Neo Approaches Record High But Centralization Concerns Persist

After gaining 2,300% in six months and launching a string of eagerly anticipated ICOs, Neo is quite the success story. It’s that rare thing in the crypto space: a blockchain that’s actually seeing use. A bitcoin price equivalence of $580 per token (if Neo had a 21m supply) suggests there’s still plenty of room to grow. Neo is currently trading for $150, after peaking at $193 earlier this month. But behind the scenes, everything isn’t as rosy as it seems; the Chinese blockchain faces persistent claims of over-centralization and rumors of US exchange delisting.

The Neo Kid on the Blockchain

Neo Approaches Record Highs But Centralization Concerns PersistIf 2017’s crowdsales were all about Ethereum, 2018 is shaping up to be the year of Neo. The Asian smart contract platform has some way to go before it can match the transaction volume, market cap, or number of ICOs as Ethereum. But if hype is any arbiter of things to come, Neo is on course to own 2018. The biggest token generation events this month have all been on the Neo blockchain, with tokens selling out in record time.

The Key raised $22 million in minutes, and projects such as Aphelion – a Neo P2P

DEX – and Deepbrain – an AI platform – have also reported record uptake. Others still to come include Zeepin, Narrative, and Apex, the latter boasting one of the largest crypto Telegram groups and guaranteed to hit its $25m cap. On the surface, everything is going smoothly, but beneath the waters the good ship Neo is sailing on, trouble may be brewing.

Who Controls Neo?

Da Hongfei, Neo’s CEO, is a man of few words and even fewer tweets. Binance CEO Changpeng Zhao is loquacious, personable, and approachable; Hongfei, on the other hand, is an enigma. The entire Neo team aren’t known for their communicative skills, preferring to let their community do the talking. One reason for this may be the uncertain regulatory environment in China. Like other crypto companies that originated in the country, Neo is obliged to keep government officials onside, as it walks a delicate tightrope, balancing its goals with its legal obligations. The core team has since relocated, but Neo retains close ties with its country of origin.

One of the biggest concerns regarding Neo, and indeed many other cryptocurrency projects, is the level of centralization. Ethereum, despite its “strong leader” handicap, is at least decentralized in terms of the nodes that secure the network, as a recent study has shown. With the majority of Neo nodes controlled by the project’s inner circle, the blockchain is susceptible to interference, either directly or at the say-so of government officials. Its Github also only has one branch.

Loads of Nodes (Just Not for Neo)

Like many blockchains, Neo seems to be working to a “future decentralization” model: get things up and running first and then, once the teething problems have been ironed out, decentralize. Great if it works, though as history shows, power, once gained, is hard to relinquish. Bitcoin and Ethereum have over 30,000 globally distributed nodes between them; the number of official Neo nodes is less than 10. The Neo blockchain is fast and has high throughput, but speed is of little benefit if it comes at the expense of security. Speaking of security…

Security or Utility?

One of the greatest challenges Neo may face in 2018 stems from a land beyond its reach: the USA. The Chinese blockchain doesn’t need America’s blessing to function, but with the US dominating the crypto market, Neo’s absence would be a major blow to Da Hongfei’s plans for global domination. With Bitfinex having closed its doors to US residents, the number of licensed exchanges where US traders can buy Neo is already limited. The token is currently available on Bittrex, but rumors suggest the US exchange may be poised to delist Neo.

Deposits and withdrawals of Neo have been unavailable at Bittrex for a month, and the exchange recently delisted another token, Mysterium, for no apparent reason. With the Securities and Exchange commission looking closely at tokens that may constitute securities, it is thought that Bittrex may be removing security-like tokens to head off an SEC clampdown.

Neo token holders are paid Gas as a dividend, and while most people wouldn’t view this as a profit share, the SEC may see things differently. As it stands, Bittrex doesn’t pay out Gas to token holders for that reason, whereas Binance does. Even if Neo can shrug off issues on foreign soil, it is a prime target for regulation should China or South Korea come wielding the axe. Delisting from Upbit or Okex would be a major blow.

Officially, Neo wallets on Bittrex are awaiting a developer update

Plagiarism and Fake Goods

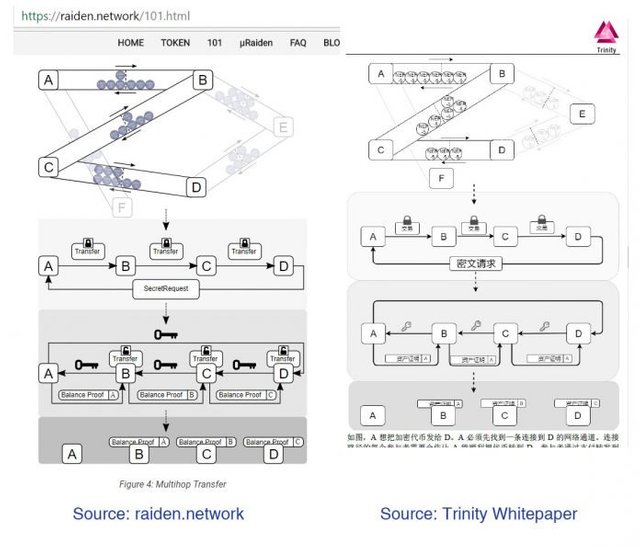

The global counterfeiting economy is valued at half a trillion dollars a year, with the bulk of those fake goods coming from China. The blockchain space isn’t immune from accusations of counterfeiting either, with China accounting for its fair share of imitators. There’s Tron for example, led by Justin Sun, which was shown to have copied entire chunks of its white paper. Then there’s Trinity, a project operating on the Neo blockchain, which has copied its state channel diagrams directly from Raiden. This plagiary is not the doing of Neo – nor is it limited to Asia – but it does indicate that the crypto projects to emerge from this part of the world deserve close scrutiny.

If Neo can overcome its centralization issues, and the ICOs it launches can add value and not vaporware, there is every likelihood that the project will flourish. Many investors though see potential hurdles, from the US to China, at every twist and turn. As the coin continues to rise in value, one of the biggest obstacles it may face is a logistical one.

Unlike other cryptocurrencies, neo is indivisible. You can buy a fraction of a neo on an exchange but you can only send whole units between wallets. Should the token ever attain the same sort of valuation as ethereum, this could present a major problem. Hodlers with half a neo on an exchange would then be faced with a quandary: sell it or shell out another $500 just to be able to withdraw.

Coins mentioned in post: