good newsPaytm Money opens early registration, invites users to invest and grow wealth

One of India’s leading e-wallet provider, Paytm, run by One97 Communications has launched early registration for Paytm Money to provide investment and wealth management products. With an investment of close to $

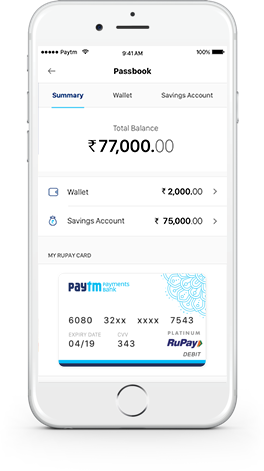

One of India’s leading e-wallet provider, Paytm, run by One97 Communications has launched early registration for Paytm Money to provide investment and wealth management products. With an investment of close to $ 10 million, Paytm Money is the fourth product in Vijay Shekhar Sharma led- One97’s portfolio.One of India’s leading e-wallet provider, Paytm, run by One97 Communications launched Paytm Money to provide investment and wealth management products. With an investment of close to $10 million, Paytm Money is the fourth product in Vijay Shekhar Sharma led- One97’s portfolio after Paytm Mall, Paytm Payments Bank and Paytm wallet.

10 million, Paytm Money is the fourth product in Vijay Shekhar Sharma led- One97’s portfolio.One of India’s leading e-wallet provider, Paytm, run by One97 Communications launched Paytm Money to provide investment and wealth management products. With an investment of close to $10 million, Paytm Money is the fourth product in Vijay Shekhar Sharma led- One97’s portfolio after Paytm Mall, Paytm Payments Bank and Paytm wallet.

The company has opened its early registration from today. Vijay Shekhar Sharma, founder of Paytm tweeted, “Hello India! Here comes @paytmmoney - check out.” Notably, the customers can apply for early registration today, by providing their mobile numbers. Upon inputting the correct one time password, the customers will get a verification note saying, “You have been registered for early access.”

Currently, the website looks under development, and has a statutory disclosure regarding investment into mutual funds. “Mutual fund investments are subject to market risks. Please read the offer document carefully before investing,” reads the website note.

Paytm, which also has a payment bank, could make money through the deposits customers keep in their wealth management accounts. Experts have raised concerns over the business model of payments banks and how it would be difficult for these banks to make money as they are not allowed to lend. Synergies between Paytm Money and bank could help solve that problem for Paytm. Paytm Money will be headed by Pravin Jadhav as senior vice-president.

According to reports, Paytm had sought the approval of the Securities and Exchange Board of India to offer a wide range of financial services, that include cross-selling products of Paytm Payments Bank. Paytm is also talking to leading asset management companies to offer Mutual Fund Investments in Direct Mode for users. “We ultimately want to be the Charles Schwab of India with a zero-fee brokerage,” Vijay Sharma told Livemint earlier. Paytm Money currently has a 40-member team working out of Bengaluru and is looking to add another 150-plus people over the next 12-18 months.

“We will launch share trading and insurance products very soon,” Bloomberg had reported Sharma as saying. “We want to become an Internet-age financial services company,” he had added. Paytm Payments Bank is targeting to become the world’s largest digital bank with 500 million bank accounts and aims to turn into an integrated financial services company that offers everything from wealth management to share trading. “We are unveiling our money market fund, launching our debit card and we’ll have the capabilities to allow enterprises to open business accounts,” Paytm founder Vijay Shekhar Sharma said in a phone interview to Bloomberg in November this year.

Upvote done

thankz

Wow

thanks

What is this dear i still not understand. I am already a paytm wallet and Paytm Bank user

Wow thats great to know! upvoted! visit my profile for latest post on paytm!!