What is Triangular Arbitrage and How does it work?

In my last post, I talked about the dollar cost averaging implementation which is a strategy that is more beneficial than full deposit as it helps spread your portfolio on a large scale. You may wonder what the title on this post mean. It's also a trading strategy just like the dollar cost averaging.

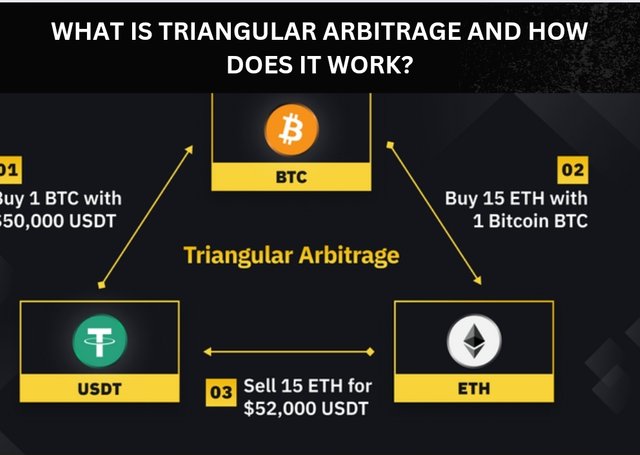

This triangular arbitrage refers to a trading strategy where investors and traders alters the price differences between three different crypto assets to make huge profit. What does this mean? As the name implies, a triangle has three sides, the top and two bottom.

So this triangular arbitrage is more like using a triangle number of sides which is three to picture three different assets with varying prices to make money in the crypto space. The unique thing about this strategy is that the exchange rate between these cryptos doesn't match up which creates an opportunity for this trading strategy to manifest itself.

Any trader will capitalize on these differences in prices or exchange rates to execute a series of fast transactions, producing profits that are huge.

How does this trading strategy work?

It works based on certain principles of which caution is applied. Traders using this strategy need to monitor the exchange rates or prices of these crypto assets and look for ways in which there's no alignment in price which creates a huge opportunity for arbitrage. For example, the price of bitcoin in ethereum is different from what you would get if you convert bitcoin to ETH.

You also need to calculate your profits which is the major goal of this strategy. Let's say you found a situation where there's no alignment in prices which creates an arbitrage, you start with a certain amount of bitcoin and then convert it to ETH and then to LTC and from LTC back to BTC like a triangle. BTC stands as the head of the triangle then moves to the first side of the triangle which is ETH and then moves to the third side which is LTC and then moves back to BTC

If this works on your favour, you'll end up having more BTC than what you started out with. The differences in what you started out with and what you ended up with is your profit. Sometimes there's always a reduction that's why you are told to identify situations.

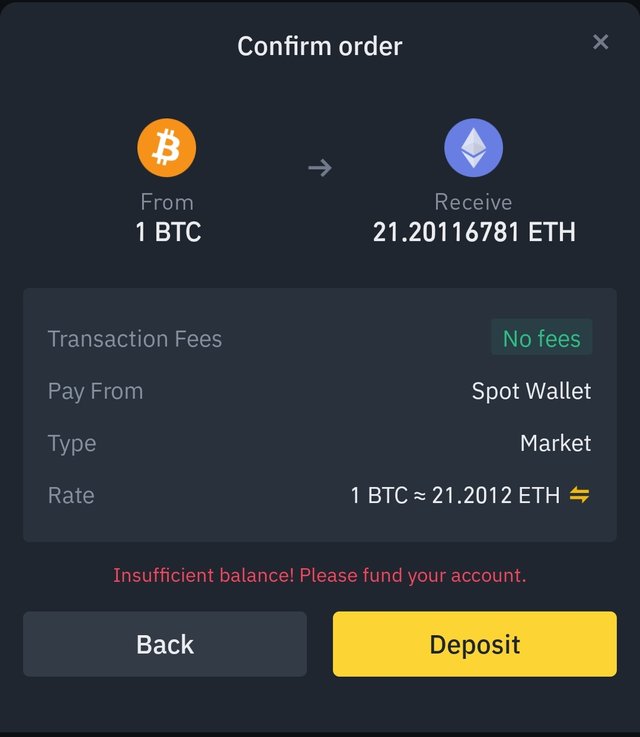

Let's illustrate this in simple terms;

Let's say the exchange rates of bitcoin is that of the current market price now.

You convert 1 BTC = 21.2 ETH

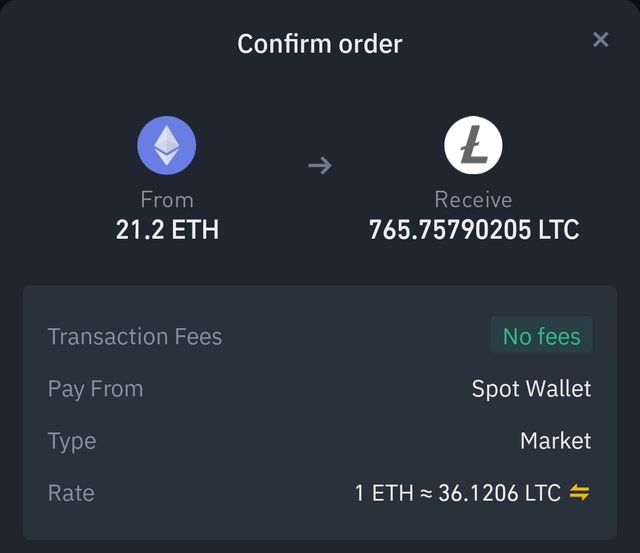

ETH/LTC - 1 ETH = 765.75 LTC

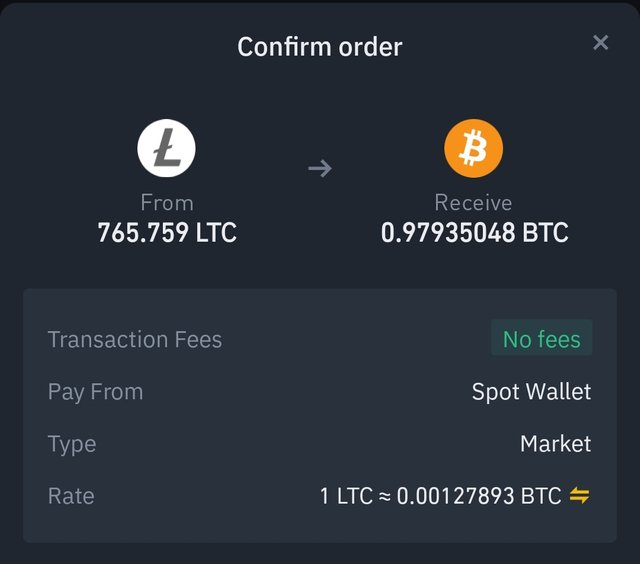

LTC/BTC: 1 LTC = 0.97BTC

Let's do these conversions rightly. If you use 1 BTC to convert, you'll get 21.2 ETH in the process of converting. You then convert the 21.2ETH to get 765.75 LTC. You now have 765.75 converted back to BTC which will lead to losses of 0.021

|  |

|---|

This won't work as the arbitrage isn't identified. The conversion will lead to loss as it hasn't added to your original bitcoin.

- You'll also need to execute this trades fast as speed and efficiency are the watchwords. Once this discrepancy is spotted, you'll need to be fast as there can be changes in the price of an asset which springs from how volatile the crypto ecosystem is. Traders must act swiftly to capitalize on the differences in prices before it comes back to normal.

To execute trades with a good speed, traders use leverage automated trading tools and possible algorithms programmed to monitor market conditions in terms of the prices of these assets. These automated tools not only streamlines the process but also reduces the risk of making decisions that are emotional.

Terminologies involved |

|---|

- Exchange rates and crypto pair: Exchange rates are the priced which one cryptocurrency can be exchanged for another crypto while cryptocurrency pairs consist of two crypto currencies such as BTC/USD or BTC/USDT

- Cross rates: Refers to the exchange rates calculated between two cryptocurrencies that are no traded directly. Traders often need to calculate cross rated to get these arbitrage opportunities. To calculate cross rates between two assets, you'll need to use the formula.......

Cross rated= Exchange rate of base currency 1 /Exchange rate of base currency 2.

Let's say these exchange rates are;

BTC/USD = $62,000

ETH/USD= $2900

Your calculations would be = 62000/2900= 22.1

Meaning 1 Bitcoin is converted to 21.1 ETH

In conclusion, It's very important for traders to engage in this triangular arbitrage to understand how these can be calculated as well as getting to know the transaction costs, liquidity in the market and risk management strategies Involved.

All screenshots are from my binance_......

Disclaimer :Any financial and crypto market information provided in this post was written for informational purposes only and does not constitute 100% investment advice. It's just basic knowledge every crypto trader or investor should have

https://twitter.com/bossj23Mod/status/1790097510641381428?t=SCzhL5VfocXxxrFmiYp2xw&s=19

Note:- Please make your topic unique as this topic has been discussed before in the community

Regards,

@jueco