Triangular Moving Average (TRIMA) Indicator - Crypto Academy / S6W4 - Homework Post for @fredquantum.

Hey guys,

I welcome you'll to the 4th week of the SteemitCryptoAcademy course by Professor @fredquantum. In this course, I will run a comprehensive review on the crypto Trading Strategy with Triangular Moving Average (TRIMA) Indicator.

All images used in this post unless otherwise stated are not mine and were extracted from tradingview, for the purpose of this assignment.

Question 1

What is your understanding of the TRIMA indicator?

TRIMA stands for Triangular Moving Average. The indicator works by representing an average of prices of assets however, it places importance on the middle prices of the selected time period. The TRIMA indicator is just like other moving averages. The triangular moving averages depict the mean price if assets in the financial market usually over a specified number of points of data. The characteristic feature of this indicator is that it is averaged twice. You can use different kinds of data inputs including the volume and prices of assets. If you choose, it can as well display volume on the price chart in addition to the default prices. The triangular moving indicator illustrates the average price of an asset over a certain data point. These data points are usually price bars. Just like how indicators lag during trades, the TRIMA indicator is also included. It doesn’t react quickly during a volatile market. The implication of this is that it may take a longer time for you to notice the indicator move in the appropriate direction.

Principally, the use of the indicator is that it helps to smooth out the prices of assets. It does this by using data points and the result is that a line indicating this, appears on your chart. It is particularly slow when you use it in a volatile market. The TRIMA indicator line lagging feature can be used anyway. Let us assume that the price of an asset moves back and forth in a choppy manner called the ranging market. When there is this kind of market, the TRIMA indicator won’t react much in response to this market structure. It takes a more sustained move in the market structure for the TRIMA indicator to move in that direction. The calculation of this indicator is such that the indicator adds SMA values then it divides the value by the number of periods. Interestingly, the indicator can make you some god profit especially when it keeps you in a trend longer. However, when the price reverses, you may be disadvantaged because it will react slowly to the reversal.

If you use platforms such as tradingview, Binance, and meta trader for trading, you may likely be a forex or cryptocurrency enthusiast. Forex markets are quite volatile as well as crypto markets. During fundamental analysis, you understand that one news in the globe can turn the tide of things and the market will respond in the direction of the news. Using the TRIMA indicator may be dangerous in situations like this because it will definitely not show you an immediate reversal and when you understand that the market has turned, you may be at a loss. The TRIMA is actually an average of the mean of the last prices of an asset. If you add this to a chart, just like how other averages operate, you can easily fathom the direction of trends in the market. This connotes that you can ascertain the trends in a market using the oscillating line of the indicator.

During an uptrend, the slope is of the indicator and the prices of an asset are directed upwards.

During a downtrend, the slope of the indicator and the prices of assets is directed downwards.

Question 2

Set up a crypto chart with the TRIMA indicator. How is the calculation of TRIMA done? Give an illustration (Screenshots required).

I am going to set up a crypto chart with the TRIMA Indicator. Platform used: www.tradingview.com.

Crypto pair used: Proceed by clicking on the chart to access the chart screen.

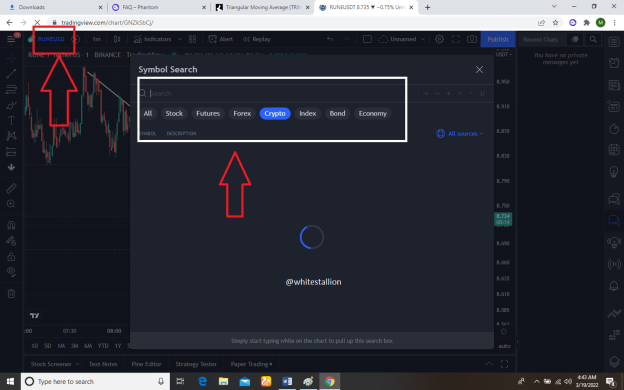

- After accessing the screen, proceed by clicking on the bar to search for your choice of crypto. A menu will pop up showing you options to choose from. Either crypto, stocks or crypto or index, etc. Since we will be using crypto, we will proceed by clicking on crypto and adding the required pair which will be Bitcoin / USDT.

- The next thing to do is to locate the add indicator bar and click on it.

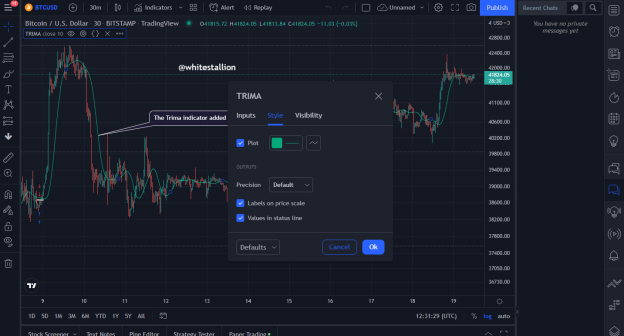

- You will be prompted to search for the indicator in the search bar, type trima and the platform will automatically publish a list of names. Select the indicator

- The indicator will be added to our chart.

- In case you want to edit the settings or features of the indicator. You can do this by double-clicking on it and editing the period if you choose. The indicator comes with a period of 9 as its default. Just as the period sounds, it is a brief one and traders who do not really trade long may decide to use this period. The bad side to this is that the indicator is likely to present more false signals. You can use other periods such as 20 or 21 for a better experience.

- You may decide to use a different style, to change the aesthetics of the indicator. Changing the color from green to red will make your indicator line green. You may also choose to tweak the thickness of the line of the indicator.

Just like many other indicators, the TRIMA indicator has a mathematical formula that can be used to calculate it. The first thing to be done is the calculation of the simple moving averages value.

SMA = (The price 1 + the price 2 + the price 3 + the price 4 + the price n ) / n

Where Price = indication of the interval of the asset In a question from 1 – N

N = this is a connotation of the period of observation used.

Furthermore, after getting our SMA, the next thing to do is to find out our TRIMA. We are going to use our SMA

derivations to get the value for our TRIMA. In essence:

TRIMA = The simple moving average 1 + The simple moving average 2 + The simple moving average 3……. ……………The simple moving average n

Lastly, let us use an illustration. Let us assume the simple moving averages for Bitcoin for 10p periods is 200, 290, 100, 200, 250, 340, 500, 100, 250, 600.

We will use our TRIMA formula to solve.

TRIMA = The simple moving average 1 + The simple moving average 2 + The simple moving average 3……. ……………

The simple moving average n'

TRIMA = 200 +290 +100+ 200+ 250+ 340+500 + 1 00+ 250+ 600 / 10

TRIMA = 2,290

Question 3

Identify uptrend and downtrend market conditions using TRIMA indicator on a separate chart.

The TRIMA indicator is a powerful indicator that helps traders find out the trends that dominate a market. When traders approach a market, the first thing they usually look out for is an opportunity to buy or sell. That means, if the market looks like it is going to be bullish. They ensure that they utilize perfect entry points. A traditional uptrend market makes higher highs and higher lows. The TRIMA indicator flows on the chart in a manner that can help traders identify entry and exit points in a market. The two things to watch out for during a trend is the direction of the slope of the indicator and whether it is above or below prices on the chart.

Let us identify uptrends

So let us start with bullish markets. The capital way a trader can identify whether it is an uptrend is that the indicator line goes below the price chart. The candlesticks ride way above the indicator. The azimuth of the indicator always moves in response and with respect to that direction of the bull trend.

Take a look at the chart above for a graphical explanation. The Bitcoin / U.S Dollar pair shows a great uptrend and the TRIMA indicator agreed. The candlesticks were riding above the indicator line and the angle of the indicator was sloping upward in response to this.

Having spoken about uptrends, let us proceed to talk about bearish trends. Just like how the TRIMA indicator depicts uptrends, it does the same for downtrends. The major difference is the direction of motion. During a downtrend, the market exhibits lower lows and lower highs. The candlesticks of the asset drop below the indicator line and the angle of the TRIMA indicator rides above the cloud of the prices as shown below.

Looking at the Bitcoin / Tether U.S Chart above, we can see that there is a period of a downtrend as the TRIMA indicator rides above the candlesticks and the angle responds in similar fashion. In summary:

Question 4

With your knowledge of dynamic support and resistance, show the TRIMA acting like one. And show TRIMA movement in a consolidating market.

I like to give a brief description of subject matters before diving fully into it. The concept of support and resistance has been in existence since the creation of the financial market. It is created by a flux of orders from buyers and sellers in the market. Usually, prices of assets dwindle around these zones before eventually breaking out f them. Strong support or resistance is judged by the number of tests. That means the number of times the price of an asset has gotten to that level and reversed, not having enough momentum to breakthrough. We use moving averages as dynamic supports sometimes. The reason is that traditional support and resistance levels are straight lines. But when we talk about dynamic support and resistance levels, we are talking about S&R levels that are changing depending on the price of an asset. The EMA indicators are best used in finding these zones. Thus, the TRIMA indicator is one of the best examples of indicators that can be used to explain dynamic support and resistance zones. Support zones are general zones in the market where buyers take advantage of retracement. Because financial institutions and traders take profits during the course of trades, this makes the market to retrace and that point becomes a support level before the uptrend continues. So, using the TRIMA indicator as an example, when we see a chart and the candlesticks of an asset are trading above the TRIMA line, the TRIMA line automatically serves as a support region for cases like this. The reason is that, once the price retraces and bounces on the line, the prior uptrend continues after traders make purchases at lower prices thus increasing the volatility of the market.

The image above seeks to give a graphical explanation of what I just said. As you can see from the Bitcoin / U.S Dollar pair, the market was in a serious bullish trend and quite some number of retracements. The retracement was a chance for more buyers to come into the market at cheaper rates. Furthermore, the TRIMA indicator line served as support for the uptrend. The prices always touched the line and bounced back into the prior trend. Let us also consider the resistance zone. When the candlesticks of the asset drop below the indicator line, we see that the market is in a downtrend. The implication of this is that the TRIMA will then serve as a resistance zone. The market will pull back to accommodate more sellers but the trend will continue in the previous direction.

The indicator line served the purposes of dynamic resistance. As the prices of the Bitcoin / U.S Dollar pair touched the point, the prices continued in the prior direction.

A consolidating market is one that doesn’t have a defined trend direction. Prices keep alternating between support and resistance zones in a market like this. This is a pointer to the balance between buying and sell orders in the market. This quite a dangerous stage to trade because the market is in a state of uncertainty as the trading volume is low. As you can see in the image above, the TRIMA indicator was changing direction in response to the prices. It went below and above in some places indicating no specific trend in the market. I personally don’t trade when the market is ranging like this.

Question 5

Combine two TRIMMAs and indicate how to identify buy or sell positions through crossovers. (Use another period combination other than the one used In the lecture, explain your choice for the period?

The question demands that I combine two TRIMMA indicators but ensure they are of different periods. I stated earlier that it is possible to adjust the parameters of the indicator, the periods, and the style. So, the best way to carry out this operation is to make sure that one period of the indicator is higher than the other. I also stated earlier that a TRIMA indicator that has a period of 9 or 10 will react quickly to changes in the market while a TRIMA indicator with a period of about 21 may react slower. Since the default period is 9 nor 10 and it is too quick. A period of about 20 will be at perfect pace. I will also set my second TRIMA at 50 just like how other EMA operate.

Buying Chance

Initially, I stated how that you can change the colors of the indicator lines. For this reason, I made my 50-period line to be yellow while my 20-line remained green. The indicator operates like the traditional EMA indicators. What this implies is that, when you observe the smaller TRIMA period crossing above the longer period TRIMA, it indicates a bullish market. It means there is enough momentum and volume in the market to push it in a bullish direction. See the image below:

As you can see in the image above, the shorter TRIMA line crossed above the longer one in the Bitcoin / U.S Dollar pair. The uptrend was a brief one anyway. But that is the operational principle.

Selling Chance

During a downtrend, the reverse is the case. The longer TRIMA line crosses above the shorter one. This indicates an opportunity for sellers to get on the market. You may decide to enter the trade immediately the crossover happens. See the image below, it shows the instance where the longer period was above the shorter period, indicating a downtrend and opportunities to sell. As we all know, downtrends are characterized by lower lows and lower highs.

Question 6

What are the conditions that must be fulfilled to trade reversals using TRIMA combining RSI? Show the chart analysis. What other momentum indicators can be used to confirm TRIMA crossovers? Show example on the chart?

Trading reversals is an entire ball game. Some traders specialize in it. However, to make proper utilization of this strategy, there are some criteria that must be followed. As a matter of fact, I will just continue from the last question. In question five, we saw how we can identify bullish and bearish trends using two TRIMA indicators of different periods. There are conditions that must be fulfilled before you trade reversals using this strategy. These conditions listed below are combined for both bullish and bearish reversals. The principal determining factor for the choice of trade is the motions of the TRIMA lines.

The first condition to be observed is to add the two TRIMA indicators to your chart.

The second condition is to ensure that you change the periods of the indicator to make one shorter than the other.

If you want to trade bullish, make sure that the shorter TRIMA line is above the longer one. If you want to trade bearish, make sure that the longer period TRIMA line is above the shorter one.

Make sure you exit trades when you hit your take profit using proper risk management when the price hits resistance zones.

If you observe the image above, you will notice that the cross-over happened late owing to the lag nature of the TRIMA indicator. However, the cross-over with the shorter TRIMA line above the longer showed that the uptrend had begun. Whenever this happens, anytime the prices break over and above the shorter TRIMA line, it is an indication that the market is bullish.

Bearish Trend

Bearish trends are characterized by the movement of the longer period TRIMA line above the shorter period line. It means that there is enough sell volume in the market to pull the trend down. You can decide to enter the trade and set your stop loss and take profit levels as you deem fit.

The image above, Bitcoin / U.S Dollar pair is depicting what I just explained. The trend was bearish, the longer period TRIMA line (50) was above the shorter period TRIMA line (20). This fulfilled the criteria for entering the trade. Of course, we can observe the traditional character of bearish markets, lower highs, and lower lows.

Furthermore, we are going to discuss the RSI and the TRIMA combined.

The image above shows the chart having a combo of the TRIMA and RSI indicators. I love the RSI indicator; the reason is that it is simple to understand. All you have to take note of are the equilibrium or ranging market, the overbought, and the oversold market. When the price is around the level 70 or 80, we can say the market is overbought. When the indicator is around level 30, we can say the market is oversold.

How can I make trading decisions using this information?

- Bullish

It is quite simple. Anytime you observe that the price is dancing around level 80 in the RSI indicator bar, be certain that the market is about to reverse. The market makers take profit at this point and the market comes crashing down in reversal.

- Bearish

When the price of an asset dance around level 20 in the RSI chart, be certain that the market is about to reverse as the big boys in the market are about to take profit.

What are the conditions that must be fulfilled to trade reversals using TRIMA combining RSI?

The first thing to look at during an uptrend using the TRIMA indicator is which of the indicator lines is crossing which. When we see the shorter indicator line crossing above the longer period indicator line, we know it is an uptrend. Furthermore, we must then look at our RSI indicator. Remember that I spoke about level 70 or 80 being our overbought level and bullish markets reverse at this point.

Downtrend

The image above depicts a downtrend because our longer period TRIMA line is above the shorter TRIMA line, which is in fulfillment of the criteria. As you can see in the image above, there was an initial trend reversal from level 80 in our RSI chart. The cross-over happened at level 60 and immediately the market was at level 20 (oversold region) in our RSI chart, the market became choppy as many took profit of their trades. This made the trading volume to below as more buy and sell orders were open.

Uptrend

Bullish trends operate similarly. The first thing that is observed is that the shorter TRIMA line gets above the longer period line as you can see in the image below. The market had just left an over-sold region of about 20 on our RSI indicator chart. This is in fulfillment of our earlier stated criteria. More buyers took control of the market as the uptrend grew stronger and stronger. As you expected, once the volume pushes the market upwards to the region where it will get to 70 or 80 in the RSI indicator, It will show that the market is over-bought and the prices will reverse.

Question 7

Place a demo trade and real trade using the TRIMA reversal trading strategy (combine RSI

). Ideally, bullish and bearish reversals. Utilize lower time frames with proper risk management (screenshots required)

I AM GOING TO PLACE A BULLISH DEMO TRADE TO ELABORATE ON THIS.

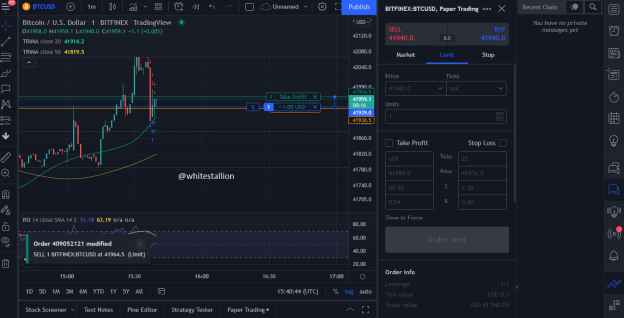

I chose the Bitcoin / U.S Dollar crypto pair. Furthermore, I set my timeframe to 1 minute. Since I had already set my long period (50) TRIMA line in yellow color and my short TRIMA line at 20 periods which is in green, I proceed to watch the crossover. To place a bullish trade, I made sure that my short TRIMA line was above the longer period TRIMA line. In essence, it means the buyers had the upper hand in the market.

- The bullish trend was already properly defined and I waited for a good entry. I watched and there came a very long bearish candlestick indicating a time in the market where positions were closed. I made sure to enter the market immediately

- I was able to hit my take profit level as shown above. I made 20 USD profit.

Question 8

What are the advantages and disadvantages of TRIMA Indicator?

I have spoken a lot about the TRIMA indicator, it has pros and cons.

The cons of the indicator

- The TRIMA indicator helps to reduce the noise in the market thus, making interpretation of the market easier.

- You can identify entry and exit points in a trend because of the dynamic nature of the resistance and support levels, identified using the TRIMA indicator.

- You can easily enter trades because of the presence of the long and short TRIMA periods that I used earlier.

The pros of the indicator

The indicator lags. I mean sometimes, reversals happen way before the indicator picks it up. This is the major disadvantage of the indicator.

Although other indicators require this, you may have to combine other indicators such as the EMA or RSI to be able to use the TRIMA indicator properly.

Conclusion

Wow! It has been a great journey so far. Discussing the TRIMA indicator has been interesting. I have been able to go through many things I didn’t know about the indicator before. It’s my personal opinion that if traders make proper study and implement what they have learned about the indicator, they will maximize trading the financial market.

Special thanks to Professor @fredquantum