3 Altcoins to Rival Ethereum ( Eos , Antshare , Golem )

Ethereum has created spoiled investors.

There, I said it. I am just as guilty as you are.

It's important to remember that it took Bitcoin years to reach its current state. And Ethereum, which is barely two years old, was gearing up to take Bitcoin's dominant market cap just a few weeks ago.

But now, Ethereum's growth has stalled. The entire cryptocurrency market (with exception to the heavily hyped initial coin offerings) has cooled.

And, like fat cats who got too much food at once, investors are irritably looking for their next meals.

And that brings us to the topic of this post: altcoins.

In the wake of Ethereum's lull, I have seen a renewed interest in other altcoins.

The most common question that investors are asking: Is this the next Ethereum?

In honor of such questions, I decided to break down the top three altcoins that are generating buzz.

Keep in mind that these altcoins are not the normal flock that we cover at Wealth Daily. (We typically cover Litecoin, Ripple, Bitcoin and Ethereum.)

Rather, they are tokens that people have asked about in comments or on Twitter.

I am not going to speculate on whether these currencies will do well at this stage. This is strictly informational, and I am pulling information from other sources including Cointelegraph, Reddit, GitHub, and company websites.

Let's start with EOS.

What Is EOS?

EOS is the youngest digital currency we're talking about today.

You could start to buy EOS on June 26th.

Right away, trading volume spiked.

Of course, the high trading volume makes sense. The token was heavily hyped, and its ICO is unique.

20% of all EOS tokens were sold in the first five days, and the remaining 70% will be sold over the course of the year. 10% is reserved for EOS's founding company, Block.one.

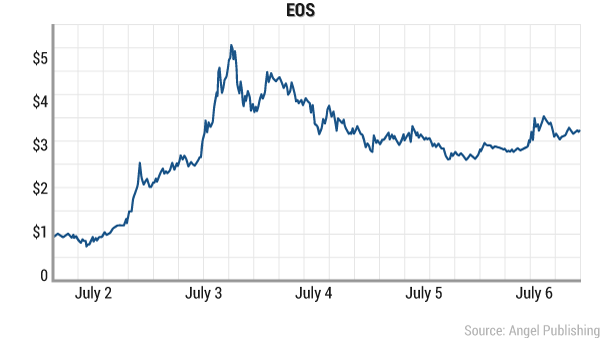

Now, let's take a look at that growth. EOS grew fairly rapidly.

The initial price of $1 increased by 400% in the first few days.

As I type this, EOS is sitting around $2.87

But here's the kicker: EOS is still a concept. It's not a functioning product yet. And if you plan to buy into it, you have to understand that you will be taking a gamble on an unproven idea.

So, let's take a look at that idea...

Is EOS the Ethereum Killer?

Believe it or not, EOS doesn't stand for anything. But the internet was quick to try to name it, with the most popular (and terrifying) name being "the Ethereum Killer."

And in all fairness, if you look at Block.one's vision for the product, the nickname makes sense.

EOS is a platform, like Ethereum, that will support decentralized applications.

But, unlike Ethereum, the proposed platform is far simpler, allowing businesses to develop decentralized applications without a heavy technical background. The tools are going to be built into the program. And this makes EOS a phenomenal tool for companies that are trying to control and monitor information flow without too many complications.

All of these traits should have Ethereum shaking in its boots.

But it's important to remember that EOS is just a concept. A company can say as much as it wants to about a product, but until it's been tested, the company's claims should be taken with a grain of salt.

Where Can You Buy EOS?

You can purchase EOS tokens on the EOS.io website.

Ethereum can be used to make the purchase, and you can transfer money from another wallet including Jaxx, Exodus, Poloniex, and Kraken. For a full list of participating wallets, click here and scroll down to question 13.

Now, if you're an American, you'll immediately notice something weird.

EOS is not available to purchase if your computer displays an American IP address. To me, this is an immediate red flag. I can understand a company's desire to keep the price stabilized during its ICO, but limiting the American market (a very large digital currency consumer) seems strange.

So, I went searching. There are ways for American investors to buy EOS, you just have to Google and it will pop up. In the digital currency world, there are rarely obstacles one can't overcome.

EOS Takeaway

It's important to remember that EOS is still a concept. So, investing is a gamble.

EOS has already made an appearance in articles from The New York Times and Reuters. So, the hype is out there, and people are curious. But the product remains a pipedream until further proof.

What Is Antshares?

Antshares is another promising concept that is receiving a lot of attention. The token is referred to as the "Ethereum of China" and has captured the attention of both Chinese and American markets.

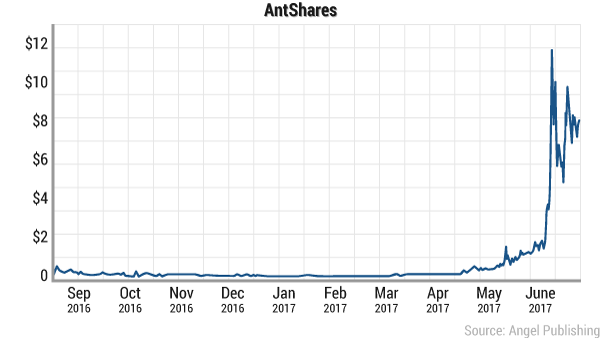

That said, the growth has been fairly dynamic — especially on the tail of Ethereum, which initiated a wave of buying for altcoins.

Antshares is currently up 2,207% — moving from a starting price of $0.39 in September 2016 to a high of $9 in June 2017. Like the rest of the crypto market, the price entered a lull in late June.

A four-digit growth is nothing to shake a stick at.

But, in the case of an Ethereum look-alike, it prompts a lot of questions.

Is Antshares just another altcoin that's benefiting from Ethereum's popularity? Or does it have a unique technology that will ensure its own success?

Is Antshares a Good Buy?

It's hard to take a digital currency named after an insect seriously. But Antshares is actually a fairly interesting technology.

Sidenote: Antshares is undergoing new branding. You can check that out here.

It's very comparable to Ethereum and acts as a decentralized peer-to-peer network. And it allows individual investors to take part in decentralized financial exchanges. Like Ethereum, the token can be used for raising equity or crowdfunding.

Antshares is already tackling many of the scaling issues that tripped up Ethereum. Tackling issues before massive market exposure will be a positive for the digital currency in the future. Ethereum's grapple with scaling issues has shaken overall investor confidence.

Antshares also has a lot of power behind it, which is usually an indicator of good utility. Google backs Ripple, and Ethereum has an entire alliance — the Enterprise Ethereum Alliance (EEA). Both support systems indicate that the currencies will do well (and they have).

For Antshares, the support list is impressive, with multiple multimillion-dollar Chinese companies — including Alibaba, China's central e-commerce retailer.

Of course, with all digital currencies, finding this support is like falling down a rabbit hole. There is hard proof that the digital token is being used to improve email systems and tracking for these e-commerce sites. Other than that, I struggled to find anything solid. But that might be partially my own fault. I am often thwarted by Antshares's biggest problem: its language barrier.

You may wonder why a revolutionary technology like Antshares hasn't been adopted by the mainstream world yet.

The main issue is the language barrier. Murmurs of this digital currency just started in the U.S. market. And the currency isn't as readily available as Ethereum. The only American exchange you can buy on it Bittrex by using Bitcoin as payment.

Antshares Takeaway

Antshares is a cool concept that's had more market exposure than EOS. It's already producing functioning technology and is being adopted by Chinese companies. It may continue to grow with more exposure to the western market (particularly the adoption of other exchanges). But whether or not that will happen is still up in the air.

What Is Golem?

Golem is a digital token that is being used to fund a decentralized internet project.

It's also a personal favorite, so I may be a bit biased. I really like the project and the team's way of approaching it. I will talk more about the features that I like in a minute.

First I would like to point out that I'm not alone not alone in my Golem adoration. Since its birth in 2016, the digital currency has managed to amass a cult following. And many of those early investors made a killing.

Since its ICO in 2016, Golem has grown by over 4,366.67%.

And, if we take the Golem team's word, the project is just getting started.

Right now, Golem is still a concept. Golem did not escape the digital bloodbath unscathed. Following the example of larger tokens, the currency slumped and is now static.

And as I type this, its price is hurting.

Even though Bitcoin and Ethereum recovered (slightly), Golem's price seems locked in a dip.

Unfortunately for Golem, the digital currency bloodbath took place right when the Golem team was approaching a major deadline: Brass Golem.

The Golem team is unrolling its decentralized vision one step at a time. And now, with a crucial step delayed, the market is nervous.

Of course, the underlying project is still sound and worth taking a look at. If investors decide that the technology is unique enough, it might be worth investing in the dip.

How Does Golem Work?

In essence, the Golem team wants to develop a decentralized network. It will go into this goal in a unique way.

Golem will use the leftover computing power (CPU) on existing electronic devices. This includes laptops and cell phones.

And the best part: the team is going to pay individuals to share that CPU.

If this concept comes to fruition, your phone could be paying you.

Golem's decentralized network could improve our existing internet by leaps and bounds.

One of the biggest issues we have today is internet security. People are more worried about digital thieves than the ones that come through back windows.

And it's not just individuals, businesses are equally as concerned. Huge companies are constantly bombarded by denial of service (DDoS) attacks — a targeted hack that basically bombards a server with commands until it's overpowered, which breaks the system.

These kinds of attacks continue to happen because it's easy to slam a centralized server. But it's nearly impossible to target a decentralized network.

If you were at a picnic, would you rather be irritated by one large horsefly or by millions of fruit flies? You can't beat a million; you can always beat one.

Servers are about the same. If something is in one location, it's easy to squash.

That is why so many companies have already gotten on board with Golem's mission.

There are rumors that Google is backing Golem, but that hasn't been proven and should be taken with a grain of salt (If anyone has solid proof, I urge you to tweet me at @AlexandraPerry C. This is a fast moving market and resources often get lost.)

There is, however, proven interest from other big players, including Reddit's CEO who took to Twitter to express their support of Golem.

Golem's team is not trying to capitalize on ICO fever and has separate funding rounds in place for each level of Golem's development.

Now investors just have to hope that Brass Golem arrives soon and saves the digital currency from its current value hemorrhage.

Golem Takeaway

I really like Golem, but like EOS, I have trouble investing in a concept. You can see the Golem road map on its GitHub here.

From that, everything looks promising. The company is like a well-positioned startup, and its communication with investors is phenomenal.

It's true that the delay of Brass Golem has undermined investor confidence. At the same time, if the company can churn out a valuable product at the end of a long wait, it will speak for its competence as it moves forward. As an investor, I would rather see delays early on in a project than later on down the line. (I am looking at you Bitcoin.)

There you have it — three digital currencies to think about outside of Ethereum.

Best of luck with all your digital currency investments!

Thanks for your insightful article. Antshare was recommended to me some months back and I was fortunate enough to get in at 0.10 for several thousand shares. I just recently entered Golem as well.

You welcome bro

Thank you very much.

좋은 분석과 추천에 감사드립니다