A typical Token Sale (TGE/ICO)

Currently a typical Сrowdsale (Token Sale/TGE/ICO) is done as follows:

Preparation for an ICO:

- Issuer will determine parameters and goals of the ICO (how much money will be raised, project’s business model, product, timeline, which platform to use for raising money, etc.). The results of this step will be published in a whitepaper document. If an issuer is taking a responsible approach to an ICO then after its successful completion the issuer shall follow the parameters and obligations set forth in that Whitepaper.

- Issuer will perform a promotional campaign to establish interest for the ICO among potential investors.

- Issuer will create and further develop a community for its project.

- Issuer may offer to a community a so called “bounty” program which will offer rewards to community members for certain support for promoting the project, software development, preparation for ICO, etc. This may include translation of whitepaper and website contents to other languages, maintaining specialized forums, likes and shares on social media, graphic design, etc.

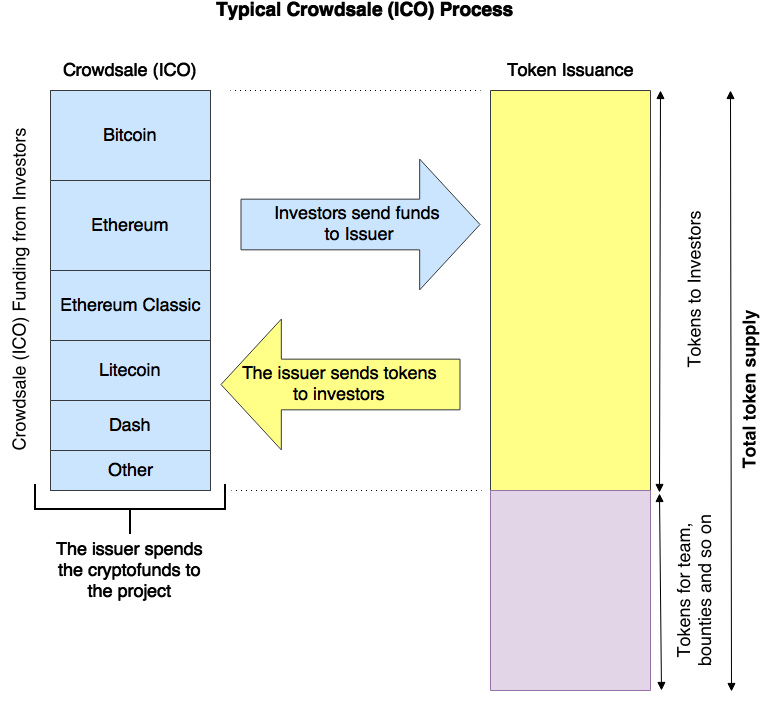

ICO (crowdsale):

- Investors self-register in a personal area of that specific ICO and then transfer their crypto assets (or sometimes fiat assets) into special wallets that were created by the issuer in each supported cryptocurrency.

- As a result, all crypto assets raised during the ICO will be accumulated in those special wallets of the issuer.

Token issuance and distribution:

- After completion of the crowdsale (or, in some cases, even earlier — if it is required and possible) the issuer will create (issue) the token with the parameters specified in the whitepaper.

- After creating the token and completing the crowdsale, the issuer will distribute a certain share of tokens (usually starting from 50–70% or higher) among the investors who participated in the crowdsale, and another share of tokens among other potential token holders — for example, founders and project team, bounty program participants. Distribution of the token shall be done according to the token structure published in the whitepaper.

After ICO is completed, its participants are as follows:

Issuer (and/or the project team):

- All proceeds from the ICO are to be spend on the project

- Share of tokens, as specified in the whitepaper — for the founders and the team

- Share of tokens, as specified in the whitepaper — for bounty programs

- Other tokens that are not yet distributed, but reserved for certain goals in the whitepaper

Investors:

- Share of tokens, distributed by the issuer according to the rules of the ICO specified in the whitepaper

After the ICO is successfully completed and the funds have been raised, the project’s lifecycle continues — the issuer start spending the funds for development of the project. For example, for a typical IT project it may include the following categories:

- Software development of solution

- Marketing

- Sales

- Community development

As a result of such spending the funds raised during the ICO, it should create some value of the investors. It could be either sharing revenues from sales of the product or services created by the project, access to an exclusive product or service, or various additional opportunities and discounts.

Social Media:

Please follow us on social media:

- Facebook: https://www.facebook.com/tokencab/

- Twitter: https://twitter.com/tokencab/

- Slack: http://slack.token.cab/

- Telegram News Channel: https://t.me/tokencab

- Telegram Community Group: https://t.me/tokencaben

- Medium: https://medium.com/tokencab

- Bitcointalk: https://bitcointalk.org/index.php?topic=1977396

- TokenCab in English: http://token.cab

- TokenCab in Chinese: http://cn.token.cab

- TokenCab in Spanish: http://es.token.cab

- TokenCab in Russian: http://ru.token.cab