The Rise of ICOs: How to find the Ones Worth Investing In

The way of Initial Coin Offerings began with the evolution of peer to peer electronic cash system that was introduced with appearance of Bitcoin.

Bitcoin is the first digital currency of cryptocurrency. Satoshi Nakamoto wrote his paper in 2008 & Bitcoin, a digital currency introduced that built on the blockchain network. Blockchain is a decentralized distributed ledger, an open source database where transactions are recorded & stored.

Information is cryptographically stored across block; these blocks are mined by solving a complex mathematical problem. These are connected with already existed blocks & develop a blockchain.

Blockchain is immutable & nonreversible. The information available on blocks are cannot be altered because the nodes/computers are connected around the world. Any alteration can easily be identified.

The blockchain technology revolutionized the world economy & it birthed to new form of fundraising- Initial Coin Offerings (ICO).

What is ICO?

ICO is the abbreviation of Initial Coin Offering. It means that someone offers investors some units of a new cryptocurrency or crypto-token in exchange against cryptocurrencies like Bitcoin or Ethereum. Since 2013 ICOs are often used to fund the development of new cryptocurrencies. The pre-created token can be easily sold and traded on all cryptocurrency exchanges if there is demand for them.

With the success of Ethereum ICO are more and more used to fund the development of a crypto project by releasing token which is somehow integrated into the project. With this turn, ICO has become a tool that could revolutionize not just currency but the whole financial system. ICO token could become the securities and shares of tomorrow.

Short History of Initial Coin Offering? – ICO

Maybe the first cryptocurrency distributed by an ICO was Ripple. In early 2013 Ripple Labs started to develop the Ripple called payment system and created around 100 billion XRP token. The company sold these token to fund the development of the Ripple platform.

Later in 2013, Mastercoin promised to create a layer on top of Bitcoin to execute smart contracts and tokenize Bitcoin transactions. The developer sold some million Mastercoin token against Bitcoin and received around $1mio.

Several other cryptocurrencies have been funded with ICO, for example, Lisk, which sold its coins for around $5mio in early 2016. Most prominent however is Ethereum. In mid-2014 the Ethereum Foundation sold ETH against 0.0005 Bitcoin each. With this, they receive nearly $20mio, which has become one of the largest crowdfunding ever and serves as the capital base for the development of Ethereum.

As Ethereum itself unleashed the power of smart contracts, it opened the door for a new generation of Initial Coin Offering

Little Investment & enormous return:

Traditionally companies often find the way to get handful amount of money by venture capital. With the introduction of Blockchain technology, companies investing little amount around $40,000 to $50,000 investment, they are able to earn enormous amount of fundraising.

Usually, companies offer Initial Public Offerings (IPO) which are launched by regulated companies registered in Security Exchange Commissions or regulated body of the concerned country. The company need to meet all compliance regulations, comprehensive legal requirement, contract & terms conditions & a lengthy paper work requirement.

The rise of ICO is the main reason that it is not regulated through strict compliance like IPO. Besides this, with little investment, companies are able to generate millions of dollars in the shortest possible time.

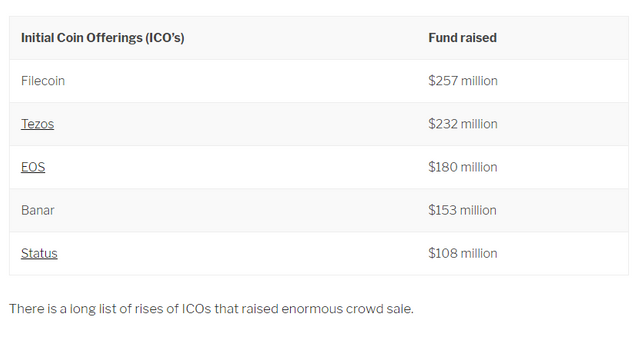

The undernoted list of ICO is showing the fund-raising amount:

Rise of ICOs in 2018:

In 2017, over 200 ICO company’s funds generated around $3.2 billions around the globe. The trend of launching ICOs remained growing & it should continue in 2018 with somewhat limitations. The boom of cryptocurrency attracts money laundering & tax evasion across the border.

The regulatory bodies are more concern & have been taking strict regulatory actions to stop it. China has banned ICOs & South Korean also took measures with deep concern. Besides this, It does not route through Securities & Exchange Commission.

Launch of ICO 2.0 a superior token in 2018:

Considering different aspects, scams, non-transparency of ICOs, Ethereum founder, Vitalik Buterin stated that around 90% of present ICO project would wipe out & should lead to the creation of superb tokens which are called ICO 2.0 in future. ICO 2.0 has distinctive feature to associate a company with digital certificate of title.

The number of ICOs should be limited in 2018 covering mentioned below reasons:

1.ICO’s should be scam protected

2.Business plan of ICO startup should be realistic & implemented in the real world

3.The ICOs startups have operational Capability to carry out business plan

4.The company offer exclusive wallet security that protect the investment of the supporters

How to find worth of Investment in ICOs:

Booming cryptocurrency industry is considered the best investment option in digital coins & launch of ICOs. It works on principle of appreciation of money

Lucrative profit outcomes on investment in the money of internet. Before investing into any ICOs or cryptocurrency the following factors should be determined to make better investment decision.

Technology:

Considering factors connecting to the ICO, technology cannot be overviewed. Technology is the root cause for success or failure factor of a digital currency.

It should be noticed that the network built on blockchain should be verified. It should be considered that ICO or cryptocurrency built on Bitcoin Blockchain or Ethereum blockchain or has compatibility to run smart contracts. Every cryptocurrency has its own blockchain. Developers are able to executes transactions using concerned currency blockchain.

Blockchain technology of ICO’s or currency has potential to offer wide solutions for developers to run smart contracts.

The technology should be embedded with decentralized plate form connects with individuals without central authority where activities of buying & selling perform with instant transactions with lowering cost. Like REX, peer to peer decentralized plate form offering real estate multiple listing services

Cryptocurrency Exchanges:

It is noteworthy that digital currency is listed on which exchanges. There is a list of well reputed exchanges like Coinbase, Bittrex, Bitfinex, Poloniex are considered trusted exchanges for trading of digital currencies.

Team & the idea working behind ICO:

Strength of any project can be better evaluated by reviewing the team of Professionals & developers working behind ICO. Professional expertise & experience to the relevant industry, what contribution team members has been made before to invent the future.

The services of the professionals have been acknowledged as visionary figure who received any recognition on introducing innovative technology by prestigious organizations.

The vision of team can be accessed by its white paper, act as modus-operandi for execution of the project. The idea working behind the project has potential to attract attentions of investors. The idea endorsed the immediate solution to the existing business problem.

DIMPAY Wallet & Mobile Wallet:

##Dispute Resolution Dialogue

Marketing

Roadmap

Team

Business Model