Get 50% Tax Exemption Donation Under Section 80G Through NGO

In India, the average number of people filing for income tax returns is around 5-crore.

In a population of 130 crore, the end of the financial year has millions of people thronging the office doors of the Income tax department. The percentage of income tax amount depends on the annual income of every individual who falls under a certain tax bracket.

There are provisions made in the Income Tax Act, 1961, which help an individual tax deductions and reduce their tax burden. There are a number of deductions available under various sections, the most popular is Section 80C of Chapter 6A.

Here is a list of deductions that a taxpayer can claim under Chapter 6A:

• Deductions on investment under Section 80C

• Deductions for contribution towards pension account under Section 80CCD

• Deduction for house rent Under Section 80GG

• Deduction for interest on education loan for higher studies under Section 80E

• Deduction for the premium paid for medical insurance under Section 80D

• Deduction for donations towards social causes under Section 80G.

To encourage more people to contribute towards performing philanthropic acts, the Government of India introduced Section 80G. You are eligible for a 50% or 100% tax exemption depending on the Non-Government Organisation (NGO) you have chosen to donate to. You are eligible for tax deductions only if the organisation is a certified NGO and has a 12A Certificate along with tax exemption status under Section 80G. So, before you donate to NGOs, make sure you do a check on criteria like how much will you be able to save and what percentage of your deduction is taxable.

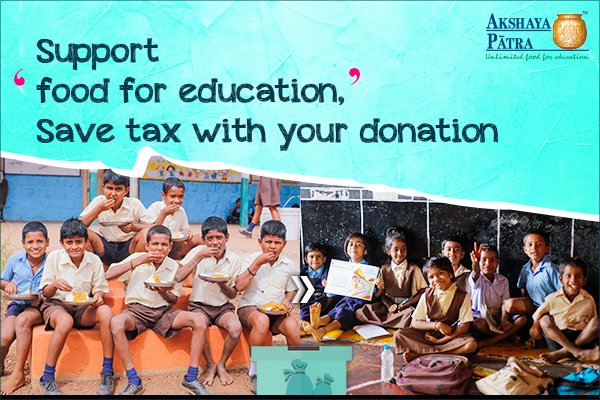

One such NGO where you can make charitable donations and save at the same time, is The Akshaya Patra Foundation which is one of the pioneers in running the Mid-Day Meal Programme in India.

• The Foundation is registered as a not-for-profit organisation under the Indian Trusts Act, 1882 (Reg. No. 154).

• It is registered under Section 12A (a) of the Income Tax Act, 1961.

• The Foundation is also registered under Section 6 (1) (a) of the Foreign Contribution (Regulation) Act, 2010 (FCRA Reg. No. 094421037).

The minimum amount you need to donate to avail tax exemption under section 80G is ₹500. When you make online donations, you are eligible to get tax receipt and certificate, instantly. But, if you want to donate in cash, you must note that cash donations of ₹2000 and above are not applicable for 80G certificates.

What exactly is Akshaya Patra into?

The Akshaya Patra Foundation serves school lunch to children hailing from challenging socio-economic backgrounds. It started off by feeding 1,500 children in Bengaluru and today feeds 1.8 million children across India by implementing Central Government’s Mid-Day Meal Programme. Mid-day meals are a great initiative to bring children to school so that they get the basic education that will pave way for their development in the future. By consuming school lunches prepared by Akshaya Patra every day, children get the adequate amount of nutrition such as proteins, vitamins, carbohydrates and energy making them nourisshed and healthy.

When you donate to Akshaya Patra, you are helping in building an educational foundation for children to brighten their lives. Your donation towards providing food for their education can help them think of a future they have always dreamt of.