The Deutsche Bank Death Watch Has Taken A Very Interesting Turn

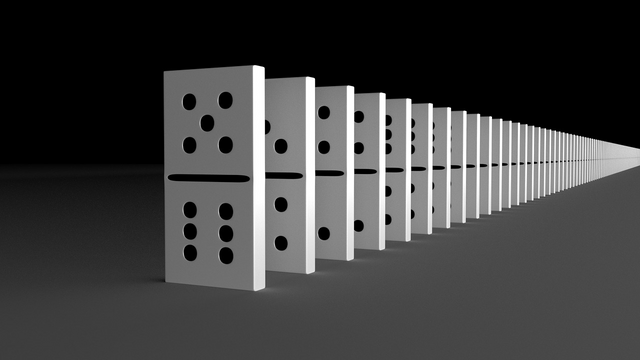

The biggest bank in Europe is in the process of imploding, and there are persistent rumors that the final collapse could happen sooner rather than later. Those that follow my work on a regular basis already know that this is a story that I have been following for years. Deutsche Bank is rapidly bleeding cash, they have been laying off thousands of workers, and the vultures have been circling as company executives desperately try to implement a turnaround plan. Unfortunately for Deutsche Bank, it may already be too late. And if Deutsche Bank goes down, it will be even more catastrophic for the global financial system than the collapse of Lehman Brothers was in 2008. Germany is the glue that is holding the EU together, and so if the bank that is right at the heart of Germany’s financial system collapses, the dominoes will likely start falling very rapidly.

There has been a tremendous amount of speculation about Deutsche Bank over the past several days, and so let’s start with what we know.

We know that Deutsche Bank has been losing money at a pace that is absolutely staggering…

Deutsche Bank reported a net loss that missed market expectations on Wednesday as a major restructuring plan continues to weigh on the German lender.

It reported a net loss of 832 million euros ($924 million) for the third quarter of 2019. Analysts were expecting a loss of 778 million euros, according to data from Refinitiv. It had reported a net profit of 229 million euros in the third quarter of 2018, but a loss of 3.15 billion euros in the second quarter of this year.

If you add the losses for the second and third quarter of 2019 together, you get a grand total of nearly 4 billion euros.

How in the world is it possible to lose that much money in just 6 months?

If all they had their employees doing was flushing dollar bills down the toilet for 6 months, it still shouldn’t be possible to lose that kind of money.

When investors learned of Deutsche Bank’s third quarter results last week, shares of the bank went down about 8 percent in a single day.

Overall, the stock price has lost over a quarter of its value over the past year.

Unless you enjoy financial pain, I have no idea why anyone would want to be holding Deutsche Bank stock at this point. As I have previously warned, it is eventually going to zero, and the only question remaining is how quickly it will get there.

We also know that Deutsche Bank has been laying off thousands of workers all over the world…

On July 8, 2019, thousands of Deutsche Bank employees across the globe arrived at their offices, unaware that they would be leaving again, jobless, just a few hours later. In Tokyo, entire teams of equity traders were dismissed on the spot, while some London staff were reportedly told they had until 11am to leave the bank’s Great Winchester Street offices before their access cards stopped working.

The job cuts, which totalled 18,000, or around 20 percent of Deutsche Bank’s workforce, were the flagship element of a restructuring plan designed to save the ailing German lender.

The day before those layoffs happened, most of those employees would have probably told you that Deutsche Bank is in good shape and has a very bright future ahead.

Just like we witnessed with Lehman Brothers, there is always an effort to maintain the charade until the very last minute.

But the truth is that anyone with half a brain can see that Deutsche Bank is dying. There have been so many bad decisions, so many aggressive bets have gone bad, and there has been one scandal after another…

In April 2015, the bank paid a combined $2.5bn in fines to US and UK regulators for its role in the LIBOR-fixing scandal. Just six months later, it was forced to pay an additional $258m to regulators in New York after it was caught trading with Myanmar, Libya, Sudan, Iran and Syria, all of which were subject to US sanctions at the time. These two fines, combined with challenging market conditions, led the bank to post a €6.7bn ($7.39bn) net loss for 2015. Two years later, it paid a further $425m to the New York regulator to settle claims that it had laundered $10bn in Russian funds.

At this point, it is just a zombie bank that is stumbling along until someone finally puts it out of its misery.

Money is so tight at Deutsche Bank that they have even cancelled the Christmas reception for retired employees…

Times change. Once upon a time (2001, in fact), Deutsche Bank was able to book stars like Robbie Williams for its staff Christmas party, with a Spice Girl turning up too just because it was such a great party. Now, according to the FT, Christian Sewing has even cancelled the daytime coffee-and-cake Christmas reception for retired employees.

Of course saving a few bucks on coffee and cake is not going to make a difference for a bank with tens of trillions of dollars of exposure to derivatives.

Deutsche Bank is the largest domino in Europe’s very shaky financial system. When it fully collapses, it will set off a chain reaction that nobody is going to be able to stop. David Wilkerson once warned that the financial collapse of Europe would begin in Germany, and Jim Rogers has warned that the implosion of Deutsche Bank would cause the entire EU to “disintegrate”…

Then the EU would disintegrate, because Germany would no longer be able to support it, would not want to support it. A lot of other people would start bailing out; many banks in Europe have problems. And if Deutsche Bank has to fail – that is the end of it. In 1931, when one of the largest banks in Europe failed, it led to the Great Depression and eventually the WWII. Be worried!

Sadly, most Americans can’t even spell “Deutsche Bank”, and they certainly don’t know that it is the most important bank in all of Europe.

But those that understand the times we are living in are watching Deutsche Bank very carefully, because if it implodes global financial chaos will certainly follow.

Perhaps people whose grasp of banking is limited to maths expect Deutsche Bank to go bankrupt. However, as you point out in this article, that collapse would destroy the EU, which has huge implications for not only the EU itself, as a political body with a national military, but each and every nation in the world, also with armed forces, and particularlly those within the EU, some of the most powerful militaries in the world. So, it's not just a financial mathematical problem, but a military force and political issue, at the very heart of neoliberal globalism, clearly the dominant political faction in the world today.

Deutsche Bank is not going to fail and plunge the world into war. If the plunge to war is imminent, for other reasons than mere maths, Deutsche Bank may be allowed to trigger that conflict. It's as good a trigger as any other. However, if global war on a scale previously inconceivable isn't the specific goal of the globalist puppeteers yanking every useful political string on the planet, then Deutsche Bank isn't going to fail. [Edit: if it is war coming, the utility of equity on stock markets is pretty questionable. Particularly in this war, which would be instigated by those undertaking QE on a global scale today, legacy financial mechanisms that have been so protected and implemented are extremely likely to be a large part of the reason for undertaking global cataclysmic war, in order to implement new mechanisms for the world's wealthiest to secure their wealth, because this one is clearly dysfunctional.]

Unlike Lehman, which was merely a player on the field, Deutsche Bank is the most influential and powerful player on the field. I suggest the EU, major national polities within the EU, and outside of it dependent on trade with it, and even those opposed to it but unprepared to physically take the ground controlled by their enemy, will contrive to keep it that player no matter what BS they have to come up with to do so.

Because of this, today is a great day to buy DB stock. It's gonna get bailed up, and DB will assert the financial power of the political power of the EU, probably illegally and contrary to honest free market rules, regulations, and practices.

The alternative to DB stock being criminally supported by the most powerful people in the world is them losing their shit.

I'm not an investor. I'm not buying in, nor selling out. I don't have a nickel in the market. Don't listen to me and consider what I say financial advice, because if you do you are the biggest fool that has ever invested. All that being truthfully said, I don't see any realistic alternative to DB being prevented from collapsing the EU and the massive political power dependent on it.

Thanks!

To listen to the audio version of this article click on the play image.

Brought to you by @tts. If you find it useful please consider upvoting this reply.