Steem Total Value Powered Up - $67 million - May 1, 2022

This is next in my series of posts reviewing the amount and value of powered up STEEM on the Steem blockchain. For previous posts, see the end of this entry.

Noteworthy in the last week,

- Week over week, the number of powered up STEEM increased by 176K, or just about 1/10%.

- The week saw 6 daily increases and 5 new highs in number of STEEM powered up.

- At 41.61%, the series-long high as a percentage of market cap was recorded on April 26. All other observations were in the 39% range, so this was probably a fluke of timing in the way that CoinGecko updates their market cap and price fields.

- The modeled value of powered-up STEEM gained ground against all comparison tokens except TRX, ranging from 1.7% against BTC to 9.8% against the SBD.

- The modeled value of powered-up STEEM lost ground against the USD by less than 1%.

- Total power-downs this week totaled 653K STEEM, up slightly from last week's 636K.

- In terms of all comparison tokens, today's locked value is markedly higher than the January 1, 2022 baseline.

Here are the numbers as-of a few minutes ago:

Total value locked in powered-up STEEM (USD): $67,298,639.17

STEEM market cap $170,515,627.91

Locked value in terms of other tokens:

| token | price | locked value equivalent | Jan 1, 2022 | pct of Jan 1 baseline |

|---|---|---|---|---|

| tron | $0.07 | 986,566,578 | 809,173,538 | 121.92% |

| steem-dollars | $3.85 | 17,480,166 | 11,284,131 | 154.91% |

| bitcoin | $38,259.00 | 1,759 | 1,300 | 135.35% |

| ethereum | $2,807.60 | 23,970 | 16,501 | 145.27% |

| litecoin | $98.68 | 681,988 | 411,561 | 165.71% |

| steem | $0.43 | 156,618,096 | 142,930,214 | 109.58% |

| USD | $1.00 | 67,298,639 | 61,837,042 | 108.83% |

And here are the charts, based on data collected daily since April 10, 2021.

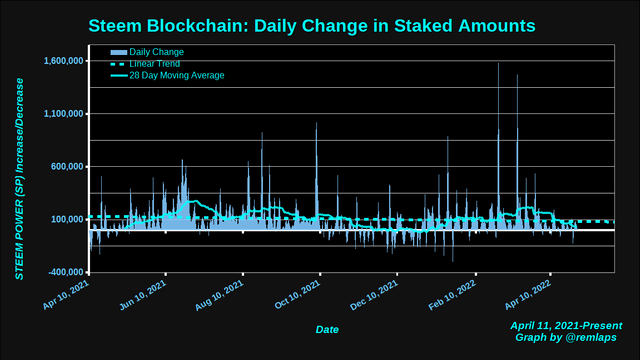

Daily Changes

Here is a chart of daily changes in powered-up STEEM from April 11, 2021 to present. The graph also includes a linear trend line and a 28 day moving average.

Here are some descriptive statistics, for numbers geeks.

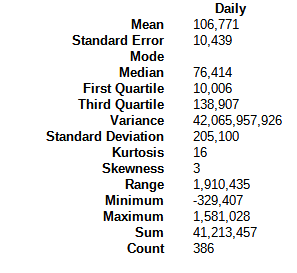

VESTED STEEM

With a weekly increase of about 176 thousand or 1/10%, this week saw six out of seven daily increases and also new highs on five days. The graph is continuing to run just a touch above flat.

Modeled value of powered-up STEEM in terms of USD

In terms of USD, we saw a weekly decrease of about half-a-million dollars, or less than 1%. The value is presently near its series-long average value.

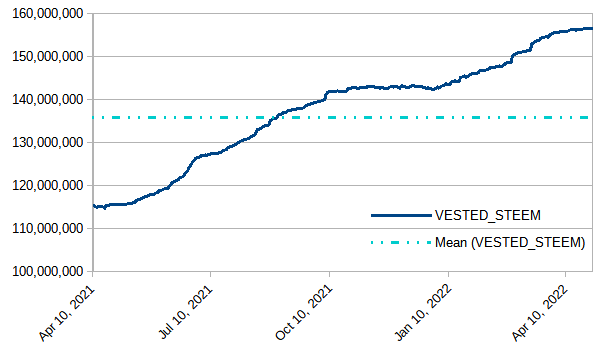

Modeled value of powered-up STEEM in terms of Tron (TRX)

After reaching a new high of 1,357,208,461 on April 27, the modeled value of powered-up STEEM lost value against TRX over the week by about 48 million, or 4 1/2%.

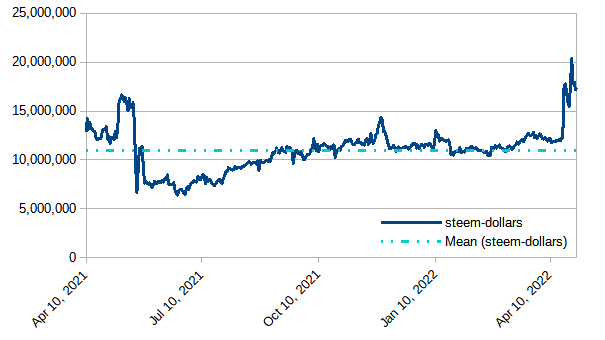

Modeled value of powered-up STEEM in terms of Steem Dollars

Up by a bit over 1.5 million or just shy of 10%

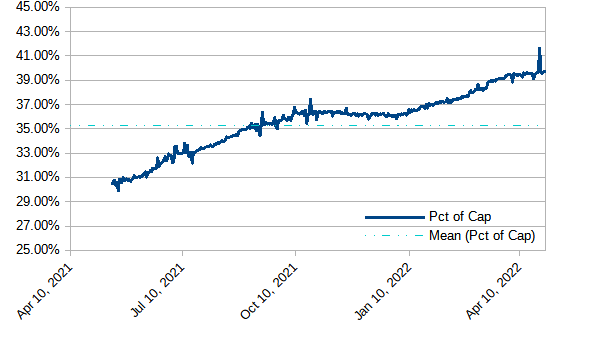

Modeled value of powered-up STEEM as a percentage of Steem's market cap

Running just slightly above flat for the last three weeks, with an anomalous jump up on April 27. We have now seen 27 consecutive days above 39%; 60 consecutive days above 38%; 91 consecutive days above 37%; 218 consecutive days above 35%; and 281 straight days above 1/3. After three months of upslope, the graph is now leveling off. Will it hold above 39%? Will it go above 40%?

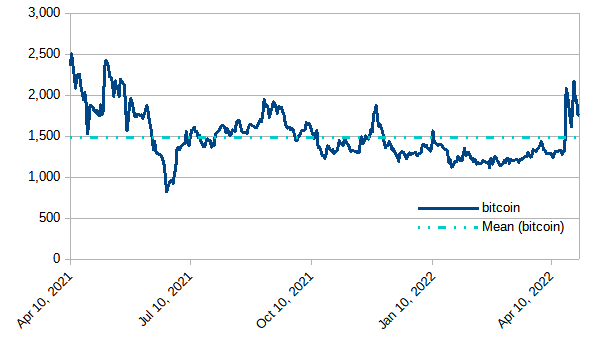

Modeled value of powered-up STEEM in terms of bitcoin (BTC)

Up by about 29 BTC, or 1.7% during the week.

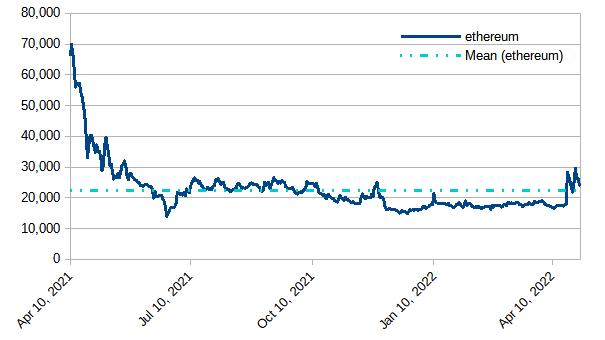

Modeled value of powered-up STEEM in terms of Ethereum

Up by about 800 ETH, or 3.4%.

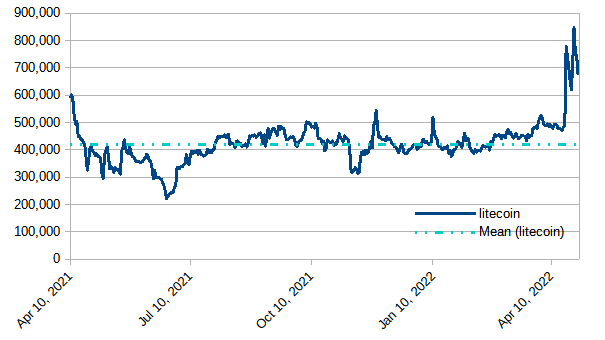

Modeled value of powered-up STEEM in terms of Litecoin

Powered-up STEEM increased by about 23,000 LTC, or about 3 1/2%. This is the eleventh consecutive day above the previous series-high near 600K. After reaching a new observed high of 846,828 on April 27, it settled back into the 600K-700K range.

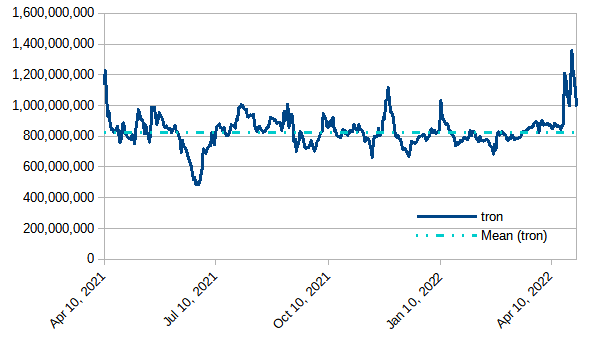

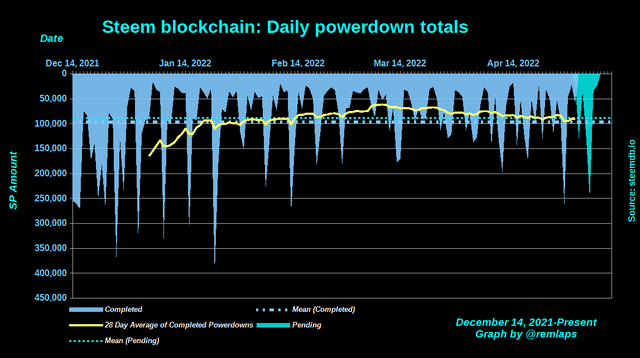

Daily Powerdown Activity

Here is graph with data from steemdb.io to show daily completed and pending powerdown activity. Overall, with about 653K powered down last week and 680K pending, we can expect weekly powerdowns to be basically flat, with a small percentage of increase. The big spike in pending powerdowns is exactly two weeks after the April 21 price pump. That spike represents more than 1/3 of this week's pending powerdowns.

The horizontal lines are the average values for completed (blue) and pending (cyan) powerdowns, and the yellow line is a 28 day moving average of completed powerdowns.

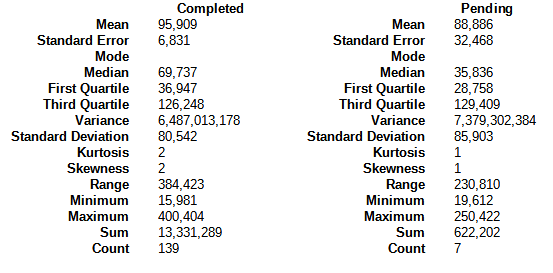

Here are some descriptive statistics for the numbers geeks:

Notes

- Reference prices for STEEM and other tokens are downloaded from coingecko.com

Previous posts

- Steem Total Value Powered Up - $67 million - January 2,

20212022 - Steem Total Value Powered Up - $57 million - January 9, 2022

- Steem Total Value Powered Up - $60 million - January 16, 2022

- Steem Total Value Powered Up - $43 million - January 23, 2022

- Steem Total Value Powered Up - $46 million - January 30, 2022

- Steem Total Value Powered Up - $54 million - February 6, 2022

- Steem Total Value Powered Up - $50 million - February 13, 2022

- Steem Total Value Powered Up - $46 million - February 20, 2022

- Steem Total Value Powered Up - $48 million - February 27, 2022

- Steem Total Value Powered Up - $47 million - March 6, 2022

- Steem Total Value Powered Up - $47 million - March 13, 2022

- Steem Total Value Powered Up - $51 million - March 20, 2022

- Steem Total Value Powered Up - $60 million - March 27, 2022

- Steem Total Value Powered Up - $65 million - April 3, 2022

- Steem Total Value Powered Up - $55 million - April 10, 2022

- Steem Total Value Powered Up - $68 million - April 24, 2022

- Steem Total Value Powered Up - $67 million - May 1, 2022

Hi sir @remlaps-lite, I always follow your updates. and I'm glad to know.

I'm not a graphic savvy. But since just joining the Steemit platform, about six months ago, I think the STEEM token is a good token for investment.

Because the exchange rate of steem can be said to be stable. STEEM did not drop significantly, and looks good strengthening.

Since I joined 6 months ago, and I immediately learned about the new Steemit Team rules and programs that were enforced at that time. That is related to steemian participation in club5050, club75 and club100.

In my opinion, the Steemit team program is successful. so many steemians are participating in the club, and that is a factor that makes the STEEM token stable. I don't know the data on the number of power ups. but what I know, every week, the steemians always turn on the electricity.

I want to say this. Steemian who does not have the capital to buy STEEM, like me, and there are many. we will try to keep participating in club5050, club75, even club100 programs. Of course to get support. and we turn on, although in each of us, the number of ignitions is small, but there are millions of steemians (I don't know the actual number). Those are the factors that make STEEM tokens stable and a good token for investment.

regards.

Interesting, seeing the growth in the value of steem that returned to its value at the beginning of this year.

I have observed that this month, there have been several increases in the daily transaction volume of Steem, which sometimes can suddenly increase in size in the market.

Is this a signal as a code for the return of the strengthening of the steem exchange rate to the peak?

I see the graphs, I read your post, I think about the predictions that are made every month, it makes me laugh to think that it is the same as the weather predictions, they give us hope, however the volatility of cryptocurrencies is evident, so it is better not to believe in predictions so as not to feel bad later , but yes , save and save , do not sell , well that 's my opinion

this week's power outage was probably caused by the increase in the price of steem. For a long time, the Steem price remained around $0.3, and people wanted to trade Steem at 0.4 - 0.5$.

I agree with this.

I like the progress on Steem. A few months ago I was hopeless. With the cooperation of the Steem community and Tron, it will take it to a greater level. The increase in powerup level on Steem is really important. This shows how much people believe in Steem.

A big pump of STEEM is coming very soon. I think #Steem price will hit $1 very soon. Crypto market is now going down, but it will go up very soon and Steem will go up faster than many other coin. Thank you.

I think it is necessary to increase the usage areas of steem as much as powerup. As the usage areas increase, the powerup rate will increase. I want witnesses to reflect on this.

Steem total value powered up has decreased a little this week but we should wait for next pump. Hopefully Steem will pump again in next 3 week. Thanks for your deep analysis.

Experimental: Here is a SteemPoll question

Will the May 8 modeled value for powered-up STEEM be above or below 1,756 BTC (this week's value)?

My HP is not compatible to go there.