Bitcoin’s Impending Economic Suicide

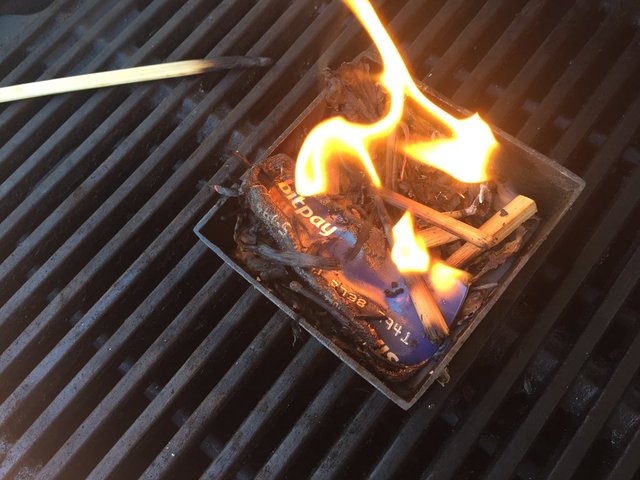

In the latest elements of the ongoing Bitcoin drama, swaths of the community have turned against several key economic actors. The heaviest recipient is undoubtedly BitPay, whose actions in support of the SegWit2x scaling agreement has caused a revolt:

It’s not just BitPay, though. Many of the largest companies in the Bitcoin space remained committed to the scaling agreement, and have since come under fire. More than a simple chain split, the attempted “forking off” of Bitcoin’s considerable economic advantage could amount to suicide for the coin.

Bitcoin has few advantages in raw features

As the original cryptocurrency, Bitcoin pioneered the underpinning of the field: send this many units to this destination in a permanent, public way. While perfecting this basic function and applying it to as many market situations as possible, other coins came up to explore innovation in the form of other features: privacy, instant transactions, governance, smart contracts, etc. While other coins tried new things, Bitcoin remained focus on its use case and continued to develop its biggest advantage: network effects. Without those, its root code, which has been copied and added to hundreds of times by other projects, doesn’t stand out.

The massive ecosystem lead over other coins could evaporate

Right now, the lead in ecosystem that Bitcoin holds over other coins is massive, formerly insurmountable. Several key large retailers, dozens of exchanges, and services all over the world are integrated with Bitcoin, and Bitcoin alone. BitPay provides one of the only good point-of-sale solutions with easy conversion to fiat currency, and only accepts Bitcoin. Purse.io allows customers to buy virtually anything online, and only accepts Bitcoin (though other currencies can be used with ShapeShift). BitWage allows workers to be paid in Bitcoin alone. Some of the most critical services in the cryptocurrency world are Bitcoin-only. To declare war on these businesses is to completely squander the significant advantage of a several-year head start.

Branding advantage will soften and confuse a “flippening”

Beyond its economic entrenchment, Bitcoin has another key advantage: branding. The very name causes users to trust the coin and brings in new investors in the general field of digital assets. If many of these large companies switch over to an implementation not endorsed by the Core team, the significant economic advantage moves over to a different name: Bitcoin Cash, Bitcoin2X, whatever it may be. Rather than allow a smooth transition to whichever implementation the economic majority utilizes, a branding issue will result, causing new users to still pour into the original Bitcoin name, only to discover that they have to get a different Bitcoin in order to use it. This back and forth will prevent the more successful fork from gaining easy ground, and will prolong uncertainty with the coin.

The chaos will delay crypto adoption, but could lead to a different winner

Further confusion resulting from another chain split will temporarily hamper cryptocurrency adoption, particularly if a chain deemed “unoriginal” maintains the economic advantage. However, this mess does create an advantage for some actors: other coins. Without the branding and ecosystem advantages centralized on one chain, other projects have a much better chance at rising above. Cryptocurrency will win wide adoption in the end, but this chaos increases the chances of that winner being something other than Bitcoin.

que no sea pronto

https://99bitcoins.com/bitcoinobituaries/