The Crypto Economics Series | Episode 1 - "Backing" Currencies and Fiat

"Fiat is a problem because it's not backed by anything!" - A concerned citizen. FALSE

Welcome to Episode 1 of the Crypto Economic Series

Economics is daunting, the capacity released with decentralized blockchains is near-infinite. Put them together and it's obvious why many people are left confused and unaware.

In this series we'll introduce and open up the discussion for several fundamental aspects of the paradigm evolving power of blockchains and crypto-currencies.

Fiat

We're evolving past the limitations of our current economic systems!

"While gold- or silver-backed representative money entails the legal requirement that the bank of issue redeem it in fixed weights of gold or silver, fiat money's value is unrelated to the value of any physical quantity. A coin is fiat currency to the extent that its face value, or value defined in law, is greater than its market value as metal." -Wikipedia

Many people believe that since fiat is no longer backed by gold that national currencies aren't backed by anything.

However, national currencies are backed. They are backed by debt, taxes and interest (i.e. the people who provide the taxes).

Fiat: Latin for, "let it be done."

Crypto-currencies are fiat. They are created out of nothing (at least nothing tangible). This is precisely what makes them so powerful! The main point of difference between them and national currencies is that they are decentralized. Value is derived from the market and not a centralized entity; and the people have the capacity to dictate policy, not a centralized bank.

Backing

Backing our mediums of exchange creates an abundance of the mechanism or item of backing. Up until now, this has only resulted in monumental waste and abuse.

This was true for gold-backed dollars, it is true for debt & taxes-backed national currencies and is true for the 'work'-backed Bitcoin.

Gold

Consider the absurdity as we destroy mountains, forests, and ecosystems in search for gold. So, we can waste countless hours of human productivity digging it up, shipping it around, and purifying it; just so we can lock it in expensive vaults right back under-ground and further waste human time guarding it. All of this, so humans could feel 'secure' knowing that their paper money was 'backed' by something.

National Currencies

Debt

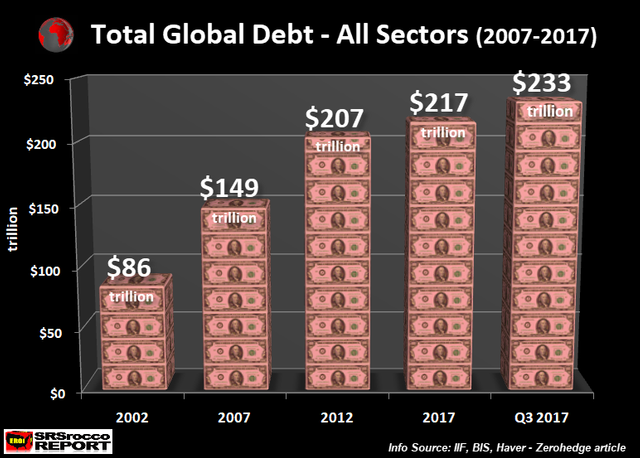

At present our national currencies are backed by debt, or the promise to pay it back. In short, this was a bankers solution to countries who might otherwise create too much money and cause hyper-inflation. So, now the world is 233 trillion dollars in debt!

Interest and Taxes

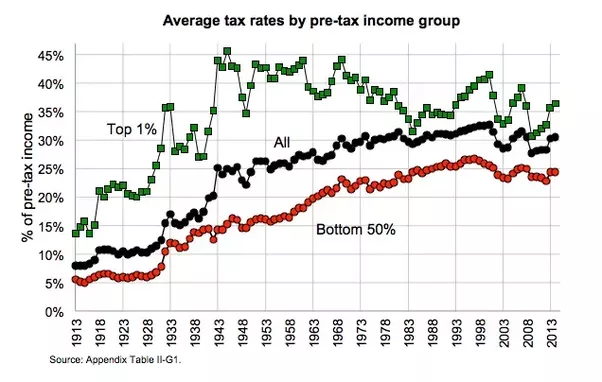

Increasing debt equates to increasing interest payments. This means that nations will need to tax their populations at an ever increasing rate to pay back the debt and interest created when making money. This has resulted in an abundance of taxes. We all love them!

Bitcoin (Proof Of Work)

I probably don't need to tell you this. But the electricity used to secure BTC is outrageous. Some estimates average that for a single BTC transaction it takes up about as much energy as a house would in a month.

This is because POW is 'backed' by processing power. Which creates an abundance of said processing. Which in the real world is an environmental catastrophe and monumental waste of energy, money and physical resources.

POS (Proof of Stake)

So, understanding the faults of POW we evolved to POS. Which is essentially(not factually) backing a currency by collective stake. Which means that POS is incentivizing and creating an abundance of 'stake'.

For a currency, this results in economic stagnation and a variety of other issues such as "whales", and the centralization of rewards and power simply to those who have a higher degree of stake. Which, when governance is tied to this stake, creates a form of plutocracy (government by the wealthy).

If we want a healthy cryptocurrency-economy we need to encourage using- and transacting with- our mediums of exchange, not hoarding them. Else, people will likely just hold crypto and exchange with national currencies.

Utility

Utility is another method to 'back' a currency. Or, to give users confidence that it will retain value and that others will accept it. Proper utility is mandatory for a cryptocurrency to succeed. This creates demand for the currency, otherwise there will be no demand to meet the supply.

Restricting access to platforms that provide a service to currency users is a simple way to create utility and demand for a currency. As long as people want and need what the platform offers there will be demand for the currency.

Now we know

Backing our mediums of exchange creates an abundance of said item for backing.

This is a powerful opportunity!

How can we hack this to create an abundance that will better serve humanity, our planet and our economy?

What is it we would like to see an abundance of?

What about healthier physical environments? (I think we can all agree that we wouldn't mind an abundance here.)

What about an abundance of local food and food sovereignty?

What about a economy that's designed to create an abundance of healthy food that could address our global hunger and health issues caused by our industrial food system?

Backed by Food

What if a currency provided access to platforms that enabled its users to purchase local food? Would you be willing to accept a currency if you knew you could exchange it for dinner?

What if this currency was used to finance local food systems? (More on this in later episodes).

Trust

Backing has served to provide the 'trust' a currency needs in order for people to accept it as payment. As we have seen with the blockchain renaissance, we're dismantling the old paradigms methods of generating trust.

We don't need to use archaic methods of creating trust anymore, and we are transcending the old paradigms of 'backing' our mediums of exchange with waste-generating assets.

Wealth Preservation

Backing has also provided an ability to preserve wealth. Since gold didn't erode or go bad, people preferred to store value here opposed to grain or other early forms of currency. We'll discuss this topic a bit more in a later episode and how we can transcend our old wealth preservation strategies.

Let's Discuss!

Agree? Disagree? What do you believe would be the best way to "back" a currency?

Let's collaborate and evolve our ideas.

Light

This is part one of a series discussing a variety of crypto-economic systems designs and how these are implemented into an ecosystem called Light (which will be built on/with the EOS.IO software).

Light has yet to be publicly announced. This is the first series mentioning this ecosystem. I am reaching out to the Steem and EOS communities for collaboration and co-creation.

Light's goal is to create an economy that can bring forth a healthier paradigm (for ourselves and our planet).

Follow Light Alchemists to be the first to see our official release.

The Next Episode

Inflation. Discussing the myth that crypto-currencies (not tokens or assets) have value because of their limited supply; how fixed or no inflation is a design flaw and suggestions to create favorable inflation.

You got a 2.36% upvote from @postpromoter courtesy of @rieki!

Want to promote your posts too? Check out the Steem Bot Tracker website for more info. If you would like to support the development of @postpromoter and the bot tracker please vote for @yabapmatt for witness!

To listen to the audio version of this article click on the play image.

Brought to you by @tts. If you find it useful please consider upvote this reply.