CHICKENING-OUT: FED Lighting Fire Under GOLD!

The stage is truly set. We see all the right milestones met and all the necessary preliminary signals getting checked-off.

Inflation is coming back with a vengeance. When central banks tighten, normally, inflation levels begin rising much faster than what we’re currently seeing – this sort of stability is rare, when the economy is strong.

For the markets to behave, as they do right now, the Federal Reserve board of governors must be shaking its head, baffled by the reasons for this year’s horrific stock market losses around the globe.

Not only that, but after stating on so many occasions that the economy is strong and vibrant, to see oil prices so low and economic activity in China this bad, the central planners have had to drastically change their outlook in the past two months.

From telling us that in a few days, we should expect a rate hike and in 2019, four additional ones, the market is now not pricing in any hikes for next year.

Paul Tudor Jones, who is one of Wall-Street’s best commodity traders of all-time, right up there with Jim Rogers and Ray Dalio, has assessed that the FED will chicken-out because it doesn’t want to get all the heat, if the economy in the U.S. slows or stalls, due to high borrowing costs.

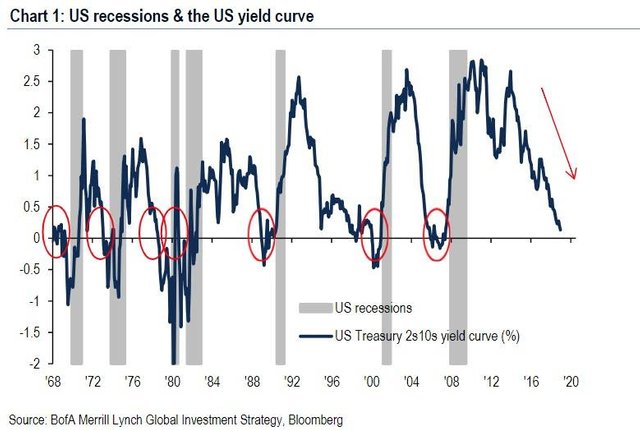

Courtesy: Zerohedge.com

Like JP Morgan bank, which produced the above chart, many of the world’s billionaire investors are shaking their head right now, looking at ways to hedge their LONG positions in U.S. equities because the likelihood of a recession has increased substantially, mostly because the tax-cuts stimulus isn’t enough to generate the growth that President Trump had set expectations for.

Again, in early 2019, I expect the market to plot a chart that resembles a polygraph test given to Bill Clinton, where he is asked about his infidelities. It’s going to be all over the place.

Stocks are going to be as volatile as it gets. Traders will buy and sell frantically, reminding me of the alertness level of an American soldier, walking the jungles of Vietnam. Any sound could make him go a-wall and duck for cover. Any false alarm could generate immediate relief.

We’re not in a recession yet. Unemployment isn’t showing signs of fatigue, nor do 12 other recession indicators we follow on a proprietary benchmark we developed.

All stock market crashes happen during recessions, which is the reason Wealth Research Group is BUYING THE DIP. We’re not in a recession yet, so the big euphoric rally is yet to be had.

We are familiar with the biggest drops in U.S. history, like the 86% horror show of the Great Depression, or the 55% panic-smash of 1937.

In the 1970s, the last inflationary crisis, stocks went down 48%. Warren Buffett’s wealth was cut in half. The Dot.Com bust was yet another 47% bust, followed by 2008’s meltdown, which took companies to the brink of collapse.

These mega-drops happen after a recession is already felt, officially announced and baked in the data.

Right now, companies are continuing to buy back shares, and interest rates are nearing their peak for the tightening cycle, so we might even see RATE-CUTS by the second half of 2019; wages are on the rise, so consumer spending is going to fuel the American engine.

There’s ABSOLUTELY no need to position in advance of the actual confirming rally for commodities, therefore. Time is working in our favor.

The reason is that the junior mining stocks are so battered-up that even if they rally 30%-40% in a few weeks, it’s, literally, insignificant in the bigger picture.

There’s so much upside.

Courtesy: Zerohedge.com

First, we will see yield inversion of the 2-year and 10-year Treasury bond. Then, the economy will roll over into an official recession. After that, the market will tank badly. That’s the chain of events we will likely experience, all in time for the 2020 elections.

2019, then, will only be the warm-up for the real showdown.

For now, the key is to remember that if the market takes another 5%-10% beating, there’s a considerable demand underneath, supported by share buybacks, so I’m going to be a buyer.

Here are some of the top companies I’m interested in and the prices I’m willing to pay for them:

- General Mills (GIS) below $33.75.

- Travelers (TRV) below $100.32.

- Nestle (NSRGY) below $74.33.

- Kimberly Clark (KMB) below $107.18.

If the market correction becomes drastic, I’ll publish a lengthier list, which will include deep-value bargains, especially in the healthcare and tech sectors.

There’s no meeting halfway here. You are either going to buy, just when the media is pounding “end of the world” headlines, or you’re going to wait until it’s “safe,” missing the moments of real bargains.

Best Regards,

Lior Gantz

President, WealthResearchGroup.com

Original Article Available HERE