Bitcoin Taxation - How and Why

A bit of a read today! No beer! TAX and BITCOIN. Yes in the same sentence. Local versus global. What is your take on it?

We are all taxpayers, willingly or not! Community would fall apart otherwise. Only a radically different state of consciousness would make everything work. Bitcoin will follow that, I’d wager. In developed countries faster than in poor ones. Let’s look at the state of Croatia.

I’ve spoken to several people and they are all dumbfounded on how to get their money out of the virtual without getting fined. Croatian IRS is a maze of regulations and BTC is in all reality still the future of money. I wouldn’t even try talking with them without an experienced accountant.

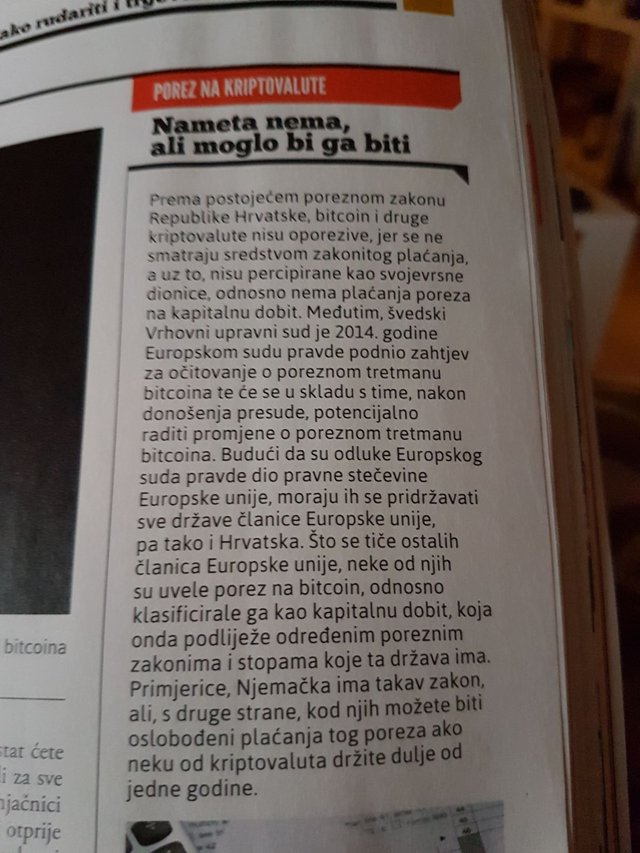

This is what I’ve read just the other day in BUG, a Croatian computer and information technology magazine. Image courtesy of @carebbear.

In translation:

There is no levy but there might be one [in the future or now? Unclear in the text]

According to the existing tax law of Croatia, Bitcoin and other cryptocurrencies are not taxable because they are not considered to be the means of lawful payment and, beside that, they are not perceived as stocks, in other words, there is no corporate tax on it.

However, in 2014 Swedish Supreme Court has submitted a request for the statement on the bitcoin taxation from The European Court of Justice, and according to the veredict there will be potential changes to the tax treatment of Bitcoin. Since the decisions of The European Court are binding legal acts of the EU, all members must uphold them. That is the case with Croatia as well.

As for the other members of the EU some implemented a tax on Bitcoin, that is, classified it as corporate tax, which in turn is subjected to particular tax laws of any one country. For example, Germany has that kind of law. But, on the other hand, you can be free of this tax if you hold [HODL, really?] a cryptocurrency for more than a year.

In all honesty. This seems vague and even ridiculous, especially the last part.

How do exchanges deal with it?

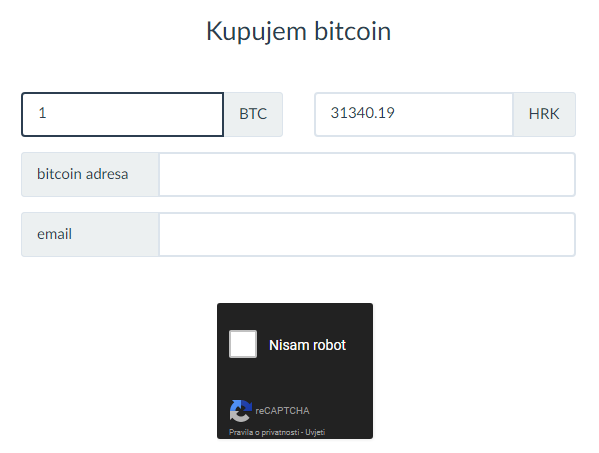

The biggest one in Croatia is bitcoin-mjenjacnica.

https://bitcoin-mjenjacnica.hr/#buy-hrk-btc-national-hr

Operated by the very entrepreneurial Nikola i Marin. Just check their website and call them if you don't find it trustworthy. They should be available.

They sent me a response to the article over What's App no less!

We can not confirm anything related to the tax policy of Croatia since the tax policy is unclear. The only advice we can give to people is to make an effort to consult with theTax Administration by themselves and with a qualified accountant. Magazines and exchanges are not a competent source of information for dealings with the Tax Administration.

The crux of the problem: they send you money on your IBAN account. How to proceed with that? Any advice?

Wow, that was quite a read today! I'm off to The Who Cares For Beer Festival!

For all the cryptocurrency news follow @kingscrown

Buy BTC with Coinbase. You and I both get 10$ for free if you use this link and buy 100$ worth of BTC.

How to make letters so small? Ask me in chatroom! Let’s hang out!

You lost me at, "community would fall apart Otherwise."

😐

Would you buy Bitcoin with a beer when the current transaction fee is $5?! If we don't remove these fees Bitcoin is dead in the water.

http://www.FlippyCoin.com is the #1 Cryptocurrency Exchange!

Let's see what will happen in the future. I hope it's a good one .

@buzzbeergeek

Can you Explain this?

https://steemit.com/bitcoin/@newsworld/bitcoin-taxation-how-and-why

Yeah! He knows how to copy/paste. Thanks for bringing this to my attention.

I already took him down for copying @ratel

One more from me he have nothing left.

No Mercy for Plagiarism. Using external sources while naming them and adding some value is just fine. But copying 1:1 from fellow steemians...

I have heard BTC is private transactions so it not taxable.

It's all logged so not really private.

@buzzbeergeek you are right, however, IMHO what I am referring to is it is private transactions. So let's say I only buy a product using BTC. Or I give you money in private, not talking about hiding anything. Just the way I am thinking at the moment.

I really like your note on the Community. Many people hate to pay taxes but just don't realize that this funds the police, healthcare, infrastructure, etc... Therefore I respect your decision to look up the regulations and pay your taxes!

ohh i wish it does not happen! it will not be good for us all if it happens so :D i mean its beneficial for us all as long as no tax on cryptocurrency (more profit ) ;)

Yeah, true that, but I'd rather pay something so I can sleep peacefully :)

well... this comment of yours changed my thinking this time! agreed with u :)

As long as it is not a straight out robbery

ya ofcourse

Haha! You got a point @buzzbeergeek :)

I envision countries eventually creating their own digital currencies with taxes, fees and all that built into the currency.

I deal with the same exchange as you, and do you want to know my secret?

I close my eyes and hope for the best ;)

Haha, thank you my favorite gamer! So far I did the same :)

Interesting, funny how they replied with WA. I want to know how to make letters that small. What is your chatroom url? I hope you have a fantastic day! Following you!

Same username ;)

OK cool thanks!

👍👍👍

Great post. You really explained the topic simple and interesting.

Taxation will be a major problem crypto has to overcome/solve before it can reach true mainstream adoption. It is a two sided medal.

On the one hand, crypto is about freedom and not being regulated by anyone.

On the other hand, it is absolutely vital for every society to have strict rules, for example taxes. There shouldn't be a way out of a tax, just because you are using an other medium. Circumventing taxation is what is called money laundering!

So either, there is no income tax at all or there is but also on crypto income.

It will be a big task to find ways to correctly tax crypto transaction so that everyone is fine with it and it is hard to skip. It will also be hard to calculate the amount you have to pay. If a coin fluctuates between 10$ and 50$, you would obviously write 10$ in your tax report, right?

I am not offering solutions here, I am just pointing out the problems. If anyone has ideas on how to solve this, please comment. I would be really interested.