Why I think Bitcoin Futures are the key to several major retailers accepting Bitcoin

Bitcoin Futures Products launched late last year with much fan fare.

At the time, there was much excitement and prices of bitcoin continued to rise and rise and rise.

Bitcoin climbed all the way to about $20k per coin shortly after the CME and CBOE had both launched their Futures Products.

However, the volume was only high for about a week or two and has since come down quite a bit.

Overall, the volumes have not been what many would have hoped for.

Most people are missing the big benefit from these products though.

On the surface allowing institutional money to enter the space was the big selling point.

Institutional investors were not allowed to purchase bitcoin and other cryptocurrencies from unregulated cryptocurrency markets, at least that was the narrative.

Once regulated markets started popping up, we would see a flood of new money coming in.

However, that really hasn't been the case, and I would argue that wasn't really the biggest benefit to having these products anyways.

The biggest benefit to having Futures Products was what it would mean for mass adoption.

Yes, you read that right.

Having Futures Products was going to help open the door to a whole new world of cryptocurrency adoption.

I know that sounds a bit counterintuitive, but think about it for a second.

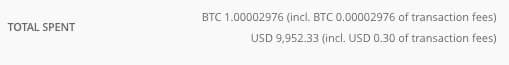

So far the only retail stores that are accepting bitcoin are ones that immediately convert that bitcoin to dollars using some 3rd party service.

A process that can work for some small retailers, though not something that can scale very well.

However, with the introduction of Future's Products, the doors have been opened to the likes of Walmart or Amazon and a whole host of others to start accepting Bitcoin because it will allow them to hedge.

The single biggest deterrent for stores accepting bitcoin is the amount of volatility surrounding the coin.

No one can afford to take the risk of accepting bitcoin as payment only to see it's price drop 30% by the next day.

However, if they have the ability to lock in prices for long periods of time, the risk of volatility is largely mitigated.

This is what happens in the Airline industry with oil.

Did you know that the Airline industry is one of the largest purchasers of oil futures in the world?

They have to do this in order to lock in consistent oil prices and be able to offer consistent rates to their customers.

The same thing can be done by retailers now via futures contracts on bitcoin.

Awesome, why hasn't it been done yet?

This is still a very recent development.

Futures have only been trading for a couple months now.

Some don't know about it, have given it much thought, or figured out exactly how they would go about setting it up yet.

As time goes on though, and markets mature, we will see large retail companies start dipping their toes into the futures markets in order to lock in prices of bitcoin that they will be accepting at their stores.

Which means...

Large retailers accepting bitcoin as a form of payment is likely just around the corner.

Stay informed my friends.

Image Source:

http://theconversation.com/with-a-new-futures-market-bitcoin-is-going-mainstream-86852

Follow me: @jrcornel

You have a point there.

But what I think, retailers will only start accepting it if it will be stable and have fast transaction confirmation otherwise it is very unlikely to be adopted by them.

I think as compared to bitcoin, steem has more chances.

Gresham's law ( "bad money drives out good" )prevents BTC from being used as money. When you have continually devaluating fiat. There is no good reason to use a defaltionary, possible store of wealth currency for normal purchases. Unless you just have too many of BTC, which may be the case for a few people.

You must not have seen all the whale humping going on in steemit, which some call raping the rewards pool. If you were a major retailer, do you want your profits linked in any way to all the crap that goes on in steemit.com? No way.

STEEM was never intended as a store of value, which is in part needed for a reliable payment tool. People complain about POW using too much electricity. But STEEM uses Proof Of Brain, which lets the sleazy whales rape the rewards pool. Not much security in that system.

I agree 💯👍 just followed you

There is Segwit and lightening network to fix the scaling problem which is becoming more poular, this would likely cause many retailers to start adopting Bitcoin.

Interesting thinking 🤔

interesting perspective... didnt think of it from the bigger retailers view point

good job

Very interesting! Upvoted and followed!

There are no BITCOIN futures products because that would assume bitcoins were involved or could fill the contracts, These are cash settlement BETS on the average price of bitcoins in the Future. NOT Bitcoin Futures. In a real FUTURES contract I either sell or buy a contract to purchase an item, in this case it would be BITCOIN. Unfortunatly, unlike real futures contracts where folks can actually buy a contract to BUY the commodity, there is nothing involved in the bitcoin contracts other than a gamble on the future of bitcoin on some other exchange. IT IS A SCAM of the highest degree. If I wanted to buy Silver with a silver futures contract I could. I could sell the contract or let it laps or force delivery , with these FAUX futures contracts I can not force delivery because there is NOTHING in the contract to force. VEGAS has odds on the ups and downs of price.. these "Faux Futures" are just a variation on guessing the number of jelly beans in a jar where you don't get the beans even if your right.

Current "futures" add a very thin veneer of respectability. Will it be enough to bring all the big hedge funds into the space in 2018? Going to be hard for the hedge funds to sit out another big uptick of BTC price, if a handful jump in and take the risk, the rest of the industry will come crowding in follow the leader fashion.

I would rather see a real ETF if that is what they are going to do or a Mutual Fund stuffed with crypto.

Good info

It's possible that futures trading will lend legitimacy and foster greater use of bitcoin. That was the thinking when it was announced that bitcoin futures would be traded. Bestselling author and Wall Street veteran Jim Rickards, however, has warned of a potential downside to futures trading, namely that smaller, newer holders of bitcoin might get ripped off by bitcoin whales via the futures market. Rickards pointed out a way it might be used to rip off newer and smaller bitcoin investors via the following tweet.

I want to make it clear that I firmly believe that blockchain/distributed ledger technology will change the world in a fundamental way and that some cryptocurrencies will explode in value in the coming years, but Rickards is a very smart guy who is quite knowledgeable about the financial markets. It's worth considering what he has to say about bitcoin in particular.

why wouldnt they just use payment processors like Graft or Utrust? Seem like a lot less of a pain to me. Still not very known, but these should be better for hedging (instant and lower cost) than futures. And retailers wouldnt have to connect to the futures exchanges (saving resources and time)

They dont have to always be connected with Future exchanges.

What happens is that big retailers might, for example, buy an certain amount of BTC Future contracts with one month expiration date, lets say 10 BTC, and no matter what Will be price of BTC at the expiration date Will be worth the same amount in dollars.

That way, they can accept 10 BTC for 1 month without worrying about the price.

but they DON'T. buy ANY bitcoin to back up the futures contracts because they are not really futures contracts they speculative BETS on the PRICE of BITCOIN and not on BITCOIN it's self

Technically true but the futures contract tracks the price of bitcoin. So what's your point

two of the keys to value is scarcity and usability The Faux futures add nothing to either and perpetuate the illusion of the Debt Fiat system. The bigger point is, they are contracts that contain NOTHING. Yes they track value but they do not change value, neither do they help spread the real USE of bitcoin. ALSO the delude those of us who actually believe in crypto into makeing decisions based on futures contracts that are not really contracts for ANYTHING. Folks selling their bitcoin because they see the futures contract constricting, when the fact is the futures contract is constricting either manipulatively to push down the price of REAL Bitcoin or to PUMP it up so they can WALE SALE. It is all NOT GOOD unless you can take, or at least potentially take posession. The market can then base trade value on supply and demand and not gambling speculation .. ANYWAYS.. :-)

Future contracts are not only about speculation.

The main reason of an Future contract is to hedge risk.

And with BTC it works the same way with other commodities.

For an example, Oil are negotiated on an open market, and it is a product that have lots of uses.

An company like an airline that have to buy a huge amount of oil uses Future contracts to lock the price of the oil it is buying.

That way, no matter what will be the price of the Oil on the Future, the cost for the company is already defined, so it brings stability on the costs of operations.

The same can work on the future with BTC.

Retailers may acquire future contracts to protect themselves agains the price volatility of the BTC.

They mey acquire a 10 BTC future contract with an expiration date for 1 month, and that way, they can receive 10 BTC without worrying if the price will be higher or lower 1 month later.

Future contracts doesn't trade BTCs, but they add a way to counter the volatility.

You have collected your daily Power Up! This post received an upvote worth of 0.35$.

Learn how to Power Up Smart here!

Graft and Utrust are not that established yet. A big retailer will either build it in-house or go with a more established crypto payment processor.

BTC futures currently are only for 1 and 5 btc increments; e.g. large-scale hedging.

Bitcoin Futures do not exist. There are no bitcoins to be owned in a faux bitcoin futures contract for any amount. It is a BET on the price of Bitcoins on exchanges not in contracts. it is all a scam. I would be glad to get involved in a real futures contract where I could speculate on the price of bitcoin in the future and then force settlement by taking possession but that is not available.

Watch the exchanges and see at the time of "settlement" if there are any purchases that match the contracts. There are none. it is a pure speculation BET on the price of something in the future and not on the actual ITEM in the future.

Bitcoin futures obviously do exist but they are cash-settled. If you saw my previous posts than you'd have known that is precisely why bitcoin and crypto etfs are much bigger.

And yes had we realized that there was difference on price impact between cash-settled and underlying commodity-settled futures than we'd all have sat out the last hype cycle

It is a bait and switch. Read the details, cash settled bets not bits. There are no underlying actual assets in the product because there is no product in the true Futures reality.

That's why the products from Greyscale and the like for physical index funds/ETF's would be huge if approved for everyone and not just for accredited investors.

Keep in mind that even physically-settled futures can be heavily manipulated--check out gold and suspected price suppression by the central banks/big banks.

To top it all, bitcoin transaction fee is now very low with ledger Nano S and blockchain wallet. Exchanges add their own fees.

I guess this may lead to more acceptance. Thanks @jrcornel for bringing this up.

Appreciate your posts as always. Litepay will allow for instant transactions in litecoin with the merchant getting their base currency (USD/EUR/etc). I'd expect Coinbase Commerce to eventually have the same functionality for the currencies that they support.

https://www.litepay.us/accept.html

Discl: Long BTC, ETH. I don't hold any LTC at the moment but will be looking to add if the price becomes attractive