The Investment Case for ETH

In 2015, well-known value investor Bill Miller made an investment case for BTC in his essay “The Value Investor’s Case for …Bitcoin?” Value investors are generally known to analyze assets based on cash flows, so it was surprising to some to hear that a volatile digital currency that lacks cash flows was on the radar of a famous value investor.

I’d like to take the same probabilistic approach to evaluate ether (ETH), the digital currency that the Ethereum blockchain is based on. Currently hovering around $1.1B in total market value, it’s likely that ETH is starting to show up on on the radar of traditional value investors.

The Economics of ETH

The genesis block for Ethereum occurred on July 30th, 2015 and the blockchain has been running for over a year and a half. This is a long-time in the blockchain world but a short period of time in the grand scheme of technology.

Unlike Bitcoin’s monetary policy, which was clear to all from the beginning (21M fixed supply, 50 BTC distributed from the blockchain every 10 mins with halving every 4 years until the year 2140), the monetary policy of Ethereum has always been nebulous. The lack of a fixed supply has turned off some people and it’s not clear exactly what the long-term supply will actually be. Here’s what is known currently:

- Total ETH created (as of 2/13/17): 88,849,495 (see https://etherscan.io/stat/supply)

- ETH created at launch: 60M (sold to the crowd) + 11.9M (allocated to the developer fund)

- ETH created each year: 15.6M (fixed amount each year)

- Inflation rate: Year 1: 21.6%, Year 2: 17.8%, Year 3: 15.1%, Year 4: 13.1%, Year 5: 11.1%, Year 6: 10.4%, Year 7: 9.4%, Year 8: 8.6%, Year 9: 7.9%, Year 10: 7.3%

Given the current plan for coin distribution, there will be 227.1M coins in existence after 10 years. This is subject to change though, as the coin issuance schedule is not yet set in stone and will depend on decisions the Ethereum Foundation makes when the protocol switches from proof-of-work mining to proof-of-stake mining.

The Risks

The risks of ETH as an investment are significant. I believe that there is an 80% chance that the price of ETH goes to zero over time for one or more of the following reasons:

1.) Security vulnerabilities persist: A turing complete scripting language gives hackers a broad attack vector. We’ve already seen the impact this broad attack vector can have on Ethereum (e.g. the DAO hack). There is a lot of work to be done to ensure that Ethereum smart contracts are secure enough to build reliable and scalable decentralized applications. If the security vulnerabilities persist, Ethereum will end up ineffective as a developer platform, potentially killing the value of ETH completely.

2.) Lack of immutability: Following the DAO hack, Ethereum hard-forked to prevent the DAO hacker from stealing over $150M worth of ETH. When this happened, a new blockchain was created and its history was revised to revoke the theft. This was controversial to some who believe that a blockchain must maintain immutability, and two different versions of Ethereum ended up forming: Ethereum and Ethereum Classic. Without immutability long-term, it is very difficult for a blockchain to gain mass trust. It’s possible last year’s blockchain revision, or others in the future, could prevent Ethereum from gaining the trust from developers and users it needs to become a widely used blockchain.

3.) Failure to successfully transition from proof-of-work to proof-of-stake: Currently, Ethereum relies on a similar decentralized security model as Bitcoin: proof-of-work. Miners all over the world expend electricity to prove their work, verify transactions, and earn ETH. Ethereum plans to transition to proof of stake to secure the network and distribute tokens, which is highly risky but could pay off with a more accessible and environmentally friendly token distribution process.

4.) Regulation: Unlike Bitcoin, which lacks a central point of failure, the Ethereum Foundation is a clear central point of failure for Ethereum. A regulator that wanted to thwart the adoption of Ethereum can look to a clear choke point in Vitalik and the Ethereum Foundation. This would severely cripple the progress of the project, as a developer platform is as only as strong as the developers behind it.

The Upside

While there are a multitude of risks associated with Ethereum that could destroy the value of ETH, I do think ETH offers an asymmetric risk/reward opportunity. The upside is that Ethereum becomes the infrastructure on which decentralized applications are built and securities are issued. There is tremendous developer momentum in the Ethereum community to date, as evidenced by:

- Akasha (decentralized online community): We may see a number of decentralized online communities that aren’t controlled by anyone and have economic incentives baked in built on top of Ethereum

- Digix (gold-backed digital asset): Ethereum smart-contracts make it easy to issue any new type of token, and we could eventually see all currencies, commodities, and securities represented on top of Ethereum.

- Augur (decentralized prediction market): A prediction market is something we haven’t seen reach mass adoption in the centralized world primarily because of regulation, and a decentralized prediction market that can’t be stopped has promise.

- IDEX (decentralized exchange): A decentralized exchange that empowers people to exchange their own assets and not rely on any third parties has been a holy grail in the blockchain space, and we’re starting to see some projects emerge.

None of these are ready for mainstream adoption yet, but they demonstrate the developer momentum Ethereum is experiencing.

If Ethereum does not go to zero, I believe it will grow into one of two directions:

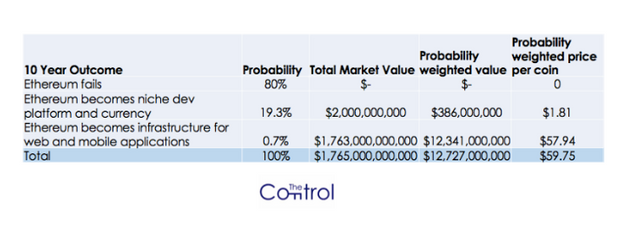

The modern infrastructure for web and mobile applications: There’s a growing group of decentralized applications that are emerging on Ethereum as described above. ETH is the token required to run all of these decentralized applications — you can think of ETH as the “crude oil” of the decentralized web movement. The market opportunity here is enormous — the total market value of the top 10 internet companies today is $1.763 trillion. Assuming just a 0.7% chance that Ethereum becomes the infrastructure of the Internet in 10 years and supplants the 10 current web leaders gives ETH a probability weighted total market value of $12.3B ($1.763T*.007) and a price per coin of $57.94 ($12.3B/212.3M) . ETH is trading at ~80% below that currently.

An experimental developer ecosystem and niche digital currency community: I believe there’s a 19.3% chance that Ethereum doesn’t die completely or grow into the infrastructure for the decentralized web, and instead becomes an experimental developer ecosystem and niche digital currency community. This would give ETH long-term a value of ~$2B, and a probability weighted market value of $386M ($2B*.193), or $1.81 per coin in 10 years.

The Probability-weighted Intrinsic Value of ETH

Given my assumptions about the long-term success of ETH, I believe that the intrinsic value of ETH currently is $12.727B ($12.341B+$386M). Factoring in 10 year inflation, I think the fair price per coin of ETH is $59.75, up 5X+ from it’s current price.

Any risk-seeking investor looking for asymmetric risk/reward opportunities may want to consider ETH to their portfolio.

NOTE: THIS POST WAS ORIGINALLY PUBLISHED ON MEDIUM

About me: I run The Control and am an investor at Runa Capital, an early stage venture fund. Previously, I worked on business development and marketing at Coinbase. Follow me on Twitter, signup for our newsletter, and support us by upvoting!