Child Allowances are Transforming the Conversation Around Cash

Last week, Senator Michael Bennet (D-CO) and Senator Sherrod Brown (D-OH) released a new bill to convert the Child Tax Credit into a fully-refundable, monthly child allowance. Whether you call it a “UBI for Kids” or a “Little-BIG” (Basic Income Guarantee), the American Family Act is the first proposal of its kind from sitting U.S. Senators, and sends a strong signal that the tide is turning in favor of basic income-style proposals among our elected.

Under the Bennet-Brown plan, households would receive $300 per month for every child under the age of six, and $250 per month for children ages six to eighteen. That represents an annual credit of $3,600 and $3,000 for each young and older child, respectively — a significant jump from the current maximum Child Tax Credit of $1,000 per child. Most significantly, “full-refundability” means families will be eligible for the full credit regardless of income or work history, thus providing a true income floor for households with children.

The payments decrease for upper-income households in line with the existing Child Tax Credit, with phase-outs beginning at $75,000 for single taxpayers and $110,000 for married taxpayers filing jointly, and is therefore not quite universal. Nonetheless, it is worth reflecting on the progress this bill represents for the Basic Income movement more broadly.

We Have the Tools to Cut Child Poverty in Half

As the sociologists Luke Shaefer and Kathryn Edin document in their book $2. 00 a Day: Living on Almost Nothing in America, since the 1996 welfare reform the U.S. social insurance system has transformed into one in which virtually every public benefit is conditioned on work in some way or another, or is otherwise delivered “in-kind” (meaning delivered as a specific good or service.)

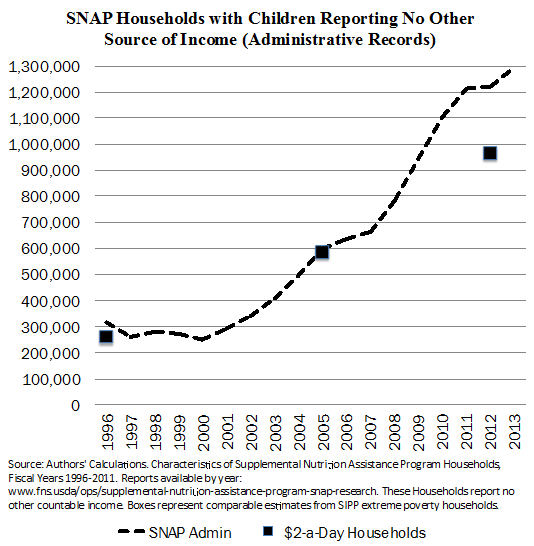

Shaefer and Edin argue that this policy trend has contributed to a rise in so-called “extreme poverty,” defined by households which subsist on less than $2.00 a day of cash income in any given month. The rise in extreme poverty has been particularly stark for families with children, growing 130 percent between 1996 and 2011 to over 3 million children.

Unfortunately, both major political parties have in their own way contributed to this outcome. The ’96 welfare reform gave unconditional cash assistance a bad name, and convinced a generation of Democratic reformers that “work-first” social programs were good politics, if only to protect them from Republican attacks. What resulted was a generational consensus that shut cash-based assistance out of the realm of the possible.

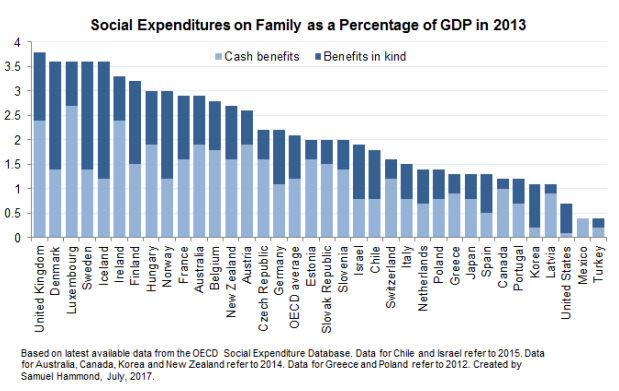

Meanwhile, as I detailed in a recent memo for the National Academies of Science, the evidence has become clear that cash-benefits are paramount to reducing child poverty and providing for the economic security of families. The United States has the lowest social expenditures on families and children of any other OECD country, after Mexico and Turkey. And of that expenditure, the proportion that comes in the form of cash is a pittance. Brown and Bennet’s bill would help close that gap, reduce child poverty by 45%, eliminate extreme poverty altogether, and provide the choice and flexibility parents need to navigate raising a family in the modern economy.

But perhaps most importantly of all, the American Family Act sends a strong signal that the silent consensus against cash has finally begun to crack, meaning the debate of how to address questions of economic security in the 21st century has been permanently broadened.