$4bn Trade Volume 15 Days after Launch? China Cooking Up the Biggest Crypto Exchange Bubble or Disrupting Industry?

By Bianca Chen, Executive Producer of "Next: Blockchain" Docuseries

When I asked our production assistant "are you following FCoin," she gave me a perplexed look and replied, "what? Filecoin?" Apparently, FCoin was not on her radar. I don't fault her. Nowadays, with over hundreds of crypto exchanges around, an exchange that is barely a month old doesn't sound like something that warrants paying attention to. When I typed "FCoin" into the Google search bar, the search engine autocorrected to "pcoin." However, this exchange in its infancy has already become the focus of the Chinese crypto circle and is either writing its own legend or will eventually reveal itself as one of the biggest scams in crypto history.

I heard about FCoin for the first time on Jun 12th. Members of the Chinese crypto circle had started talking about this new entrant to the game. The new kid on the block was not only already billing itself as the biggest exchange by volume, having accumulated over 28 billion yuan within a 24 hour period on the 15th day after launch, but had even gone as far as to publicly announce that its trading volume surpassed the sum of the trading volumes of the second to the seventh biggest exchanges, including major players Binance and Huobi. The first reaction among the crypto crowd was to question the authenticity of their data. Even as I pen this article, their trading data can still not be found on popular crypto data sources such as coinmarketcap.com or Block Hero. Fake trades, that is, the trading of cryptocurrencies between two accounts owned by the same exchange, is an open secret across the exchange industry, especially in China. Everyone is doing it but no one owns up to it. Some industry insiders have told me that, in their opinion, at least 85% of the trading volume at the top exchanges is “fake,” a shocking number if there is any validity to the “allegation” in an industry that is trying to build a trustworthy reputation for itself. I was unable to find a way to independently verify the number, however when I asked Bobby Lee, the founder of BTC China, about FCoin’s trading volume, his first reaction was, "I wouldn't trust any volume numbers from cypto-exchanges.”

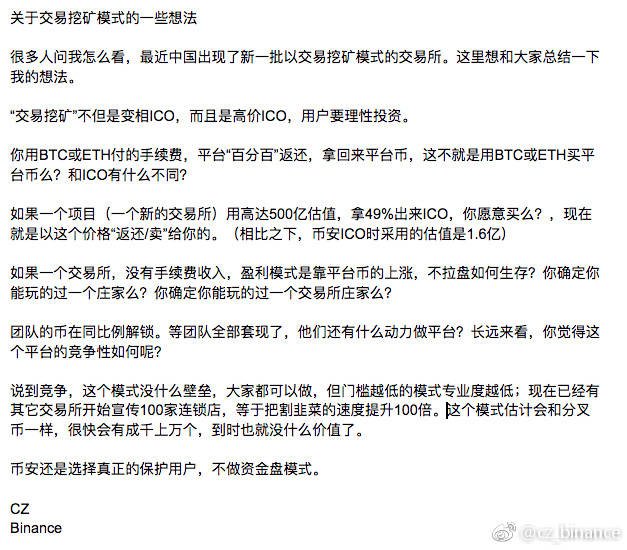

FCoin’s story has since evolved beyond the issue of trading volume manipulation. Soon afterwards, Huobi announced that they plan to ally with 100 exchanges and adopt the same model as FCoin. Then CZ from Binance (the world’s second largest crypto-exchange if FCoin’s numbers are to be believed) said sarcastically on Weibo, the closest thing in China to Twitter, that they are ready to work with even 1000 exchanges in order to emulate the model. Apparently, it isn’t just a story of someone cooking the trading number as the sector’s biggest players already found it a new threat.

.png)

The cryptocurrency exchange industry is evolving at a super-fast pace. Mt. Gox, remember them? They were the first-generation exchange and used to be the sole player dominating the bitcoin trading business. Their reign ended when their entire network sank after a major hack. In China, BTC China was the first to initiate the cryptocurrency exchange business, however, were surpassed by OKCoin and Huobi within a couple of years. Last year, Binance moved to the head of the class in months. On December 16, 2017, they sent out a tweet saying: “5 months to reach Number One in the WORLD.” Then Binance saw their 1st quarter earnings in 2018 surpass those of 148-year-old Deutsche Bank.

.jpeg)

However things have since been changing even faster, with the time between events, no longer counted in months but rather in days. It took FCoin roughly one tenth of the time that it took Binance to move into the number one position, assuming their data is correct. Zhang Jian, FCoin’s founder and former CTO of Huobi, said in a WeChat group that even members of their own team were surprised that things were happening that quickly. The team had to work day and night to constantly upgrade the system, as the trading volumes the system had to handle kept growing exponentially.

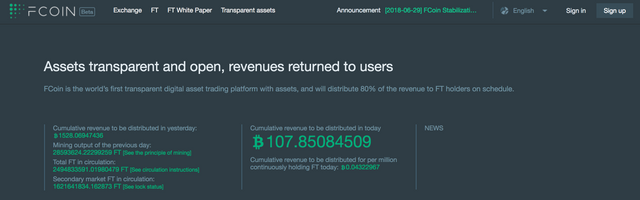

Now let’s talk about FCoin’s model. What kind of magic is attracting that volume of trades? FCoin’s model is called “trans-fee mining.” They didn’t really invent it. Besides FCoin, several other cryptocurrency exchanges had made their appearance around the same time trying out that model, for example Dragonex, yet the model deployed in each case varies in the details. In FCoin’s case, users can trade cryptocurrencies and facilitate the trades by paying transaction fee like any other exchanges. However the users will receive the full rebate of the transaction fee in the form of FT, FCoin’s token. Every day, FCoin will reward dividends to all the FT token holder. The dividend is based on the transaction fee income accumulated in the last 24 hours. At the beginning FCoin took 80% of all the transaction fees as dividends to the user. Now under certain condition, the entire 100% is returned to the user.

.png)

The user not only earns FT tokens, but also gains dividends simply by holding onto the FT without the heavy investment in machines and electricity that is needed to mine bitcoin. If FT’s price can be held at a certain level and the transaction fee revenue stream is stable, the user can make money if they hold onto their FT long enough. It sounds lucrative to many people. Users rushed in and kept on selling and buying, not for the purpose of changing positions, but purely to create the trade that allows them to receive or mine FT coins. Zhang said now their biggest challenge is to calculate all the dividends on a daily basis as it has now become so massive. According to their official website, about 170 BTC is distributed to users as a dividend today and the number was over 1500 BTC the day before. I guess the trading volume is pretty volatile.

During the interview with the press, Zhang Jian explained that his idea behind this new model follows Satoshi Nakanomo’s original design for bitcoin. He said his fundamental theory is to build a community to support the trading eco-system rather than simply seeking to maximize profits like other centralized exchanges. Besides receiving a dividend, the FT holder can also participate in the system’s management. Zhang gained a lot of support in the crypto circle especially from the people who made money on Fcoin. However, many questions remain.

Firstly, the question of the fake trades: Zhang Jian says that the FCoin system can prevent fake trades as they simply wouldn’t have the money to reward FT coin holders with the dividends. Although not everyone buys that answer, since some people think FCoin can still fiddle with the volume number by trading between its own accounts and give their own accounts FC coins, generating a lot of dividends, most of which is just returned to FCoin after the fact. Given that FT is not on blockchain now makes it hard to track how they are distributed. Zhang said FT will be put on the chain eventually. Still it is possible that FT is a “fake it until you make it” case. However, FCoin may not have a strong motivation to overstate the data for sustainability reasons, something which I will explain later.

Secondly, CZ from Binance said in a statement that he believes FCoin is simply another kind of ICO. The users pay FCoin the transaction fee using BTC or ETH and receive FT coins in return. At the end of the day, it is not really any different than using BTC or ETH to purchase FT. And, when I hear of valuations of FCoin at 50 billion dollar, it does seem off the wall, especially considering the firm’s short history. Upon hearing that Binance doubted the evaluation, Zhang laughed it off and retorted in return that Binance was an ICO project as well at an interview.

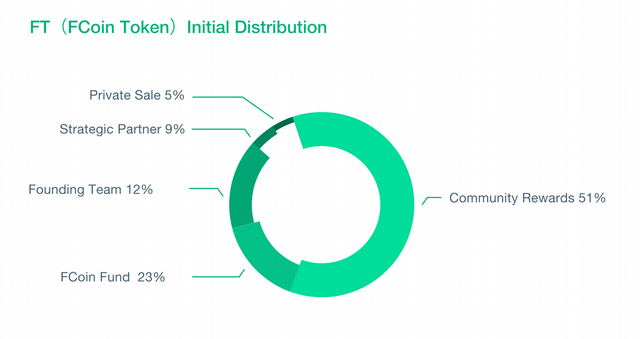

The third issue is sustainability. One has to question whether the transaction fee income is enough to support the run rate, and as to whether FCoin’s model, as it is currently structured, can support itself for much longer. There is a limited supply of FT coins, 10 billion in total. According to FCoin’s announcement, 51% of them will be rewarded to users through the “trans-fee mining.” At the time of this writing, FCoin’s official site indicated that more than 28 million FT had been mined the previous day. Let’s assume on average that 25 million FT are mined per day. That means, it will take only 204 days to mine all the FT needed to award users through the “trans-fee mining” program. What will happen after that? The FT holder can still receive the dividends but will no longer receive any FT coin for the transaction fee they paid. The return, in that case, will be significantly lower. This could become a cycle, with another exchange suddenly showing up with a more lucrative mining program, instigating a massive migration to the new player. And when that player runs out of tricks, the next one could come along.

That is already happening: on Jun 25th, Bit-z launched its platform token BZ and started a similar “trans-fee mining” program. They claimed that within the first 12 hours, the transaction volume had hit 27 billion yuan, if the data is to believed.

.

The article is also published on Medium and NEXT Blog. Want more exclusive interviews, latest international trends, crypto stories uncovered by large media outlets? Join our email list here!

Check out NEXT: Blockchain on Amazon Prime, the documentary with the biggest, most star-studded cast in crypto. Full series coming this fall.

Hello i gave you an upvote dont forget to follow me for future upvotes & i always follow back

fb/john.thephotoeditor.56

Thanks for the upvote!