Deribit Review - Bitcoin Options and Futures Exchange

Introduction To Deribit

Deribit, which comes from the words derivative and Bitcoin and is exactly as the name suggests a platform for trading cryptocurrency derivatives. Deribit is based out of the Netherlands with their team lead being a former options trader on the Amsterdam Options Exchange. His motive for creating Deribit was his frustration with the shortage of crypto based derivative instruments. So he set out to make it himself.

.png)

Advantages

Transparency – Deribit is running since the summer of 2016 and being operated out of the Netherlands. The team behind the project is not afraid to publicly show themselves. From their team lead. To those smarty pants math and tech guys.

Security – when it comes to security, Deribit applies two of the most popular features. Cold storage, means the coins are kept in wallets, which can’t be accessed online and even if a hack occurs, nobody will be able to steal them. Two-factor authentication (2FA) is a system, which connects your account and smartphone (via an app) to protect your funds, even if somebody learns your log-in credentials.

Privacy - Since there is no FIAT deposits pesky KYC and AML laws do not apply.

Multiple Instruments - Deribit offers Futures, Options and spot price trading through its perpetual swap contracts.

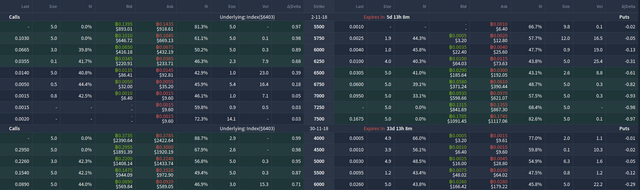

Options are European style (meaning they can’t be executed before expiration, unlike the US style ones) and short-selling is allowed. Keep in mind the latter carries a theoretically unlimited risk. Here is a preview of the options board at the time of writing.

Trading fees are competitive – the costs of trading at this exchange are in line with the offers from other similar trading venues. Deribit is better than competitors in terms of the fees on futures contracts (-0.02% for people who take liquidity from the book and +0.05% for people who add liquidity, compared to -0.03% and +0.05 for makers and takers on its competitor BitMEX)

No Deposit Fees – the platform doesn’t charge users anything for making a payment to the exchange. Withdrawals cost just 0.0006BTC, appropriate mining fees will also apply.

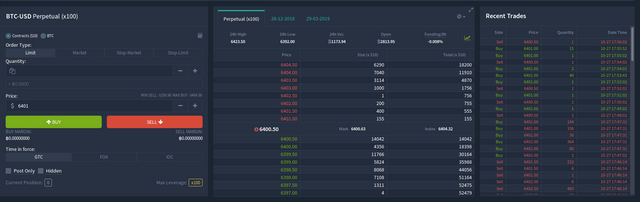

High leverage offered – Deribit offers 100x leverage on its perpetual swap and futures contracts. Leverage can be used to offset exchange exposure (Depositing 10% of your trading stack then using 10x leverage so in the unlikely event the exchange gets hacked you can only lose 10% while still being able use all your portfolios capital) or you can just use the leverage to YOLO all your Bitcoin away like a real man.

Solid Platform – The platform at Deribit is solid. We see this as the best word to describe it, there is nothing revolutionary here, but all the features one would expect are there. The charting package provided is by TradingView, which is always seen as very nice.

.png)

Demo trading available – Deribit offers a demo trading environment. That being said, it isn’t advertised clearly on the front page of the website and one must go to the FAQ section to learn about it.

Deribit Disadvantages

Only BTC related products – Probably the biggest disadvantage of this derivatives exchange, when compared to other similar exchanges.

Accounts held in Bitcoin – While this feature will attract crypto enthusiasts, it may serve as a deterrent for old school traders (who prefer having a USD balance). The mere BTC volatility will cause fluctuations in the value of your account, even if you don’t actively trade. However Bitcoin exposure can be easily hedged by opening a 1x short position.

No fiat payments – Deribit does not allow you to make a cash transfer and get some Bitcoins in exchange. This isn’t that surprising, as most of the more complicated trading facilities don’t. That being said, there are a lot of “entry level” companies, which usually accept Bank Transfers or Credit Cards.

Conclusion

Deribit is an interesting and quite competitive entry into the newly emerging crypto derivatives space. Fees are cheaper than other competitors, The platform is stable, easy to use and they are the first to offer competitive Bitcoin options. This all attests to the increase in volume on the exchange. But can they take the crown off of the top dog BitMEX? I don't see why not if they continue to innovate and BitMEX continues to be complacent. Whatever the outcome may be, competition can't not help.