MAP Rewarder: MAPR Payouts to Delegators and Price Increase for Token-Holders for 20 July 2020 (19.5% APR)

Earn significant passive income with STEEM without locking SP by investing in MAPR tokens.

This week's distributed profits are 0.374%, equivalent to 19.5% APR and 21.4% APY.

This is higher than most individuals can earn from vesting their own STEEM.

There is a lot of information to get through today, so please read the News below very carefully.

Remember that MAPR has a unique distribution and pricing system. If you look at the MAPR tokens you, as delegator, have received today, multiply that number by the new official BUY Price and you get the same amount in STEEM as you would have done under the old system of just paying out STEEM transfers.

Token-holders receive no token distribution, unless they are also delegators. Their profit comes in the token price increase.

The added bonus is that if you don't sell this week's tokens, then next week their value will rise to at least the new BUY Price. This is how the token allows compounding of profits, for both delegators and token-holders.

Using the language of investment trusts, delegators hold "income" stakes where the "interest" is paid out in tokens, whereas token-holders have "capital" stakes where the profit is added to the token price.

A reminder that new delegations start to earn 2 days after the day of delegation. This means that the first week's payout will be lower than for a 7-day week. Also, as payouts are done on Mondays, delegating on a Saturday or Sunday will yield no distribution till the following week. This has always been in place and is to avoid people trying to game the distribution. The positive part is that there is no unstaking period for the tokens, merely the standard waiting time for undelegating.

MAPR: The Numbers

All these numbers relate to a 7-day period (Monday to Sunday) and calculated in STEEM per SP.

Value of Steem upvotes = APR 48.3% [1a], 27.5% [1b], 26.6% [1c]

Value of Steem author rewards payouts = APR 24.1% [2a], 13.7% [2b], 13.2% [2c]

Distributed MAPR payouts = 0.374% (APR 19.5%) [3]

Projected Compounded APY 21.4% [4]

Average APR 17.6% (26-weeks)

MAPR BUY Price: 1.1710 STEEM [5]

MAPR Price increase = +8.9% APR

MAPR SELL Price: 1.1840 STEEM [6]

[1] Theoretical maximum value of Steem upvotes, assuming 10 full upvotes at 100% power for 7 days, averaged over 7 days and expressed as an APR. This calculation was performed for an SP of 1 million STEEM to be as close as possible to linearity. Your own upvote will be somewhere between 50-100% of this value.

The values are now calculated for three levels of voting power: 1 million SP (a); 10,000 SP (b); and 1,000 SP (c).

[2] Theoretical value of Steem upvote author rewards, assuming 50% curation rewards, 50-50 split of post payouts and SBD print rate, averaged over 7 days and expressed as an APR. Your own author rewards will be somewhere between 50-100% of this value.

[3] MAP Rewarder distributed payout sent to delegators this week as tokens and the MAPR price adjusted to reflect this.

[4] Equivalent compounded yield as an APY for this week's distribution in [3]. We now have enough data to give a better historical picture of progress and have including a 26-week average to give a measure of medium-term returns.

[5] Our BUY price is the price you may sell your MAPR tokens such that their value in STEEM is the same as if this week's distribution was done by direct STEEM transfer.

[6] Our SELL price is about 1% above the BUY price.

Our MAPR distribution [3] is much higher than the average blockchain author rewards for most users [2b & 2c].

Profits will be paid today in the new MAPR tokens. The token buy-backs on Steem-Engine may need to wait a few hours for our power-down to take place.

MAPR News

The price increase has been attenuated this week to keep in line with our fund value. As has been mentioned for a few weeks, we continue to make adjustments based on third party token holdings. However, our earnings remain strong even as the upvote yield on the Steem blockchain continues to come down.

The main news this week is that the Steem blockchain yield has dropped considerably - again. This is actually moderately good news as it was spiralling upwards. I estimate it will take another few weeks for it to reach some new plateau. However, our own income is slightly up on last week, illustrating what I have often said about income being a function of both the potential yield and the actual opportunities.

That APR of 48.3% [1a] remains historically high; during the last couple of years it has been hovering at around 22%, save for a few spikes during hardforks. This value is very much related to rshares activity on the chain and the value of the reward pool. In the extreme case in which all STEEM was vested and voting, this figure would be down to below the coin minting rate - at somewhere around 6% APR. I've never seen this happen, but it sets a floor on what it could be.

I note that leases are peaking at 22%; given that returns are on a downward trajectory, it may be useful to lock in such rates if you have spare SP.

To put these numbers in context, please take a look at the above numbers [1b, 2b]; those assume an SP of 10,000 STEEM. So a full vote yields 27.5% and the author rewards would be about 13.7% APR. So this week's income of 19.5% APR is some 40% higher than the author rewards for a 10k SP stake.

We shall continue to generate yields that are as high as we can given the economic model and in the hope that activity - voting rshares activity - will pick up at some point.

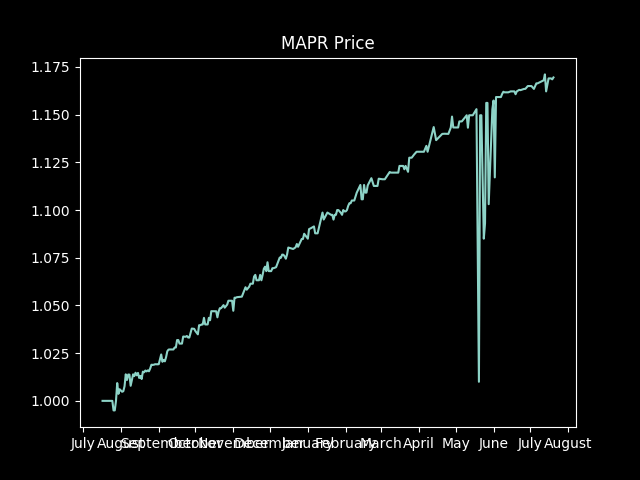

And finally, although our weekly returns are variable, here is a graph of how the token price has been performing since the MAPR token was launched. (Thanks to @gerber for the discord-bot.)

MAP Rewarder, without the token, has been in operation for some 30 months, so you can extrapolate back from that graph to get an idea of our returns to members. We celebrated 2 years of operations at the start of February.

As can be seen, the turbulence of the last few weeks has, for now, abated. We shall see going forward - there remain factors outside our control.

Anyway, don't panic! We may need to flatten the curve slightly but, to be honest, this is the least of our worries.

See you next week!

Next rewards distribution will be on Monday 27 July.

[BUY MAXUV] - [READ MAXUV]

[BUY MAPR] - [READ MAP REWARDER]

ONECENT: The First Strategic Token Investment Game (STIG)

I think you deserve some $trdo

Congratulations @pixelfan, you successfuly trended the post shared by @accelerator!

@accelerator will receive 1.63174500 TRDO & @pixelfan will get 1.08783000 TRDO curation in 3 Days from Post Created Date!

"Call TRDO, Your Comment Worth Something!"

To view or trade TRDO go to steem-engine.com

Join TRDO Discord Channel or Join TRDO Web Site

Thanks, as always :-)

Can one enter the program by following a trail instead of delegating

You can always follow a vote ;-) Some did before with steemauto.

Some !trdo as well. I delegated some SP to @accelerator, I hope that's the right account? :)

Yes, thanks - I sent some tokens yesterday and in the memo just a reminder that the first week is adjusted, so will be higher next week. :-)

Sorry, getting confused - M token I left a memo, MAPR del was very recent and you'll receive full payouts from next Monday.

Thank you, I understand :) I just wanted to be sure I delegated properly ;)

Congratulations @accelerator, your post successfully recieved 1.631745 TRDO from below listed TRENDO callers:

To view or trade TRDO go to steem-engine.com

Join TRDO Discord Channel or Join TRDO Web Site