Are you Shorting Fiat Currency yet?

10,048 BitShares worth $1,019 for free in just 12 days.

Cryptocurrency is your lifeboat in a globally-sinking financial system.

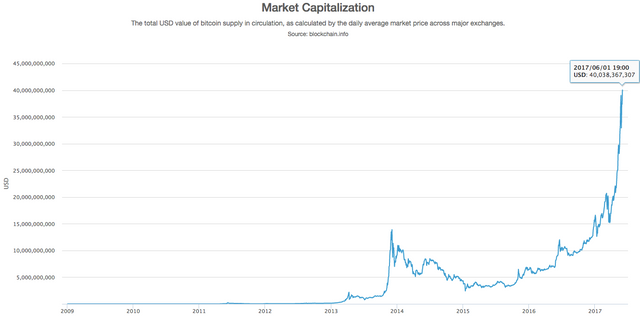

The fiat money in your wallet and bank account is losing purchasing power. People are flooding into the cryptocurrency market where value is determined by voluntary free exchange and not by government decree. You can see this trend via the market cap rise of cryptocurrencies like bitcoin:

You don't have to sit by and watch your purchasing power decline. You can gain value simply by having value and predicting where things are going. I've talked about this before and will keep talking about it until more people like you start doing it.

- Playing in the Margins: bitUSD and BitShares on Open Ledger

- A Simple Example of Shorting the U.S. Dollar With BitShares

- 9 Day bitUSD Loan Result: 19,821 BitShares and 199 ZAPPL for Free

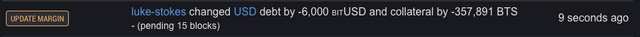

In today's example, I created $6,000 in bitUSD using my BitShares as collateral at a 5:1 ratio on May 24th and bought around 70k BitShares at $0.086 per share.

And then the price dropped!

Patience is Key

In order to be successful at speculating and investing, you need reserves and patience. When I saw my ratio drop down to 3:1, I added more BitShares to the margin position to bring it back to 5:1 so I wouldn't have to worry about it executing a settlement and selling my BitShares at a loss. Once the market recovered, I put things back to where they were originally at 5:1. As I saw the price go up above my purchase price, I sold and closed out the contract.

See the posts above for more information. Anyone who owns BitShares can do this, but please, keep a large reserve in case the market goes in the opposite direction. Corrections should be expected, but I think they will be temporary given the long-term trend of cryptocurrency over fiat. With enough reserves, you can add BitShares to the margin contract and ensure your margin isn't called at a price you don't want.

I hope this information is useful to you, and I hope more people create a BitShares wallet at https://bitshares.openledger.info to get involved. @ash just posted this excellent tutorial to get you started with BitShares. Check it out!

This is not investing advice.

Never speculate with money you can't afford to lose.

A debt-free investor is a confident, rational investor.

Created with love using ChainBB

Luke Stokes is a father, husband, business owner, programmer, voluntaryist, and blockchain enthusiast. He wants to help create a world we all want to live in.

I'm shorting fiat currency for more than 5 years.

hahaha, love this one, me too, who wants FIAT ?

Sadly uneducated people are chasing those worthless piece of paper like it's the primary reason of the universe existence.

Everytime I thing I'm getting diversified or well enough invested in crypto you drop some knowledge like this one me. Will have to do my research and add this to the repertoire! Thanks!

I'm so thankful to hear these posts are driving others to continue learning. Thanks!

Your post and this one are in many ways polar opposites. I would love to get your take on this article. I have no affiliation with this steemian, I just really want to know what you think about it.

https://steemit.com/alternative/@unionunited/get-out-while-you-still-can

Why is that whole post pictures? Trying to avoid cheetah bot for plagiarism? Odd. I'll comment there, but my basic view is there will be much volatility until the market cap grows a lot more. I watched bitcoin price plummet from $1200 down to $250 in 2014 and I didn't sell. Only those who jump off a rollercoaster while it's still going get hurt. The long term trend will be away from fiat currency. Dumping $2,500,000 on a market would obviously drop the price given the current market cap. Smart investors will then swoop in and buy up cheap coin as the price recovers. This is a poorly written hit piece, IMO, though the concerns over high transaction fees are real and if Bitcoin doesn't fix it, other cryptocurrencies will gain market share (as we're already seeing now).

"only those who jump off a roller coaster while it's still going get hurt"- @lukestokes

I love that, excellent quote. The blog definitely seemed fishy because none of the avatars had pics not even in the comment section, but some of the numbers backing his argument seemed legit. It jumped out at me because it reminded me of the rhetoric I used to hear from every person I told about bitcoin back in 2013. I just didn't think anyone still held this view. He is saying we should all sell our bitcoin before it's too late. Maybe he will buy it from us.

That quote, I think, was originally Dave Ramsey's. He used it when talking about the stock market and long-term investing in growth mutual funds. He's not a fan of bitcoin (yet), but I think it applies here as well if the long-term gains of crypto are positive as they seem to be.

I really liked the idea of shorting the dollar. I added a twist though, besides going long bits hares, I went 66% longer in BTC. Doing okay.

Also Bitshares reduced fees. It's costing me zero fees to maintain my collateral.

I don't meme all that often, but I just saw this in my mind when I read your post. :)

Lol! I was in Kingman AZ this weekend

I don't think it is wise to make correlations of the Fiat world with the crypto world. There are far more complicated dynamics in place. Remember. 3 companies in China control the Bitcoin transactions much like the Fed controls Fiat flow.

They are both centralized as fuck. Either can pop at any moment. It is a gamble which will do it first. The bitshares price is tight to bitcoin. Let's not get ahead of our selves. I know you are saying that that is not an investing advice but darn man. It's like those pharmaceutical commercials that sell you the hype and then in 4 seconds, in super fast speech or small letters, they tell you the warnings.

I don't agree with chart analysis. Sorry. I also think that it makes noobs that want to invest in the crypto world, scared. It becomes all about the money and less about the technology.

All markets have chaotic dynamics. There are only so many ways for human beings to store, transfer, and represent value, so I think a comparison and correlation is warranted here.

I hear this claim often, but do you remember back when one mining farm got close to 51% and the whole bitcoin network started freaking out? In almost no time, the system adjusted and people moved their hashing power, even if that resulted in less rewards. Many in crypto are rational actors motivated by greed (for lack of a more friendly word) who can be trusted to make decisions in their own self-interest. The more bitcoin doesn't deal with scaling and centralization problems, the more they open themselves up to systemic risk and other cryptocurrencies gaining marketshare at a faster rate than bitcoin (we're already seeing this now). Those 3 companies don't control bitcoin in that they can't just create 8 trillion dollars out of nothing over the last 8 years like the Fed did. That's not a good comparison, IMO.

Not sure I agree there. The number of bitcoin holders determines the level of centralization. Miners can only censor transactions or attempt a 51% attack and that's all theoretical at this point. Yes, governance is a problem but BitShares, Steemit, and soon EOS are already solving that problem so bitcoin needs to evolve or die.

To the degree exchanges do everything in BTC pairs. This is also changing as more exchanges offer pairs in ETC or Monero or, like OpenLedger, offer all kinds of pairs including BitShares. Yes, the prices are tied together, but most of that is due to the main onramp of cryptocurrency from fiat still being BTC. I don't think that will be the case for much longer as BTC is just too damned slow and expensive right now. If they screw up too much, others will take their place.

Yes, the "this is not investment advice" is a disclaimer much like the drug companies. I do think those who are looking to invest should be investing into cryptocurrencies and not fiat currency. At the same time, people need to make their own damned decisions and not point to a post of mine as their reasoning. That's why I add those comments (and for any possible legal ramifications not having them might have).

I didn't really make any. I wasn't talking about fib lines or anything, just showing history in graphical form.

The money and the technology go hand in hand. There have been some great tech startups with amazing technology that failed so bad the tech was lost forever. The money matters in order for the technology to actually gain adoption and improve human existence.

I'll just leave this here mate. 1% of bitcoin people control 99% of the wealth. Anybody can check this out. Same exact parallel with the FIAT world. Almost identical.

Is this FUD or has it been adjusted appropriately according to known exchange addresses (which represent many, many people) and/or very early (possibly lost) addresses such as the ~10% Satoshi owns that have never moved?

I imagine with those changes, you'd get closer to the 80/20 principle which (currently) seems to be an emergent pattern in nature and in our species. I don't think that will change (or that it would even be automatically beneficial if it did).

The difference to me (and this is key) is that the fiat world can create new value out of nothing at any time and distribute it directly to cronies with many ways to hide their tracks and avoid audits. Crytpocurrency has to follow the protocol and is completely public. To say it's an exact parallel is not accurate, IMO.

The pareto principle is largely a myth that started from guys like Tim Ferris and later on other motivational speakers. Taleb corrected the assumption and actually argued in Black Swan that is more like 99/1% rather than 80/20. Not gonna get into it, just know that even 80/20 is nothing close to decentralization. No need to push it.

one word. ICOs

do you really want to me to start enumerating the scam coins?

ICOs and scam coins are not representative of the blockchain market share growth over the last 7 years or so which is why I put in my post.

It sounds to me you're saying, "Nope, because it's not perfection so it's just as bad as everything else."

Really?

Yes, corrupt people will continue to do corrupt things and IMO this technology allows that to be more visible then ever (see the outcry over the BAT ICO). Much more so than the FED. It's a huge step in the right direction.

ICOs and new cryptocurrencies still don't "create money out of nothing" they create money out of market action, people buying and selling. If they try to distribute a token at a valuation the market does not respect, the price tanks.

I am saying that there is not such a great divide right now between crypto and fiat. Dan explained how pretty much everything is centralized pretty much - hence EOS. You argued for that as well if i remember correctly.

ok lets talk what happened with BAT or black coin or or or. there is a lot of manipulation. much like the FED.

Who has looked at the FED's books directly? I know we can see what the treasury does with the FED, since the treasury publishes that data, but you can't actually look at the books of the FED and you have to trust the treasury completely.

The blockchain can be analyzed by anyone. That, to me, is a hugely important difference. What you call manipulation may also be an example of flaws outside of the blockchain itself which have not been improved on yet. These aspects are still fragile and have not yet obtained the anti-fragile nature of the blockchain.

Dan says the EOS distribution will be different. I think it will improve on anything we've yet seen based on what he's already innovated. This ecosystem evolves towards solving issues people are not happy with. The FED does not.

nice....your post deserve my upvote and resteem....

Thanks... but it seems you say the same thing to everyone. Some may consider this spam, so be careful. :)

really...that 's my sincere comment!

Nicely done article. I agree that shorting fiat is profitable. Nice profits! Keep up the good work

I'm definitely short fiat dollars. It has been a long haul in that regard but I have less than a month in Crypto. I've been learning. If you could recommend a good Steemit mentor for me, I'd be grateful!

I think you just found one. There are a wealth of posts in Luke's blog.

Thanks Dayne. :)

What do you expect from a mentor?

Most of the cool things I know I've just gone out there and learned through research, effort, time and experience. I try to learn from everyone, even people who may see me as the teacher in that moment.

One of the people I follow recommended getting a Steem mentor. I guess it means someone to get pointers about how to make the most of Steemit. https://steemit.com/money/@natxlaw/our-steem-dreams-what-is-it-we-all-hope-to-get-from-the-new-cryptocurrency-socialmedia-paradigm

Much learning comes from experience. Try things out. See what works.

How does development on this platform work? I was a programmer before I was a lawyer.

Development on Steemit? It's done here: https://github.com/steemit/steem

Thanks!!

If you are more of a front-end guy you can check out the steemit code here: https://github.com/steemit/condenser It is built in React & Redux with Redux-Sagas.

i would love to know how to use bitshares

Follow the link to the tutorial to learn! Also, the other links I included will give you a bunch of information include videos you can watch.

Thank You sir. Followed for upcoming blogs

Good stuff! At first glance looks intimidating and sophisticated! The whole ecosystem is an exodus happening! Thanks for sharing!