencies is one thing but making sure this profit is sustainable is another. When we trade crypto, we want to ensure that our digital assets can be protected and secure on the long run.

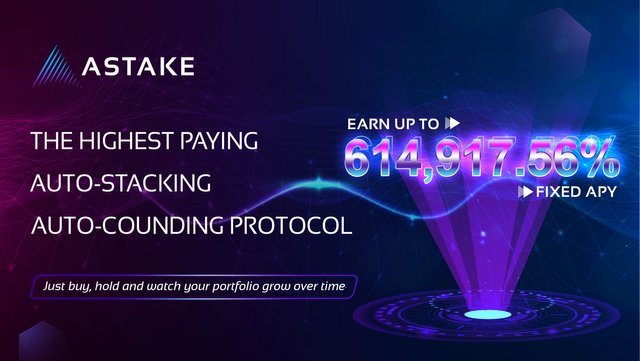

One coin that guarantees sustainability and huge profit to investors is the ASTAKE Token. It has an automatic staking and compounding feature and offers the highest APY of about 614,917.56% in the crypto market.

The ASTAKE Token creates an avenue for holders of its token to benefit by increasing their portfolio in an exponential manner. Investors can get to make profit every 10 minutes which is automatically staked and compounded using the ASTAKE Token.

HOW DOES THE ASTAKE PROTOCOL WORK?

The Astake Auto-staking protocol (AAP) is one of the latest protocol that makes staking of interest easier for ASTAKE token holders. The AAP gives the Astake token its automatic staking and compounding feature. Interestingly, the AAP uses a complex set of factors to support its price and rebase reward.

The AAP uses a simple but effective automatic staking feature which it calls the Buy-Hold-Earn system. This system allows users to simply Buy and Hold the Astake token in their wallet. With this system, holders of the Astake token earn rebase rewards as interest payment directly into their wallet.

Similarly, the AAP increases the Astake Token every 10 minutes. The AAP also uses a positive rebase formula which makes it possible for it to distribute token in a directly proportional manner to the epoch rebase reward. This reward is worth 0.0166% every 10 minutes. These rewards are usually distributed to all Astake holder.

In that light, with the AAP protocol, Astake token holders can receive an annual compound interest of 614,917.56% for a year if they do not remove the Astake token from their wallet. This is one of the highest interest rate users can obtain in the crypto market.

WHAT IS THE ASTAKE INSURANCE FUND

Astake token like other responsible organisation ensures that it backs up its assets and ensure sustainability in the crypto market. One feature that helps it do this is its Astake Insurance fund (AIF).

The AIF is a separate wallet in the Astake's AAP system. The Astake Insurance Fund is supported by a portion of the buy and sell trading fee which accumulate in the AIF wallet. The AIF uses an algorithm which backs the Rebase Rewards.

Every Rebase reward distributed are backed by the AIF parameter. Thus, the Astake AIF ensures a high and stable interest rate to Astake token holder in a sustainable way.

About 3% of all trading fees are kept in the Astake Insurance Fund wallet which it uses to help sustain and back the staking reward provided by the positive rebase. The AIF works together with the Astake treasury to ensure liquidity of the Astake liquidity pool.

Conclusion

Trading the Astake token opens different opportunities for investors to make large profit on their investment. The Astake platform has various interesting features that makes it easy to trade and provide guarantee of digital asset to traders.

USEFUL LINKS;

Website : https://astake.finance/

Whitepaper : https://wp.astake.finance/

Telegram : https://t.me/astake_finance

Twitter : https://twitter.com/astake_finance

Discord : https://discord.com/invite/vpCQr4cQEV

Reddit : https://www.reddit.com/r/ASTAKE_FINANCE/

AUTHOR'S DETAILS

Bitcointalk Username- Rescuea

Bitcointalk Profile URL- https://bitcointalk.org/index.php?action=profile;u=2767664;sa=summary

Wallet Address: 0x357dbbd64983e3B5Fb8a33173A33AD038F07ff32