AssetLink - A New Cross-Chain Interoperability Solution from HPB Labs and MyTrade Coming soon to High Performance Blockchain (HPB)!

Introduction

Hi everybody, I am back with another exciting article regarding High Performance Blockchain (HPB). As you all know, I am hooked on HPB! I have been blown away by the sheer amount of information I have come across regarding this project and I feel the need to share my knowledge on it. I am trying to write about other projects but I keep coming back! The more I learn the more I want to share. Just so you are aware I am going all-in on HPB as my low cap gem of choice in 2021. Why is this project so cheap still!

Before I start, I need to convey my thanks to the huge amount of content creators I reference throughout my articles, without the hard work by others I cannot do my work. I have a huge problem with plagiarism, we all must give credit where it is due!

For ease of reference, in this new article I’ll walk you through:

- Cross-Chain Interoperability

- Current Workarounds in the Space

- The Blockchain Silo Effect

- The Need for Trust

- AssetLink Solution

- AssetLink Advantages

This article is going to cover Cross-Chain Interoperability. I am going to teach you why this is a huge problem in the blockchain sphere today, showcasing some of the current workarounds and showcase the “AssetLink” co-developed by HPB Labs & MyTrade.

I also inserted a link to an Assetlink AMA with Kris from MyTrade in the further reading section at the end of this article, this took place in the HPB TG channel on the 29th April 2021. Please check it out after reading this article to learn more about Assetlink.

What is Interoperability and why is it important in the blockchain sphere?

Interoperability is a huge talking point in the crypto sphere today, as the real-world requirements for it intensify, let us first examine Interoperability.

The Oxford Dictionary defines interoperability as the ability of computer systems or software to exchange and make use of information across different systems (Mei, 2020). Boudjemaa, (2020) adds it requires the cross-communication of two or more completely different systems speaking to one another easily. Let us look at the payment for a coffee as an example:

- With fiat currency, you can use your debit/credit card to pay, regardless of what country you are in and what the local currency is. This is “Interoperability” in the traditional financial world.

- With cryptocurrency, if the coffee chain happened to only accept Bitcoin as payment for your coffee but you only have ETH in your mobile wallet, you currently have no easy option to instantly convert this.

This is a simplified version of how the cryptocurrency sphere is not Interoperable, it’s a key pain point in the industry. The traditional world in comparison is fully interoperable, for example:

- You can pay for goods/services instantly in any currency, as indicated in the above example.

- The internet gives us any roadway imaginable from a single gateway (our computers).

- Apps on your phone interact with features of your phone such as WhatsApp to your camera, or Amazon to your stored credit card details.

- Electrical grids, railroad lines, and interstate systems all built by competing entities are all now internationally connected.

The blockchain sphere lacks this level of interoperability. Boudjemaa, (2020) describes blockchain as the “currency revolution” and DeFi as the “financial system revolution”. It is this DeFi sector that demands Interoperability, hence the focus on Cross-Chain solutions.

The Blockchain Interoperability Problem and Current Workarounds

Blockchain lacks Interoperability today and it is probably considered the largest pain point when it comes to global adoption. Seba, (2020) states blockchains today look like a thousand island archipelago with each island representing a separate blockchain project. Boudjemaa, (2020) adds that Interoperability in blockchains means 2 or more blockchains systems speaking to one another and exchanging value between them. In the coffee shop example above, I would have been able to use ETH for my coffee as the transaction would have converted my ETH to BTC instantaneously.

Blockchain Interoperability is still undergoing a development cycle today to solve this issue. It is important to note that most solutions today only offer a workaround to the problem rather than solving it. Interoperability is an intense subject in the space, multiple in-depth journal articles are exploring it in detail, see my references if you wish to really dig in! I will do my best to summarise them below. Qin and Gervais, (2021) sort existing primary Interoperability solutions into 3 main areas:

Notary Schemes

This involves a 3rd party intermediary who allows you to convert Crypto A to Crypto B for a fee. You need to use their custodial wallet to do the swap (Boudjemaa, 2020). These are cross-authentication models and the simplest form of cross-chain. This relies on Centralisation and this is not what crypto is about so I will not discuss this further.

Hash-Locking (HTLC)

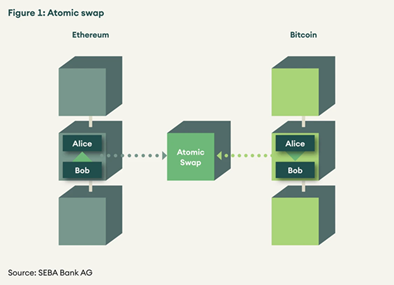

The most well-known of these types are Atomic Swaps. Hashed Time Lock Contracts or HTLCs in short are when two parties in a peer-to-peer transaction enter an HTCL on their respective chains and a swap is conducted, there is actually no cross-chain communication. Partial execution cannot occur, protecting each party. These are limited as opposing blockchains largely do not share the same hashing algorithms or fully support HTCL’s.

Relays and Sidechains

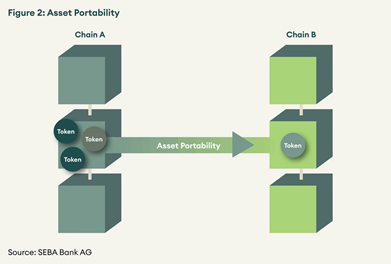

These are workaround solutions that peg subordinate chains to parent chains. The portability comes as you lock assets on the parent chain then create them on a new subordinate chain and assign a deterministic exchange rate. To unlock the assets on the parent chain you need to destroy them on the sidechain. This is a two-way peg scheme locking and unlocking assets across different chains. (Qin and Gervais, 2021).

Wrapped Bitcoin is the perfect example of this. The smart contract issues a “WBTC ERC-20 token” pegged 1-1 with bitcoin. This provides the “Cross-Chain Interoperability”. A 3rd party custodian, mostly exchanges are involved here, holding your BTC locked while they issue you WBTC, and to get your BTC back you must burn your WBTC in the WBTC factory. There are multiple types of wrapped assets on offer today, all very much similar in design. Considering you need to use Centralised Exchanges (CEXs) mostly here, where is the decentralisation?

The Blockchain Silo Effect

Although the above workarounds offer good solutions, they do not solve the key problem and sacrifice many of the benefits of blockchain, mainly decentralisation. In my opinion, Blockchains today exist in their own “Silo Ecosystems” with little knowledge of one another or the real world surrounding them. To achieve global adoption of blockchains true Interoperability is the one last obstacle. Seba, (2020) adds that true Interoperability solutions have the potential to break the silos and create a network of blockchains. It is a catalyst for the broader adoption of blockchains and cryptocurrencies.

Blockchain projects that get Cross-Chain correct in the most decentralised way will Excel. The HPB & MyTrade Cross-Chain solution “Assetlink” certainly seems to tick the box in this department.

The requirement for a trusted Protocol to achieve Interoperability

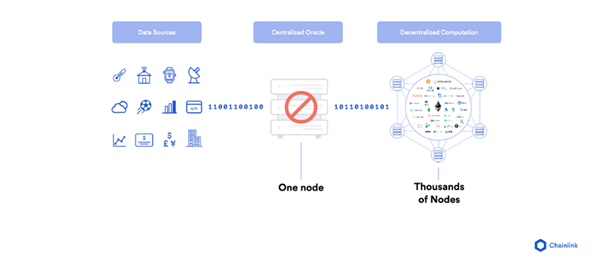

HPB, (2021) states that their AssetLink Protocol is the first Cross-Chain solution for decentralised assets based on an Oracle. They are using Chainlink for the Oracle service, as it is seen as a market leader in the DeFi space. This is a game-changer, Chainlink is by the far the best-known Oracle service out there. It is important to know why an Oracle is required.

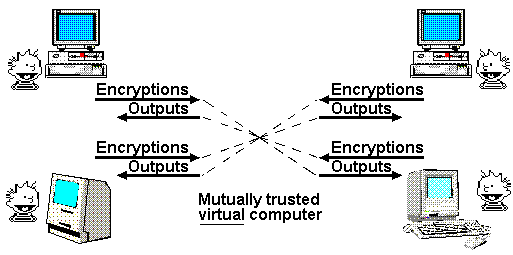

Smart Content, (2021) put forward an excellent article explaining Oracles. Oracles represent a “Deity” or “God” who are the most trustworthy intermediaries possible, that possess absolutely no bias, who can compute all the relevant input data and output the correct outcome, whilst protecting the identities of each party from one another. In other words, full trust.

Further research suggests Nick Szabo, (1997), a well-known computer scientist came up with the idea of “God Protocols”. They arbitrate and facilitate processes between 2 parties exchanging some form of value with no bias whatsoever, working to mutually agreed rules, which are fully transparent to all. In short removing human intermediaries to remove human bias, thus ensuring fair transactions. This is what an Oracle is.

Smart Content, (2021) outlines the 3 core technological pillars of Blockchain technology to achieve true Cross-Chain Interoperability:

- Blockchains: These are the physical entities (Nodes) providing decentralised computing to do the work, removing the central authority. In this example, HPB blockchain with its Node Network working off a PoP consensus to validate transactions and record on its ledger for transparency. This essentially exists within the “Silo Ecosystem” explained above. HPB Network gives our “God protocol” its “trustworthiness and unbiased nature”.

- Smart Contracts: Developers using HPB can write smart contracts similar to ETH because HPB is EVM compatible. These provide the “Brains” to allow dApps to work on HPB, in essence, programming in multiple coding languages to provide computing logic. HPB creates fully Turing Complete smart contracts so any dApps are possible, similar to ETH. Smart contracts also allow fairer governance on blockchains (see my HPB Governance Article). We now have “Brains “but there is still one thing missing, the Blockchain/dApps are still not connected to the outside world due to the “Silo” effect!

- Oracles: As explained above these represent a true intermediary to the outside world from the “Silo” allowing HPB and its smart contract dApps to become aware of events outside and interact with them. Think of Oracles as gathering up real-world data outside the HPB blockchain and doing something with it. This off-chain data is infinite, such as IoT info, financial market data, sports stats, etc…Oracles act on behalf of smart contracts as an external entity to perform the tasks the blockchain/smart contracts cannot do from within its “Silo”.

Smart Content, (2021) states that the above 3 combined provide this “God like protocol” which is far superior to current 3rd party solutions relied on today (as listed above in the article).

The weak point of Interoperability is the bridge or gap to the outside world. HPB & MyTrade are tackling this head-on, they will not utilise the workaround solutions mentioned above in this article which fail at this point to deliver security, speed, and decentralisation. The AssetLink Protocol will use a Chainlink Oracle to act as the intermediary at this point, thus keeping with the HPB vision of being a truly decentralised blockchain.

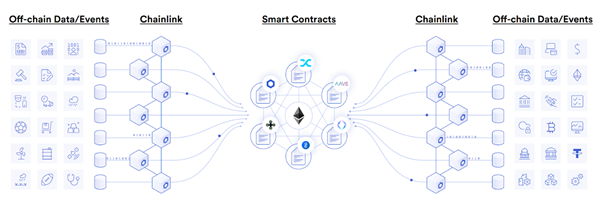

Chainlink Oracle on AssetLink

The HPB & MyTrade Cross-Chain solution “Assetlink” utilises a Chainlink Oracle to create their “God-like protocol”. I believe they have gone the smart route in their development of this solution.

“Given the wide adoption of the Chainlink decentralized oracle network, the God Protocols are closer than ever to reaching a more complete form, revolutionizing how society forms agreements and exchanges value” (Smart Content, 2021)

I will not go into too much detail on Chainlink here, as I am merely explaining why it is the ideal solution for Assetlink. Think of Chainlink as a network of heterogeneous frameworks where a huge amount of independent oracle networks operate (networks within networks), these operate like Nodes on a blockchain. The Chainlink network of nodes is fully decentralised, trustless, scalable, and fully secure. This removes the point of failure at the oracle level I explained above, in essence, providing the “god-like protocol”. This is how Assetlink will interact with off-chain data on behalf of HPB smart contracts. In tech terms it allows for aggregation of data and keeper functions, making smart contracts more cost-effective (Smart Content, 2021).

Chainlink Oracles are used by many blockchains and it is the most popular oracle project out there, furthermore its multi-billion market cap and widespread adoption brings huge value benefits to blockchains who utilise it!

MyTrade, the exchange co-developing AssetLink with HPB Labs, will see huge benefits from this on their Decentralized Exchange (DEX) on the HPB network (See my MyTrade article for details on this great DEX). In the exchange and trading sector where MyTrade operates, the Chainlink oracle will provide:

“feeds to settle trades, allow the determination of values for liquidity mining collateral, sets market-making strategies and can secure the value of collateralized off-chain computation” (Smart Content, 2021).

Furthermore, in the NFTs space, the Chainlink Oracle combined with HPB can provide a fair course of on-chain randomness to generate NFT traits.

Assetlink Protocol

Now that I have shown you the importance of Interoperability and the essential requirement for the use of an Oracle, I can present to you the Assetlink protocol.

HPB, (2021) state that they plan to bring Cross-Chain interoperability to HPB. Assetlink Protocol V.1 as described above will utilise a Chainlink oracle to connect blockchains that support the Ethereum Virtual Machine (EVM) at first, so in essence facilitating transfers of ERC-20 assets between Ethereum and High Performance Blockchain at first, then from HPB to all other EVM chains further down the line.

HPB modelled their smart contract systems on this EVM standard, creating an easy bridge to other EVM compatible chains. EVM compatible means they share a lot of similarities to ETH smart contracts and wallets share the common 0x wallet addresses and private key system. This means cross-chain transactions can be recorded on-chain with account addresses, token type, and value amounts. As explained above, the token bridge itself is provided by the Chainlink oracle within the Assetlink protocol, which removes the need for extra cross-chain architecture. HPB & MyTrade have not tried to reinvent the wheel here as the Chainlink oracle provides this bridge. This is how Assetlink will be able to utilise cross-chain transactions from the outset. Hollander, (2019), states that this EVM compatibility creates a level of abstraction between the executing code and the executing machine, enabling easier portability of software whilst also ensuring applications are separated from each other and their host. This is key for decentralisation.

On Ethereum coders write their smart contracts in a programming language called Solidity, HPB offers more choices of coding languages. However, according to Hollander, (2019) smart contract languages like solidity cannot be executed by the EVM directly, so they are compiled to low-level machine instructions called opcodes. These are basically a set of instructions under the hood of the EVM that execute specific tasks, allowing EVM to be “Turing-Complete” (aka able to compute anything). Read BTC, (2018) argues that EVM is more of a “quasi-Turing Complete machine”-Turing complete means programmes can be written that will find any answer, the Quasi part means Gas is required on EVM to carry out computations. He adds that blockchains utilising EVM have a provable smart contract system that is proven to:

- Prevent denial of service attacks

- Prevent disturbance as programmes have no access to each other

- Be fully secure

Assetlink combines the benefits of the EVM machine and Chainlink Oracle to allow transfers between HPB and Ethereum (at first), allowing not only assets to be exchanged on MyTrade but also Cross-Chain Interoperability supporting a diverse ecosystem of HPB DApps (HPB, 2021). This is a huge milestone for HPB. HPB, (2021) claims their Assetlink Protocol, by utilising a Chainlink Oracle provides the first use case of Cross-Chain asset transfers, opening a huge use case for Oracles application in the wider world.

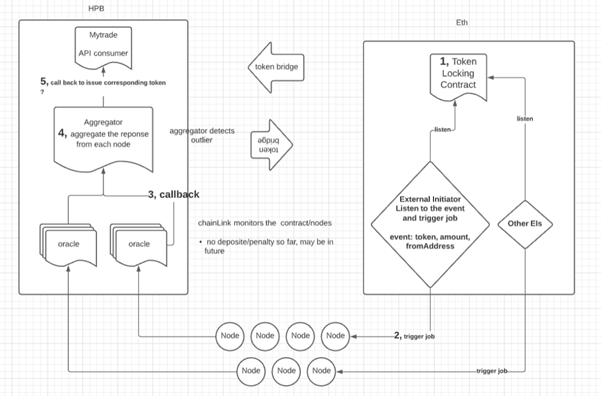

The above showcases the Assetlink Protocol process between HPB and ETH on the MyTrade DEX. HPB, (2021) state that the steps will be as follows on the Chainlink Oracle:

- Users lock their tokens on ETH.

- An ETH smart contract then publishes the lock-up log.

- Chainlink notices this and broadcasts this to the smart contract onto the HPB blockchain which in turn mints the corresponding token to the user.

As per the AMA with Kris from MyTrade (Linked below), AssetLink provides 2 smart contracts on separate EVM chains (As depicted above), each with matching accounts and the trusted oracle providing the bridge between them. So, in short, during the asset transfer, the oracle will send a message to the matching account on the destination chain smart contract telling it it’s ok to mint new tokens there and vice versa.

The most interesting thing is that the above was not developed just for HPB-ETH transfers. MyTrade and HPB are thinking bigger with this Assetlink protocol. They see this as the true solution for full Interoperability between all EVM compatible blockchains, HPB and ETH are the mere starting point. They envisage a world where any developer can build their own Cross-Chain contracts and the Oracle can be expanded. HPB, (2021) state that they will develop compatibility with all EVM compatible blockchains (ETH, HECO, BSC, NEAR, HPB, etc…)

HPB Competitive Advantage with Assetlink

From reading about Assetlink it is clear to me that this is how they will compete with the likes of BSC (which is also EVM compatible). As we all know BSC is stealing dApps from ETH due to their lower gas transaction fees than ETH, so why not move to HPB with even lower fees and faster speeds? Are you beginning to see this new competitive advantage yet?

HPB has a clear advantage over other EVM-compatible blockchains. Their Assetlink Protocol is an entire EVM solution, it will fan out to Cross-Chain functionality on all EVM blockchains. HPB has a first-mover advantage here as they will be the first use case. MyTrade will also benefit hugely as these Cross-Chain transactions will take place on their DEX. HPB-ETH will be the first trading pair and this will fan out equalling more liquidity on their exchange.

HPB, (2021) state that Assetlink will:

- Not require staking to ensure asset security thus allowing for “cold starts” making it easier to expand.

- Offer lower construction costs for Cross-Chain networks than its competitors due to its lower Oracle costs.

- Offer faster speeds compared to its Cross-Chain competitors like Fusion, Polkadot, and Cosmos who utilise side-chain workarounds, and other Cross-Chain solutions like Near Protocol.

- Offer true decentralisation, Assetlink requires no registration, KYC, or AML to list Cross-Chain assets making it fully permissionless.

Assetlink will be more scalable, offer better security, will have a much lower cost, and will offer a more user-friendly solution than its competitors. Assetlink offers a fully decentralised solution thanks to the use of a Chainlink oracle closing the pain point at the bridge point, as explained in my article. This is the Interoperability we are seeking in the blockchain space.

Likewise, the launch of Assetlink is a huge milestone for HPB as it showcases its huge advantage in the space! This will be the start of a huge amount of dApps launching on HPB in my opinion.

Limitations

My only concern is that Assetlink is restricted to EVM-compatible blockchains. The “God Protocol” I discussed above may not be fully achieved just yet! HPB, (2021) does however convince me of their commitment to achieving this in full through further development. It is a far superior solution thanks to the use of a Chainlink oracle.

Conclusion

In my humble opinion, HPB & MyTrade offer a near to as possible “God Protocol” thanks to Assetlink, connecting HPB to real-world data, whilst ensuring true decentralisation is maintained. Assetlink solves the pain point which exists in the blockchain sphere today.

Assetlink will crack open the HPB blockchain Silo and connect it to the world. As mentioned throughout this article we need Cross-Chain Interoperability for mass adoption in this space.

What HPB & MyTrade are doing is a game-changer with Assetlink, they are solving a known problem by utilising the very best Oracle service out there with Chainlink. This ensures the bridge point is fully secure, unlike the many workaround solutions which exist today. They are capitalising on their advantage of being an EVM-compatible blockchain to achieve this feat! This will surely see the start of HPB’s rise to an all-time high, a position I truly feel is deserved considering the huge amount of development going on in the background.

Further information

- HPB Website: http://www.hpb.io/

- HPB Twitter: https://twitter.com/HPB_Global

- HPB Telegram: https://t.me/hpbglobal

- HPB Full White Paper: http://www.hpb.io/static/file/whitepaper/HPB_Whitepaper_English.pdf

- HPB 1 Page Summary Whitepaper: http://www.hpb.io/static/file/whitepaperA4/HPB_A4_en_%E8%8B%B1%E8%AF%AD_English.pdf

- MyTrade Twitter: https://twitter.com/mytradeglobal

- MyTrade Medium: https://mytradeglobal.medium.com/

- MyTrade Website: https://mytrade.org

- MyTrade Telegram: https://t.me/MyTradeGlobal

- Assetlink AMA with Kris from MyTrade: https://t.me/hpbglobal/480603

References

- Belchior, Vasconcelos, Guerreiro, and Correia. 2021. A Survey on Blockchain Interoperability: Past, Present, and Future Trends. 1, 1 (March 2021), 63 pages. Available at: https://arxiv.org/pdf/2005.14282.pdf

- Bitdegree.org, 2016. Ethereum Virtual Machine: Introducing Ethereum and Solidity. [online] Bitdegree.org. Available at: <https://www.bitdegree.org/learn/ethereum-virtual machine#:~:text=Ethereum%20virtual%20machine%2C%20or%20EVM,created%20objects%20safe%20from%20modifying.> [Accessed 8 April 2021].

- Boudjemaa, A., 2020. Cross-Chain Interoperability: Enabling the Future of DeFi | Hacker Noon. [online] Hackernoon.com. Available at: https://hackernoon.com/cross-chain-interoperability-enabling-the-future-of-defi-7et3wgr [Accessed 9 April 2021].

- Curran, B., 2021. Looking Ahead to Blockchain Interoperability: Issues & Future Solutions. [online] Blockonomi. Available at: https://blockonomi.com/blockchain-interoperability/ [Accessed 10 April 2021].

- Hollander, L., 2019. The Ethereum Virtual Machine — How does it work? [online] Medium. Available at: https://medium.com/mycrypto/the-ethereum-virtual-machine-how-does-it-work-9abac2b7c9e [Accessed 8 April 2021].

- HPB Global, 2020. Medium. [online] Medium. Available at: https://medium.com/hpb-foundation/mytrade-officially-launched-on-hpb-mainnet-cb241ed2cf1 [Accessed 10 April 2021].

- Ivan on Tech, 2020. Blockchain Interoperability and Why It Matters For Mass Adoption. [online] Academy.ivanontech.com. Available at: https://academy.ivanontech.com/blog/blockchain-interoperability-and-why-it-matters-for-mass-adoption [Accessed 17 April 2021].

- Mei, 2020. Remitano. [online] Remitano.com. Available at: https://remitano.com/forum/eu/post/2588-blockchain-interoperability-what-why-how-1 [Accessed 12 April 2021].

- Qin, K. and Gervais, A., 2021. An overview of blockchain scalability, interoperability and sustainability. [online] Eublockchainforum.eu. Available at: https://www.eublockchainforum.eu/sites/default/files/research-paper/an_overview_of_blockchain_scalability_interoperability_and_sustainability.pdf [Accessed 12 April 2021].

- Read BTC, 2018. Before you continue to YouTube. [online] Youtube.com. Available at: https://www.youtube.com/watch?v=Dq87pM6kjXg [Accessed 10 April 2021].

- Seba, 2020. Blockchain Interoperability: Towards a Connected Future. [online] Seba.swiss. Available at: https://www.seba.swiss/research/blockchain-interoperability-towards-a-connected-future/#introduction [Accessed 12 April 2021].

- Smart Content, 2021. Completing the God Protocols: A Comprehensive Overview of Chain-link in 2021. [online] Medium. Available at: https://smartcontentpublication.medium.com/completing-the-god-protocols-a-comprehensive-overview-of-chainlink-in-2021-746220a0e45 [Accessed 9 April 2021].

You got a 100.00% upvote from @votemypost Send any amount of Steem to @votemypost with your post link in the memo for a proportional upvote. Earn a passive income by delegating Steem Power to @votemypost

If you are looking to earn a passive no hassle return on your Steem Power, delegate your SP to @votemypost by clicking on one of the ready to

delegate links:

25SP | 50SP | 75SP | 100SP | 250SP | 500SP | 1000SP | 2500SP | 5000SP

Another Amount

You will earn 85% of the voting bot's earnings based on your delegated SP's prorated share of the bot's SP each day! You can also undelegate at anytime.