Goldman Sachs On The Cryptocurrency Market

For those of you that do not know, Goldman Sachs is one of the world’s leading financial institutions. Goldman Sachs provides a wide range of financial services, such as investment banking and asset management; the group reported a net revenue of $30.61 billion in 2016. In short, Goldman Sachs is a very influential player amongst financial institutions, and this is what the group had to say about the cryptocurrency market.

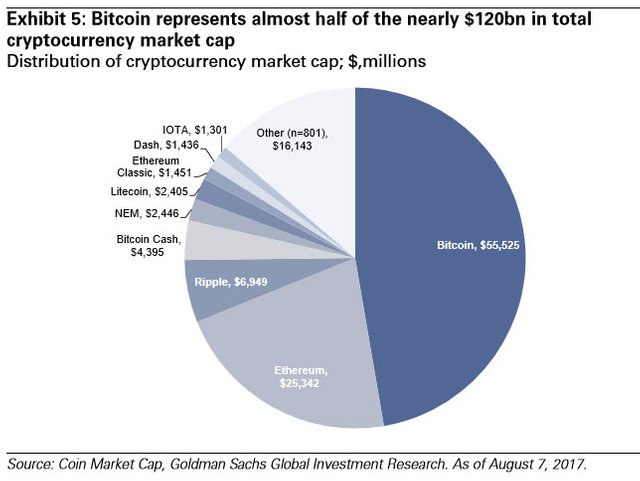

In a note circulated by Robert D. Boroujerdi, an analyst at Goldman Sachs, he indicated that: 'with the total value of cryptocurrencies nearing $120 billion, it was becoming harder for institutional investors to ignore the market'. Considering that the value of the cryptocurrency market was $40 billion at the start of the year, there are significant growth opportunities that financial institutions could potentially capitalise on. Should Goldman Sachs whole-heartedly embrace the cryptocurrency market, this may signal to other financial institutions to do same. As of now, many financial institutions have predominantly held back from fully committing to the crypto-space. A big reason for this, is the risk of uncertainty in the market with regard to how it will be regulated. For example, The Securities and Exchange Commission (SEC) recently ruled that initial coin offerings (ICOs) can be regarded as securities, and as a result, they should be subject to securities regulation. Thus, it is entirely possible that, as a clearer picture is formed with regard to how the crypto-space is regulated, the more capital that financial institutions may commit to cryptocurrencies, in hopes to capture the growth that the space has experienced so far.

Goldman Sachs On Initial Coin Offerings

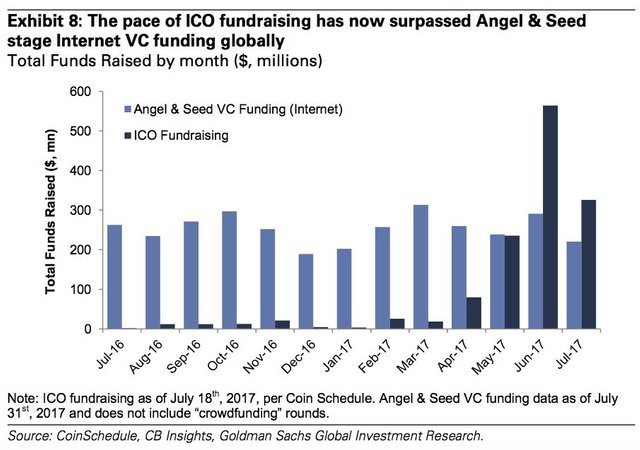

In a Goldman Sachs FAQ, held for institutional investors, the group highlighted the increasing popoularity of ICOs in the market. Over $1 billion has been raised so far this year through ICOs. ICOs, as a method of raising capital, has proved far more popular amongst start-ups than Angel & Seed VC funding.

Similarly to the manner in which financial institutions profit from a company’s Initial Public Offering (IPO), there may be an opportunity for financial institutions such as Goldman Sachs, to position themselves in such a way that allows them to benefit monetarily from ICOs. Given the substantial amount of money that ICOs normally raise, ICOs could be a very lucrative source of revenue for financial institutions in the future.

Long Tail In The Crypto-Market

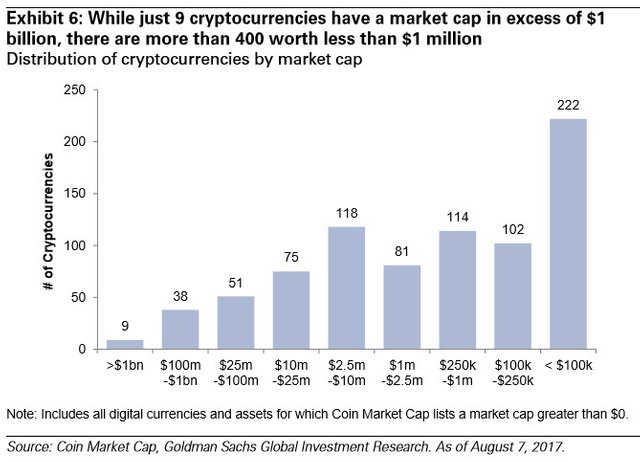

Goldman Sachs also highlighted the long tail in the cryptocurrency market, alluding to the disproportionate market capitalisation across digital coins. As Goldman Sachs noted in the FAQ: ‘There are currently over 800 cryptocurrencies out there, though just 9 have a market capitalisation in excess of $1 billion'.

The obvious implications of having such a concentration of capital in a handful of cryptocurrencies is that the cryptocurrency market is really only being driven by the performance of a few coins. This is especially true for Bitcoin, where crypto-market movements are heavily linked to Bitcoin’s performance. However, this is to be expected when Bitcoin, in terms of market capitalisation, represents nearly half of all cryptocurrency market capitalisation. It is important to note that tailwinds do also provide investment opportunities, as one is likely to find undervalued coins that have significant room to grow and realise potential.

Conclusion

Goldman Sachs’s recognition of the potential of cryptocurrencies is an important one. It will serve as a signal to other financial institutions to also conduct some research into the space. After regulatory issues are resolved, I expect to see a significant increase in capital and involvement by financial institutions in the cryptocurrency market. Acceptance of cryptocurrencies by the financial sector would bring validation to the market, which may serve as a signal for its adoption by the wider populous.

What do you think? Make sure to let me know in the comments below.

Personally I believe that the end of this year and the beginning of the next year will be the time big institutions from all segments of the business sphere and the governments will start buying cryptocurrencies in huge chunks. Until about 5 months ago the cryptocurrencies were not taken seriously by the vast majority but that is changing at this point after the huge rise we have seen recently. We are shifting from crypto enthusiasts and firm believers to wealthy individual investing into space which will be continued by the institutional investors and governments. We are still very early in the game with approximately 0,3 percent of the world population being aware of the cryptocurrencies. Neverthelles, things will pick up pretty fast and the rise in the 6 months will continue even faster. The train is leaving the station and those that are not onboard will miss out. Cryptos will be worth trillions of dollars in the next 2 to 3 years. Those are very exciting times to be in. Oh well, just my thoughts. Have a great night everyone.

I agree as well. Hoping my few hundred dollars will turn out huge for me in the future as that is all I can invest with at this time.Im hoping it will make me enough that I can one day open my own business that accepts crypto. Crypto only has one way to go in my eyes and that is up. All good newsthat comes out for crypto just makes people more and more optimistic.

basically this.. i think everyone else feels that there has been a huge turning point in 2017 where the tide is now in our favor. we've grown from a small piddling market cap to something that actually has meat to its bones, and this beast known as bitcoin/cryptocurrencies/assets feeds more and more every single day. the revolution will be televised!

I hope so!

That is exactly the problem though isn't it? that we think of holding crypto for profit, means we are thinking about it in terms of stock.

For adoptions and price stability to happen and be used as an actual currency, we need more people using it to buy/sell good/services.

From what I see, most people hold crypto, a small percentage of the trade back and forth on exchanges, and small percent use it as it was intended.

The bubble many talk about is the fact many hold it. Should many decide not to hold any more(for whatever reason) the price can go down just as fast as it went up. The Fear Of Missing Out on buying and hold crypto right now is fever pitch and at an all time high.

Never put all of your eggs in one basket!

Agreed. GS interest in DA can be a game changer.

Get with it or get left behind !

@adsactly I think that the validation will also be in the adoption of the services built around the blockchain. Once they are trusted, all of the people calling "the moon" on each and every coin may not be too far off.

Many banks are developing their own blockchain technology for their purposes. I personally think their stupid because people more and more are turning towards existing blockchains like Bitcoin/Altcoin.

Goldman Sachs is silently saying: "If you can't beat em, join them"! But their saying it with the silent footnote that investing always carrys a risk with it so it's better to drop your money at their bank which still uses the oldfashioned technology.

Good point, the trouble is that their business model is based on hot air, fractional reserve banking means you can lend out money you don't actually have. So they'll always have the benefit because your government is backing their ass.

When you know most governments are just corporations pretending to be above you the whole game changes. Therefore also the SEC is just a corporation pretending to be a goverment body.

The future is ownerless blockchains and what have you. We should never let government interfere with our business because it is none of their business!

@baus85

Excatly

Change is the only constant thing in life and adapting to things we can't change is human. My only fear is how this guys will regulate the crypto market and not end up aborting the purpose of cryptocurrency and blockchain. I know they will surely play a long but i pray they don't do that harshly

very true. I think the banks are stupid for creating their own crypto, because why would it really have any value(the value of crypto is that it isn't centrally controlled/owned).

All major banks are already involved in crypto experiments fot many years since they see the potential or threat coming. In the near future I do not think banks will use it at a large scale, but only for niche productas as long as the scale problems exist.

There will be more financial institutions and research companies looking into blockchain tech and we are lucky to be at the forefront of all these developments.

Ignore crypto at your peril!

Goldman Sucks I don't like them to be part of the crypto world they never have good things in there mind!

Goldman Sach's doesn't realize it but their brand is very tarnished in the U.S. along with the rest of the "bailed out" money center banks.

Like they care if they're tarnished! Their existence despite all their fraud is proof that fraud still wins in America.