Crypto dip: Are you actually winning? + new portfolio tool (Cryptagon)

(Full disclosure - this is a little bit of a plug, but even if you don't use Cryptagon, this is a really important analysis to do.)

A friend likes to say the two hardest things in life are:

- Identifying bad decisions despite good outcomes

- Identifying good decisions despite bad outcomes

- Off-by-one bugs

With this latest prolonged dip in the overall cryptocurrency market, hodlers and swing-traders alike are re-examining their strategies, whether loading-up, scaling in or out of their overall positions, or diversifying into alts.

Among the myriad philosophies and approaches, there's a game-changing point of view that's been percolating through the trading community for a while:

The goal of trading alts is to get more BTC.

In other words, you should evaluate your altcoin portfolio relative to BTC, not fiat (USD, Euro, Won, etc.). If you can't beat BTC, you should probably just be hodling it.

An Illustrative Example

With $10,000 I buy 1 BTC. Then I use that to buy 10 ETH.

Let's say BTC shoots up to $20k. I could sell ETH to buy 0.5 BTC and on paper I'll still have $10,000 in portfolio value, but I'll have essentially lost 0.5 BTC. In the long-run, these kinds of trades add up to a losing strategy, relative to holding Bitcoin.

I won't go much more into the reasoning behind this approach, though I will recommend the in-depth treatment of this by Coinmastery.

How to see this in your portfolio

In a decade+ as a data scientist and product manager, and I know firsthand that the metrics we watch drive our behavior. This is why if you visit data-driven startups, you'll see dashboard with carefully-selected charts and metrics displayed for all to see.

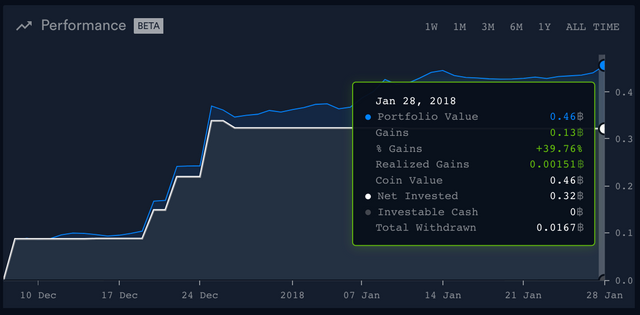

The quickest and easiest way to see this is with Cryptagon - the portfolio tool I built with two good friends and launched just a month ago. We've made it as easy as possible to connect (with secure read-only access) to your exchanges, so you're able to see key metrics like this in one place.

Here's an example of using the BTC toggle:

On a less rational and more emotional level, it's just nice to see a graph going up and the right :)

Whether you slog through a spreadsheet or sign up for Cryptagon, I'd encourage you to get this view of your portfolio. You never know - you might be actually winning during the dip, relative to Bitcoin.

(Please note that none of this constitutes investment advice.)

I was surprised as I network with others how few understand the concept that they need to trade against BTC not fiat. The only time the fiat price comes into play is when you want to buy fiat. People need to break out of the concept of stock market mentality in this market and learn its a game of money flows thru a network. On the other note, I will be checking out the shared software you are showing here. I've been looking for a new portfolio management tool.

Yes! You know what I'm talking about. Let me know what you think of the tool!

if you have control over greed you are a winner