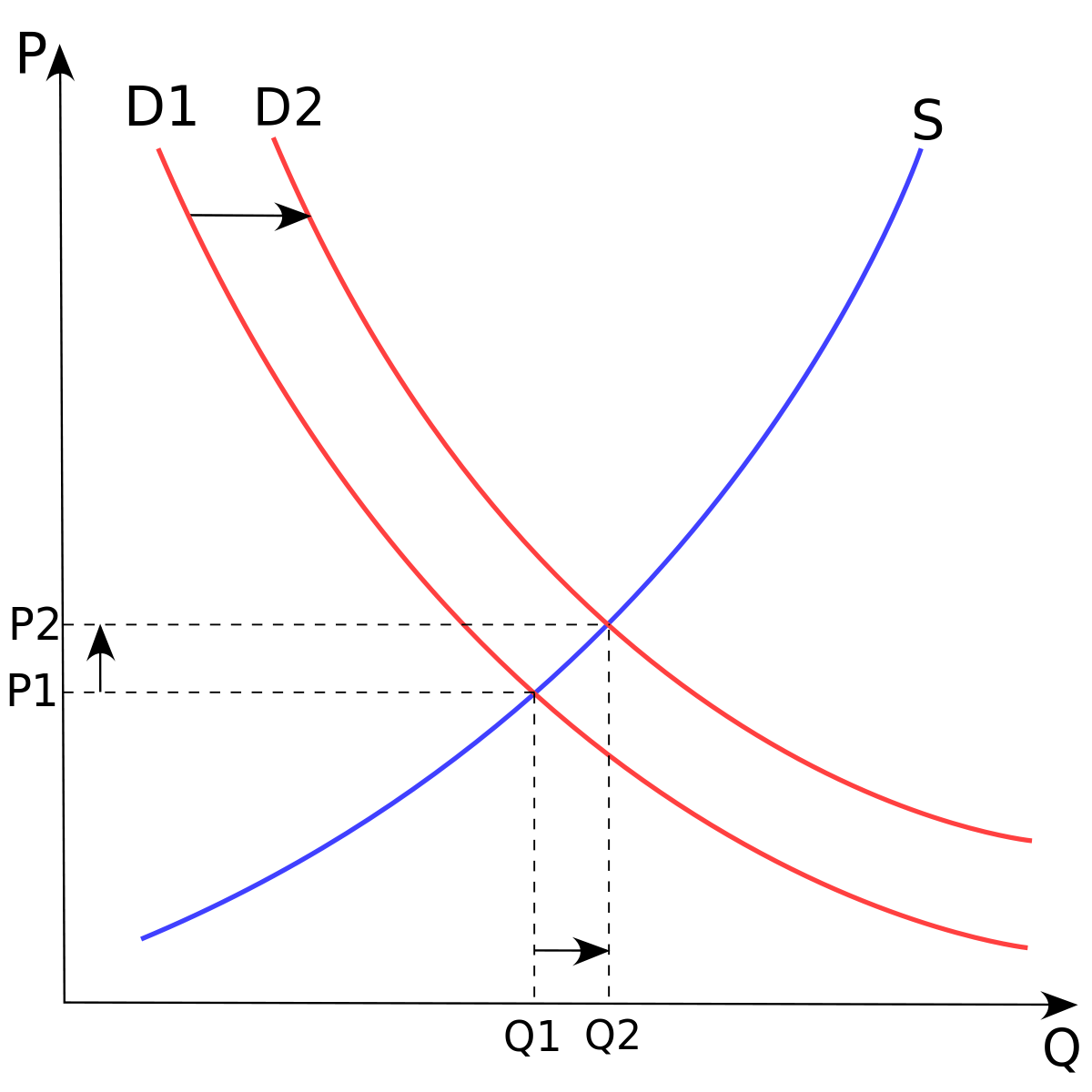

In the crypto market, demand is denoted by ‘opportunity’ (to make money)

The one truth of the altcoin market is that trading volume moves in cyclical waves. The same thing occurs in every other marketplace, industry and financial exchange in the world.

Take for instance Candles.

Candles have long been forced out of the market for being inferior to the light bulb, therefore it’s only logical to assume that sales of candles have drastically decreased over the last 150 years.

However, let’s say there was a power-cut throughout the sub-urban areas of New York, and city officials predetermined that this power cut will persist for 14 days.

What happens to the sales of candles under these circumstances?

Instantly, the amount of candles being purchased within New York begins to surge. This increased demand also causes the prices of candles to climb as supplies begin to dwindle.

I might add, there isn’t a power cut in New Jersey – and so the supply of candles is high whilst the demand is low. Meaning prices for candles in New Jersey are still at rock bottom levels.

So intelligent merchants begin to pick up on this and start purchasing wholesale lots of candles from New Jersey, in order to sell them at 1000%++ marked up retail rates to their customers in New York (Arbitrage / Diversion.) Meaning they can buy 10,000 candles at $0.1 each in New Jersey, and then sell them to the people who need them in New York, for $1.00 each.

If Candles where truly obsolete, then they will have long been pulled from production and removed from distribution (delisted from the exchange.) But, power cuts occur every day and when they do, sales of candles tick upwards, as do the sales of kerosene and lanterns etc.

This is just an example of the cyclical nature of trading volume. It details how an item that had been cast to the side for an extensive period of time can instantly be brought back into high demand, even if only for a small stretch of time, due to the occurrence of a particular set of circumstances

With altcoins, this cyclical nature of trading volume takes on a slightly different form.

Instead of ‘circumstances’ being the main driver of trading volume from one altcoin to another, a coins technical ‘condition’ is a much more determining factor as to whether or not trading volume is able to pass through it, and cause it’s price to surge.

This isn’t rocket science, in fact it’s quite simple.

As regular participants in the crypto currency markets, we all understand that there is no real use or application for 98% of the coins in this market – instead, the demand for these coins is driven by the opportunity to make money, rather than any physical or digital use or application.

This is why we see the values of these coins surge into stratospheric price ranges after a 100% bump upwards in price – because, as I frequently mention, 90% of participants in this market are unskilled, and for the most unskilled altcoin traders, the most convincing evidence that prices are going up – is that that prices are going up. So they pile in, as this is when amateurs perceive that the chance or potential of making money is at its highest, and that’s what 100% of the participants in this market are here to do: make money.

With this being said, I must also mention that these traders who only buy whilst the price of a coin is actively moving upwards, are the market’s biggest losers. In fact, if you are a consistent profiteer, then it from these novice traders that your gains are derived.

It is common sense, if it is your goal to make sizable and consistent profits from trading altcoins, then your method of buying must be almost the opposite of the typical, untrained… unskilled and unprofitable novice trader.

If a novice trader only buys after the price of a coin has increased, then you must only buy after the price of a coin has suffered a major decline.

It’s just like the Candle analogy that I provided above. The biggest profiteers during a city-wide power cut, aren’t the ones who buy candles in bulk from their local supply store – because the prices for candles will have certainly already been marked up by several hundred percent. The largest profiteers are the ones who purchase bulk lots of candles from another city, that isn’t effected by a power cut and therefore has a low-demand for candles which means LOWER PRICES.

In the crypto market, demand is denoted by ‘the opportunity to make money.’

Therefore, if amateur traders – 90% of the participants in this market – only perceive value in a coin when it’s value is ALREADY moving upwards, clearly that is when demand is at its highest. Thus, prices will also be at their highest levels.

So as a skilled trader, you must switch your strategy to one that allows you to take advantage of coins that have yet to explode in value – but have all the hallmarks of being able to explode in value. This is where the skill comes in.

A skilled trader knows that trading volume can only pass through a coin that is in prime condition. A skilled trader understands that a certain string of criteria must exist before trading volume can pass through a coin, and send its price into orbit.

It is this knowledge that allows skilled purveyors of the altcoin market to succeed on a scale that is so grandiose, that onlookers can only scratch their heads in amazement. But, there is nothing super-natural about this. It’s the skilled traders knowledge of market psychology and the mechanics behind price movement that keeps his wallet flush with an endless influx of bitcoins

I am often asked what the greatest key to continuous success is in the crypto market as a whole. The answer to this comes down to a simple observation that anyone can undertake for themselves.

Simply, the majority of traders in this market lose money. Therefore, in order to merely stay afloat and to maintain your balance on the road to continued profit, you must learn – as a habit – to disregard the majority opinion, as it is wrong 99.99% of the time.

The one true factor that displays that most of the people in crypto are at least partially able to ‘go against the tide,’ and behave contrary to majority held beliefs and opinions is the fact that despite the false claims and accusations by bankers that is consistently broadcast to the world through each and every respected media channel in existence, that the crypto currency market is unsafe and void of any profit potential – most of you are still regular participants in this ‘dark side’ of the financial world, and not only do you relentlessly continue to participate, but some of you have been reaping above average profits on a weekly basis…

However, the pressure of majority opinion still exists in this market when it comes to the questions of what to invest in and when to invest.

You see, in the western world, we tend often to accept majority opinions too uncritically. If a lot of people say something is true then true it must be… right? Well, this is how the human mind has been conditioned to operate – to accept the will of the majority. Hence why if you aren’t sure of something, you’re likely to ‘take a poll,’ and if 75% of the people reach a consensus, it seems almost blasphemous to ask, even in a whisper, “Hey, wait a minute, could they be wrong?”

Well… they very well could be.

This humble acceptance of the majority opinion plays a major role in the financial pursuits of the unskilled, who listen not only to economists, bankers, brokers etc, but mainly to majorities.

You need only to bring up the subject of ‘which coins are currently ripe for buying’ to hear the faecal discharge of ‘conventional wisdom’ regurgitated… “only buy when you see that buy support is high” … “wait to see the cup and handle pattern, or the head and shoulders pattern before you buy”…“stay away from low volume coins..” and as each useless piece of wisdom is disgorged, the majority swarms to express their agreement; “YES! Quite right.. Excellent advice!”

The majority of people believe conventional wisdom to be unarguable truths. In the light of this, it may be instructive to note that the ‘majority’ of people aren’t rich… and to go even further, in this market, the ‘majority’ of people lose money almost consistently.

So clearly, in order to reap continuous gains and to maintain your balance on the road to continued profit, in the crypto market, you must learn – as a habit – to disregard the majority opinion, as it is wrong 99.99% of the time

This is a whole series on skilled trading and altcoin manipulation analysis and crypto market cycles and how to get in tune with them.

So check out my profile for more and if you like it make sure to follow me - Ryan

That's the secret of supply and demand !!

Nice post, thanks.

You welcome I intend to engrave many more articles onto the blockchain. Make sure to follow me :-) Ryan