HOW DID AMAZON SUCCEED?

Would you invest in a company that in its past lost more than 95% of its value in a year, and was part of one of the biggest bubbles of humanity?

If you said no, then you wouldn't be willing to invest in the biggest company in the world right now: Amazon. This one went from a financial bubble to a profitable multinational, leaving the following question: “Why did Amazon succeed?”

In this article we will answer this question, showing the main factors that make an asset “Boom”, as was the case with Amazon, and showing that an asset has the prospect of doing the same in this decade.

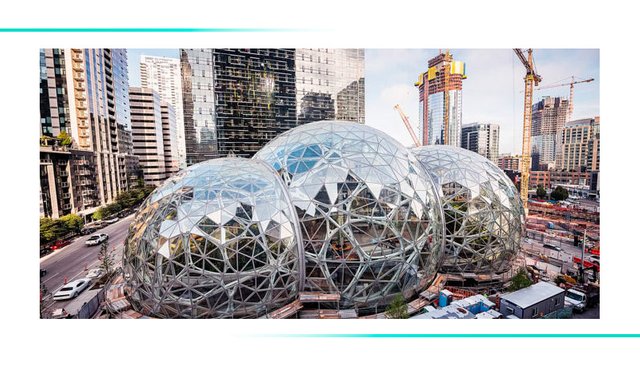

Created in 1994 by Jeff Bezos, Amazon has become one of the biggest technology companies in history, revolutionizing the sales model and becoming a reference for global e-commerce.

So in 2018 the company reached the 1 trillion dollar Valuation mark, being considered one of the Big Four of technology along with Google, Apple and Facebook and making its founder Jeff Bezos the richest man in the world.

However, in its early years, the company's scenario was quite different. In 2001, the height of the Internet Bubble on the American Stock Exchange occurred, this event was responsible for the bankruptcy of thousands of companies.

At that time the internet was very discredited and considered just something speculative and useless.

Along with that, Amazon was also discredited, and the specialized media just waited for the days to pass to announce the company's bankruptcy and the end of the e-commerce model created by it.

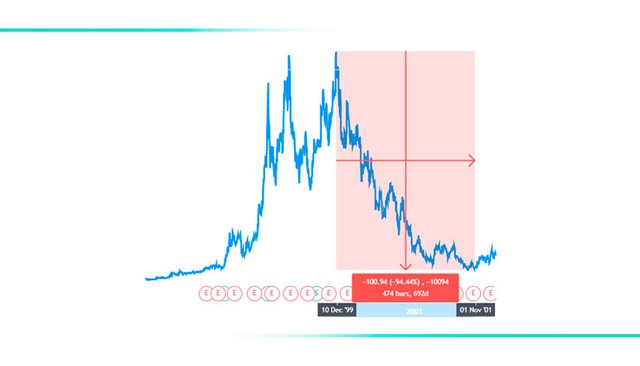

AMAZON WAS A BUBBLE

It's hard to believe that this graphic belonged to Amazon in 2001, showing how the company suffered from the bursting of the Internet Bubble. However, understanding this moment is crucial to understanding the company's current success.

The financial bubble phenomenon has already been present at different times in humanity, and assets such as Gold, Dow Jones and the S&P 500 have gone through these speculative processes before their Ascension.

This occurs because many times assets and inventions considered revolutionary are highly speculated in their beginnings, when they do not present a real utility at that moment.

Amazon is a great example of this. The company had a revolutionary business model for its time and far ahead of its time. It used state-of-the-art technology for that period, the internet, a means of communication and sending content that was becoming popular in the early 90s.

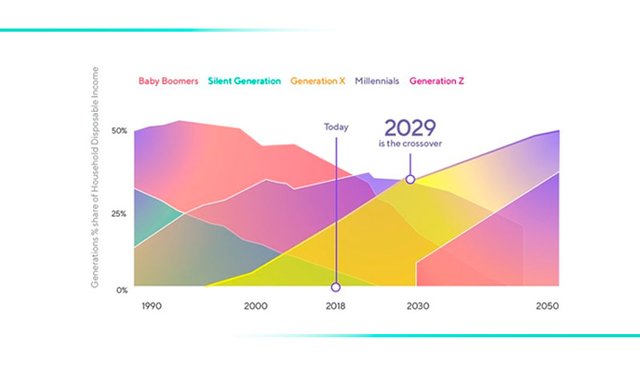

However, the generation that had most of the economic power in the 90s, the Baby Boombers, did not understand the real usefulness of the company and had no affinity with the internet.

Thus, for them, consuming products from that tool was extremely difficult, making Amazon not popular among them, which discredited the company to these people.

But for the younger people at the time, who were born at the time of the internet boom, the Millenials, the scenario was different.

This generation had a great interest in making their purchases in a virtual environment and believed in the Internet as an innovation. However, for the most part, this generation was not economically active, which made it difficult for them to become consumers of the services offered by Amazon.

As a result, Amazon's product was perfect, but at the wrong time, as the public that the company had the most potential to reach did not yet have the economic conditions to consume its services.

THE AMAZON BOOM

In 2010, Amazon started its ladder to become one of the largest companies in the world, with 30,000 permanent employees and after surviving the .COM Bubble, the company started its project to become the store of everything, in addition to constantly investing in your customers' experience.

Added to this, the company had two other external factors that were responsible for its exponential rise: mass adoption of the internet and the beginning of the financial independence of the Millennial generation.

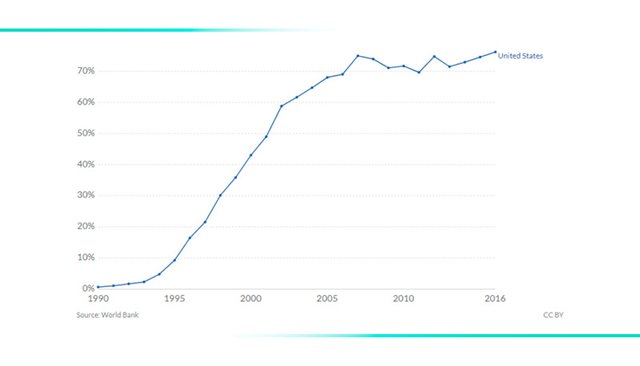

The first is due to the fact that the internet became increasingly cheaper over the 2000s, with its usage boom, which meant that more than 70% of Americans had access to this technology in 2010.

As can be seen in the graph, the period between 2002 and 2007 was the time when there was the greatest growth in the US internet user base. This being the period before Amazon's growth.

Thus, this factor was fundamental to the company's success, because with the growth of Internet technology, more people would have access to the company's website and, consequently, the company would have more potential customers.

The second and most determining factor is the financial rise of your target audience. If we look at the graph below.

The period between 2000 and 2010 is the time when Millennials begin to have their financial independence and it is the time when Generation X, who had a greater familiarity with the internet than Baby Boombergs, start to grow considerably their consumption potential.

With this, Amazon's target audience finally has conditions to consume its products and services and the sum of these factors makes the company have an exponential growth in the 2010s.

So in 2018 the company reached the 1 trillion dollar Valuation mark and more than 180,000 employees. Coming out of a financial bubble, the largest company in the world in less than 20 years.

And this story will repeat itself with several other companies and assets.

THE NEXT AMAZON

The period between 2000 and 2010 is the time when Millennials begin to have their financial independence and it is the time when Generation X, who had a greater familiarity with the internet than Baby Boombergs, start to grow considerably their consumption potential.

With this, Amazon's target audience finally has conditions to consume its products and services and the sum of these factors makes the company have an exponential growth in the 2010s.

So in 2018 the company reached the 1 trillion dollar Valuation mark and more than 180,000 employees. Coming out of a financial bubble, the largest company in the world in less than 20 years.

And this story will repeat itself with several other companies and assets.