Steemit Crypto Academy Season 2: Week2 | Cryptocurrency Contracts For Difference (CFDs) Trading

Introduction :

The cryptocurrency market is an increasingly attractive market for traders. However, knowing how to get started is not always easy. Especially since there are several options to participate in this new market.

For those who wish to profit from the fluctuation in the price of cryptocurrencies without actually owning the underlying assets, trading CFDs on cryptocurrencies can be an attractive option.

In this article, we will discuss the different aspects of cryptocurrency CFDs theoretically, and practice using the broker eToro, considered a leader in this type of trading, but let's first quickly define what CFD (Contract for difference) is in general?

What is a CFD?

It is an agreement that is based on an underlying asset, usually a stock, index, commodity, or cryptocurrency. When you decide to trade a CFD, you expect that the value of that underlying asset will increase or decrease. You don't actually own the asset, but instead expect it to go up or down and trade on it.

For every point the price moves in the direction you set, you will be paid multiples of the number of units you bought or sold. However, if the price moves in the opposite direction to the direction you expected, you will lose as much as you move in units as well.

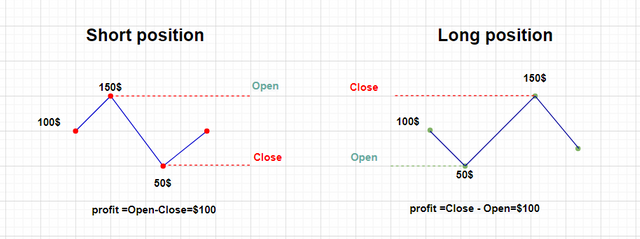

Trading a contract for difference means that you are trading a specified number of units. You are faced with two options here.

Purchase, or what is called a "long position". In this scenario, you expect the price of the cryptocurrency to rise in the future. If you are skilled at forecasting, you can make big profits even if the price movement is negligible.

Sell or what is called a "short position". In this case, you are selling the asset because you expect its price to decrease. You can buy back the same asset after its price has actually decreased.

CFDs offer, unlike traditional trading, the opportunity to earn both ways (when buying or selling).

What is Cryptocurrency CFD Trading? How does it work?

Cryptocurrency CFD trading allows you to predict the future change in the value of the currency you will choose, whether bitcoin or other popular currencies. Many CFDs allow you to open trades on the performance of cryptocurrency in fiat currency, usually in US dollars, but some service providers from brokers also offer contracts for difference against cryptocurrencies and some of them, for example BTC / ETH.

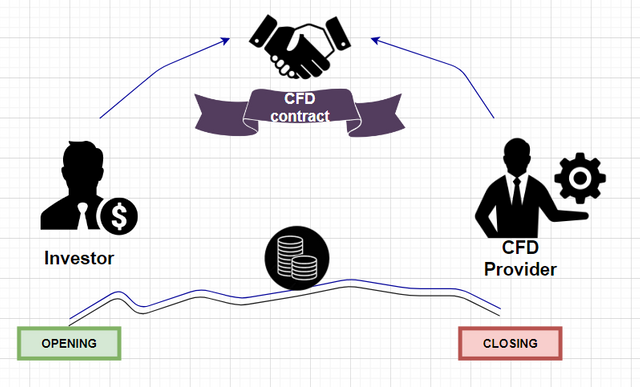

To understand what contracts for difference in cryptocurrencies, we have to understand well the mechanism of creating and working these contracts, which can be explained by the following points:

First: The trader (Investor) selects the asset that the trading broker(CFD Provider) offers it as a contract for the difference to the traders.

Second: During the buying and selling process of the chosen asset, the trader opens a position for the purchase that he makes and specifies the following matters (whether the position is long or short-term, the amount of leverage, the amount he wishes to invest in, and other criteria that differ from one broker to another)

Third: Both the seller and the trader participate in a contract where they agree on the opening price of the established position, and on the fees that may be added to the rollover fee, for example.

Fourth: Now the position for this process is opened and remains open until the trader decides to close it, or it may be closed automatically in a predetermined way, such as reaching a specific profit point or a specific loss point, and it may close automatically in the event of the expiration of the previously agreed contract period.

Finally, the profit or loss is determined, if the contract is closed on the profit, the broker pays the trader, but if the broker is closed on a loss, the broker’s fom takes the money from the trader on the closing differences.

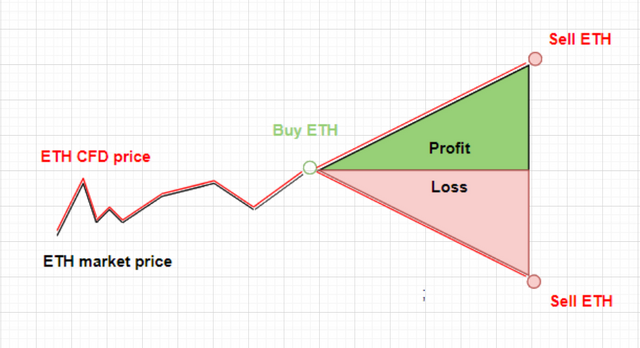

Ethereum CFD Trading Example:

You want to take a position on Ethereum thinking that the price of the currency will go up.

You buy 1 Ethereum CFD contract = $ 1 (each point is equivalent to $ 1) during $ 1980.

After a little, while the Ethereum ends up at $ 2020, you sell your Ethereum CFD contract. You will earn $ 40 (40 points x $ 1).

If your scenario is not the right one and the price of Ethereum drops to $ 1940, if you sell your contract you will lose $ 40 (40 points x $ 1).

Remember that you can keep your Ethereum CFDs as long as you want, there is no expiration date. You sell when you want!

In this example, an Ethereum contract is worth $ 1 but it will depend on the broker on which you decide to trade.

Cryptocurrency CFDs, leverage and margin trading :

It can be confirmed that CFDs are often financial products considered complicated and risky, as they are based on the principle of leverage and margin trading.

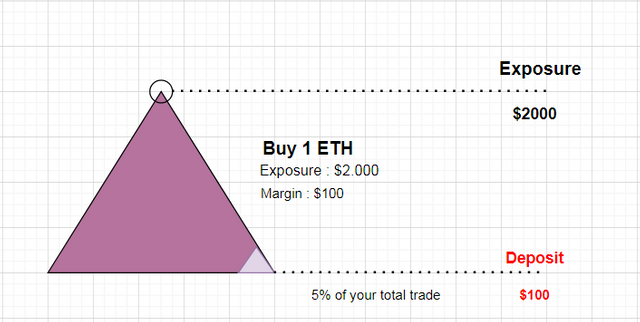

Leverage is one of the key concepts that you need to understand before trading cryptocurrency CFDs, which is one of the most important benefits and drawbacks of this type of derivative. To trade in cryptocurrencies with a CFD system, you only need to deposit a small percentage of the total trade value.

So with the 20x leverage, if you are opening a position of $ 2,000, for example, you may only need a deposit of $ 100. However, you can still get 100% of the gains if the price moves towards your expectations.

It also allows you to trade on margin by using leverage to maximize your returns, providing the potential for a return much larger than the relatively minimal amount you deposited. It also means that your losses are magnified as they are calculated based on the full value of the deal. This means that you could end up losing significantly more than the deposit you made if the negative balance was not protected. This is a major risk you should be aware of before entering into cryptocurrency CFD trading.

How to start trading Cryptocurrency CFDs with a free demo etoro account ?

You can try trading CFDs in cryptocurrencies without risk with a free demo account. It is the perfect way to find out if you are good at investing. The process of trading with the demo account is useful and easy to learn and provides you with a safe environment to ensure that you are provided with all the expertise and information necessary to successfully start in the world of financial markets.

Why start with a demo account?

- Demo trading is 100% free.

- You will get started in minutes.

- The results are completely real.

- Learn how to invest.

- There are no risks or costs

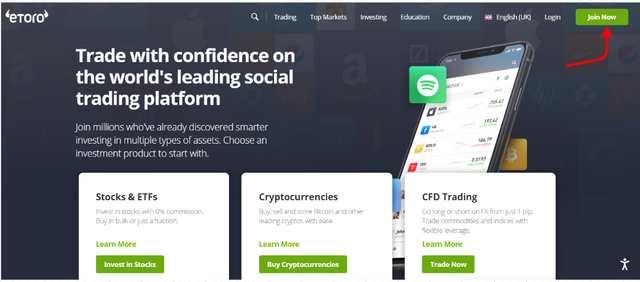

Here are the steps to open an eToro account:

Visit https://www.etoro.com/ and click on the “Join Now” option.

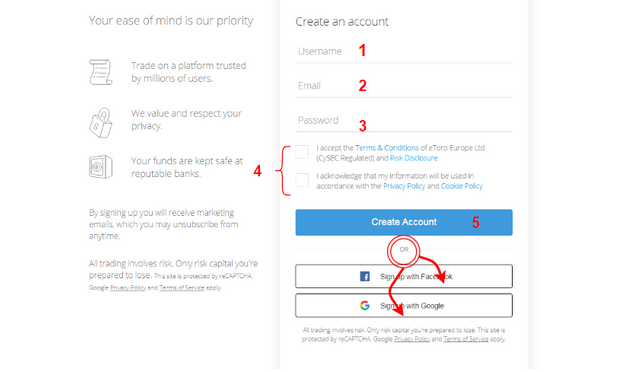

On the “Sign-up” page, you must enter: your first name, last name, e-mail, and then set your password --> Agree to eToro’s “terms and conditions” as well as eToro’s privacy and cookie policies --> Click on the option “Create an account”, and your account will be created.

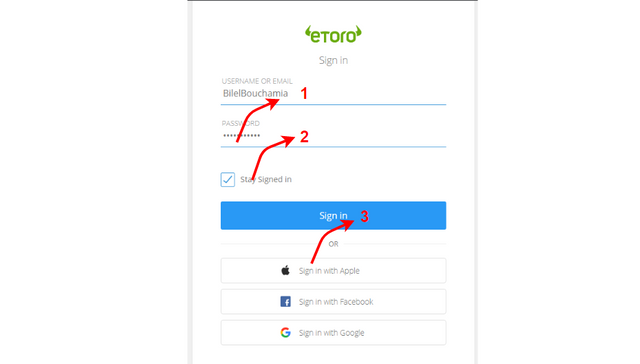

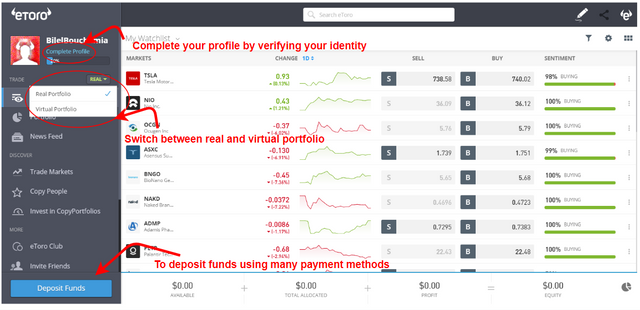

On the “Sign-in” page, Enter your username and password, then you will be automatically taken to the main page where you can deposit funds into your account, start trading or copy successful investors.

You must go to the “Complete Profile” page, where you must fill in all the requested information.

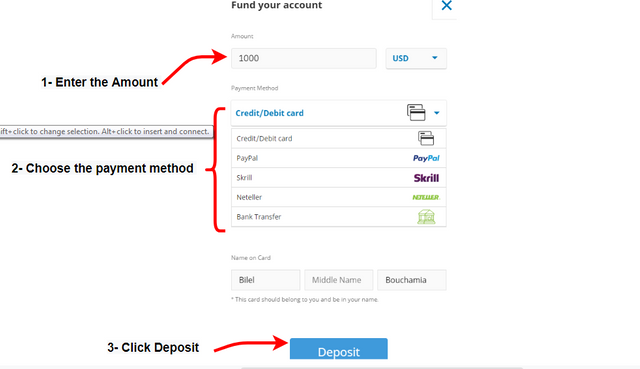

To fund your real portfolio you must follow the following steps:

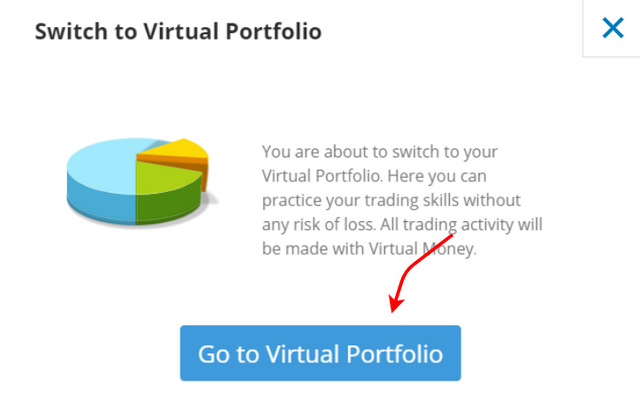

You can now switch from live trading to demo trading by clicking on the “real” or “virtual” options available on the home page. Your virtual balance will be $ 100,000 to learn about the CFDs trading environment.

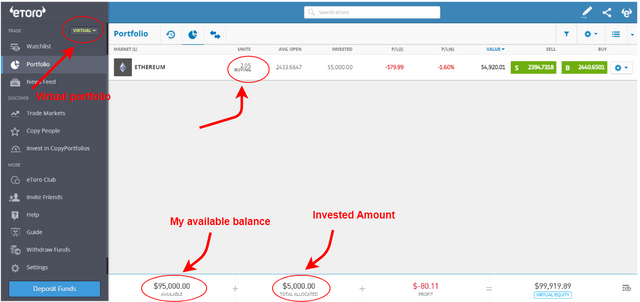

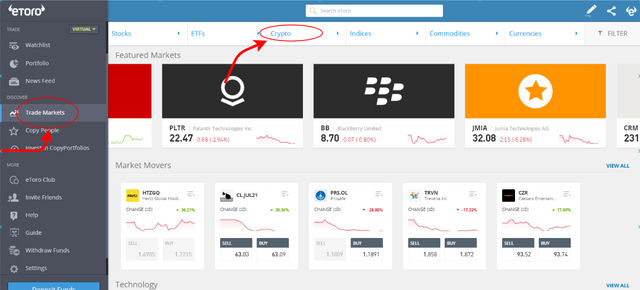

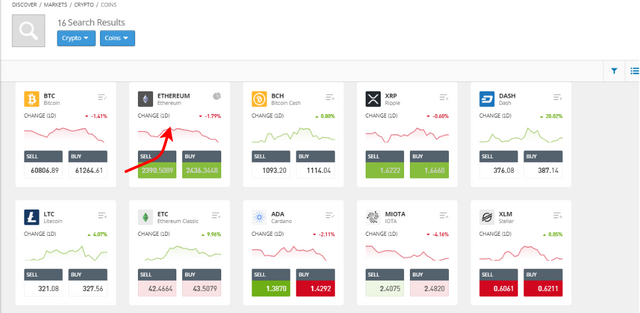

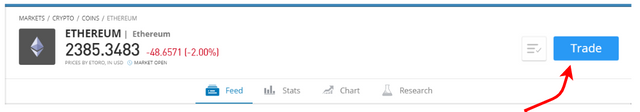

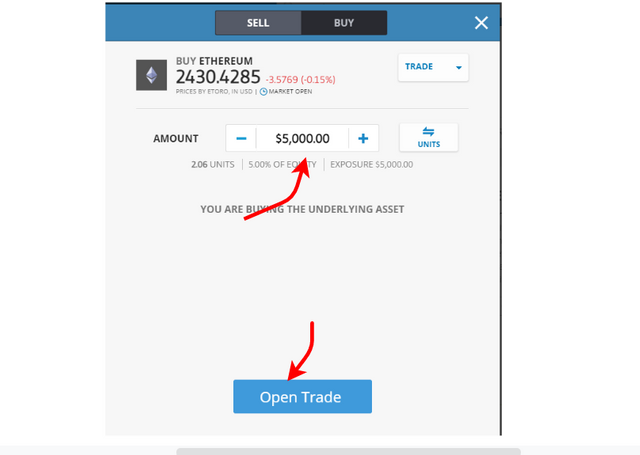

Here, I opened a trade by buying 2.05 units of Ethereum worth $ 5,000. To achieve this task, I followed the following process:

- Click on Trade markets

- Choose the crypto asset

- Select as cryptocurrency Ethereum

- Click on Trade

- Enter the desired amount and click on Open Trade

Benefits and risks of trading cryptocurrency CFDs

Advantages of cryptocurrency CFDs:

No need to go through the complex process of buying cryptocurrencies or securing tokens in wallets;

You can trade the cryptocurrencies underlying CFDs with your fiat currencies;

Possibility of winning during bullish and bearish phases of the market;

Take advantage of leverage and margin trading to trade a larger amount;

Better risk management with many tools and functions such as the classic, trailing, or guaranteed stop-loss;

Trade in a safe environment with a regulated broker offering certain protections;

Faster account opening process than with an exchange;

Disadvantages of cryptocurrency CFDs

If the margin trading and the effect are poorly controlled, then it can lead to very large losses;

The sum of the financing fees paid when you hold a position overnight can sometimes exceed the amount of profits made over the long term;

Risk of a margin call or account liquidation if you incur significant losses and do not have sufficient funds in your trading account.

Who is suitable for trading CFDs on cryptocurrencies?

Since cryptocurrency CFDs are leveraged products that allow you to profit from highly volatile asset price changes, they are not suitable for all investors.

Trading CFDs with cryptocurrencies can fit your trading strategy if you:

Bear in mind that purchasing cryptocurrency is too expensive for you;

Find exposure to the crypto-asset market without holding coins/tokens;

You want to profit from trading on margin and have a relatively low initial capital;

Follow an investment target to make quick wins on small price changes;

You have a short term trading strategy;

Aiming at high (long or short position) and low (short or short position) of cryptocurrency rates;

You want to benefit from a safe trading environment via a regulated CFD broker that provides certain protection for investors;

Enjoy taking risks and trading in stressful trading environments.

Conclusion :

Cryptocurrency CFDs are popular products. They allow crypto-traders to make short-term profits by monetizing the bullish and bearish movements of cryptocurrencies without owning them.

Besides, CFDs offer greater exposure to the digital currency market through margin trading and leverage.

To become a successful crypto trader, you don't need to have the best trading strategy. It is simply necessary to adopt a strategy adapted to your personality, your trading objectives, your availability, your trading capital, and finally your risk tolerance.

Homework tasks :

Write an article in which you must answer the following questions:

- What is a cryptocurrency CFD?

- How do I know if cryptocurrency CFDs are suitable for my trading strategy?

- Are CFDs risky financial products?

- Do all brokers offer cryptocurrency CFDs?

- Explain how you can trade with cryptocurrency CFDs on one of the brokers (Using a demo account).

Rules :

- Try to read the lesson and the assignments carefully before you start editing.

- You must write an essay that contains at least** 300 words**.

- Make sure that you post your homework into the Crypto-Academy community.

- Use copyright-free images with mention of its source, if possible, produce your own.

- Plagiarism is forbidden in Steemit Crypto Academy, and its perpetrators may face serious penalties.

- This homework assignment runs from April 19, 2021 through April 25, 2021.

- Include in your post among the first five hashtags #kouba-s2week2 #cryptoacademy.

- Review your article as if you are the reader. When you do the last review, try to assume the role of a person who sees the article for the first time. This greatly helps you to know how others will receive your thoughts.

Cc:-

@steemitblog

@steemcurator01

@steemcurator02

This is a great one from you professor @kouba01. I enjoyed every bit of this lecture, more grease to your elbow, sir. I have a quick observation in the screenshot below.

From the above, you mean "the price of Ethereum drops to $1940", right?

Thanks for the lecture once again, sir.

thank you my dear. i will fix it.

It's okay professor.

Respected Sir, It is an extraordinary lecture about CFD. Here is my submission for your kind consideration. Thanks

https://steemit.com/hive-108451/@mawattoo8/crypto-academy-season-2-week-2-or-or-homework-post-for-kouba01-or-or

Hello professor @kouba01, please this is my entry

Homework

My Homework Task

https://steemit.com/hive-108451/@masumrbd/crypto-academy-week-10-homework-post-for-kouba01-cryptocurrency-contracts-for-difference-cfds-trading-by-masumrbd

My submission professor @kouba01

https://steemit.com/hive-108451/@salamdeen/cryptopunks-academy-week-10-or-or-home-post-for-kouba01-crypto-currency-contract-for-difference

Hi. My entry professor @kouba01:

https://steemit.com/hive-108451/@oscarcc89/crypto-academy-week-10-homework-post-for-kouba01-season-2-week2-or-cryptocurrency-contracts-for-difference-cfds-by-oscarcc89

This is the link to my assignment professor

https://steemit.com/hive-108451/@jimah1k/steemit-crypto-academy-season2-week2-assignment-by-jimah1k-cryptocurrency-contracts-for-differences-cfds

Saludos profesor @kouba01, acá le dejo mi participación, la clase estuvo perfecta aprendí mucho acerca de los CFD.

https://steemit.com/hive-108451/@rodriguezz/steemit-crypto-academy-temporada-2-semana-2-or-tarea-contratos-por-diferencia-cfd-por-rodriguezz

My entry

https://steemit.com/hive-108451/@blessingkasabe/steemit-crypto-academy-season-2-week-2-homework-post-for-kouba01

https://steemit.com/hive-108451/@swetatiwari/steemit-crypto-academy-season-two-week-1-homework-post-for-yohan2on

Please check