Quoinex Exchange Review In Detail

Quoinex is very interesting for one reason: it is one of the first regulated exchanges in Japan (since Sept 2017). Quoinex is a fiat-to-crypto exchange, launched in 2014 by a strong team coming from the traditional banking world, most of its clients are in Asia. With this article, we hit two important targets: publish our very first "exchange review" and make a difference by publishing a review about an exchange that desperately lacks English speaking coverage.

Note that Quoinex is one of several projects ran by Quoine Pte Ltd, the others are: Qryptos (crypto-to-crypto exchange) and the Liquid Qash project (on which we just published a in-depth analysis).

This analysis is done following strict criteria and is the result of hours of research.

If you like this article, please: upvote, share or donate (details at the bottom of the article).

Follow us on Twitter @icoPntsAnalysis

In a nutshell

This “in a nutshell” section is opinionated. Please do make your own judgement by reading this article and doing your own research.

Pros & cons

Pros

- Strong fiat currencies listed: JPY, SGD, USD, EUR, AUD, HKD, IDR

- Strong crypto currencies listed: BTC, ETH, BCH, QTUM, QASH, DASH, NEO

- 10 trading pairs with decent volume (above 500’000 USD).

- Bringing trust: regulation from the Japanese government

- Bringing trust: very high security measures (cold storage, 2FA, confirmation emails at every level, etc)

- Bringing trust: old school “traditional investment world” team

- Bringing trust: Quoinex has been running successfully since 2014

- No fee on trading pairs including base currency

- Various trading types available

- Complex UI: highly modular, allows one to create and save custom trading dashboards that fit his/her tastes

- Decent support team

- Regulated exchange: probably used as a sort of storage by some traders

- You can use the same credentials to access Quoinex and Qryptos, that’s because they operate under the same company (Quoine Pte Ltd).

Cons

- Extremely slow crypto withdrawals (Quoine is working on it though): Quoinex processes crypto withdrawals 1 business day after the withdrawal request has been made. This is a huge turn off for most crypto traders as it means a crypto withdrawal can take up to 72h (i.e. if you initiate it Friday at 1am, it will get processed earliest on Monday at 9am). It goes completely against one of the main reasons why crypto is so successful/revolutionary (transaction speed).

- Low volumes on many trading pairs (below 500’000 USD): the first 10 trading pairs have a decent volume, but all the others don’t - one is often forced to transfer its fund to another exchange to trade.

- No “instant transfer” between Quoinex and Qryptos: this means that to transfer crypto between Quoinex and Qryptos - which are ran by the same company (Quoine) - one must wait 1 business day (c.f. the “slow crypto withdrawal” issue) and pay transaction fees.

- Not providing service to US citizen or US resident.

- Complex UI: extremely flexible but can be confusing (Quoine is working on it though) - a "basic" and "advanced" trading mode would be most welcome

- Confusing communication across channels: information about the project isn’t easy to find, it’s spread across different channels. A strong community channel that is indexed by search engine (versus a chat) would be much better. Additionally, a public trello board (or something similar) to inform on the past, present and future milestones would make it easier to follow the project's progress.

- Community management: Quoinex’s English community is very quiet, all the info one can find online is mostly communication from the company itself. Apart from the Telegram channel and the Quoinex Bitcointalk thread, there doesn’t seem to be much of an English speaking community out there. Quoine has a lot of space for improvement. The reason for this might be because Quoine’s team is mainly coming from the traditional banking world and doesn’t know how to handle this challenge.

- Regulated exchange: therefore it’s probably used as a sort of storage by some traders - but the extremely “slow withdrawal processing time” issue is almost totally removing this interesting “storage approach”.

- Decent support team: but not really visible from the outside - not enough testimonies.

Overall rating

- Note: Quoinex is not tradable (no token launch, no ICO). We added these ratings below simply to show how much we believe or not into this project's future.

- What investment rating do you give?

- 3.5/5 - Quoinex is quite unique, has a lot of strong points and could definitely become huge if addressing the main issues (see “cons” in the “pros and cons” section).

- What investment risk do you give?

- 4.5/5 - Quoinex is an established exchange since 2014 and has very strong points, so there is no reason for Quoinex’s market to decrease (rather the opposite since the total crypto market cap keeps going up).

- What’s your gut feeling about this project?

- If the Quoinex’s weaknesses are addressed, it could definitely reach the top 3 biggest fiat-to-crypto exchanges in the world (by volume). The western market is largely untouched so there is a huge opportunity.

The nitty gritty

In this section we dive deep in every aspect of the project, with a fact based approach (we try to NOT be opinionated).

Exchange Overview

- Is the exchange traded itself (did a token launch, i.e. an ICO)?

- No.

- What is the official website?

- What is the organisation behind the project?

- Quoine Pte Ltd

- https://Quoine.com

- In which country is this organisation based (country of jurisdiction)?

- Based in Japan - with offices in Singapore and Vietnam

- Is this exchange regulated?

- Yes. Quoinex is regulated. Other projects of Quoine do not fall under that regulation though.

- Quoinex is regulated by the Japanese FSA, one of the most strict financial service authorities in the world.

- “As of 29th September 2017, we are the first global cryptocurrency firm in the world to be officially licensed by the Japan Financial Services Agency (License 0002).”

- Read the official announcement on the Japanese' FSA website

- What is the goal of the project?

- The goal of Quoinex is to be the world’s most advanced and most popular cryptocurrency trading platform.

- Note that Quoinex only lists fiat-to-crypto trading pairs.

- However, Quoine also operates Qryptos: Qryptos only lists crypto-to-crypto trading pairs.

- What is the best way to describe the project?

- Quoinex is one of the largest regulated fiat-to-crypto exchanges in the world with over $12 billion annual transactions.

- However, we could not find data to compare the total volume per exchange in the last 6 months to verify the ranking of Quoinex vs other exchanges. And Quoinex falls very much behind for rankings on 24h volume.

- The mobile-ready platform prioritizes security (over speed?) - this is done via approving accounts (KYC/AML) and utilizing multi-sig, offline cold storage to ensure proper handling of all trades.

- Quoine, the parent company running Quoinex, stood out when getting the Japanese license.

Trading Summary

- Fiat supported

- JPY, SGD, USD, EUR, AUD, HKD, IDR, INR (INR just for withdrawals though)

- https://quoine.zendesk.com/hc/en-us/articles/115011122147-Supported-currencies-fiat-and-crypto-

- Crypto supported

- BTC, ETH, BCH, QTUM, QASH, DASH, NEO

- https://quoine.zendesk.com/hc/en-us/articles/115011122147-Supported-currencies-fiat-and-crypto- (however, as of writing, this article not up to date)

- Countries supported

- Quoinex is not licensed to provide service to United States citizens and United States residing customers.

- Quoinex does not provide service to residents of:

- Iran

- North Korea

- Myanmar

- https://quoine.zendesk.com/hc/en-us/articles/115011120147-Supported-countries

- Trading types

- Market orders

- Limit orders

- Stop orders

- Margin trades

- Quoinex offers 2x, 4x, 5x, 10x, and 25x rates.

- Derivatives (Future trading) - not sure

- This was announced but doesn’t seem available for now

- Futures trading is a result from partnering with BitMEX, with a separate fee structure (than other trading types) as well as terms and explanations for different products

- Trading fees

- Quoinex has a pretty standard fees policy. Except for when trading in a pair involving your base-currency: it has no fee!

- Note that you can change the base-currency to the currency of your choice (by contacting the support) if the currency of your country of residence is not available. For instance, if you reside in the UK, as the pound sterling is not listed on Quoinex you can contact the support to set-up your base currency.

- Fee Structure (for deposits, withdrawals, and trading)

- Note: we could not find the fee structure planned for the derivative tradings

- Quoinex has a pretty standard fees policy. Except for when trading in a pair involving your base-currency: it has no fee!

- Down time

- Planned maintenance

- Quoinex had/has planned maintenance every now and then, just like any other crypto platform.

- Unplanned maintenance

- Quoinex does not seem to have any bad history of unplanned maintenance.

- Planned maintenance

Trading tools

- Demo Mode

- Yes, Quoinex has a demo mode available

- Trading UI

- Quoinex’s trading UI is quite complex: highly modular, allows one to create and save custom trading dashboards that fit the user’s taste (move and edit panels).

- Quoinex’s trading UI can be confusing at first, even for traders with experience.

- This reddit thread shows how you can customize your Quoinex trading dashboard

- Trading reports

- Mobile apps

Fiat deposits and withdrawals

- Deposit via bank card

- You cannot deposit money into your Quoinex account via bank card.

- Fiat deposits: fees

- No fiat deposit fee charged. However, there can be a 3rd party fee from a Quoinex partner: for instance, a client got charged 2 euros 3rd party fees when sending from Europe.

- Fiat deposits: processing time

- Pretty standard fiat deposit processing time of 1-2 business days. However, Quoinex is located in Japan, so if you transfer money from a bank located in another continent, it might take additional time (add 1-2 business days)

- Fiat withdrawals: fees

- Fiat withdrawal fees have pretty standard pricing.

- Fiat withdrawals: processing time

- We do not know the “total processing time” (from the request to the moment when the money is visible on the given bank account) because we didn’t find any customer who actually tried withdrawing fiat via Quoinex.

- Fiat withdrawals processing time

info provided by Quoinex

Crypto deposits and withdrawals

- Crypto deposits: fees

- Standard: no fees for crypto deposit

- Crypto deposits: processing time

- Standard: a given number of confirmation according to the crypto being transferred.

- Crypto withdrawals: fees

- Pretty standard: the fee depends on the network fees for the given crypto

- Crypto withdrawals: processing time

- Quoinex only processes the crypto withdrawal 1 business day after the withdrawal request has been made. This is because Quoinex uses cold wallets (offline) to store the users’ digital assets.

- Quoinex’s crypto withdrawals slow processing time has been pointed by many customers as the platform’s biggest flaw

- However, Quoinex plans to implement a change allowing faster withdrawals up to a certain value per day.

Security

- 2FA

- But cannot be reset via the platform - one must do this via emailing the support (Quoinex plans to change this though)

- Email with link of confirmation when:

- logging in from unknown IP

- adding new crypto address to send crypto to

- doing all sorts of sensitive action. May be an overkill since it cannot be turned off for any action.

- Funds storage

- Cold wallet: funds are stored offline - hackers cannot attack your wallet to steal your funds

- KYC/AML check

- Passport

- Proof of address

- Proof of bank account

- Nice & easy process, all within the web app - responsive support team (answer in the next 24-48h) helps to speed up the process if needed

Other reviews

- Positive reviews:

- Forexbrokerz.com : Quoinex review - is it scam or safe?

- Rating 3.8/5

- Mentions the complains about slow withdrawal process and the B2C2 lawsuit

- However, gives a decent rating

- https://www.forexbrokerz.com/brokers/quoinex-review

- List Of All Current Exchanges: Review & Safety Ranking

- Quoinex is ranked in the first tier of the list, next to Coinbase, Bithumb, Binance and other famous exchanges.

- https://bitcointalk.org/index.php?topic=2609971.0

- Forexbrokerz.com : Quoinex review - is it scam or safe?

- Negative reviews:

- We could not find decent negative reviews about Quoinex

- The main complaints seem to always be about the withdrawal 1 business day delay, slow funding (i.e. when sending the money from other continent), or huge price changes because of illiquid trading pairs (due to low volumes).

Competitors

- GDAX comes to mind in the area of regulated exchanges

- Gdax is regulated and based in the state of New York - Quoinex is regulated and based in Japan

- Gdax lists 3 fiat currencies: USD, GBP, EUR - Quoinex lists 7 currencies: JPY, SGD, USD, EUR, AUD, HKD, IDR

- Gdax lists BTC, ETH, LTC, BCH - Quoinex lists 7 cryptos BTC, ETH, BCH, QTUM, QASH, DASH, NEO

- However, the volume is very low on most of the trading pairs that Quoinex lists. And Gdax has a total volume much bigger than Quoinex (4+ times bigger at the time of writing this).

- Gdax is based in the US so it has a lot of content in English (reviews, tutorials, forum threads, and so on). Whereas Quoinex is based in Japan and there is very little content to be found in English. Check out the volume of Quoinex’s trading pairs on coinmarketcap and you will quickly understand why there is so little content in English.

- Gdax has simpler UI than Quoinex. But Quoinex has a lot more features. Quoinex and Gdax probably could learn from each other, one for the simplicity and the other for the available features.

- Gdax has an “instant transfer feature” between Gdax and Coinbase (who run under the same company) - Quoinex and Qryptos do not have such feature, which seems rather silly since they run under the same company (Quoine).

- Binance come to mind n the area of big exchanges based in Asia trying to take over the world

- However, Binance is a crypto-to-crypto trading platform, whereas Quoinex is a fiat-to-crypto platform.

- Binance has significant volume (above 500’000 USD) on over 200 trading pairs - whereas there are only 10 trading pairs for Quoinex at the time of writing.

- Binance is established since less than a year and is the fastest rising exchange - whereas Quoinex is established since 2014 and is rising steadily towards user adoption.

- Binance’s team has a lot of experience in both the traditional banking world and the crypto space. Quoinex’s team mostly has experiences in the traditional banking world.

- Binance’s support has a very good reputation and provides support in various languages - whereas Quoinex’s support still has to make a name for itself out there.

- Binance’s community is huge, whether it’s the 80K followers on Twitter, the many popular threads on Reddit, the many reviews available in English (Steemit, Medium, Bitcointalk, and more) - in comparison, Quoinex’s community is almost nonexistent.

- Binance is traded on crypto exchanges (ticker: BCN) whereas Quoinex is part of Quoine Pte Ltd (a “traditional” Limited company).

- Binance’s interface has been praised by many - Traders tend to complain about Quoinex’s interface.

- Binance is not regulated (although trying to be regulated in Japan) - Quoinex is regulated in Japan

- Partnership: Quoine and Binance are having a partnership in the Liquid Qash project

Team experience

- How many people are in the team?

- Quoine has 90+ people on its team.

- And Quoine is hiring 30+ new team members

- Are the team member names and history known?

- Yes. All or most of the team members are visible on the website.

- What is the approximate proportion between tech people and business people?

- There seems to be an appropriate mix of tech and business people.

- Does the organization have a history of successful projects?

- Yes, Quoine has successfully launched two exchanges.

- Quoinex: launched in early 2014, a fully compliant digital asset exchange with over 12 billion USD in annual transactions.

- Qryptos: launched in 2017, a fully digital exchange exclusively for cryptocurrencies. The platform plans to offer token issued in an easy way to list and trade their own tokens.

- Quoinex is one of the first regulated exchanges in Japan, this adds to the maturity of the organization.

- Do the advisors have a history of successful projects?

- The advisors include current and former bank CEOs, consulting firm directors and a former vice president of Visa to name a few.

- Does the project have any partnership with other organisations?

- In addition, Quoine has partnerships with 15+ exchanges.

- What is the experience of the individual team members?

- Quoine has an incredibly talented team.

- The team brings pre Quoine-era experience from the traditional banking industry, in Forex, IT, Forex IT, Algos, equity trading systems, and FICC (Fixed Income, Currencies, and Commodities ) - all combined with expertise in Internet and mobile technology.

- The team brings Quoine-era experience in the crypto field from building Quoine and Quoinex crypto exchanges.

- Quoine’s management team mostly comes from the traditional banking world and has worked at the following companies: Goldman Sachs, Bank of America Merrill Lynch, Credit Suisse, Citigroup, Barclays, UBS, ANZ, Union Bank, Rabobank, Wells Fargo Bank, Bloomberg, Price Waterhouse Coopers, SoftBank Group Corp., SAMSUNG, SingTel, Mitsubishi Corporation, Anderson Consulting, and AirAsia.

- What is the reputation of the support team?

- There isn’t much information available online (reddit, medium, and other forums) about the support team.

- How good is the support if you actually ask a few users of the platform?

- Responsive support team and providing good information.

Project status

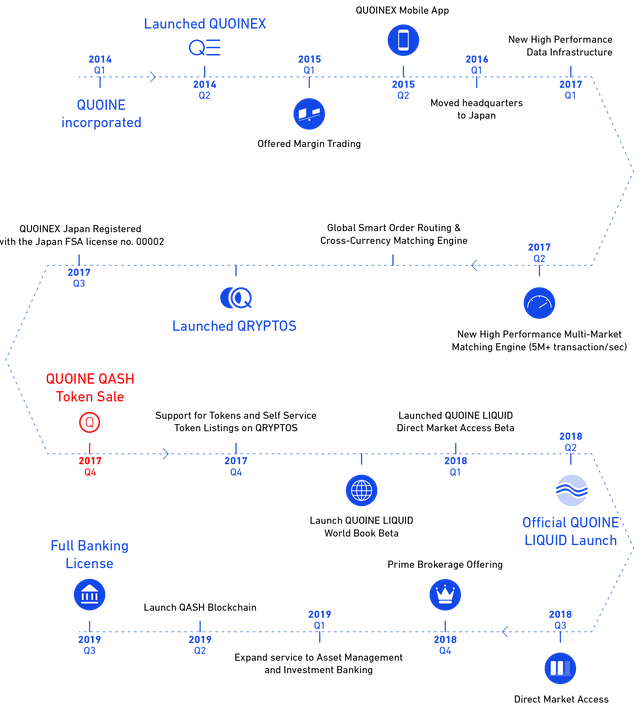

- When did this project start?

- Q1 2014 - Quoine Pte Ltd gets incorporated

- Q2 2014 - Quoinex launch

- Is the organization regularly reporting progress on the social media streams (facebook, Tweeter, Reddit, Medium, Telegram, Slack)?

- Yes, Quoine regularly uses social media and email marketing to notify its users of platform updates and to announce new coins added to its platforms for exchange.

- What were the achieved milestones?

- Q1 2014 - Quoine Pte Ltd gets incorporated

- Q2 2014 - Quoinex launch

- Q2 2015 - Quoinex mobile app

- Q1 2017 - New High Performance Data Infrastructure

- Q2 2017 - New High Performance Multi-Market Matching Engine (5M+ transaction/sec)

- Q2 2017 - Global Smart Order Routing & Cross-Currency Matching Engine

- Q3 2017 - Quoinex Japan Registered with the Japanese FSA license no. 00002

- What is the state of the project?

- The project is live.

- What is the roadmap for the future?

- Improve the UI

- Faster processing time for fiat deposits

- Faster processing time for crypto withdrawals

- 2FA reset without having to contact the support

- https://bitcointalk.org/index.php?topic=1098105.620

- Is the project on track or ahead of its roadmap?

- The project is on track

- Is there a public Trello board (or such) showing the progress?

- No, there does not appear to be a public board showing the progress.

- Is the project already profitable?

- Yes.

- Does the project already have clients?

- Yes, Quoine already has thousands of clients.

- See the roadmap below

Market size

- What is the size of the targeted market?

- Quoinex is targeting the whole fiat-to-crypto market.

- Billions of USD are exchanged every day between fiat and cryptos. As an idea, the last 24h total crypto volume is over 36 billion USD; the fiat-to-crypto volume is “only” a part of that, but still, it means hundreds of billion of USD per month.

- How does the project current market cap compare to some of its competitors?

- Gdax and Binance - the competitors mentioned previously - have a market cap over 1 billion USD.

- If Quoinex becomes big, that’s how the market capitalization it could reach; and the crypto market cap is only going up so it could go well above.

- How much demand is there for the project, short & long term?

- There is definitely space for another crypto-to-fiat exchange that people highly trust. The regulation from the Japanese government, the very high security measures (cold storage, 2FA at every level, etc) and the old school “traditional investment world” team definitely bring that trust feeling.

- Does/did the project get discussed in the relevant communities more than usual before launch?

- As mentioned previously, Quoinex’s community is very quiet, in the western world at least. Therefore, Quoinex’s launch barely got discussed in the English speaking communities.

Legal

- Did the organization behind the project ever get sued?

- Quoine was sued by electronic market maker B2C2 after a flash crash of its platform resulted in B2C2’s order not being picked up.

- Has there been appropriate consideration of legal matters?

- Quoinex exchange is legally compliant and regulated in Japan. Whereas Qryptos is not. There definitely is a strategy regarding the legal matters.

- It is the first exchange in the world to be fully regulated at a country-level -- bringing security, reliability, compliance, and governance to its products and services.

- Does the project have a identifiable legal representation?

- As mentioned above, Quoine employs a Chief Compliance Officer.

- Has the company provided an analysis of legal issues presented?

- Yes, they address the risks of money laundering and terrorism financing in their white paper and note the compliance and security measures they have taken to counteract those potential threats.

- Ken Mazzio is Quoine’s Chief Compliance Officer. Ken works with an independent internal auditor, as well as a Big 4 accounting firm as an external auditor.

- Quoine claims to have developed a “culture of compliance” indicating that they take legal and security matters seriously.

- Is there a significant legal risk to token holders or other actors?

- N/A. Quoinex didn’t do an ICO.

Online presence

- On which chat platform are the team members most active?

- Telegram

- How many people are on their Facebook group (in total, for the english speaking ones, there can be several groups)?

- There is no Facebook group.

- Quoine’s Facebook page has 7000+ likes and followers

- https://www.facebook.com/pg/QUOINE.SG/about/?ref=page_internal

- How many followers do they have on Twitter?

- https://twitter.com/quoine_SG

- 9K followers (Jan 2018)

- How many subscribers do they have on Reddit?

- https://www.reddit.com/r/quoine

- 38 readers - only!?

- https://www.reddit.com/r/LiquidQASH

- 2.3K readers - but that’s for another project of Quoine called “Liquid Qash”

- How many followers do they have on Medium/Steemit?

- https://medium.com/@QUOINE

- 210 followers (Jan 2018)

- https://steemit.com/@quoineliquid

- 140 followers (Jan 2018)

- How many people are on their Telegram group?

- https://t.me/QUOINE

- 9.5K members (Jan 2018)

- How many people are on their Slack channel?

- Slack channel is no longer active

- Is there much Youtube videos covering the project?

- Quoine YouTube channel: 900+ subscribers

- https://www.youtube.com/channel/UCOR2GJnFoOgTazC5v6mBTSA

- What is the average number of views these youtube videos get (roughly)?

- Searching for “Quoinex” in Youtube brings relevant videos with a few hundreds views each at most.

- Is there much attention on the bitcointalk page?

- Quoine created this thread to announce updates to the platform, respond to queries and for forum users to voice any issues encountered

- There are about 32 pages on this bitcointalk thread, which is not much considering it's been the thread was created in 2015.

- Overall, is there a strong and well maintained social media presence?

- Yes and no.

- Overall, Quoine's social media presence is quite strong: the Quoine team produces content on a regular basis and the bounties created during the Liquid Qash ICO (another Quoine project) created quite a lot of content. However, there seem to be a lack of objective content - content that is NOT created by Quoine team - and it doesn’t look like Quoine is trying to change this.

- There is a lot of confusion between the 3 projects that Quoine is running (Quoinex, Qryptos and Liquid Qash). It is very chaotic, one thread is called Qash but sometimes talks about Quoinex. Another is called Quoine and talks mostly about Quoinex. The community will struggle to grow if topics are not set clearly. Each project of Quoine is significant and deserves its own community space.

- The Telegram channel is quite active. However, one often gets its queries ignored: maybe simply because there are too many people on the channel or who knows why.

- Another issue is that since the most active “community channel” is Telegram, its content is not available on the internet (there is no web page with the content of the discussion held on the Telegram channel). It creates 2 issues:

- Hard to find info & little accountability, something said on Telegram has little value since referring to a Telegram conversation is very difficult (unless you took a screenshot).

- The Telegram conversation aren’t indexed by any search engine. Not every (potential) Quoinex customer has the time to go through hundreds of hours of Telegram chats or ask every single question she/he has to the Telegram chat.

- A very active “indexed” community channel is much needed, the bitcointalk thread is a start but it is too little for now. The best solution is probably Reddit.

Noise

- Much mainstream media coverage?

- Quoinex -- not much English speaking media coverage yet

- Much niche media coverage?

- If any, then it is not in English.

- Much buzz on social medias?

- No

- TBC: The Liquid Qash project might have a lot more buzz in the Asian region (Japan especially)

- Any recognisable partners such as governments, companies, institutions or influencers?

- Quoine is the only exchange to be approved by the Japan Financial Services Agency.

- Quoine has partnered with 15+ exchanges.

- Any recognisable backers/investors such as governments, companies, institutions or influencers?

- Quoine’s investors are very successful Japanese businessmen that have relevant experience in worldwide banking, payments, forex, etc.

- Investors include billionaire Taizo Son, chairman of GungHo and brother of Masayoshi Son, Japan's richest man.

- Any recognisable advisors?

- Yes, Quoine has a number of high-level advisors.

- Masaaki Tanaka -- former board of director at Morgan Stanley and advisor to Japan Financial Services Agency

- Atsushi Taira -- former SVP at SoftBank Group Corp. and former CMO of Yahoo! Japan

- Shozo Isaka -- Investment Group Leader at JAFCO Co., Ltd.

- Yes, Quoine has a number of high-level advisors.

Overall marketing

- Is branding taken seriously?

- Yes.

- Is this project more marketed than usual (given the type of project, market cap & what competitors are doing)?

- The ratio marketing vs community noise is definitely far too unbalanced.

- Is there a clear and well defined marketing plan?

- This is expected - considering the organisation behind the project - although not communicated since a "proprietary style" ran project.

- Is the project lead regularly active on social media, publishing articles, being interviewed (videos & podcasts) & giving talks?

- Overall, the leads of the project are very active: getting interviewed, attending conferences, attending AMAs on reddit, participating in the Telegram chat group and so on.

- Is the team mostly communicating about business (partnerships, exchanges...) or technical topics?

- Both topics.

- Is there much help available to get new users up to speed (wiki, articles, youtube...)?

- There isn’t much 3rd party coverage in English regarding how to use Qryptos or Quoinex, the two existing products of Quoine. So we can expect the same for Liquid Qash.

- However, the Quoine team does publish a lot of help for their projects (FAQ, tutorials, articles…) and provide good support (email, Telegram…) so it does compensate.

- Have marketing bounties been established to incentivise the advertising of the project?

- Unknown for Quoinex. However, there are bounties for other projects ran by Quoine.

Code quality & transparency

- Is the code publicly available (i.e. on github)?

- No.

- Was the code audited by 3rd party companies/organisations? if yes, was the audit published publicly?

- One of the Big 4 firms is auditing the code (c.f. section “6.5 Compliance and Security” of the white paper)

- TBC: But there is not any public publication of the audit available

- “Since the amended Payment Services Act came into effect on April 1st 2017 in Japan, QUOINE has worked closely with the Big Four audit and accounting companies, developing comprehensive AML countermeasures, internal audit, management systems, as well as communicating with the JFSA and Kanto Financial Bureau. In addition, QUOINE has also received a comprehensive review from one of the Big Four companies as part of the licensing process.”

- Is there any history of hacking?

- No.

- Is there any history of big bugs?

- No.

- Is there any strategy in place to avoid hacks or similar issues?

- Quoine maintains all trading wallets off-line on cold storage at all times. This effectively eliminates any possibility of bitcoin being stolen by hackers at any given point in time. Even if a hacker does manage to get through the security firewalls, all bitcoin funds are 100% safe.

- Has a bug bounty been established to incentivise the discovery of exploits and bugs?

- Not as far as we could find.

Technology

- Is there a live network/project?

- Yes, the project is live since 2014.

- What programming language is it written into?

- N/A

- What license is the code written under?

- Proprietary license.

- Is there any history of long lasting down time?

- No.

- How many orders per sec can it process, in theory?

- “Quoinex’s matching engine is capable of processing close to one million transactions per second”

- How is the transaction fee calculated?

- See “Trading Summary’s fee section”

- Can the project easily scale to millions of users?

- Yes, in theory.

- Is there any history of long lasting down time?

- No

- Does the exchange have any unique feature?

- Quoine claims extremely high attention to security

Sources

- https://www.forexbrokerz.com/qryptos-vs-bitmex-forex-broker-comparison

- https://www.prnewswire.com/news-releases/quoine-is-the-first-global-cryptocurrency-fintech-company-to-receive-license-from-japan-financial-services-agency-300528136.html

- https://bit.do/qashbountyprogram

- https://www.facebook.com/groups/1871020506452050

- https://www.reddit.com/r/ethereumnoobies/comments/7h6upn/thoughts_on_quoinex/

- https://www.ft.com/content/f102c906-3a23-11e7-821a-6027b8a20f23

- Futures trading thanks to partnering with BitMEX - https://www.bitmex.com/app/tradingOverview

- User complaints about poor trade reporting tool https://bitcointalk.org/index.php?topic=1098105.600

- Quoinex's official bitcointalk thread - https://bitcointalk.org/index.php?topic=1098105.0

- Customer complaints about the extremely slow withdrawal processing times - https://bitcointalk.org/index.php?topic=1098105.msg25871553#msg25871553

- Quoine announcing planned improvements on withdrawal processing times - https://bitcointalk.org/index.php?topic=1098105.620

- Quoinex review - https://www.forexbrokerz.com/brokers/quoinex-review

- Another Quoinex review - https://bitcointalk.org/index.php?topic=2609971.0

- Quoine announces hiring 30+ new employees - https://twitter.com/QUOINE_SG/status/953205165661683712

- B2C2 suing Quoine - https://www.forexbrokerz.com/brokers/quoinex-review

Closing

Authors and contributors

- Follow us on Twitter @icoPntsAnalysis

- Written by

- Adrien Berthou - founder of ICO Points Analysis | Crypto Content Writer

- Konstantin Michael Batanin - Web Architect | Crypto Content Writer

If you liked this article, please:

- Share this post

- Vote up

- Comment if there is anything incorrect or missing to the article

- Donate

- BTC: you're funny

- IOTA: ZPIXGFSROQRVZXHMQOSTCBRJODELQEUKMIYVARCABAQLFXTUMHBXESWIAWQRJO9RXTWPPADSQCTWMFQJYFNNBJJYKX

- ETH: 0x5C3c3C12ba509Bb277D0997A91AdCF9EFf7b439E

- ERC20 tokens: 0x5C3c3C12ba509Bb277D0997A91AdCF9EFf7b439E

- PIVX: DEyCTTsK89LSDVxHGzi8iHdWs4EBiZVAuZ

- NEO: AaFdvPJ6zACF7eiFHfbUAXqn7wbkipdwnd

- BCH: 357p1BEgz3p67VhXz3HtSF4iMp7nxAVN71

- DASH: XjxB8CaEBQizhpjQgHRfSxvtsjjXivb7Sw

- LTC: LRKEHbMUmtyAeumKcQR7bJn9ndjuphVXAY

- QTUM: 0xc6cc90e81c6e431675fc9655d7035da08d23d24e

- STORJ: 0x7cb93df618c196c892fc646159549ebd281c800f

- XLM: +RgwjTD4RuaSUYXOXANTyQ==

Congratulations @ipa-news! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPExcellent article, you've explained several things I found a bit puzzling.

I see Quoinex and Cryptos now have a new basic trading dashboard!