Short to Mid-Term Bitcoin Price Analysis

Been an exciting year for bitcoin gaining over 1347% from the low of $760 from this time last year to an impressive $11,622 at the time of writing.

But its not stopping yet, with segwitx2 canceled market faith has never been higher with record volumes nearly three times the average seen earlier in the year going from $2 bill > $6 Bill traded daily!

Support for bitcoin is currently at a level so high that does who so profusely denounced it as a scam are rushing to learn as fast as they can to develop and get involved in the space.

Recent announcements from two of the largest options exchange's in the world CBOE/CME that trading of Bitcoin futures would begin in December with the Nasdaq following shortly behind early next year which will be another driving factor adding billions in much needed liquidity.

Anyways, let me go into detail of the reasons why growth will continue showing stats graphs Technical Analysis and details on announcements.

Technical Analysis

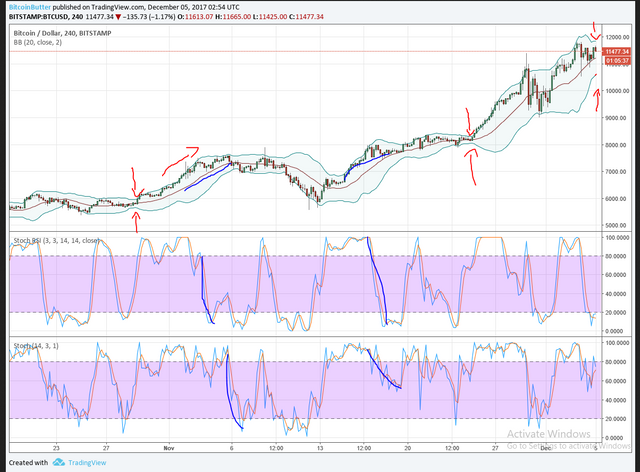

Chart showing 4 hour interval candles Stoch RSI'S and Bollinger Bands from 19th October to the 5th of December.

tradingview.com

Indicators

Stoch RSI and RSI shown on the bottom are types of a Relative Strength Index usally showing volume averages to price with fluctuations down and up starting soon before a change in direction.

As you can see marked with blue lines have changed significantly with little effect on price this shows volume has steadily increased and has had little effect on price with a small decline.

The two lines following price widening and narrowing are called Bollinger Bands these measure volatility widening with an increase and narrowing with a decrease.

Periods where bands tighten greatly as marked with red arrows show what is known as Bollinger Band Squeeze

According to John Bollinger, periods of low volatility are often followed by periods of high volatility

Which you can see has held true for the chart above and looks to be forming once again i think leading to a small correction before the next movement upwards.

Network Difficulty

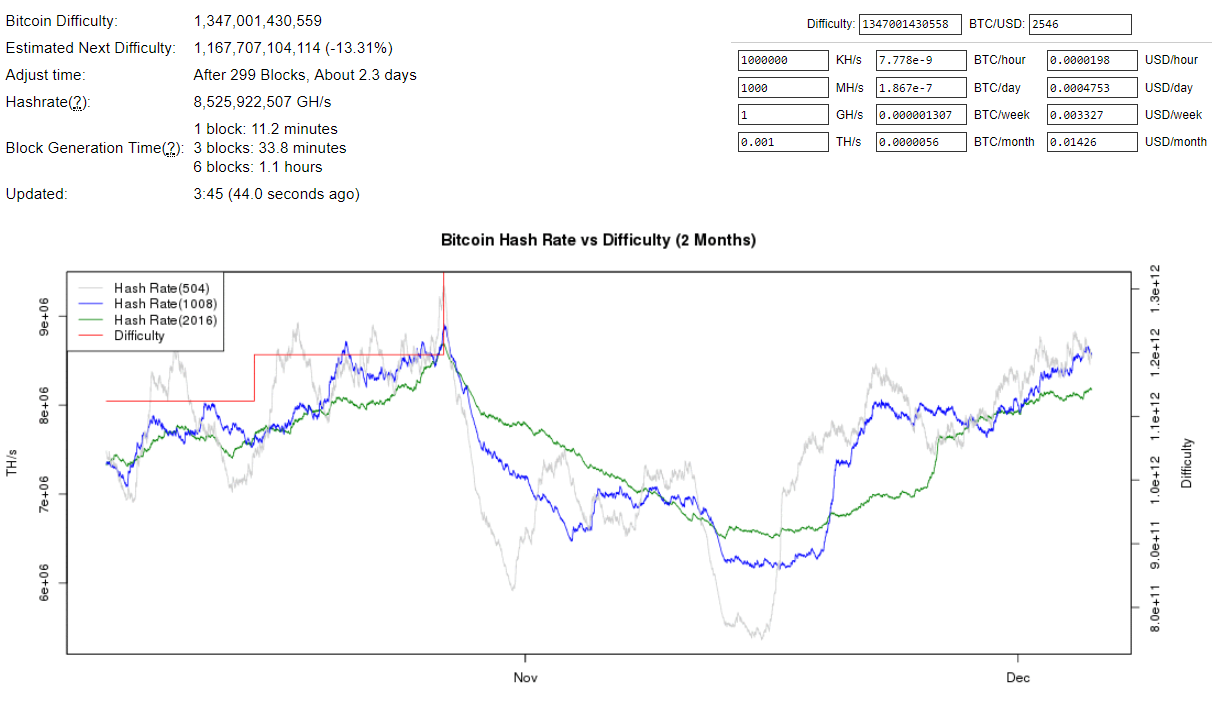

bitcoinwisdom.com

Bitcoin will see its regular difficulty change in 2.3 days which should see gains in hashing power in the network and more stability to transactions which could further add to price

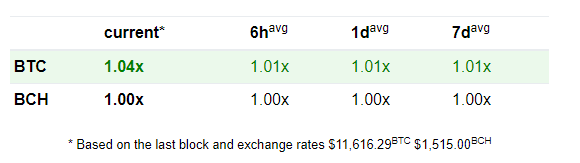

Already Bitcoin is more profitable to mine vs Bitcoin Cash and with a projected difficulty decrease of about 13% will increase mining profitability and could see movement from Bitcoin Cash adding more support to already positive outlook in around 2 days.

Bitcoin Futures

The addition to futures trading in traditional markets is a giant leap for Bitcoin and will give access to billions of funds from people who had little knowledge of crypto exchanges or weren't as tried and tested as mainstream markets

This will all change come 6 P.M EST Sunday 10th December options will begin trading on CBOE the largest options market in the world having more than $60 Bil traded daily on their stock market and seeing $6 trillion worth of interest rates being bought and sold each day.

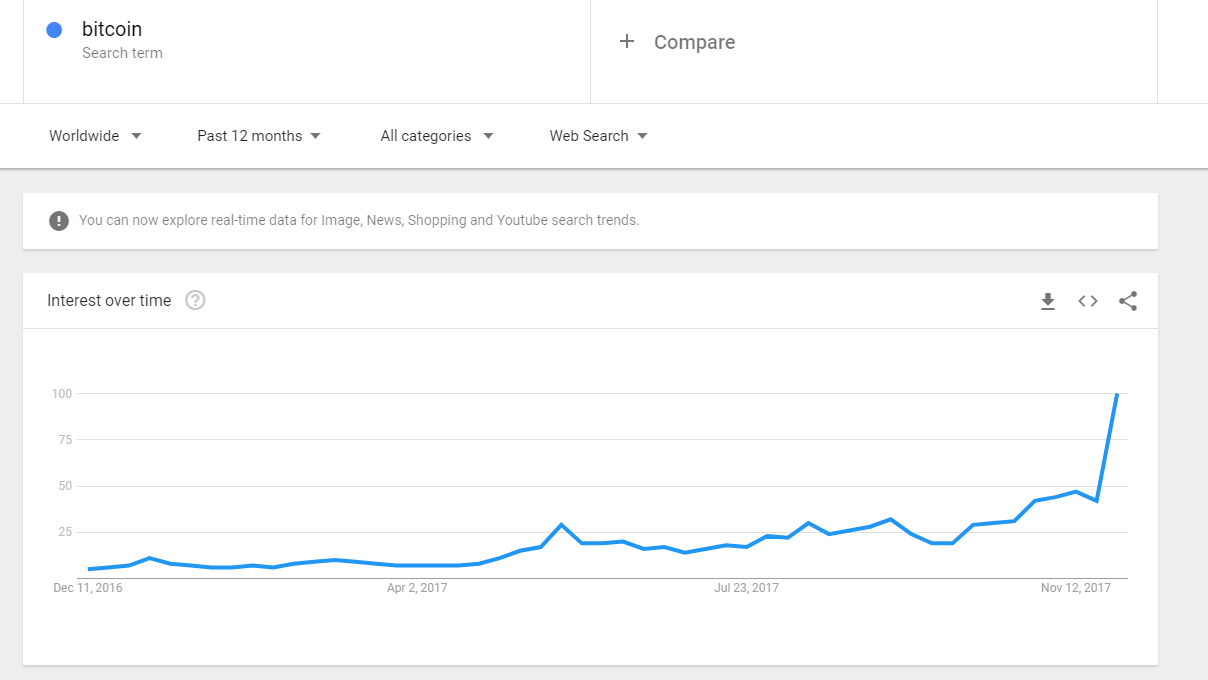

How much of this will move into bitcoin trading is hard to say but one thing is for sure is interest is never higher with search interest through google nearly doubling in November alone which i think indicates given the option many will get involved maybe not for the principles of but for purely speculative reasons

Conclusion

Based on these factors i think bitcoin will first correct slightly then start upward mobility again after difficulty change in 2 days and will make the bold prediction of at least $18k before the year is out.

If you have any questions feel free to ask and ill do my best to answer them all.

This shouldn't be taken by itself as trading advice always do your own reaserch to the fullest extent and seek expert advice if possible

meaningful post @isacoin

This post has received a 2.49 % upvote from @drotto thanks to: @isacoin.

You got a 5.13% upvote from @sneaky-ninja courtesy of @bittrex!