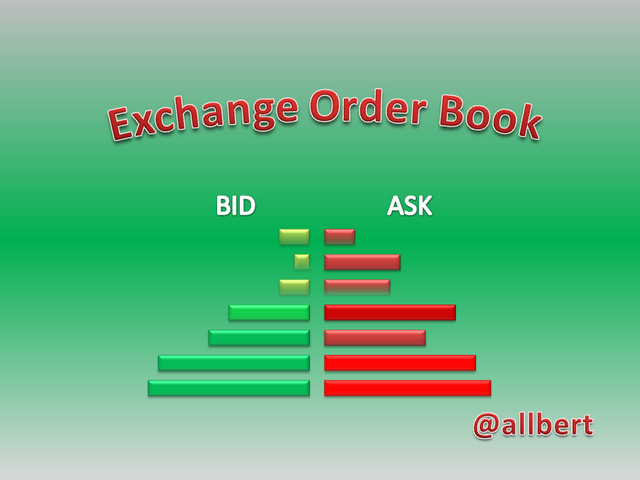

Crypto Academy Week 15 - Homework Post for [@yousafharoonkhan].Exchange order book and its Use and How to place different orders?

Image edited by me in Powerpoint.

Image edited by me in Powerpoint.Question no 1 :

Order book refers to the public list of buy and sells orders of all users of an Exchange. It records the statistics of common prices between sellers and buyers. In other words, it is a waiting list of people who want to buy and sell. The difference between the order book of an Exchange and a local market is that in our market we deal with the same products at different prices, while in a cryptocurrency Exchange we deal with different types of currencies or rather different pairs. In addition, in a market the transactions take place immediately between buyer and seller, while in the order book there is a waiting list that gives priority to the best offers, all this is managed by the exchange that regulates the liquidity of cryptocurrencies. Another difference is that in an exchange order book the orders are constantly affected by the movement of the market and the establishment of new orders. For example, if we make a purchase at a certain price in our local market, this will not affect other buyers and sellers. However in an Exchange, if we bid a better price than the existing ones in the order book, that will affect the places in which the orders are positioned, placing us first on the waiting list. Another example is that each order we place (if they are significant enough) affects the price trend and can give liquidity to the selected pair.Before proceeding...

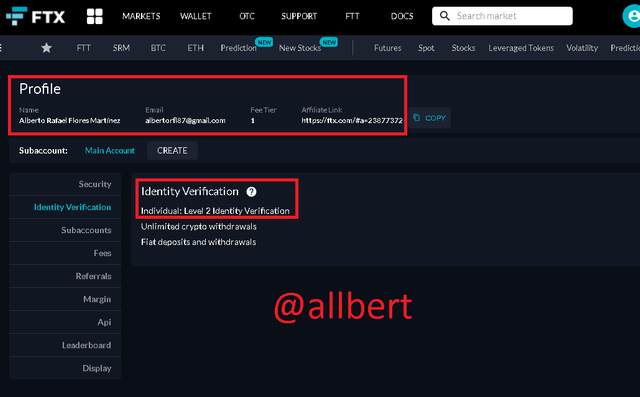

FTX Verified Profile. Image edited by me and taken from my FTX account Source.

Question no 2 :

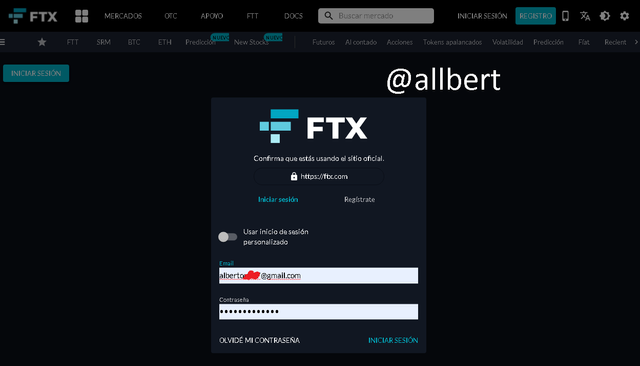

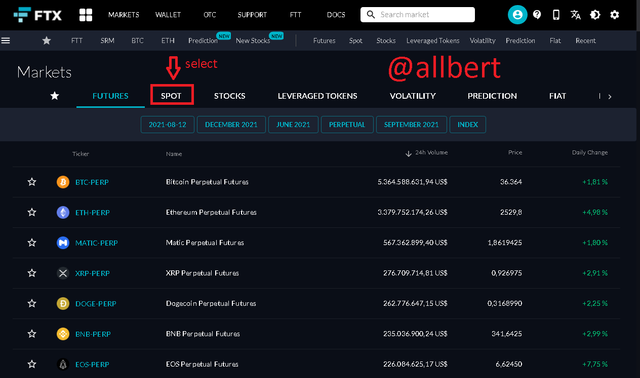

How I said, the procedure to find the Order Book will be done on the FTX platform, which is an Exchange that I have been using for about a month. 1- First of all, I log in to my FTX account. Image edited by me and taken from my FTX account Source.

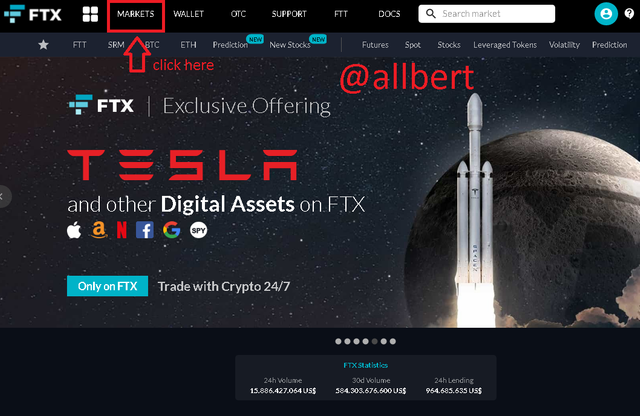

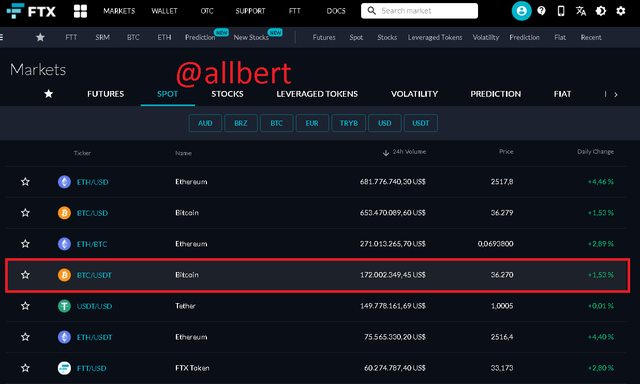

Image edited by me and taken from my FTX account Source. Image edited by me and taken from my FTX account Source.

Image edited by me and taken from my FTX account Source. Image edited by me and taken from my FTX account Source.

Image edited by me and taken from my FTX account Source. Image edited by me and taken from my FTX account Source.

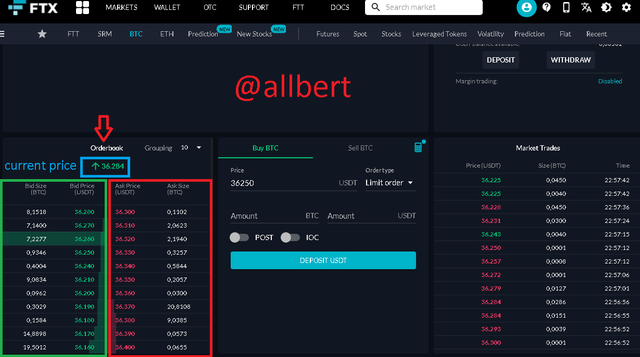

Image edited by me and taken from my FTX account Source.5-Finally, the order book in this Exchange will be located at the bottom left. The red box contains the sell orders and the green box contains the buy orders.

The current price will be located up the middle of both the buy and sell order boxes.

Image edited by me and taken from my FTX account Source.

Pairs:

Refers to the crossover between the value of two assets. In practice, the pair is composed of two currencies in which the exchange rate between them is shown. In other words, it expresses how much would be paid in one currency to obtain one unit of the other.

Support and Resistance:

Support refers to a minimum market value that the price of the asset cannot exceed downward. It is a lower limit that acts as a floor for the asset price. Support comes as a consequence of there not being enough sellers to increase supply, which does not allow the price to fall.

Resistance refers to a maximum market value in which the price of the asset cannot exceed upwards. It is an upper limit that functions as a ceiling for the asset price. Resistance comes as a consequence of an insufficient number of buyers or volume of purchase orders.

Limit Order:

It is a type of buy or sells order where a limit price or top price is set. This type of order is automatic and made to be executed in the future when a selected price is reached, without having to be monitored by the trader.

Market order:

It is a buy or sells order that is placed at the current market price, so it is an immediate operation where the trader is not looking for good prices, but only to exchange the currency he/she has for another one.

Question no 3 :

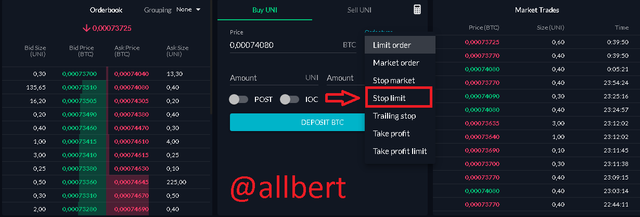

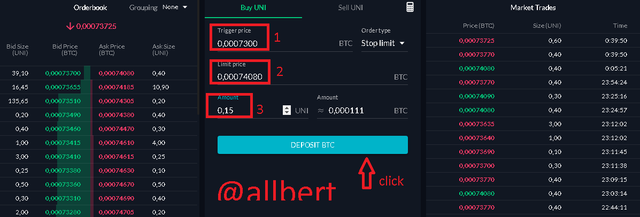

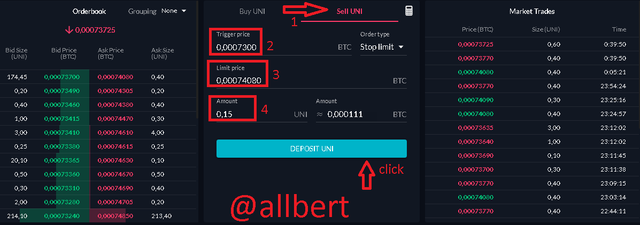

To better explain this section I have decided to do it with another pair that has less volume and that allows us to see the market movements in a slower way. I have chosen the pair UNI/BTC Again we find the Order book below and to the left, next to it (in a blue box) is the order interface which I will talk about later. Finally (in a purple box) is the Market Trades order book. Image edited by me and taken from my FTX account Source.

Image edited by me and taken from my FTX account Source.If we focus on the Order book we will see several important features. First of all, it is important to clarify that the way orders are organized is as follows: Buy orders are organized on the green side, and sell orders are organized on the red side. The orders with a better offer are placed at the top of the list, while the worst offers are placed at the bottom.

If an Exchange user places a better order than the ones in the order book, it will displace the one in the first place and take its place. Other important features of the order book are the following: 1- Bid size (green arrow) represents the size of the buy order or the number of units of the first cryptocurrency of the pair you wish to buy. 2- Bid Prize (green box) represents the price at which the user wishes to buy the set amount of cryptocurrencies. 3- Ask size (red arrow) represents the size of the sell order or the number of units of the first cryptocurrency of the pair to be sold. 4- Ask Prize (red box) represents the price at which the user wishes to sell the set amount of cryptocurrencies. 5- Volume Bars (yellow arrows) indicate in a graphical way the number of buyers or sellers that coincide on average with the selling or buying price. This is a very important part of the order book as it shows how many users can give liquidity to a cryptocurrency and in what price range. In our case, there is a sell order that stands out from the others in terms of volume: Ask size= 9.85 UNI ; Ask Prize=0.00074405 BTC. What is observed in this case is that there are several buyers whose average ask price is 0.00074405 BTC, which when adding up their total amount of tokens results in 9.85 UNI. Finally, when the value of a buy order matches the value of a sell order, a transaction is generated and registered in the Market Trades list.Question no 4 :

Image edited by me and taken from my FTX account Source.

Image edited by me and taken from my FTX account Source. Image edited by me and taken from my FTX account Source.

Image edited by me and taken from my FTX account Source. Image edited by me and taken from my FTX account Source.

Image edited by me and taken from my FTX account Source.Then we repeat the same steps as above.

Image edited by me and taken from my FTX account Source.

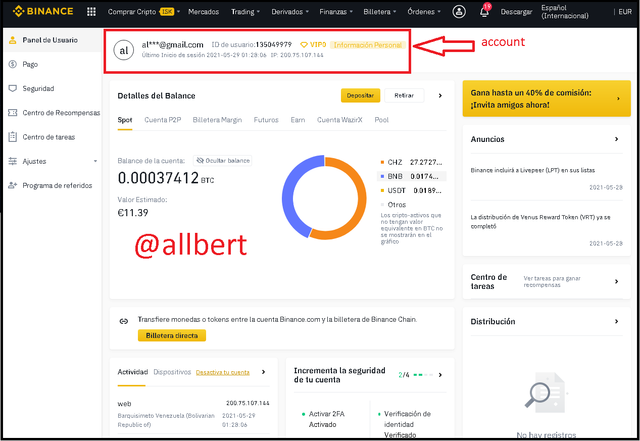

Image edited by me and taken from my FTX account Source. Binance verified account.Image edited by me and taken from my Binance account Source.

Binance verified account.Image edited by me and taken from my Binance account Source. Image edited by me and taken from my Binance account Source.

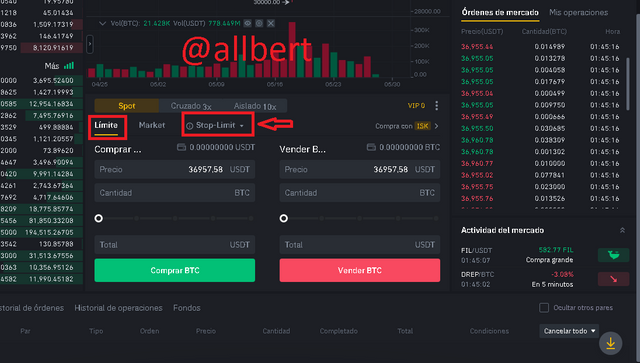

Image edited by me and taken from my Binance account Source. Image edited by me and taken from my Binance account Source.

Image edited by me and taken from my Binance account Source. Image edited by me and taken from my Binance account Source.

Image edited by me and taken from my Binance account Source. Image edited by me and taken from my Binance account Source.

Image edited by me and taken from my Binance account Source.Question no 5 :

First of all, we must understand limit orders that are placed affect the market. Understanding how they do it will give us an advantage over other traders as it will allow us to make more accurate forecasting of the behavior of the crypto-asset. However, we must understand that since these orders are not yet executed, their influence is not seen in the candlestick chart, but in the Order Book. If we manage to understand it, it will allow us to make profits and avoid losses.How?

Order Book reflects in the horizontal volume bars the amount of liquidity and the number of orders placed at a certain price. This should be an initial indicator for us which will help us to decide whether we should trade a currency or not. If the order book has low volume, and the market trades list indicates very long periods between trades, we should not trade that pair, as there is little liquidity. This means that our trade may stall and generate losses. Additionally, there may be orders that match our buy or sell price, but do not have enough cryptocurrencies in that order (aks and bid size). This means that if we place a counter offer at the same price, the order will indeed be executed but only partially. We will only be able to trade the amount of cryptocurrencies available in the book order but not beyond; the rest of our order will continue to wait for liquidity, however, there is no guarantee that this will happen and on the other hand, our position may become a loss if we wait too long. If on the other hand we can identify suitable volume indicators we can make good profits without having to look at the candlestick chart. For example: Suppose we buy a cryptocurrency at $1.75 (my case), our trading idea is to sell at $2.30 which was its historical high, however, we do not know if the price will be able to reach that value again, even worse, we do not know if the price of the asset will fall. Let's imagine that the price then falls. At this point most traders would panic and sell at a loss.However, when we look at the Order Book we see a lot of volume at a convenient buy price for us (higher than our entry price of $1.75). It means that we could place a sell order at that price as this assures us that there will be enough liquidity at a certain time given by those buy orders indicated in the order book.

In this way the study of the order book would be saving us from falling into a loss due to fear, but on the contrary to obtain a profit, which even if it is not the desired take profit, it would still be a valid profit.CONCLUSION

To summarize, we can say that an Order Book is a simple Ledger that shows the user's intentions to buy or sell a pair of cryptocurrencies. Each of these intentions is materialized through orders which are configured under certain conditions in order to be carried out.

The order book helps us to visualize the volume and liquidity of a cryptocurrency pair and it shows us the intention of the other buyers and sellers. This serves to indicate whether the exchange is able to meet the requirements of the operation we are processing, otherwise, our orders could be stalled due to lack of liquidity.

Thank you for joining The Steemit Crypto Academy Courses and participated in the Homework Task season 2 week 7.

You have done a good job and tried to answer the questions in your homework in a good way.

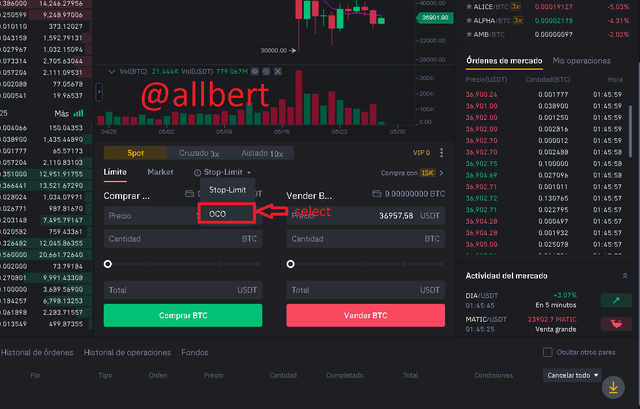

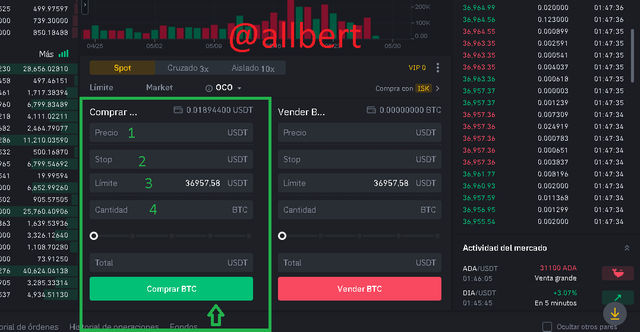

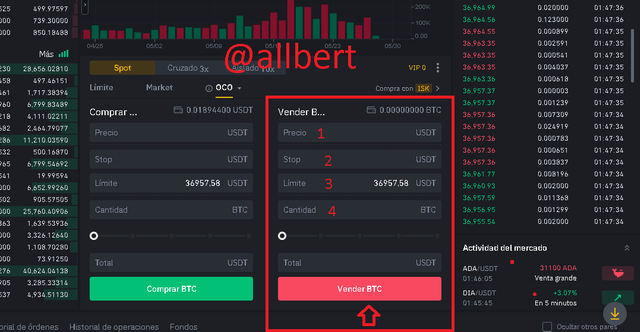

You have not specified the OCO order correctly and if you look at the screenshot it is incomplete and you have not specified your order in the text format, .

Thank you very much for participating in this class. I hope you have benefited from this class.

Grade : 7.5

Thank you Prof @yousafharoonkhan for your relentless desire to transfer knowledge.

I observed that this post from 2 days ago by @pangoli is yet to get an assessment from you. Having read through it, I've been looking forward to seeing the grade score. I believe he's expecting to see how much grade his work will worth too. Please help clarify this, thank you.

#steemitcryptoacademy #yousafharoonkhan-s2week7 #cryptoacademy #steemexclusive

Thanks for your corrections Professor.