keyTango- The easiest way to get started with DeFi.

#defi #keyTango $defi #deepdefi

keyTango- The easiest way to get started with DeFi

keyTango is a Web3 application made for those who are struggling with complex UI/UX that looks straight out of the Bloomberg terminal, which acts as a frictionless gateway to popular DeFi products and services ready to be unraveled within a couple of clicks. Unlike YFI which takes some familiarity with deep DeFi as granted, we offer easy to grasp and navigate UI/UX, that empowers you with tailored content and suggestions based on your level of experience and your blockchain history.

In today’s series, we’ll be taking a closer look at some of the key concepts in Market Making. You may be familiar with the term when it comes to the traditional financial world, but you’ll definitely need a speed boost to grasp the term’s position in the DeFi domain.

Introducing keyTango, deep DeFi for retail investors

keyTango’s team is comprised of MIT, Ycombinator and Enigma MPC alumni. The team is backed by Outlier Ventures. keyTango takes a 3 step approach to enhance retail adoption:

1) Identifying trending products:

using network analysis, financial know-how and our network of investors, we are monitoring the Deep Defi ecosystem to identify the most attractive DeFi opportunities in real time and give guidance on how to optimise returns

2) Smart contract execution:

we execute these strategies through smart contracts optimising for security, risk-adjusted return on capital (RAROC) and gas fees.

3) Simple & relevant UX:

we offer these strategies to retail investors through a simple UX/UI. The strategies are picked by our relevancy engine, tailored to the particular investor knowledge and risk appetite in a fashion that enables efficient discovery process and informed investment decision making.

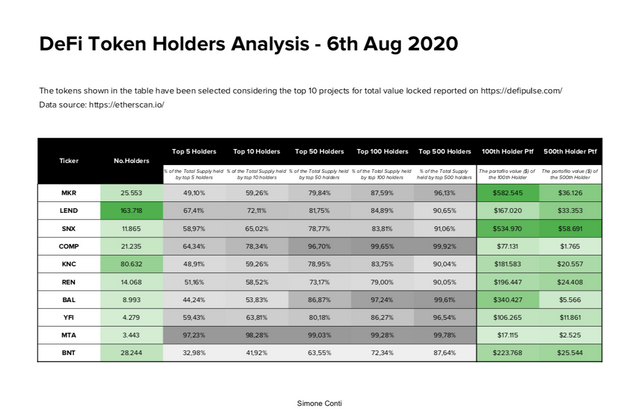

The exclusivity of DeFi

DeFi is supposed to be inclusive but beyond basic products with fiat-like returns (APR < 10%), discovery and usability are too complex for retail investors. A recent study by Simone Conti (Head of CryptoLab’s Digital Assets Investments), suggests that as few as 500 wallets hold 90% of all DeFi tokens. In order to make DeFi truly inclusive, there needs to be a better way for retail investors to discover and use DeFi products with attractive returns (APR>10%).

Complexity hinders retail adoption

In order to make “crypto kind of returns” (APR > x100%) DeFi investors use sophisticated products and strategies such as flash loans that interact with multiple underlying protocols. In contrast, for retail investors DeFi protocols are often overwhelming even as stand-alone products; the added complexity in using different combinations of protocols is simply prohibiting.

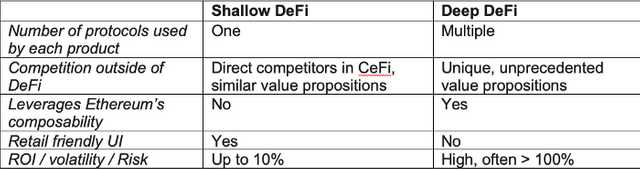

“Retail DeFi” vs. “Attractive DeFi” or in other words “Shallow” vs. “Deep”

We at keyTango believe that there are currently 2 distinct DeFi eco-systems:

- Shallow DeFi (used by retail)

- Deep DeFi (used by insiders/ professionals)

Shallow DeFi products are used by retail investors to generate up to 10% ROI while Deep products used by professionals, often exceed x100% ROI.

What distinguishes Shallow from Deep is that the former contains products that use only one underlying protocol. Conversely, Deep DeFi contains products that use multiple underlying protocols. An example of shallow DeFi is when an Argent client makes an ETH deposit on Compound Finance. An example of Deep DeFi is yield farming, a strategy often used by DeFi traders, moving assets between different protocols to maximise profits from both interest and token rewards.

Every “Shallow” product has a direct competitor in the CeFi (centralised finance) space.

For example, the value proposition to the retail investor of the CeFi products offered by Nexo, BlockFi and Celsius directly competes with DeFi’s Compound Finance and MakerDao. In contrast, Deep products are unique to DeFi. These are inherently unique and powerful because they leverage Ethereum’s composability trait, that has no preceding in FIAT or CeFi. As described by Linda Xie (managing director at Scalar Capital) “within Ethereum, protocols and applications can easily plug into each other and be combined together to create something entirely new… this is sometimes referred to within the community as “lego pieces.”

The two distinct worlds of DeFi and how retail investors are losing out

The two distinct worlds of DeFi and how retail investors are losing out

TL;DR

- DeFi is supposed to be inclusive but beyond basic products with fiat-like returns (APR < 10%), discovery and usability are too complex for retail investors. This is the leading reason that (1) 95% of all crypto assets still generate no interest and (2) 90% of all DeFi tokens are held by less than 500 wallets.

- “Deep” DeFi products can generate mind-blowing returns (APR > 100%) from crypto and hold game-changing potential if opened up to retail investors. But these products use multiple underlying protocols and are therefore inherently complex.

- keyTango provides an accessible and accommodating platform for retail investors to make sense of deep DeFi products, with tailored discovery, education and investment processes that are personalised for retail investors based on their goals, risk appetite and knowledge of DeFi products.

Market Making (MM)

In essence, Market Makers define liquidity and depth indicators in financial markets. They monitor the price of assets they are making in real time and they seize the opposite to the market trend which is often found in an advantageous position. Simply put, when most traders on the market try to sell an asset, market makers would buy it, and when most traders on the market try to buy an asset, market makers would sell it.By doing so, market makers play a regulatory role in asset price while preventing unpredictable spikes in price due to poor liquidity.

Players in the market

- Uniswap

Uniswap was the first true decentralized AMM to enter the market in November 2019. Uniswap allows for anyone to deploy a liquidity pool on the network, and enables any other trader in the ecosystem to contribute liquidity.

- Balancer

Balancer is considered to be the pioneer of AMMs recently released onto the market. Balancer functions similarly to Uniswap but also offers industry-first, dynamic features that enable the protocol in having a broader arsenal of AMM use-cases.

- Curve

Another yet fresh AMM protocol to enter the DeFi ecosystem in early 2020 was Curve Finance. Curve has admin-only generated liquidity pools where everyone can contribute to these pools, but they have one big distinction; Curve’s liquidity pools only support stablecoins.

Liquidity Pools

Liquidity pools are pools of tokens that provides liquidity to DEXs. Investors (AKA LP's) act as market makers, using AMM (automated market making) mechanisms on these exchanges. In its most basic form, liquidity pools keeps a 50:50 value ratio between ETH and a second token.

Want to learn more about DeFi with keyTango? Sign up for our beta at keytango.io, and stay up-to-date with our latest developments, and get whitelisted for our upcoming token sale. Have friends that don’t like to read? You can find the relevant video explainer at the official keyTango youtube channel.

If you want to learn more and/or sign up for our limited beta, please reach out to [email protected] or our website at https://www.keytango.io/

[1]Analysis: Most DeFi Tokens Are Concentrated In Hands of Top 500 Holders

[2] https://lindajxie.com/2019/09/25/interoperability-and-composability-within-ethereum/

[3] https://www.coindesk.com/defi-flippening-uniswap-topples-coinbase-trading-volume

For more infor visite us on:

- https://www.keytango.io/

- https://twitter.com/tangokey

- https://t.me/keyTango

- https://medium.com/keytango

AUTHOR

Bitcointalk Username: Dewi08

Telegram Username: @ dhewio8

Bitcointalk url: https://bitcointalk.org/index.php?action=profile;u=894088

Wallet address (eth): 0x53D1Ea8619E638e286f914987D107d570fDD686B