What is Fractional Reserve Banking, and is it Fraud?

Hi everyone. In this article, I wanted to talk about Fractional Reserve Banking, which is a controversial method banks use to, literally, create money out of thin air.

In the past month, Jamie Dimon (JP Morgan Banking CEO) sparked a frenzy by referring to Bitcoin as a "fraud," but there are many risky and questionable practices central bankers use frequently that many are unaware of, and one of the most popular methods is Fractional Reserve Banking (FRB). Let's dive in to what FRB is, and why it's so controversial, and then talk about how cryptocurrencies solve this problem so well.

We'll approach this in a few different sections, as outlined below:

- 1. What is Fractional Reserve Banking?

- Simple Example

- 2. Effects and Perceptions of FRB

- 3. How Cryptocurrencies Solve The Problem

What is Fractional Reserve Banking?

In a "textbook definition" sense, FRB is a system where a bank is only required to actually have a fraction of the assets they are given through deposits.

This means only a portion of bank deposits are actually backed by cash or are available for withdrawal.

Though this makes Fractional Reserve Banking sound like a sort of "legal fraud/counterfeit," let's go through a full example to figure out why that perception of FRB is exactly right.

Central Bank Creates the Money

First, let's start at the top of the chain— with central banks. In most economies, including the United States, there exist central banks, whose main power is to have the ability to create money. Whether that's printing cash or creating electronic funds, they are the ones who create the money, though they're generally monitored and controlled by the Federal Government.

Let's say that our central bank decides to go ahead and print $5.

Now the Central Bank has to answer a crucial question: "How do we get this money into circulation?" The answer to that question, is that rather than loading the cash onto a plane and flying across the US, dropping cash wherever the plane flies, the central bank does something a bit more clever: it buys securities.

The securities or bonds the Central Bank trades/buys are generally very stable, and in exchange for the securities, the Central Bank pays the seller the newly created $5.

The Central Bank has just fulfilled its goal of circulating the money, by exchanging the money with a seller for stable securities. Now, someone (the seller) now has these newly created bills ($5), and this person will either directly deposit these $5 into a private bank, or trade it / transfer it to someone else. Whatever happens, eventually the money will usually end up being deposited to a private bank.

Private Bank Receives Deposit

Now, we're at the stage of the private bank. Someone, let's say a man named Jacob, just deposited $5 into the private bank. The private bank assures Jacob:

Don't worry, Jacob. We've got your money for you, and you can trust us completely. You can withdraw your money at any time, and you never have to be nervous or worried about your money.

—Hypothetical Private Bank

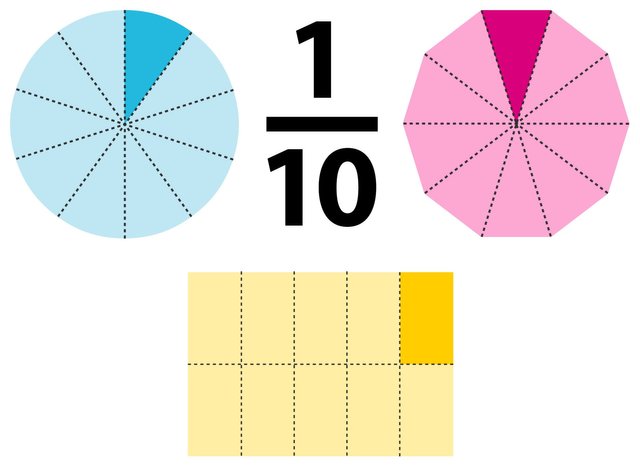

However, now we get into FRL, or Fractional Reserve Lending. The reality is that the bank is actually fully permitted to keep just a fraction of Jacob's deposit (generally 10%), or his reserves. Even more, they can then actually lend the rest of his deposit out to other customers.

The Private Bank decides to keep some of Jacob's money in safe reserves, in this case $0.50, just in case Jacob comes for a withdrawal, and realizes the probability of an overwhelming amount of their customers coming one day and asking for all of their withdrawals is very low.

This means they can just keep a little bit of money for whoever does come, and lend the rest out (in this case $4.50), even though they promised all of their customers that all of their money is available.

Private Bank Lending

Now, the private bank has some money (a fraction of Jacob's deposit) to lend out, and eventually when they are in contact with someone who wants a loan with a decent risk, they'll lend that money out. Let's say the person who requested the loan from the Private Bank is Karen. Karen now has a share of Jacob's initial deposit, loaned to her by the Private Bank.

Now, usually Karen might either immediately deposit the new loan into a bank, or she might use it to buy something. If she does the latter, the seller of whatever she bought would now have the money, and the cycle would continue until the money, eventually gets deposited into another bank.

And now, this new bank (let's call it "Other Private Bank", or OPB for short) has Karen's funds ($4.50) and they might also decide to participate in Fractional Reserve Lending and only keep a fraction of her reserves on hand (10%, or $0.45).

As usual, they lend the rest ($4.05) to another customer, and eventually, these funds end up in yet another bank.

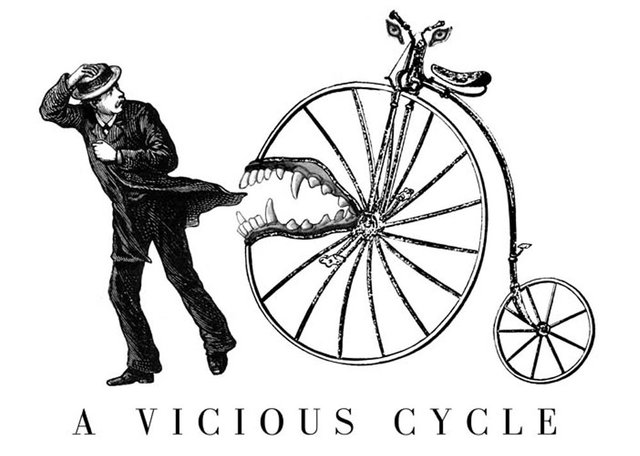

This vicious cycle continues on and on, with money being transferred and lended through a large number of banks.

Creating Money Out Of Thin Air

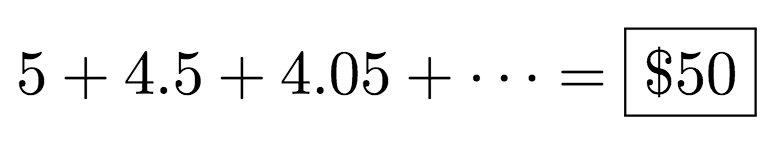

We know that the central bank started off by creating $5 and depositing that into the system or getting it circulated. But just how much money has been "created" from those initial $5?

Well, Jacob, our first bank customer of the first Private Bank, thinks he has $5 in the bank he can access at any time. Karen, the customer who took a loan out from the first Private Bank, thinks she has $4.50 in her own Private Bank (OPB). And the next person who takes a loan out may think they have $4.05 in their own private bank, and on, and on, and on.

If we sum up this series mathematically, we actually get a whopping total of $50 being created from the original $5, which is ten times the original amount!

This means $45 has just been created, completely out of thin air. The actual numbers in real world banks may vary, but these numbers assumed a 10% fractional reserve, which is what most American banks use. The only difference is that this calculation assumed the money switched from bank to bank or owner to owner an infinite or near-infinite amount of times, though in real life this can't actually happen.

Even assuming the money switched hands just a few times, a huge amount of money is created along the way. We see that even in just the first part of the cycle, $4.50 got created instantly. This means that, in general, private banks have the ability to spontaneously "create" new money whenever they want.

Effects/Perceptions of Fractional Reserve Banking

In the last section, we covered a top-down example of Fractional Reserve Banking, but now let's dive into the effects and perceptions of this system.

Effects of FRB

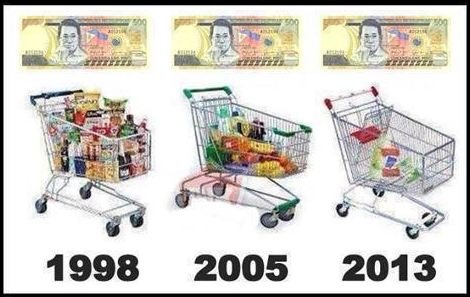

Money just keeps devaluing, and is worth much less now than it was ten or a hundred years ago.

According to estimates published by the Bureau of Labor Statistics, $180 in 1789 is roughly equivalent to over $4660 in 2016, which is more than enough to buy an entire bitcoin at today's price.

That's a difference of almost 2500%! A couple decades ago, ten to twenty bucks was enough to buy your entire family's worth of groceries for over a week. Money is devaluing and inflating, and this spontaneous "creation" of money is only worsening this process.

Perceptions of FRB

Fractional Reserve Banking is somewhat perceived as a fraudulent practice. Even to those who know little about it, just telling them that private banks can randomly create money out of nothing is sure to cause a reaction— it sounds absurd!

Many investors and economists think so too:

It should be clear that modern fractional reserve banking is a shell game, a Ponzi scheme, a fraud in which fake warehouse receipts are issued and circulate as equivalent to the cash supposedly represented by those receipts.

—Murray Rothbard, American Economist

This notion that FRB is similar to a Ponzi Scheme is actually pretty common. Ponzi Schemes are illegal systems to churn out money from unsuspecting investors, and though FRB isn't exactly a Ponzi Scheme, the results are very close.

With FRB, we're essentially "borrowing money from the future," effectively making our future a little bit shorter and our money a little bit more worthless.

Cryptocurrencies to the Rescue: How Cryptos Solve The Problem

Finally, we enter the solution to this fraudulent system. Cryptocurrencies.

Almost any cryptocurrency would be a better substitute for this system, from Bitcoin to Steem, because of the fundamental property of cryptos: they're decentralized.

What this means is that no central authority has power or governance over a cryptocurrency. No government or central bank can just spontaneously start printing new cryptocurrency or Bitcoin, and no authority could govern the blockchain. This is one of the key ideas that sparked Satoshi Nakamoto's greatest invention— the idea of a currency for the people that would be impossible to govern by a single entity.

Critics sometimes argue that, through the usage of block/mining rewards, Bitcoin does "create money out of thin air," though this approach is wrong. Bitcoin is actually a deflationary currency, meaning its value tends to rise, because these block rewards keep halving every 4 years. Eventually, mining a block will merit little to no block reward, meaning the amount of Bitcoin being created will slow down over time.

Additionally, Bitcoin and cryptocurrencies have open-source protocols that all of their users agree with, while users of the US Dollar or other currencies will probably not agree to practices such as Fractional Reserve Banking if they learn more about them.

And so, I'd like to congratulate you for reading this entire post. You should now hold a much more advanced view of banking systems and are probably much more educated about practices such as fractional reserve banking.

Hopefully, you now see why decentralized cryptocurrencies are the solution to systems such as these.

Thanks for reading,

— @mooncryption

image sources: 1, 2, 3, 4, 5, 6, 7 - self, 8, 9, 10

announcement: @mooncryption is now on other social media! Use the buttons at the right to find our various social media pages from Steemit to Facebook to Twitter! :)

standard disclaimer: All opinions in this article reflect my own opinions, and nobody else's. Please do not act based on any of the information in this article and do the appropriate research before making any public actions or investing in a cryptocurrency.

Upvoted on behalf of the dropAhead Curation Team!

Your post will be Resteemed by @dropahead witness account of the dropAhead curation team!

Watch out for the #xx-votesplus tag!

By doing the above you will give us more STEEM POWER (SP) to give YOU more earnings next time.

Keep up the good work!

Most recent post: Moving #25_votes_plus to Discord

Fractional reserve is also what is causing SILVER and GOLD price suppression which is why you should buy physical bullion that you can keep yourself. Those exchanges operate on fractional reserve as well for precious metal trading.

Great post!

Dante

Thanks! Yes, you're right, some exchanges do operate that way.

This post received a 2.11% upvote from @randowhale thanks to @mooncryption! To learn more, check out @randowhale 101 - Everything You Need to Know!

This is an eye opener for us. I will withdraw what I deposited in the bank and buy more Steem.. thanks @mooncryption...

Good decision :) I'm sure you won't regret it.

If you'd like, you can also read my article on why STEEM happens to be one of the best investments possible this year. Check it out if you have the time!

What is Fractional Reserve Banking, and is it Fraud?

Yup..it sure is.

Haha, I didn't want to lead into that with my post, so as not to force my opinion on anyone, but you can guess my opinion on Fractional Reserve Banking from this line:

Federal Reserve notes are debt.

The US (or the world?) hasn't used money this century.

Exactly Mr. Mickey. Cryptocurrencies will likely be the solution to baseless money like this in the future.

I call fraud.

I have studied the esoteric topic of "money" for close to 10 years, myself. I think you did an outstanding write-up.

Money is ...

Exactly.

A necessity noose? One few have but a faint hint of an idea of what it is?

Haha, you actually got the point of my previous comment. It's hard to define exactly what money is.

You probably realized during your studies how complex banking and money is, and sometimes how ethically challenging these things can be ;)

It's been quite a discovery that is constantly in a sort of flux. Fascinating stuff.

It is simply a form of energy. All energy operates on specific principles, as science has demonstrated.

Modern Money Mechanics is a pamphlet anyone can find online, for free.

It's an excellent leapoff point, to understand it better. What is funny is how few would even attempt to read it.

Thanks for sharing this with the community.... Cryptocurrency rules all the way.

I agree, cryptos are great.

Thanks for the perfect post! @mooncryption

Thanks for the perfect comment! :)

This post was resteemed by @resteembot!

Good Luck!

Curious? Check out:

The @resteembot users are a small but growing community.

Check out the other resteemed posts in resteembot's feed.

Some of them are truly great.

Great post!

Thanks!