Bitcoin Plunges as South Korea Crafts Cryptocurrency Crackdown

South Korea is preparing a bill to ban the trading of cryptocurrencies on exchanges

A top official from South Korea said the government is preparing a bill to ban the trading of cryptocurrencies on exchanges, stepping up its efforts to curb speculation.

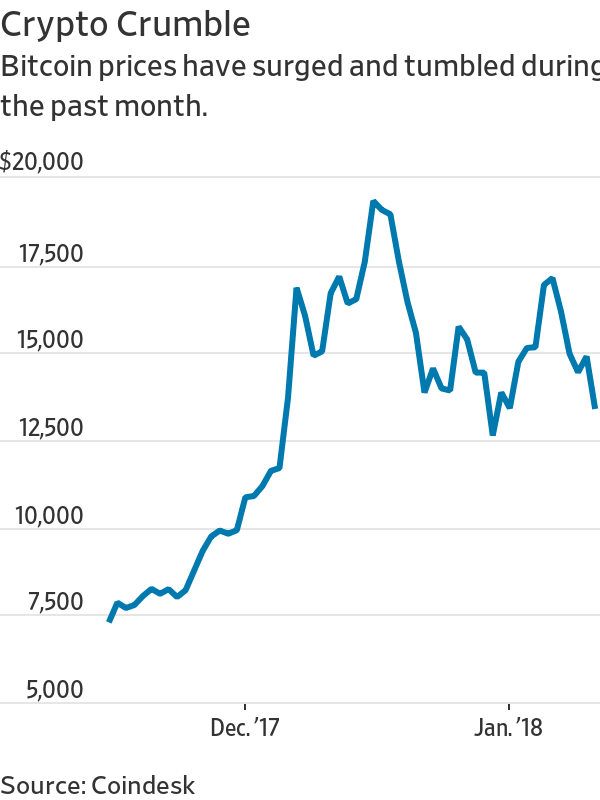

The remarks from Minister of Justice Park Sang-ki came just days after the country’s financial regulator started inspecting some of South Korea’s largest financial institutions that help facilitate digital-currency trading. Bitcoin prices tumbled as much as 13.7% Thursday, falling more sharply on Korean exchanges than other trading venues.

The government in recent weeks has announced a series of measures aimed at eliminating anonymous trading of cryptocurrencies and cooling investor fervor in bitcoin and other cryptocurrencies, whose price surges over the past year have drawn in many individual investors, including retirees and students.

‘Cryptocurrency trading is looking similar to speculation and gambling.’

—Minister of Justice Park Sang-ki

“Cryptocurrency trading is looking similar to speculation and gambling,” Mr. Park said at a press conference Thursday. “South Korea’s [cryptocurrency] trade is considered abnormal abroad,” he said, referring to how local investors have often paid higher prices for bitcoin and other virtual currencies on the country’s exchanges compared with other major global trading venues. Market participants have named that gap the “kimchi premium.”

Earlier this week, South Korea’s National Tax Service began investigations on the country’s leading virtual currency exchanges, Bithumb and Coinone.

Bithumb confirmed Thursday that the authorities had visited the company’s headquarters but declined to comment on the details of the investigation. Coinone, which is undergoing a separate police investigation for allegedly offering gambling services on its exchange, also confirmed the investigation by the tax authority.

Bitcoin, the world’s most well-known and widely traded cryptocurrency, fell Thursday to a low of $12,845.71, according to an index of prices across four exchanges from CoinDesk. Shortly after the government’s announcement, Bitcoin lost almost a fifth of its value on Bithumb, South Korea’s largest cryptocurrency exchange.

Ether, another popular cryptocurrency, fell 3.3% to $1,206.88, Coindesk’s data showed. On South Korea’s Bithumb, its price dropped as much as 15%.

Shares of several South Korean companies that are investors in local cryptocurrency exchanges also plunged on Thursday, dropping by the maximum 30% permitted in South Korea’s smaller Kosdaq market.

Hours after Mr. Park’s remarks, a spokesman from South Korea’s presidential office said abolishing cryptocurrency exchanges was “one possible measure prepared by the Ministry of Justice, but it’s not final.”

“The final decision will be made after consultation among ministries,” the spokesman added.

South Korea’s share of global bitcoin trading grew significantly last year, raising alarm bells among government officials.

Around 4.5% of all bitcoin transactions globally used the Korean won during the past year, making it the fourth-most widely used national currency in bitcoin trading after the U.S. dollar, the Japanese yen and the euro, according to data from CryptoCompare.

The country is more active in markets that trade alternative cryptocurrencies to bitcoin, known as altcoins, CryptoCompare’s data show. The South Korean won is the second-biggest national currency used for trading ether and Bitcoin Cash, a rival to bitcoin launched last summer.

South Korea’s government has tried to take a firm line to protect investors from potential losses. The country banned launches of new cryptocurrency tokens, known as initial coin offerings, in September last year.

The country’s prime minister Lee Nak-yon said in November that rising interest in cryptocurrencies could “lead to some serious distorted or pathological phenomenon.”

South Korea’s disquiet over bitcoin trading follows drastic moves taken by China, which shuttered cryptocurrency exchanges last year and is now trying to shut operations that produce bitcoin, a process known as mining.

Some market participants said details about South Korea’s latest plans were scant, making it hard for traders to gauge the potential fallout.

“A lot of people are jumping to the conclusion that there’s going to be a ban, so they’re going to sell all their assets,” said Arthur Hayes, chief executive officer at BitMex, a Seychelles-based cryptocurrency trading platform. He added, however, that it is “a little premature to draw conclusions as to what’s going to happen with regulation in South Korea in the year ahead.”

Kim Hwa-joon, the co-head of a South Korean industry group that includes some 10 local exchanges, said it isn’t certain that the Ministry of Justice’s proposal to ban cryptocurrency trading will materialize.