CryptoWisdom Market Report #2 (November 22nd, 2017)

https://twitter.com/CryptoYoda1338

http://cryptowisdom.io/cryptowisdom-market-report-2-november-22nd-2017/

GoldenAge is closer than we might think

Recently a friend of mine finally managed to buy a fraction of a Bitcoin. He has watched the crypto tale unfold, but from the sidelines for quite a long time, reluctant to buy in, because obviously buying Bitcoin is getting an expensive venture these days. While he managed to obtain about 0.3 BTC for a start, there seems to be a single point of interest: getting more Bitcoin. And this is exactly what this is about. He (and by the way everyone who does not yet own crypto, but observe it from the sidelines) wants to have AT LEAST 1 whole Bitcoin. Well, getting a whole Bitcoin is getting tricky for most people with the price hovering above $8000. It is a bit comparable to what happens with Masternode FOMO, when traders start to push that buy button because the masternode is slowly getting out of reach and they fear to miss out. Thats exactly the same with owning a whole Bitcoin. Imagine a price of way above $12k or even $50k. Telling your friends that you just bought 0.001338 BTC is nothing to be very proud of. It doesn’t have the ring to it, everbody wants a whole BTC, AT LEAST.

And this is where this story gets interesting, because right now we at the very threshold where owning a whole BTC is quite expensive, and it will soon be out of reach for most people entirely if prices go above 10k and onwards. So what does that mean? Basically it has two significant consequences. Firstly, people will push the button rather sooner than later, because they know if it continues to rise they will never manage to hold a full BTC. Especially people sitting on the sidelines observing will feel the urge. If the two options are to either have a BTC but pay much, or have no BTC at all, many will decide to buy instead of waiting even longer. The risk of missing out on this rally is just too high and the pressure is rising. Secondly, if you are not able to afford a whole BTC, what you gonna do with your 0.3 BTC? You either hold it, which is frankly quite boring, or you reinvest it into $ALTS with the chance of multiplying your amount manifold. This dream comes along with the possibility of owning even more than a whole BTC in the future. This is generally true for all Bitcoin holders. If there is only two options, to Hold or to Reinvest, it is obvious what the majority will do. If you don’t like risk I assume you wouldn’t have entered crypto in the first place. I think its pretty safe to assume that the majority of crypto hodlers are accustomed to take risks and even enjoy it, which contradicts with the “just hodl BTC” idea and strengthens the idea of reinvesting BTC into ALTS in order to obtain more BTC eventually. Sure it is more risky, but isn’t that the purpose of this crypto thing in the first place, to take some risk and potentially obtain financial independence for a lifetime? Sole focus on security usually doesn’t get you anywhere…

However entertaining the $ALTS strategy is a little more complex than just hodling BTC. Firstly, we have two requirements for making extraordinary amounts of money, instead of one. If you just hodl $BTC, all you need is to be right on $BTC. However if you are like me and decided to play this game in ALTS entirely, you suddenly need two requirements: You need to be right on BTC AND on ALTS. It is therefore way more risky, but once #GoldenAge is here (which I use to describe the situation that both BTC and ALTS rise at the same time parabolically), you will make double profits in a very short duration of time. I therefore suspect that the ALT markets will become significantly more important in the long run, as it is the ONLY way to increase your holdings of BTC. If you go to a Casino and get some chips, you want to play, you dont want to just keep it in your pockets. You will give it a go on the Roulette table and hope luck is on your side, right? Because that’s where the thrill is.

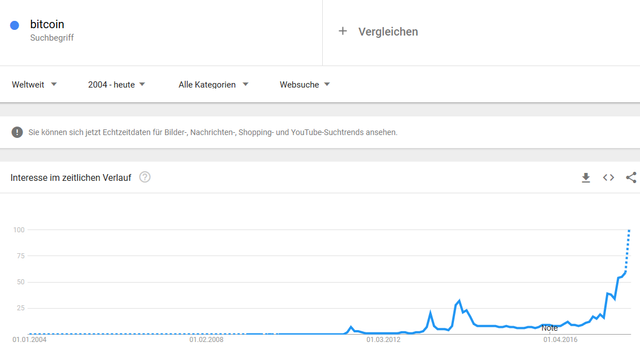

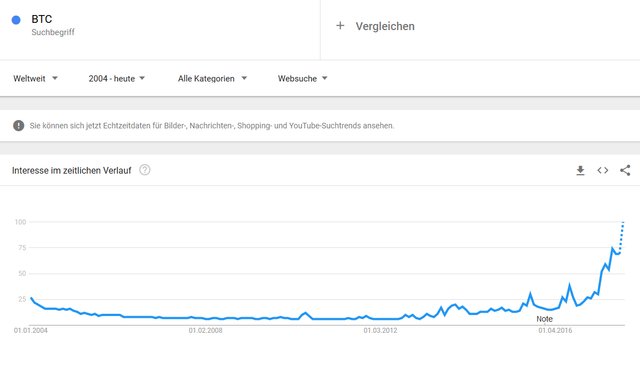

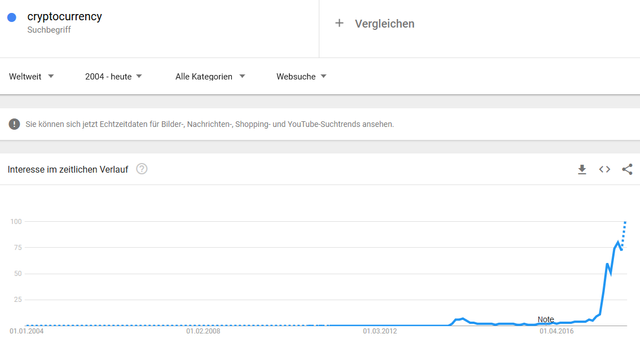

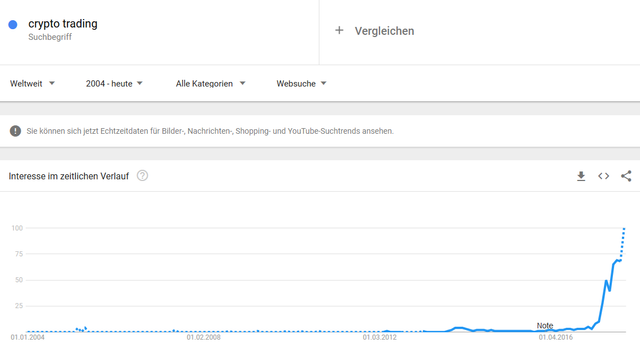

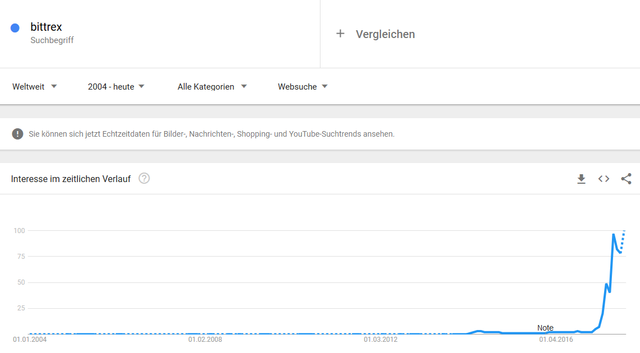

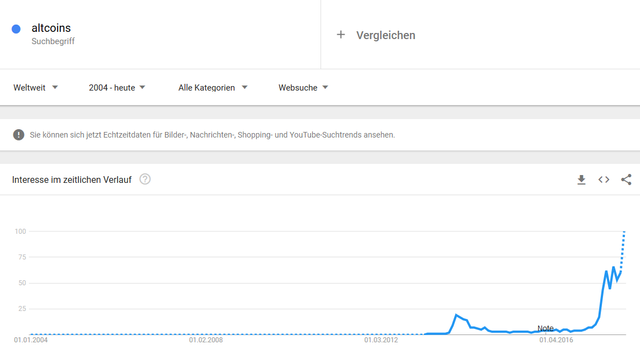

During the last week we experienced mass coverage and attention in global media, TV, newspapers, everywhere. Coming from the traditional bubble stage theory it would indicate that we currently reside in the “Media Attention” phase, which is usually followed by extreme influx of money, right into the stages”Enthusiasm”, “Greed”, “Delusion” and “New Paradigm”. Which is absolutely in alignment with the signs appearing everywhere that the Early Majority will soon begin to participate in this emerging market. It also means that Institutional Investors have finished accumulating their positions in order to dump on new market entrants during the latter stages of the trend. As a logical consequence we will soon begin to see real life adoption everywhere around us. And that in turn means that Mania Phase is ultimatively beginning. I am talking about mass fomo on a global scale, not only for BTC but more prominently any promising crypto people can get their hands on before it is too late. Is that actually theory or backed by anything? Lets check that out, here is the Google Trend Charts for some typical crypto search terms:

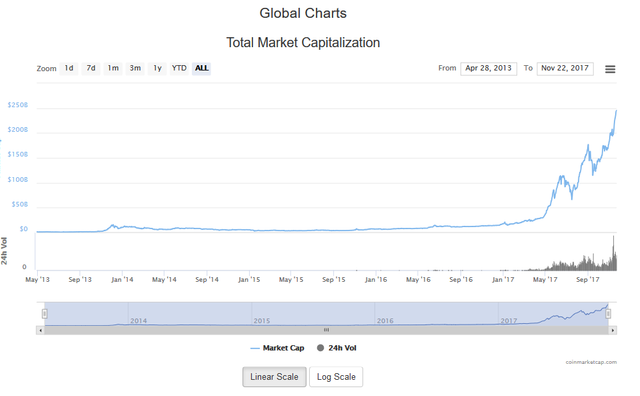

Hello! Wake up! The demand is off the charts, and we already know that Google Trends positively correlates with Price movements! We must therefore expect a massive influx of money into the ecosystem that is substantially larger than anything we have seen before. These charts are screaming for All Time Highs! And you have been thinking about selling your bags recently? Don’t you get left behind because you are focused too much on the small scale, always see the big picture of things and base your decisions on that. The time for $ALTS is coming at a rapid pace, and #GoldenAge is closer than we might think. Lets have a look at the MarketCap side of things to further strengthen that statement:

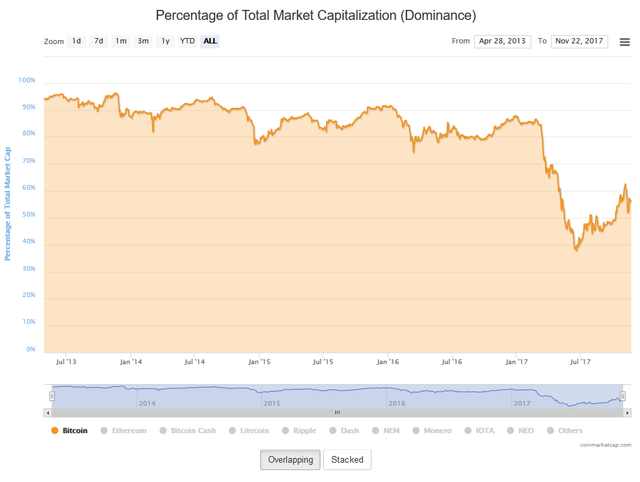

We can clearly see that both $BTC and $ALTS are taking off. That’s what i call an open end trade, because there is no technical resistance on the upside. Given these circumstances prices can go irrationally higher than we think and generally expect. All we need yet for the $ALTS strategy to completely take off and #GoldenAge officially starting is a dropping BTC percentage. This would translate to BTC up, ALTS up, but ALTS rising stronger than BTC itself, which is the ultimate outcome of this particular strategy unfolding. And here is where speculation comes in. Surely most of the price action we see today is driven by speculation. But speculation acts as a driver for innovation as higher prices attract interest, which in turn translate into adoption. We have seen it with ETH, havent we? All there was initially is speculation, but as soon as prices went crazy innovation occured in the form of ICOs. If you wait for the real life adoption to occur, it is too late to make substantial profits. You have to foresee it and speculate on that happening in order to make the gains you dream about. At this point I absolutely agree that the market is purely driven by speculation. But its a speculative bet that these projects will soon have real life usage and adoption, at which point speculation becomes innovation. It is also a speculative bet that the coins you buy today (because you think it has fundamental value) can get sold way higher in the future when real life adoption occurs. Therefore choose only the most solid fundamental projects for your portfolio. I personally have departed from holding insane amounts of various coins and went back to the roots by holding a handful very promising projects that I absolutely trust my financial future in. It is still a very diversified approach, while decreasing overall risk. I believe many shitcoins will eventually die because they can’t keep up with the violent rise of $BTC and competing cryptocurrencies. Also, holding fewer coins makes safe storage way easier in the long run.

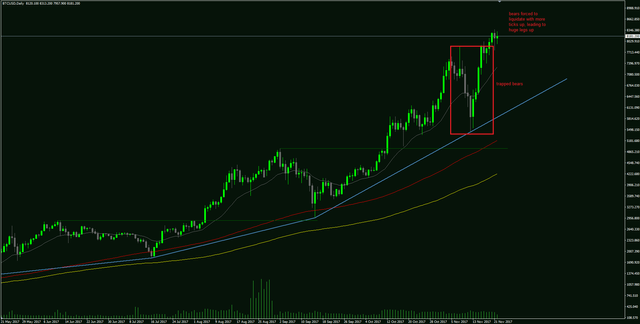

What happens if $BTC keeps rising, while $ALTS sellers become exhausted at the same time? The US Dollar value of your $ALTS will be dragged up by $BTC, while sellers refuse to sell more at these low prices in /BTC. The momentum will switch and we will see the ALT market completely taking off. It is therefore the point of no return when sellers start to become exhausted (and the signs are already obvious in Daily charts). We will see massive legs up, driven by mass fomo on a global scale, and many new market entrants having no clue what they are doing. It is all part of the game. So lets have a look at $BTC itself:

We know that those bears have been trapped in the move down to $5400 which reversed strongly. We must expect that many bears and shorts are currently holding losing positions and are forced to liquidate with more bars up. It is a tense situation which could potentially result in a very strong leg up, right through $10k, with a potential overshoot into the $12k area. This assumption is only valid if we see new ATHs soon, otherwise bears will try to regain control over the market to drive the market down in order to close positions break even or with profit. In the meanwhile as $BTC is more or less undecided, $ALTS begin to look very bullish on Daily charts, which basically is the same pattern as in April of this year. In general despite the dominant opinion that a drop in $BTC will lead to suffering in all cryptos, I tend to believe differently in that regard. A strong dip in $BTC will put insane pressure on BTC hodlers. Money gotta go somewhere, and basically there are only two options: Fiat or other Crypto. Trust in Fiat is diminshing every day, and most feel very uncomfortably holding large amount of fiat while the predominant objective is actually to hold crypto. Going into Tether won’t work either, its too fraudulent, too many red flags. Actually there is only one option left, and that is to take your BTC and put it into ALTS, therefore supporting the upside momentum. And if you look how insanely cheap $ALTS are these days, compared to /BTC, I bet many won’t need long to make that decision.

Top 5 Picks of the Week

$NXT has already popped out of buy range mentioned in the previous report, making gains of about 100% to peak. NXT likely will have strong follow up, as this is only the beginning of the trend in Daily chart. As 4 of these 5 picks have not popped yet, I recommend to check the old report again and keep an eye on the charts recommended from the last Market Report http://cryptowisdom.io/cryptowisdom-market-report-1-2/

First pick of the week is Monero due to getting close to ATH in dollar terms. Patiently waited for a long time for this one to go places, which will be very likely after ATH is taken out. Recommended strategy here is to wait for the USD ATH to be broken, then buy cheaply in XMR/BTC before the crowd understands whats happening. Taking out ATH in USD will lead to increasing momentum, which will have positive effects on XMR/BTC.

Bitshares – BTS

After fully retracing from All Time Highs, BTS successfully managed to retest breakout point (indicated green zone) it also managed to reverse the trend in daily, now having Higher Highs, Higher Lows. Officially it is an uptrend now, therefore the odds are higher for successful upside breakouts. As prices shot out of support range, the odds are even higher for this trade to become very profitable in the long run. Suggested strategy is to buy when yesterday’s candle has been triggered (green line). It is also a failed breakout to the downside, which has reversed to upside on volume. Sellers seem to be exhausted, just a matter of time until that market pops upside.

Stellar/Lumens – STR/XLM

Eyeing STR for a long time now, seems to be getting close to a breakout. Sellers clearly losing control over the market around here after dipping into support zone. We had high volume buyers at the breakout out of the range, indicating early momentum building, triggering new buyers into the market. Trendline is not yet broken, so that could be a great entry if the breakout is strong and on volume. This becomes even more likely when we realize that the latest High (at green line) is actually the trigger, which is around the same spot as the trendline itself. Suggested strategy is to be patient and buy the breakout over either last High or trendline, if it is on buy volume. Then just let it roll. Natural consequence of this pattern would be a retest of ATH which does not sound unlikely given the current market perspective.

Siacoin – SC

Very Early entry forming in $SC after building a first Higher Low in buy range, waiting for the Higher High to confirm the breakout. Buy volume slightly rising already, will probably accelerate as soon as the entry is being triggered. Using Polo prices in that example the high is located at 76, thus trigger will be 77 for at least two strong legs up, more likely retest / overshoot ATH in the medium run. Suggested strategy, buying as soon as the 76 high is taken out.

DogeCoin – DOGE

Yes, its $DOGE again. Reason for my continued interest in that trade is due to the high odds of profitability when it finally breaks the High at 20 sats. I personally know many traders accumulating heavy bags around that area here in anticipation of that happening. Buying around here would be a x10 to ATH, potential overshoot not calculated. Suggested strategy: Buy if 20 high is taken out, trigger 21.

Bonus Chart – Silver

Besides #Crypto, Silver might very well become the trade of a century. Although the market is dominated by manipulation and worthless paper shorts the market is bound to upside. Although I am not sure when that will be (although likely when the traditional markets start to collapse or danger of war increases considerably), I am generally a fan of diversification. There are repeating signs that the bear market might come to an end soon, Silver already set a Higher Low in the Weekly Chart, looking for more Higher Highs and Higher Lows in the future. Break of that High around $18 would be a signal long. Expect at least two strong leg ups, more likely retest and overshoot of ATH here as well. If you place emphasis on being financially sound in all regards, not only in crypto I suggest to observe these price movements closely in the future, especially when traditional markets come under pressure. Will update in future reports as soon as I have more information available. Suggested Strategy: Buy the breakout above $18 High.

Disclaimer: Analysis conducted purely on Technical Reasons, not taking into account Fundamentals. Do your own Research before Investing. Statements are solely my own opinions. This is no Trading Advice.

Wish you a wonderful week of trading ahead, if you are interested in reading more of these reports or join our Slack, stay tuned for our announcement later today.

Best regards, may the green be with you